Summary:

- UnitedHealth Group’s subsidiary, Change Healthcare, was impacted by a cyber attack in February 2024.

- Unfavorable medical expense cost trends present a short-term headwind for UNH.

- UNH managed to beat all of my organic growth expectations in 2023.

- Regulatory risks remain the highest risk for UNH and might hinder the share price to perform in line with UNH’s financial results.

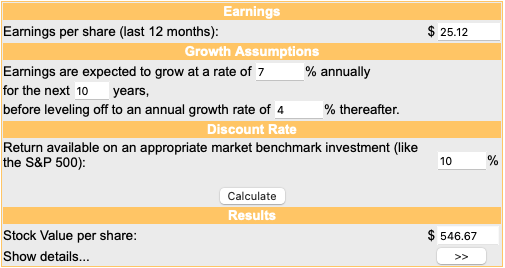

- I reiterate my buy rating on UNH. My DCF valuation leaves me to assume that UNH’s fair value per share is somewhere around $545 per share.

Wolterk

Introduction

I last covered UnitedHealth Group (NYSE:UNH) in an article published on July 31, 2023, called “UnitedHealth Group: Attractively Priced Compounder But Regulatory Risks Remain”. Several months have passed since then and there have recently been several news headlines regarding a cyber attack on Change Healthcare, a subsidiary of UNH’s Optum Insights segment. So I think now is a good time to follow up on my initial article, especially since the stock has been flat since it was published.

In this article, I will address the cyber attack and recent trends in the medical care ratio. I will also review UNH’s 2023 results.

I will skip a business overview and refer you to my initial article instead if you are not that familiar with how UNH operates.

The Cyber Attack – What you need to know

On February 21, 2024, Change Healthcare (a subsidiary of UNH’s Optum Insights) was impacted by a cyber attack. The news reports, like this one from Seeking Alpha, came out the day after the cyber attack occurred. Change Healthcare is an intermediate between pharmacy benefit managers (PBMs) and pharmacies. According to this article from Reuters, Change Healthcare “processes about 50% of medical claims in the U.S. for around 900,000 physicians, 33,000 pharmacies, 5,500 hospitals and 600 laboratories”. The cyber attack led to an outage of Change Healthcare’s service offering, including prescription deliveries and claims processing. It is safe to say that the impact of this cyber attack is not so small that it can just be shrugged off. Moody’s Investors Service said that the attack is a “credit negative” event for the company because it could lead to potential financial and reputational impacts.

Reuters reported on February 26, 2024, that according to people familiar with the matter, the outage was caused by the hacker group “Blackcat”. Blackcat is known to steal data and hold it hostage to secure massive payouts. Only two days later, there were reports that the hacker group said that they stole millions of records, including medical insurance and health data, amounting to 8 terabytes of data.

The main problem that arises from the attack is that physicians are unable to process insurance claims. Not being able to process insurance claims means no reimbursements, leaving healthcare service providers with liquidity issues and a need for short-term funding. To battle this, UNH launched a temporary funding assistance program for healthcare service providers on March 1, 2024 (which was not well received due to limitations and loan terms). A few days later, the American Medical Association (AMA) asked the Biden Administration to help with emergency funding to make sure that service providers can continue to deliver services to patients. This call didn’t go unheard and the U.S. Department of Health and Human Services (HHS) released a statement on March 5, 2024, announcing immediate steps to help out.

According to UNH, Pharmacy e-Prescribing (including claim submission and payment transmission) has been back to being fully functional since March 7, 2024. The restoration timeline released by UNH aims for provider electronic payments and the claims system to be back to operational in the middle of March, so probably this week.

Some thoughts on possible after-effects

I highlighted in my last article that an increase in regulatory pressure seems likely and is one of the risks associated with the managed care sector. UNH’s CEO Andres Witty has already been summoned to the White House and urged to take more action to resolve the current payment issues. Additionally, the HHS opened a probe into the cyber attack. The focus of this investigation will be to determine the impact of the attack and UNH’s compliance with the Health Insurance Portability and Accountability Act, a law to predict patients’ data.

The cyber attack could bring UNH back into the crosshairs of the government, with the possibility of fines and ongoing regulatory problems.

