Summary:

- Unity’s reset plan has unnerved investors, leading to pessimism and concerns over its ability to focus on its growth strategy.

- Unity is still the gaming platform leader and its headwinds could peak in the first half.

- The integration with ironSource is expected to be completed, broadening its ad revenue monetization sources.

- With U possibly looking to bottom out at the $22 level, investors should consider buying before the market realizes it.

We Are

Unity’s Reset Plan Unnerved Investors

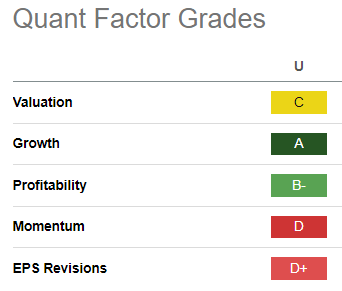

My bullish thesis on Unity Software Inc. (NYSE:U) has not turned out well. The market reacted with pessimism over Unity’s portfolio reset, intensifying the execution risks. Wall Street analysts are also mixed in their views of assessing Unity’s ability to rejuvenate its growth thesis as it attempts to chart a new growth trajectory away from ex-CEO John Riccitiello. With the ongoing search for a permanent CEO, I believe the market’s concerns over Unity’s ability to focus on its two-phase reset strategy could face more uncertainties. Moreover, despite its relative underperformance, U isn’t valued at a steep discount (“C” valuation grade). As a result, I believe the market would likely place Unity in the penalty box for 2024 as investors reassess the reliability of Unity’s ability to return to growth.

U Quant Grades (Seeking Alpha)

Notwithstanding the recent pessimism, U is still rated with a best-in-class “A” growth grade. In other words, bullish U investors could point out that the market could have been overly bearish on Unity’s growth thesis based on the opportunities for the leading real-time 3D platform.

Unity presented a recent update highlighting the robust growth momentum in the gaming industry, notwithstanding the challenges. Accordingly, “68% of studios using Unity are developing multiplayer games to increase player engagement.” In addition, Unity also underscored the continued success in multiplayer games, “with multiplayer gaming revenue growing by 10% in 2023.” Therefore, Unity’s platform leadership has remained robust, suggesting it’s well-positioned to navigate a return-to-growth from 2025.

Unity’s Headwinds Could Peak In The First Half

Unity management under interim CEO Jim Whitehurst has garnered optimism from Wall Street, highlighting his focus on “fully clearing the decks of all excess baggage.” As a reminder, Unity has positioned 2024 as a transition year, starting with restructuring its portfolio and cost (phase one) and then attempting to rejuvenate growth (phase two) in the second half of 2024.

Unity believes that Unity 6 (the latest version of its platform) is a testament to its refocus on innovation, with enhanced support helping to “streamline the entire development process” for multiplayer game development. The company also highlighted that it’s “resourcing both Unity 6 and Unity 7” as Unity looks to improve its core product offerings. Unity management admitted that the integration exercise with ironSource “may have diverted focus from driving feature velocity.” As a result, these have likely stymied Unity’s commitment to drive innovation and speed to market in feature development. However, management underscored that the integration challenges are “now resolved, with the team integrated and a solid plan to address any competitive gaps.” Consequently, Unity is confident that integrating the Unity and ironSource ads platform will broaden the company’s “monetization solutions for advertisers.”

Therefore, the worst of Unity’s headwinds could be behind the company, even as the market will likely reflect significant uncertainties as Unity hunts for a permanent CEO. In addition, the market will likely only assess the success of its restructuring from 2025 since the revenue reacceleration would occur in the second half.

With growth and tech investors having opportunities to invest in the AI space where there’s better clarity over near-term monetization, Unity might face challenges attracting these investors. With a forward adjusted EPS multiple of 32.5x, U will not likely attract value investors as it’s priced for growth. Moreover, a lack of dividends suggests that income investors will be unavailable to support its turnaround thesis, placing the burden entirely on growth investors (who are arguably more keen on AI stocks right now).

Is U Stock A Buy, Sell, Or Hold?

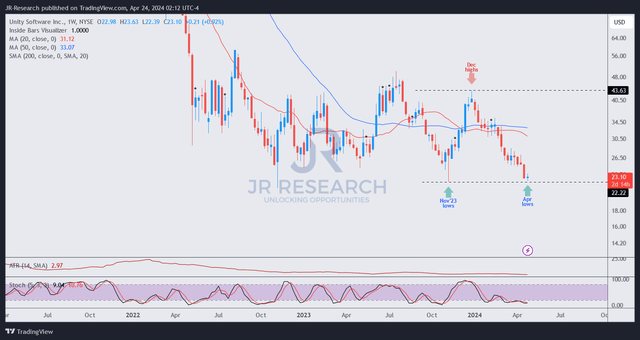

U price chart (weekly, medium-term) (TradingView)

U’s price action shows that it has been on a downtrend since it topped out in December 2023. The market has gotten it right, as Unity highlighted its uncertain reset thesis at its Q4 conference call in late February 2024.

As a result, buyers have failed to return to defend against the four-month slide, corroborated by its “D” momentum grade. However, I view the opportunity for U investors to return as more attractive now that we could re-test a strong support zone at the $22 level. While further near-term downside cannot be ruled out (to take out more stop losses at that level), I urge U investors to closely monitor the anticipated consolidation and bullish reversal.

With an improved entry point and an expected peak of its headwinds in the first half, I believe maintaining a bullish bias on U remains appropriate.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!