UnitedHealth Group: More Attractive Today, A Watchlist Must-Have

Summary:

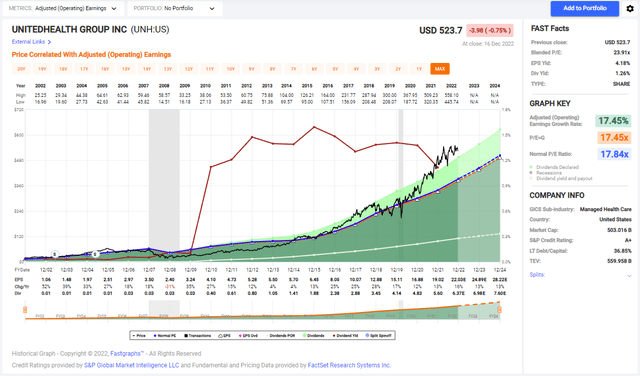

- Shares of UnitedHealth have been trading above their average valuation for a long time.

- The current volatile market has decreased the valuation gap of UnitedHealth.

- Yet, with the shares of UnitedHealth slightly overvalued, they are still a HOLD, yet investors should watch closely.

jetcityimage

Introduction

As a dividend growth investor, I seek opportunities to invest in income-generating assets and add to my existing positions when they are favorably priced. I also use market fluctuations to diversify my holdings and increase my dividend income by acquiring new positions. I try to expand my portfolio into more industries and sectors to lower the volatility.

The healthcare sector is dynamic, encompassing many industries, including pharmacies, pharmaceuticals, medical devices, and insurers. Among insurers, UnitedHealth Group (NYSE:UNH) is a dominant company I have had the opportunity to cover. In this article, I will analyze the company’s shares again and examine how attractive they are for dividend growth investors.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

UnitedHealth Group is a diversified healthcare company. It operates through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The UnitedHealthcare segment offers consumer-oriented health benefit plans and services for national employers. The OptumHealth segment provides access to networks of care provider specialists, health management services, care delivery, consumer engagement, and financial services. The OptumInsight segment offers software and information products, advisory consulting arrangements, and managed services outsourcing contracts to hospital systems and other organizations. The OptumRx segment provides pharmacy care services and programs.

Fundamentals

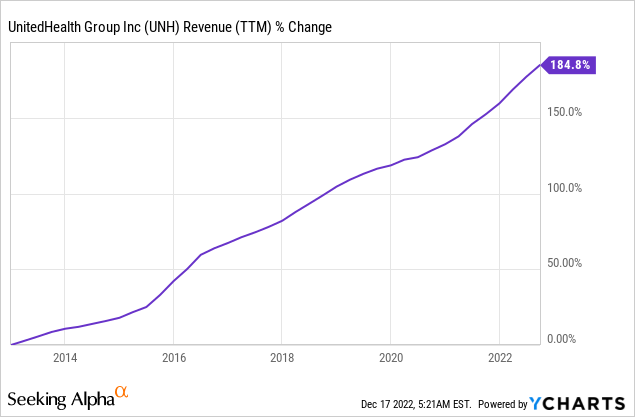

The revenues of UnitedHealth Group have almost tripled over the last decade. The UnitedHealthcare and the Optum segments showed significant growth, and each now accounts for roughly half the revenues. The growth combines organic growth and acquisitions aiming to expand the value proposition. In the future, as seen on Seeking Alpha, the analyst consensus expects UnitedHealth Group to keep growing sales at an annual rate of ~10% in the medium term.

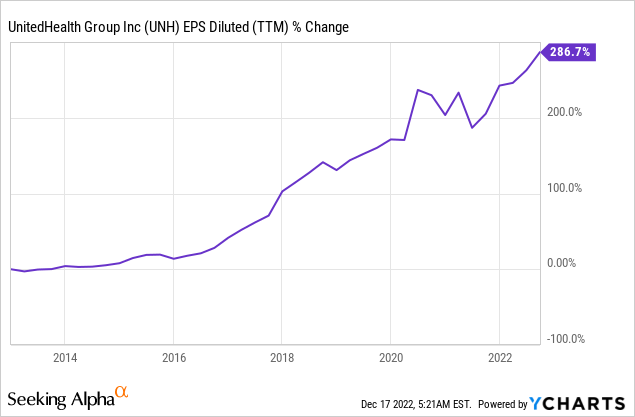

The EPS (earnings per share) has grown much faster and almost quadrupled over the last ten years. EPS growth is the result of cost-cutting that improved the margins steadily, the revenue growth, and the consistent buybacks that the company executes. In the future, as seen on Seeking Alpha, the analyst consensus expects UnitedHealth Group to keep growing EPS at an annual rate of ~14% in the medium term.

