Summary:

- UnitedHealth Group is set to release its Q1 2024 earnings report and business updates on April 16th.

- UNH stock has struggled for growth recently, facing downward pressure due to a cyberattack, Medicare Advantage rate cuts, antitrust probes, and increased scrutiny of the PBM sector.

- Despite these challenges, UnitedHealth’s Optum businesses have shown strong growth and profitability, with double-digit revenue growth expected in the long term.

- Despite some difficult headwinds, UnitedHealth has positioned itself well to meet all challenges in 2024, and I am expecting a share price revival.

J Studios/DigitalVision via Getty Images

UnitedHealth Investment Overview

UnitedHealth Group Incorporated (NYSE:UNH) expects to release its Q1 2024 earnings report plus business updates ahead of the market open next Tuesday, 16th April.

Until recently, UnitedHealth has been a wonderful business to be a shareholder in, long term – its share price rose in value in every year between 2009, to 2022, growing from ~$20 per share, to >$550 per share at its October 2022 peak.

Since reaching that high, however, UnitedHealth stock has struggled for growth, reaching lows of ~$460 in 2023, before mounting a recovery to peak at $550 again at the beginning of this year, then falling once more, to its current price of $459 per share.

When giving UnitedHealth stock a “Hold” rating last week, HSBC noted “downward pressure” on the share price caused by four factors – according to Seeking Alpha, these were:

The investment bank noted that there has been downward pressure on the stock due to the cyberattack on UnitedHealth’s Change unit, a Medicare Advantage rate cut, anti-trust probes and increased scrutiny of the PBM sector.

All of these factors are significant, although HSBC maintains that their impact on United’s business has already been baked into the share price, perhaps helping to account for the 15% decline in UnitedHealth’s share price so far this year.

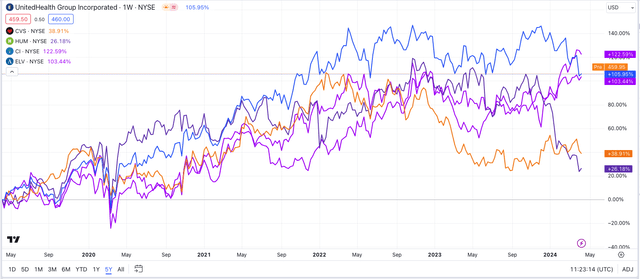

Health Insurers selected share price performance (TradingView)

If we study the share price performance of five of the largest U.S. health insurance companies — UnitedHealth, CVS Health (CVS), Humana (HUM), Cigna (CI), and Elevance (ELV) — we can see a clear trend of growth in all company share prices (barring the March 2020, pandemic induced market sell-off) until mid-2022, when prices fell across the board in response to the Federal Trade Commission (“FTC”) announcing a planned investigation the role that Pharmacy Benefit Managers (“PBMs”) played in determining drug pricing.

Ever since then, the direction of health insurer’s share prices has become far less predictable – across the past 12 months, for example, while Cigna stock is +35%, and Elevance stock +6%, CVS Health shares have sunk in value by -4%, UnitedHealth’s by -11%, and Humana’s by -39%.

UNH’s PBM Business Drives Growth, Profitability, Despite Pressure On Drug Pricing

While some analysts view UnitedHealth shares as fairly priced given recent headwinds, others have dismissed the recent cyberattack and Department of Justice antitrust probes as minor, as opposed to major issues, given the former affected only a small part of UnitedHealth’s overall business – its Change Healthcare claims clearinghouses business – and the latter came as a result of increased regulatory scrutiny directed against PBM’s in the current climate.

The implementation of the Inflation Reduction Act has made it easier for the government to intervene in drug pricing negotiations – previously controlled primarily by PBMs away from prying eyes, with outsiders speculating that insurers demanded substantial discounts to agree to carry specific drugs on their formulary lists, leading to Pharma companies’ being forced to raise their list prices substantially.

It may be the case that UnitedHealth has not yet felt the full force of these drug pricing negotiations, and therefore, attention should be paid to any updates provided in the upcoming earnings review. With that said, during the company’s Q4 2023 earnings call with analysts, the strength of UnitedHealth’s Optum Health business was underlined.

As a reminder, UnitedHealth consists of UnitedHealthcare, its health insurance plan business, and its Optum divisions, Optum RX, Optum Insight, and Optum Health, described by the company (in its 2023 annual report / 10K submission) as follows:

These businesses improve overall health system performance by optimizing health care quality and delivery, reducing costs and improving patient, consumer and provider experience, leveraging distinctive capabilities in data and analytics, pharmacy care services, health care operations, population health and health financial services.