Unfavorable Medical Care Ratio Trends

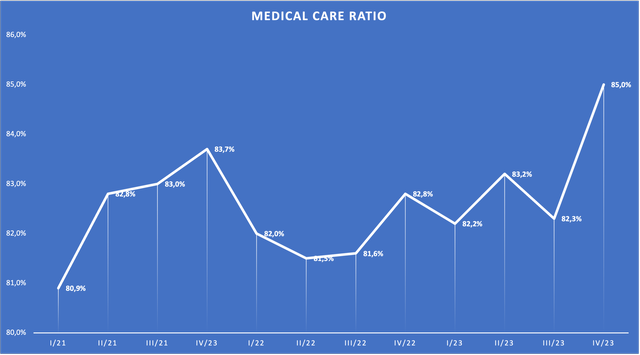

Another topic I have to address is the trend toward increasing medical care ratios throughout the sector. For instance, UNH’s Medicare peer Humana (NYSE:HUM) is down 24% YTD due to a very weak outlook regarding medical costs. As a quick reminder: The medical care ratio expresses the costs of medical expenses relative to earned insurance premiums. To be fair, Humana will take a much heavier hit due to the concentration on health insurance and Medicare but still, these trends also affect UNH. Here is a chart showing UNH’s quarterly medical care ratio trend:

UNH Medical Care Ratio Trend (UNH Quarterly Earnings Releases)

The medical care ratio increased sharply in Q4 23. For the full year, the ratio came in at 83.2% in 2023, up 120 basis points from 82.0% in 2022. Over the longer term, the ratio hovered between 82%. The big question is: Is this a temporary trend or will the medical care ratio go up to a new normal throughout the whole health insurance sector? This will mainly come down to regulatory decisions. Here is what I wrote in another article on this topic:

According to the

National Association of Insurance Commissioners (NAIC), the Affordable Care Act of 2010 requires health insurers in the individual and small group markets to spend at least 80% of their premium revenues on clinical care and quality improvements. For the large group market, the MLR requirement is 85%. A large group health plan covers employees of an employer that has 51 or more employees. UnitedHealth and Cigna seem to sit around the sweet spot of the allowed 80-82%.”

Source: Author’s article on Humana from July 13, 2023

I still think that further regulatory action seems unlikely given the current political climate in the United States. In conclusion, I think that this is a rather temporary problem that should be solved by the next insurance premium repricing cycle.

2023 Review

I will try to keep this short by focusing on the most important aspects of UNH which are:

- UnitedHealthcare Memberships

- Balance Sheet strength

- External revenue (total and by segment)

- Margin development

- Earnings growth

Memberships

Let’s start with the memberships. Here is my updated table showing UNH’s membership development over the past few years:

UNH Medical Membership Structure (Company reports – compiled by Author)

UNH grew total membership by 2% YoY in 2023, driven by 5% growth in Medicare, 2.5% growth in Commercial, and a decline of 4% in Medicaid. The decline in Medicaid memberships is due to “redetermination”. Redetermination is the regular eligibility review that usually takes place every twelve months after enrollment. This process was paused during the COVID Public Health Emergency and only commenced in 2023, so this decline should be a one-time event.

I will also compare UNH’s 2023 results to the assumptions I laid out in my last article. Back then, I argued that UNH should be able to grow its membership base by 2% going forward which is in line with 2023 results despite the Medicaid headwinds. While the U.S. workforce plus the Medicare-eligible population is expected to only grow by a bit below 1% until 2030, 2% growth going forward still seems reasonable when we take into account that Medicare is UNH’s fastest-growing segment. So UNH performed in line with my expectations regarding membership growth in 2023.

Balance Sheet

UNH’s cash and equivalents plus short-term investments currently amount to a total of $29.6 billion. Meanwhile, short-term plus long-term debt amounts to $62.5 billion. So the net debt position currently sits at $32.9 billion. This compares to adjusted net earnings of $23.6 billion and adjusted operating income (or EBIT) of $33.9 billion for 2023. In conclusion, UNH’s net debt amounts to around 1x adjusted EBIT or 1.5x adjusted net earnings, a very comfortable ratio.

