Summary:

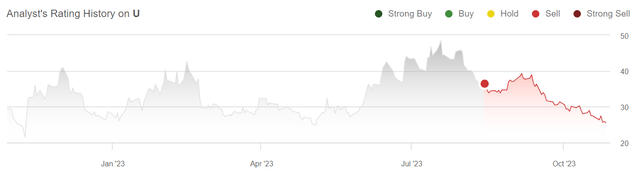

- Unity Software’s stock has declined by almost 30% since August, making it a good time to revisit the investment thesis.

- The retirement of John Riccitiello opens the possibility of a takeover bid for Unity.

- Unity’s growth prospects are strong, driven by AI and AR/VR technologies, and the company’s valuation suggests upside potential.

- I upgrade Unity stock to a cautious “Buy”, and set a $29.15/share target price with ~17% upside.

Sundry Photography

In August this year I initiate Unity Software (NYSE:U) with a Sell recommendation, citing concerns on valuation and projecting 20% downside. The thesis was a good call, with Unity shares having lost close to 30% since the time of writing, while the S&P 500 (SP500) has lost less than 10%.

As Unity stock has undershot my valuation target, I think it is a good time to revisit the Unity investment thesis. And in fact, I am now turning cautiously bullish. There are quite a few positives for investors: First, with John Riccitiello retiring from all his positions at Unity, the software company is probably open for a takeover bid; Second, Unity growth story takes shape on strong secular growth trends, including generative AI and AR; Third, Unity shares look reasonably valued now, likely giving investors who buy below $30/ share an upside skew.

CEO Transition May Catalyse A Take Over

On October 9th, the Unity board unexpectedly announced the retirement of John Riccitiello from his roles as President, Chief Executive Officer, Chairman, and Board member, effective immediately. This decision comes at a crucial time for Unity, following a period of bad publicity on the company’s decision to force developers into a new pricing agreement for Create by retrospectively changing terms of service. In that context, Mr. Riccitiello called developers who were pushing back on the new monetization strategy “fucking idiots”:

Ferrari and some of the other high-end car manufacturers still use clay and carving knives. It’s a very small portion of the gaming industry that works that way, and some of these people are my favourite people in the world to fight with – they’re the most beautiful and pure, brilliant people. They’re also some of the biggest fucking idiots.

Stepping in as the Interim CEO for Unity is James M. Whitehurst. It’s worth noting that Mr. Whitehurst has been a “Special Advisor” to Silver Lake, Unity’s second-largest shareholder, since March 2021. But even more interesting is Mr. Whitehurst background in leading Red Hat for 12 years, up to a takeover by IBM.

Although Unity officially stated that the company will initiate a search for a permanent CEO, I speculate that Mr. Whitehurst has been brought in to explore opportunities for a potential sale of the company — it would match his background. Investors should consider that AppLovin (APP) has offered to buy Unity in August 2022. Today, Unity is trading at about half the price that AppLovin initially proposed to offer, setting up the stage for an attractive opportunity for AppLovin.

Favorable Growth Outlook

While the Unity takeover argument is certainly attractive, my thesis on Unity does not hinge on a speculative deal. In fact, even without a takeover, I see Unity poised to capture strong growth tailwinds though the next decade, most notably on the backdrop of AI and AR.