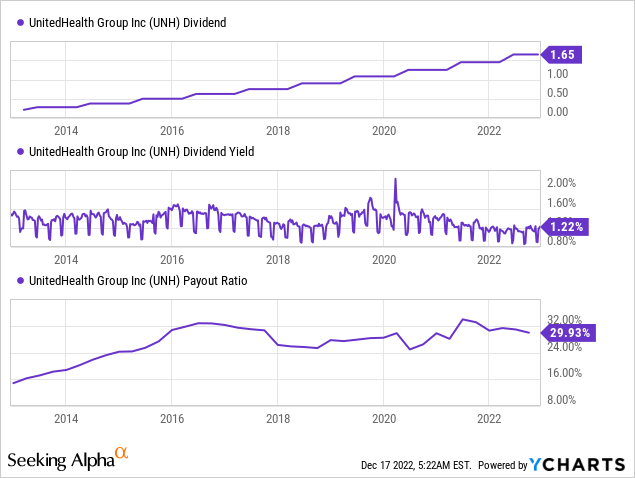

The dividend is another fantastic metric for UnitedHealth. The company has not reduced the dividend for almost thirty years and has been increasing it for the last twelve years. The dividend looks in great shape, as the charts below show. The payout ratio is roughly 30% making the dividend likely to be safe. The last five years showed an annual growth rate of almost 20%, surpassing inflation significantly. The only downside is the current yield. The high-interest rates environment offers some more attractive income prospects.

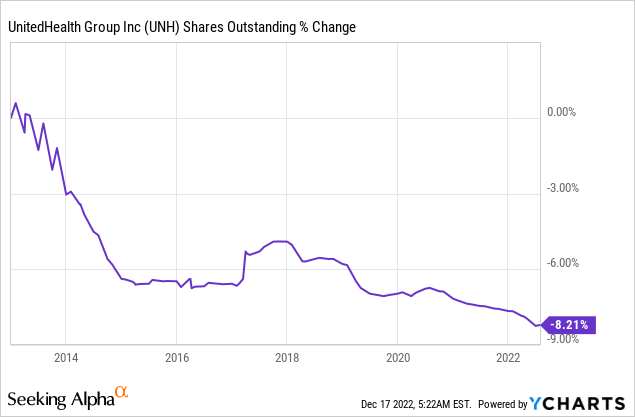

In addition to dividends, companies return capital to shareholders via share repurchase plans. Buybacks support the EPS growth as they lower the number of outstanding shares. Over the last decade, the number of shares outstanding has decreased by 8%, supporting the already fast EPS growth. Buybacks are most effective when the shares are cheap. Since this is not the case with the company, limited buybacks, as we see right now, make sense.

Valuation

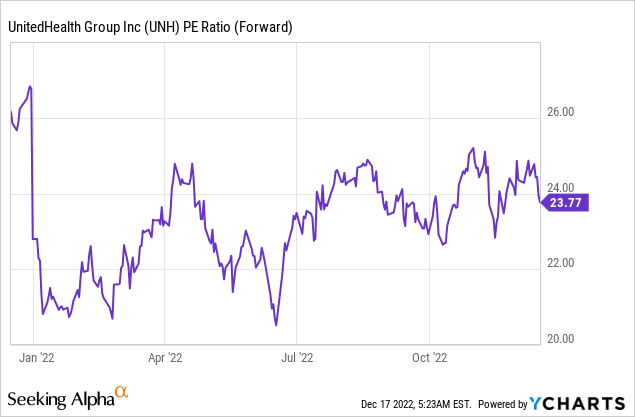

After a year of stagnant stock price, the company’s P/E (price to earnings) ratio is 24 when using the 2022 EPS forecast. It is around the average valuation over the last twelve months. Considering the projected EPS for 2023, the P/E ratio is close to 20, which seems more reasonable in the current business environment with climbing interest rates.