External Revenue

As a quick reminder: UNH reports total revenue (external plus internal revenue) and external revenue in the segment financial reporting which can be found in the 10-K filings. Internal revenue is everything billed toward other segments inside of UNH. So if the healthcare service segment Optum bills to the insurance segment, this revenue gets eliminated in the consolidation process. This is why I like to focus on external revenue. Here is a table showing the YoY external revenue growth rate for 2023 and a comparison against my long-term organic growth assumptions:

| Segment | 2023 YoY Growth | Long-term assumption (organic) |

| UnitedHealthcare | 12.7% | 6% |

| Optum Health | 24.2% | 7% |

| Optum Insight | 51.8% | 8% |

| Optum Rx | 14.8% | 7-8% |

Without a doubt, UNH performed way above my long-term organic growth assumptions (I will refer you to my last article regarding how I derived these organic growth assumptions). This is due to unusually high inflation and ongoing M&A activity. We will most likely not see such growth rates going forward.

Margin Development

Margins for the insurance segment UnitedHealthcare were flat YoY and I don’t expect margin expansion going forward for this segment. Margins for Optum Rx have also been steady at around 11-12% since 2017.

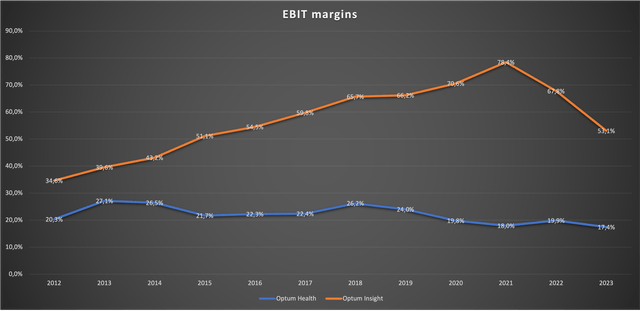

The most noteworthy margin development takes place at Optum Health (the healthcare services segment) and Optum Insight (the Software & Analytics segment). Here is my updated chart showing the margin development for these two segments:

Optum Health & Insight EBIT margins (Company reports – compiled by Author)

As we can see here, Optum Insight’s margins have now declined two years in a row. I am not sure what is happening here, and I couldn’t find any comment on this in the FY2023 Earnings Call. I can only guess that this relates to the sky-high revenue growth rate of 50%+ for the Optum Insight segment in 2023. Maybe UNH adjusted pricing to onboard new customers or the growth came from a relatively new offering that has a lower margin profile. As long as we don’t see stagnant growth with declining margins, I am not concerned on this front.

The second thing that catches my eye is the longer-term downward trend for the margins at Optum Health. Again, keep in mind that these are margins for external services. The EBIT margins that UNH reports use total revenue as a denominator while I use external revenue, so the margins that I calculate will naturally be higher. While this is an unpleasant trend for investors at first glance, it isn’t that bad if we take a longer view. With the U.S. government complaining about the sky-high healthcare costs for U.S. citizens, declining margins at the level of Optum Health can be seen as an argument that UNH keeps lowering costs for consumers as it is growing its footprint. This would also fit UNH’s keyword that it used at the last investor conference: “Value-based Care”.

Earnings Growth and Outlook

Lastly, I want to turn to more traditional metrics, specifically adjusted net earnings and free cash flow (FCF). We can use adjusted net earnings instead of GAAP earnings because the only adjustment eliminates the amortization of intangible assets, an adjustment that I have no complaints about. Here is a table showing the earnings growth in 2023 (in $million):

| 2022 | 2023 | YoY Growth | |

| External Revenue | 324,162 | 371,622 | 14.6% |

| Adjusted Net Earnings | 21,081 | 23,567 | 11.8% |

| Free Cash Flow (FCF) | 22,479 | 24,623 | 9.5% |

Since FCF is much more volatile but on average a bit higher than adjusted net earnings, we can focus on adjusted net earnings growth. UNH managed to grow at close to 12% YoY. The share count decreased by a bit above 1%, so earnings per share grew a bit higher at 13.2% YoY. In my prior article’s DCF valuation, I assumed 7% earnings growth going forward. UNH was able to handily beat that assumption.