During the last earnings call with analysts, UnitedHealth’s Chief Financial Officer (“CFO”) told analysts:

Optum Health revenues grew by 34% to over $95 billion as we increased the number of patients served under value-based care arrangements by about 900,000 to more than 4.1 million, expanded services in the home, and broadened and deepened the levels and types of care we offer.

Optum Insight’s revenues grew 30% to $18.9 billion. We concluded the year with a revenue backlog of $32.1 billion, an increase of $2.1 billion over last year.

Optum Rx revenues grew 16% to over $116 billion, driven by the continued addition of new clients, expansion with an existing relationship, and organic growth of our pharmacy services businesses. In 2023, both customer retention and new wins were among the best Optum Rx has delivered.

Much of the revenues generated by each company overlap, but even so, it is difficult to make the case that UnitedHealth’s Optum businesses have been suffering in the face of increased regulatory scrutiny. Overall, according to United’s Q4 2023 earnings press release:

Optum full year revenues of $226.6 billion grew $43.9 billion or 24% year-over-year and operating earnings increased 13.4% to $15.9 billion.

The long-term outlook for Optum is also positive, as management shared during its recent investor day conference, about OptumHealth:

We expect to continue to deliver double digit revenue growth on average and continue to target a long-term operating margin profile in the 8% to 10% range.

And regarding Optum Insight:

We target operating margins of 18% to 22%, as our customers look to us for more comprehensive solutions.

And finally, about Optum RX:

Optum Rx expects long-term revenue growth at an average annual rate of 5% to 8%, with operating margins in the 3% to 5% range.

Medicare Advantage Rate Debate Undermines UnitedHealth’s Core Business – But Negativity May Be Overblown

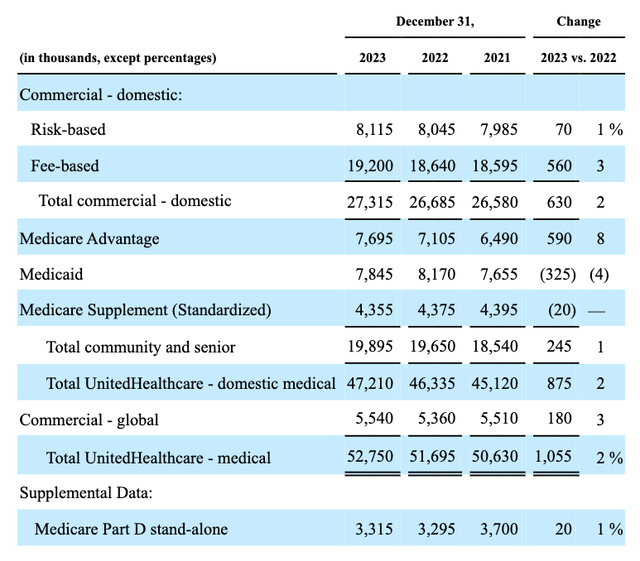

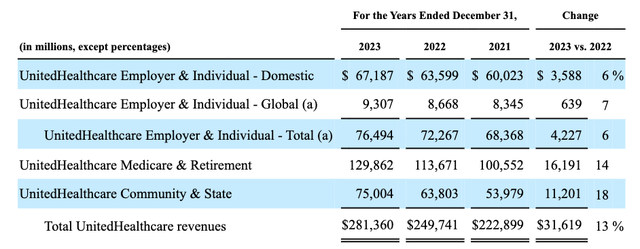

Turning to the health insurance element of UnitedHealth’s business, the following tables from United’s latest 10K submission provide some valuable insight.

UnitedHealth – members by plan type (10K submission)

As we can see above, the bulk of UnitedHealth’s 52.7m plan memberships are commercial plans, but the most lucrative, and fastest growing market for the company is “Medicare and Retirement,” as shown below:

UnitedHealthcare revenues by business (10K submission)

Here is how UnitedHealth defines Medicare Advantage (“MA”) in its latest 10K submission:

Under the Medicare Advantage program, UnitedHealthcare Medicare & Retirement provides health benefits coverage in exchange for a fixed monthly premium per member from CMS plus, in some cases, monthly consumer premiums. Premium amounts received from CMS vary based on the geographic areas in which individuals reside; demographic factors such as age, gender and institutionalized status; and the health status of the individual. UnitedHealthcare Medicare & Retirement served 7.7 million people through its Medicare Advantage products as of December 31, 2023.