Looking at the graph from FAST Graphs, it appears that the stock may be slightly overvalued. While the company’s forecasted growth rate is slower than in the last twenty years, the stock’s valuation is currently higher. It suggests that the market may be assigning a higher valuation to the stock than is warranted by the company’s current growth prospects. If in the past we had a P/E ratio of 18 and a CAGR of 17.5%, now it’s ~20 and 15%, which means shares are slightly overvalued.

UnitedHealth Group has solid fundamentals and is well-positioned in the healthcare industry. The strong sales and EPS growth will lead to continuing dividend and buyback growth. However, it appears that the stock may be slightly overvalued at present. For the stock to justify its current valuation, it must demonstrate significant growth opportunities and limited risks.

Opportunities

UnitedHealth Group is a diversified healthcare company that offers a wide range of products and services. One of the main advantages of UnitedHealth Group is its size and scale. As one of the largest healthcare companies in the world, UnitedHealth Group has the resources and expertise to offer a wide range of high-quality healthcare services and products. This way, it can harvest growth from different industries depending on which business line grows faster. The company is now enjoying the growth of OptumHealth, which accounts for half the revenues and continues to show fast growth.

OptumHealth’s third quarter revenue increased 34% year-over-year as revenue per consumer grew 31%. Growth continues to be led by the increasing number of patients served under value-based care relationships and the expanding types of care settings offered by Optum.

(John Rex – UNH Chief Financial Officer, Q3 Reports)

Another advantage of UnitedHealth Group is its commitment to innovation. The company has a long history of investing in new technologies and approaches to healthcare delivery, which allows it to stay at the forefront of the industry and offer its customers the most advanced and practical solutions. It was the rationale behind the acquisition of Optum to provide innovative value propositions directly to its clients. It implemented several digital tools and platforms that make it easier for individuals to access and manage their healthcare. The investment in digitalization and innovation was highly influential during the pandemic, and now the company capitalizes on higher margins as the medical loss ratio continues to decline to around 80%.

In addition to its size and innovation, UnitedHealth Group offers excellent digital-first customer service. In a country like the United States, where healthcare is mainly in the hands of the private sector, excelling in customer service is beneficial as it helps the company to be more sticky among patients and employers who are unlikely to shift to one of the company’s competitors. UnitedHealth Group also offers a variety of resources and support programs to help individuals and organizations make informed decisions about their healthcare, including educational materials and tools for managing healthcare costs.

Risks

The most prominent risk for the company and the industry is regulatory risk. As a healthcare company, UnitedHealth Group is subject to a wide range of federal, state, and local regulations. Changes in these regulations, or the interpretation or enforcement of these regulations, could significantly impact the company’s business and financial performance. For example, changes in healthcare reform laws or the implementation of new regulations related to the Affordable Care Act could affect the company’s ability to sell insurance policies or the premiums it can charge.

Another significant risk is competition. UnitedHealth Group operates in a highly competitive industry. The company faces competition from many players, including other large healthcare companies such as CVS (CVS), which acquired Aetna. This competition could challenge the company’s ability to attract and retain customers and its pricing and profit margins. It may be crucial, especially today when inflationary pressures exist in the services sector.

Since the healthcare segment in the U.S. is mainly private and relies on employers, there are also economic risks. A recession and even a slowdown during inflationary periods may increase unemployment and lower the company’s number of customers. Moreover, some employers may prefer less lucrative plans for their employees as businesses across America look for quiet ways to decrease spending.

Conclusions

UnitedHealth Group is a healthcare behemoth. It shows great strength in its fundamentals and has plenty of growth prospects in the future. Its risks are limited and persistent as it deals with them daily. Therefore, the company is a highly compelling investment for dividend growth investors seeking long-term dividend growth.

However, the current valuation leaves no margin of safety as the shares of this great business are slightly overvalued. The limited growth in the share price while the company kept growing made it slightly more attractive. Its P/E of 20 for 2023 is still not attractive enough. Therefore, I believe the company is a HOLD though investors may consider buying a small position and adding gradually. I believe the company will be very attractive if the share price reaches $400-$450 due to the market’s volatility.

Disclosure: I/we have a beneficial long position in the shares of CVS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.