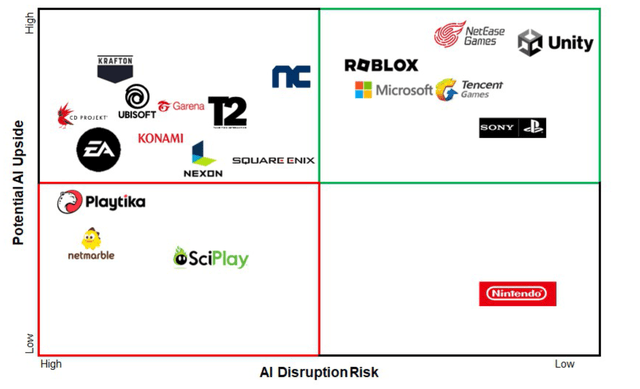

On gaming, Morgan Stanley’s equity research team has recently published a study on how AI will change the future of gaming (Research Note: How Will AI Change the Game Industry…and Who Could Benefit? Dated October 22). In that context, Morgan Stanley categorized Unity’s AI exposure with low risk and high upside. Specifically, the report identifies several growth drivers: First, there is potential benefits of AI tools on cost savings and increased efficiency in game development, which could lead to higher earnings and advertising budgets for game publishers; Second, AI tools are poised to lower the barriers to entry in the gaming industry which could lead to a bigger gaming market on more published games; Third, AI will likely strengthen gaming engagement and payer conversion, which could drive on-game monetization.

Morgan Stanley Equity Research

On Unity’s AR opportunity, I see significant growth potential in non-gaming sectors as industries increasingly adopt Real-Time 3D and digital twin technologies across a wide range of applications. In that context, Unity’s potential has been highlighted and crowned by the partnership with Apple (AAPL). As Apple is spearheading into AR/VR with the Apple Vision Pro, Unity’s functionalities relating to AR Foundation and XR Interaction Toolkit, among others, will be a major support for running visionOS.

Thanks to supportive growth fundamentals, despite the management changes, Unity has reaffirmed its previously disclosed 3Q23 guidance, including revenue estimates of $540-$550 million (a 7-9% year over year growth on pro forma estimates) and adjusted EBITDA of $90-100 million. This would suggest that Unity may be well on track for a $500 million annual EBITDA run-rate by the end of 2024.

Valuation With Upside

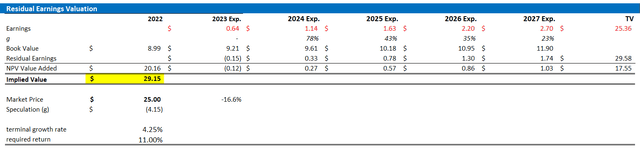

To back up my confidence on Unity’s upside independent of a takeover, I have constructed a residual earnings model for Unity stock. The residual earnings model anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With that said, for my Unity stock valuation model, I make the following assumptions:

- To forecast 2025 earnings, I anchor on analyst consensus estimates; Post 2025, I see earnings growth slowing at a ~0.70 discount factor until 2027.

- To estimate the capital charge, I anchor on Unity’s cost of equity at 11%, in line with the CAPM model.

- For the terminal growth rate after 2025, I apply 4.25%, which I believe is a reasonable estimate post-2030, given AI and AR/VR exposure.

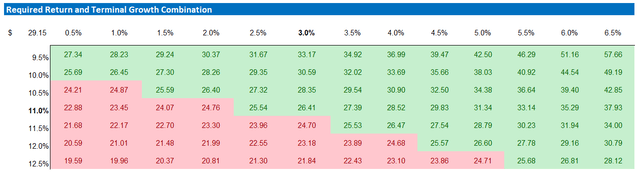

- Investors with different assumptions regarding Unity’s cost of capital and terminal growth may take reference from the sensitivity table enclosed.

Given the above assumptions, I calculate a base-case target price for Unity of about $29.15/share, suggesting ~17% upside.

Company Financials, Author’s EPS Estimates; Author’s Calculation

As promised, below is also the sensitivity table, testing various terminal growth rate and cost of equity assumptions.

Company Financials, Author’s EPS Estimates; Author’s Calculation

Conclusion

My investment recommendation on Unity Software is shifting. Initially marked with a Sell recommendation due to valuation concerns, the stock has since declined by almost 30%. Moreover, the sudden retirement of John Riccitiello, opens the door to potential changes, including a takeover bid. James M. Whitehurst, the Interim CEO with a background in leading Red Hat, aligns with the company’s potential for acquisition. But also on a takeover-independent perspective there is upside, as Unity’s growth story is poised to accelerate on AI and AR/VR tailwinds. I upgrade Unity stock to a cautious “Buy”, and set a $29.15/share target price with ~17% upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is market commentary only; not financial advise.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.