Summary:

- Mastercard has one of the largest electronic payment networks in the world.

- The company has achieved impressive revenue and earnings growth rates, surpassing its closest rivals.

- Analysts expect continued strong growth for Mastercard, much as it has done for the last decade.

- MA stock sits below my target valuation range and could see as much as a 20% return from current levels.

TARIK KIZILKAYA

Of the major electronic payments companies, Mastercard (NYSE:MA) trails just Visa (V) in terms of market capitalization, as the company is valued at $425 billion compared to $542 billion for its rival.

Mastercard has an enormous reach in the electronic payments space. The company has partnerships with more than 25,000 financial institutions around the world. While there are smaller players in this space, Mastercard and Visa are by far the largest names. Mastercard is accepted almost everywhere credit cards are, and the company has more than 3.3 billion cards in use as of the end of 2023.

Shares of the company trade north of 30 times expected earnings-per-share, but I believe that the stock still has the potential to return 20% from current levels.

Financial Results Are Very Impressive

Growth for Mastercard has been at a high rate for an extended period of time. Revenue has a compound annual growth rate (‘CAGR’) of 10.9% over the last five years, while adjusted earnings-per-share have increased at 19.4% for the same period.

This compares favorably to Visa, which had revenue CAGR of 9.43% and earnings-per-share growth of 8.64% for the same period. Mastercard’s results compare even better to American Express (AXP), which produced top-line growth of 8.64% and earnings-per-share growth of 6.5% since 2019. Looking at these growth rates, it is clear that Mastercard has come out on top when comparing it to its two closest rivals over the medium term.

Even more impressive is that the company’s growth rates have accelerated compared to the long term. For the 2014 to 2023 period, Mastercard’s CAGR for revenue was 10.3% while adjusted earnings-per-share grew at 14.3%.

There are many examples of companies that can grow at a double-digit rate for a long period of time, but it is the rare name that can improve its revenue and earnings growth rate from already high levels.

Mastercard has accomplished this feat because its profit margins are robust. In 2023, the company’s gross profit margin was 76%, the operating margin was 58.2%, and the net income margin was 44.6%. The company’s margins have improved over the last decade, but Mastercard has also retired its share count by 2.4% annually over the last decade, which has helped to drive earnings growth. However, much of this growth still stems from gains in the top-line.

Mastercard has used this level of profit generation to reinvest in its business and expand its network, but also to fortify its balance sheet. Total debt stands at $16.5 billion, but this is a relatively small amount for a company of Mastercard’s size.

Interest expense has risen in recent years, more than doubling from $224 million in 2019 to $575 million in 2023. This is due to an increase in debt, but also because of higher interest rates.

Even so, Mastercard’s ability to handle its liabilities appears to be very strong. The company generated free cash flow of more than $11 billion last year. Removing dividend payments of $2.2 billion left the company plenty of free cash flow to accommodate the rise in interest expense.

Mastercard had $9.2 billion in cash, equivalents, and short-term investments as of the most recent quarter, which positions the company to more than cover its $999 million of debt maturing within the next year.

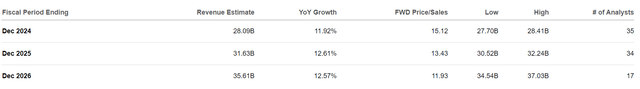

Just as important, top- and bottom-line growth is projected to continue to be strong.

While trying to predict the future can be futile, the analysts covering Mastercard are expecting that the company will see revenue increase above both the company’s medium- and long-term growth rates. This would be a further pickup in the company’s business.

Growth is even more pronounced when looking at earnings-per-share.

Here again, we see that the market expects the company to deliver mid-teens earnings-per-share growth at rates ahead of what Mastercard has historically produced.

While Mastercard will not report earnings results for the first quarter of 2024 until May 1, the company’s most recent quarterly report provided evidence that the analyst community’s expectations for this year could be accurate. Mastercard ended last year with a 13% increase in sales and a 20% improvement in adjusted earnings-per-share. For 2023, revenue was also higher by 13% and adjusted earnings-per-share increased almost 16%.

Simply by sustaining the momentum seen in 2023 into the next few years could mean that Mastercard could easily meet the market’s projected growth rates.

Valuation Analysis

Shares of companies producing double-digit revenue and earnings growth often trade with a premium valuation. Those that have accelerating growth typically see a higher multiple as well.

This has largely been the case for Mastercard since becoming a publicly traded company in 2006. As growth has increased, so has the stock’s valuation. The stock has an average price-to-earnings ratio of 41.0 since 2019 and 34.1 since 2014.

According to Seeking Alpha, analysts expect that the company will earn $14.40 per share for 2024. Currently, the stock is trading at 31.6 times forward estimates. This gives Mastercard a PEG ratio of 1.85, which is lower than Visa’s 2.09 even as the former has demonstrated a higher rate of growth.

Analysts expect Mastercard to grow earnings by nearly 17% annually over the next three years, which is right in the middle of the company’s medium- and long-term growth rates. Achieving this could very well drive the stock’s PEG ratio closer to Visa’s.

When establishing a valuation target for a stock, I like to use a range as this incorporates various potential outcomes, both favorable and unfavorable.

Assuming a PEG ratio of 2.0 for the stock, which is slightly below that of its closest rival, results in a price-to-earnings ratio of 34.0 when applied to the expected growth rate over the next three years. Factoring in the average valuations over the last decade and I have a price-to-earnings target range of 34.0 to 38.0 for Mastercard. I feel this is appropriate as it considers projected growth and the historical valuation.

Applying earnings estimates to these valuations gives a price range of $490 to $547, resulting in potential returns of 7.7% to 20.2%.

Risks to Investment Thesis

As with any investment, there are always risks to consider. While growth has been strong for most of the last decade, there is always the potential for a slowdown in the earnings growth rate for the company. This was seen during the worst of the Covid-19 pandemic when consumers were practicing social distancing. Earnings-per-share fell 17% in 2020, though Mastercard quickly recovered the next year as restrictions were eased.

The possibility of a recession could also limit spending, though Mastercard performed well during the 2007 to 2009 recession when adjusted earnings grew each year of the period. Consumers still need to spend money on gas, groceries, and other everyday items even during periods of economic difficultly, but many do so using an electronic payment. This could ultimately protect Mastercard during the next downturn.

The more pressing risk is legislation being worked on in Congress, called the Credit Card Competition Act, that would require large banks to enable their credit cards to be processed over at least one alternative electronic payment network besides the largest two, which are, of course, Mastercard and Visa. There is some bipartisan support for the legislation, but both companies are in the process of lobbying both parties against such a measure.

The bill would theoretically bring in more competition for other electronic payments providers, which could impact these two names. However, both names are so well entrenched among consumers that they might choose to stick with their brand.

Final Thoughts

Mastercard has one of the largest electronic payment networks in the world, which has enabled the company to see tremendous growth over the long term. Where many companies eventually start to see a slowdown, Mastercard has been outperforming its own growth rate in the medium term. That growth is expected to continue moving forward. The company also has a pristine balance sheet that generates a lot of free cash flow.

Despite this, shares of the company have a reasonable valuation relative to its growth rate. At the moment, the stock sits below my price target range. Investors buying today could see a possible return of ~8% to ~20% from present levels. Given the company’s historical performance, expectations for future performance, and the potential return, I rate shares of Mastercard as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.