Summary:

- Unity has suggested that cancelling its run-time fee has unblocked its renewal pipeline. While this is a positive, the company now needs alternative avenues to improve game engine monetization.

- Unity’s business outside gaming is expanding, this is not enough to offset headwinds in the rest of the business though.

- Unity is still rebuilding its machine learning stack in an attempt to enhance its advertising business. In the meantime, AppLovin’s business is going from strength to strength.

- Unity could prove significantly undervalued if adtech advances leads to improved growth. Given Unity’s ongoing struggles, it is difficult to see this happening though.

airdone

While Unity’s (NYSE:U) business appears to be stabilizing, the company remains in no man’s land. Revenue has stagnated, and despite positive cash flows, Unity continues to record losses as a result of stock-based compensation.

I tend to feel that Unity’s move away from runtime fees and deemphasis of artist tools has reduced the upside potential of its Create business, a situation that could be exacerbated by rapidly evolving AI capabilities.

Unity’s near-term prospects are now almost solely dependent on its ability to improve its adtech using machine learning. The company continues to invest in this area and management commentary is positive, but AppLovin (APP) has rapidly established a dominant position, and it is not clear that the performance gap can be closed.

I previously suggested that Unity’s monetization issues would take time to address, and while the stock is now up close to 40% since then, there have been no positive developments from a fundamental perspective. I continue to think that Unity’s share price will be dictated by investor sentiment until the company demonstrates it can develop advertising solutions.

Unity Business Updates

While Unity’s business has struggled in recent years, the company retains significant potential due to its platform, which spans from game development to live service management, user acquisition and monetization. The 3 billion downloads per month of products made using Unity also provide a large advertising opportunity.

Unity recently cancelled its planned run-time fee, removing much of the potential upside from the Create side of the business. The run-time fee caused significant tension with Unity’s user base though and its elimination has reportedly unblocked the company’s renewal pipeline. Unity now appears to be focused on pushing through subscription price increases and trying to drive adoption of tools with consumption-based pricing (multiplayer tools, live op services, tools for data management, asset management, AI-enhanced tools). While price increases are a tailwind, this will only play out slowly over time as customers upgrade/renew. Price increases go into effect in January and will start to roll through the customer base in 2025.

Unity’s business outside of gaming continues to expand and remains the fastest-growing part of its subscription business. KLM is now using Unity to power a VR cockpit training application and Deutsche Bahn has a built a series of training simulations. Most of automotive businesses globally are also using Unity for new machine interfaces in their vehicles. Unity is not trying to develop digital twins for complex simulations though and is focused on providing a 3D visualization layer that can be run on any device.

Unity is also still in the process of rebuilding its machine learning stack and data infrastructure to improve the performance of its advertising business. The company is already testing on live data and is reportedly pleased with the progress of this work. Unity is still validating the performance of these models under different conditions, which is taking time.

While AppLovin is dominant at the moment, Unity doesn’t believe it will be a winner take all market. Unity must dramatically improve its performance to prevent this outcome though. This is a question of data as much as algorithms, with Unity believing it has unique insights into how to maximize the lifetime value of gamers across platforms. While I believe there is nothing preventing Unity from closing the performance gap, AppLovin appears to be extending its lead if anything. Moving into 2025, investors will want to see a meaningful growth acceleration from Unity’s Grow business, or the stock is likely to come under pressure.

As part of its shift in strategy and renewed focus on profitability, Unity appears to be moving away from rapidly expanding its creation tools and introducing AI-enabled features into its editor. Unity now appears happy to allow startups to create gaming tools and integrate that functionality into its editor. The risk of this approach is that the capabilities of AI improve to the point that Unity’s competitive positioning is weakened. This represents a growing risk highlighted by the recent AI releases.

Decart and Etched recently introduced an AI-generated version of Minecraft where the model internally simulates physics, game rules, and graphics. The model was trained on millions of hours of Minecraft gameplay and uses an end-to-end transformer to perform next-frame prediction in response to mouse and keyboard inputs. The real innovation appears to be creating a model which provides a reasonable frame rate and low enough latency to enable a real-time experience though.

Google’s DeepMind has also developed a generative model that makes Super Mario-like games. Genie can generate a playable game in the style of classic 2D games using a range of inputs (text, sketch, photo). It was trained on 30,000 hours of video of hundreds of 2D platform games taken from the internet. The game only run at one frame per second, versus the typical 30-60 fps though. There is no fundamental limitation that prevents a higher frame rate though.

While the technology is impressive, the game suffers from thinks like hallucinations, low resolution and a lack of object permanence. Improved hardware and algorithms and access to more data could help to address some of these issues. Given the nascent state of the technology, significant advances in coming years seem likely.

Financial Analysis

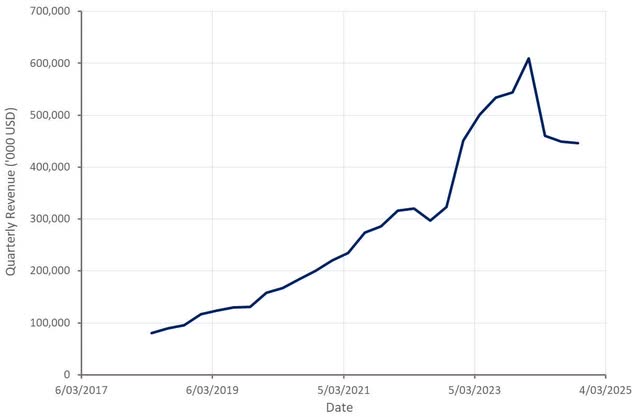

Unity’s strategic portfolio generated 429 million USD revenue in the third quarter, down 2% YoY. Third quarter Create solutions revenue from the strategic portfolio was 132 million USD, up 5% YoY, driven by 12% subscription revenue growth. Growth solutions revenue from the strategic portfolio was 298 million USD, down 5% YoY. Unity is now guiding to 1.73-1.78 billion USD revenue in 2024, implying more than a 25% YoY decline in the fourth quarter.