In the most recent earnings release for the full year, UNH affirmed the outlook for 2024 that was given at the investor conference in November 2023. At the conference, UNH set the adjusted earnings per share outlook at $27.50 to $28.00 per share. This assumes a medical care ratio of 84% for the full year 2024. Since 2023 earnings per share came in at $25.12 per share, the current outlook assumes 10% YoY growth at the mid-point of the guidance range. This is again well above my organic growth assumptions of 7% going forward.

Valuation

UNH is currently trading at $490.82 per share with 935 million shares outstanding, so the market capitalization currently amounts to $459 billion. I will assume a cash conversion ratio of 100% despite FCF being a bit higher than adjusted earnings in the past few years. With $23.6 billion in adjusted earnings for 2023, UNH is currently trading a bit below 20x adjusted earnings and somewhere around 18x forward adjusted earnings.

I always say that the long-term total return potential should be equal to the FCF yield (what the company could pay out to us) plus the FCF growth rate. In the case of UNH, this means that we could assume somewhere around 12% long-term returns (5% FCF Yield + 7% organic growth) if the company achieves the growth rates I project going forward. Any additional growth due to M&A would be a bonus. All of this assumes no changes in valuation.

Supplemental DCF Valuation

As UNH was able to handily beat every growth assumption I made, I will just use my prior assumptions again to perform a supplemental DCF valuation. I will assume the following:

- $25.12 FCF per share as a starting point (FY2023 adjusted EPS)

- 7% growth for the next decade

- 4% growth into perpetuity

- A 10% discount rate

Here is the result:

DCF Valuation (moneychimp.com)

According to my estimates, UNH should be worth somewhere around $545 per share. This implies a 10% valuation upside from today’s price.

Risks

The risks that come with an investment in UNH haven’t materially changed since my last article, so I will generally just refer you to that article.

I have to add some words to a materializing risk I covered before though. Here is what I wrote in my last article:

The recent news that the Justice Department is already looking at the managed-care industry might be a warning. As I outlined earlier, Optum Rx for example seems to have around 20% market share in the pharmacy services segment (which is huge when we consider that pharmaceutical spending is around $633.5 billion). This shows the kind of scale UNH has already achieved and makes it a perfect target for any kind of monopoly probe. I do rate this risk as high so this is something that should be monitored.

Source: Risks section of Author’s article from July 31, 2023

I highlighted regulatory risks and a potential monopoly probe as a high risk. According to news reports from the Examiner News and the WSJ, the Department of Justice (DOJ) is probing UnitedHealth/Optum over antitrust concerns. According to this Seeking Alpha news report, shares fell to the lowest level since September 2023 after this news. The probe aims to investigate the relationship between UNH’s insurance arm UnitedHealthcare and the healthcare services arm Optum. UNH’s share price already showed weakness before the news, but it has been flat since the news came out while the broader market is up significantly in 2024. I think that these (and the potential for further) regulatory actions against UNH remain one of the greatest risks for UNH and the share price performance.

Another unknown risk is the outcome of the recent cyber attack I highlighted at the beginning of this article. UNH might face a fine from the HHS or lose market share to competitors due to safety concerns. Further news regarding the HHS’s investigation into this matter should be closely monitored.

Conclusion

Negative outcomes of the recent cyber attack remain unknown but might include fines or other actions as a result of the HHS’s investigation or market share losses for Optum Insight’s offerings that were compromised. Overall, regulatory risks remain the main risk for UNH.

Unfavorable medical expense cost trends are another headwind in the near term. The medical care ratio reached 85% in Q4 23, a level UNH has not seen for quite some time. For the full year 2024, UNH’s outlook assumes a medical ratio of 84%, well above the range of around 82% we have seen in recent years.

Nevertheless, UNH’s financial results for 2023 were outstanding. The company exceeded all of my long-term organic growth assumptions, while the share price has been nearly flat over the past eight months. I reiterate my conclusion that UNH should be able to deliver low double-digit total returns for the foreseeable future. My supplemental DCF valuation leaves me to assume that UNH also has some upside potential on the valuation level.

In conclusion, I reiterate my buy rating on UNH and might even upgrade it to a strong buy when the price drops further to somewhere around $450 per share. In my opinion, UNH remains the default choice for a very diversified, best-of-breed buy-and-hold stock in the broader healthcare sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH, HUM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.