Research shows that gross margins for MA plans are twice that of ordinary plans, while private plans cost the government – and, therefore, the taxpayer – on average 4% more than standard plans.

This has created both a massive opportunity for Medicare Advantage plan providers – and UnitedHealth in particular, given it is the largest provider of MA plans, with ~28% of a ~30m patient market – and a problem.

Initially, health insurers realized that MA plans were the most lucrative plans to administrate, and have adjusted their business models so that they are geared to extracting the maximum benefit from them – in short, the cheaper they can administer these plans on behalf of the Centers for Medicaid and Medicare Services, the more profit they could realize.

More recently, however, the CMS, which calculates rates of payment per plan based on the historic costs of administering healthcare in particular regions, and also offers bonus payments for plans rated four stars out of five or higher, has begun to realize it may have been overpaying its private insurer clients, and is attempting to claw back what is essentially taxpayer’s money.

For example, when the CMS indicated earlier this month that it did not plan to raise rates by more than the 3.7% it initially recommended in January, before hearing feedback from the insurer’s themselves (the first time in a decade it has not responded to feedback by raising rates) the market panicked, and sold CVS Health, Humana, and UnitedHealth stock heavily.

The profitability of MA to insurers is usually measured by the benefit risk, or medical care ratio, which is total healthcare spend divided by premiums collected – should this figure climb above e.g. 90%, as it has done for Humana, for example, then a health insurer may struggle for profitability.

Meanwhile, it is becoming harder for companies to attract new MA members by dropping premium prices, given they are struggling to deliver a strong profit margin.

So the theory goes, at least, but in UnitedHealth’s case, the company reported a “medical care ratio” of 83.2% in 2023, which is higher than in 2022 – 82% – and of 85% in Q4. This is wider than its rivals, some of whom — notably Humana — have been scrambling to readjust its pricing, leading to flat membership growth, a more negative long-term financial outlook, and share price losses.

UnitedHealth may have experienced the latter, but according to company CEO Andrew Witty, speaking on the Q4 2023 earnings call:

During the recently completed annual enrollment period, we added about 100,000 more consumers and we remain committed to our full-year goal of 450,000 to 550,000. We believe our assumptions of ongoing care activity and approach to supplemental benefit management are entirely appropriate for the environment we are planning for and feel positive about our positioning for growth entering this three-year period.

In short, UnitedHealth, already the largest provider of MA healthcare plans, continues to acquire new members at an impressive click, and expresses no concerns around its pricing plans. While Humana may insist there will be a reckoning for companies that do not adjust their MA plan pricing today, UnitedHealth appears equally confident that it has the right model in place.

Tim Noel, UnitedHealth’s CEO of Medicare and Retirement, told analysts on the last earnings call:

And certainly as we look forward, we don’t believe that we have any material pricing catch up to do in future periods and feel like we’ve got a very thoughtful response to the changes that will be encountered by the program into 2025 and 2026. So we think the forward view of our competitive outlook is quite solid and quite strong as we think about growth over the long-term.

Concluding Thoughts – Strong Optum, Strong Healthcare, Strong Business = Strong Share Price Growth Potential

In many ways, it is easy to understand why UnitedHealth’s share price is no longer the cash cow it was during all the past decade, and the first two years of this one.

With a market cap valuation of $423bn, only the two Pharma companies behind the GLP-1 weight loss revolution, Eli Lilly (LLY), and Novo Nordisk (NVO), enjoy a higher market cap within the healthcare sector. It would be unreasonable to expect any company’s share price to keep growing ad infinitum.

Additionally, the explosive growth potential of the early days of the Medicare Advantage market was unlikely to be long-term sustainable, and inevitably, perhaps a few years later than expected, owing to the pandemic, the government’s would infiltrate pricing negotiations and try to put a cap on price inflation.

Whilst these are serious concerns for UnitedHealth, the company clearly believes there is plenty it can do to maintain its current, handsome profitability margins, whether through “value-based care” provided by its Optum health services, or through implementing long-term, effective pricing strategies.

As such, when earnings arrive next week, I am not expecting any more unpleasant surprises. As a result, I think UnitedHealth stock can mount a small comeback providing results suggest the company can meet its FY24 target for $27.5 – $28 in earnings per share, and revenues >$400bn.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.