Figure 1: Unity Revenue (source: Created by author using data from Unity)

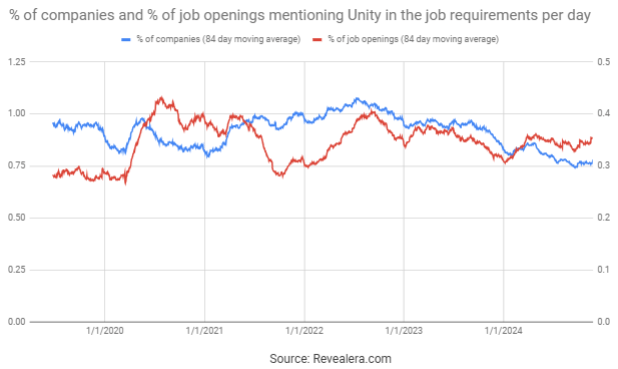

The number of job openings mentioning Unity in the job requirements has been in decline for several years, much of which is likely due to general gaming headwinds. While the elimination of runtime fees could provide Unity with a tailwind going forward, it is not really clear how much of a headwind the proposed change was in the first place.

Figure 2: Job Openings Mentioning Unity in the Job Requirements (source: Revealera.com)

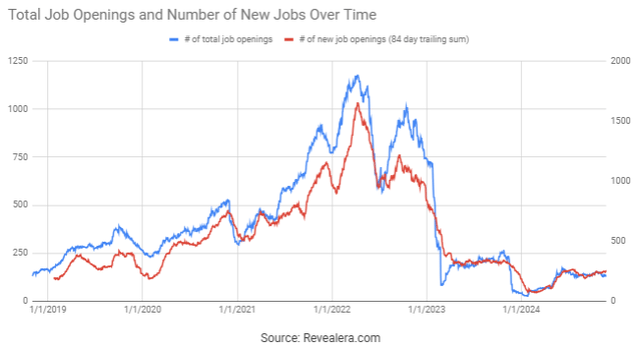

The number of Unity job openings is also still depressed and doesn’t suggest an imminent turnaround. Any rebound in hiring is likely to occur on the back of improved ad performance in 2025.

Figure 3: Unity Job Openings (source: Revealera.com)

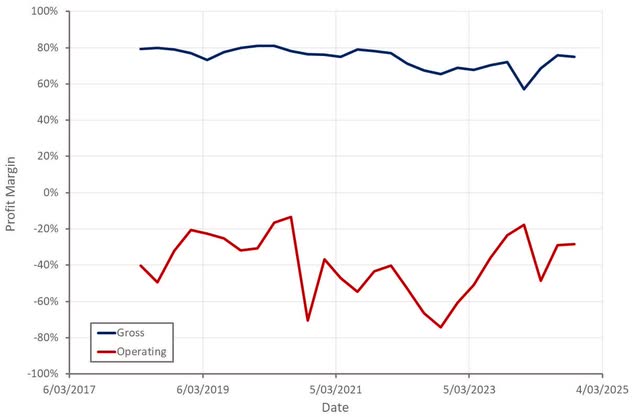

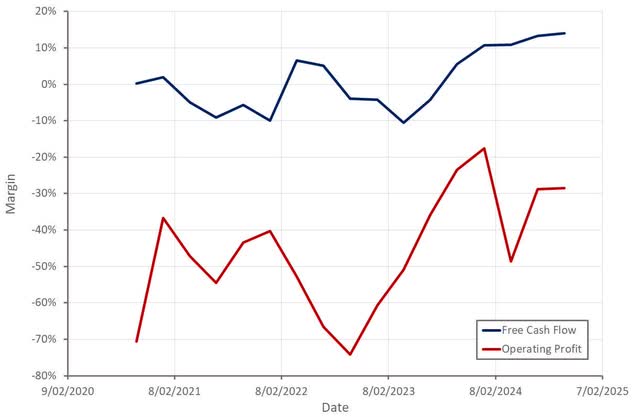

Despite Unity’s focus on extracting more engine from its engine and focus on cost control, the company’s margins are yet to move meaningfully higher. Adjusted EBITDA totaled 92 million USD in the third quarter, along with 115 million USD free cash flow. While this likely provides some measure of support to the stock, SBC was over 100 million USD, meaning Unity is a long way from creating real value for shareholders.

Figure 4: Unity Margins (source: Created by author using data from Unity)

Figure 5: Unity Free Cash Flow (source: Created by author using data from Unity)

Conclusion

Unity’s share price has rebounded somewhat in recent months on the back of optimism regarding a change in management and a potential turnaround. This may be premature though, as there are no tangible results, despite management’s positive commentary. If anything, AppLovin appears to be extending its lead, generating strong growth at scale and with extremely strong margins.

While Unity’s move away from runtime fees could strengthen user sentiment toward the company, Unity must still demonstrate that it can improve the monetization of its engine, particularly if its Grow business continues to languish.

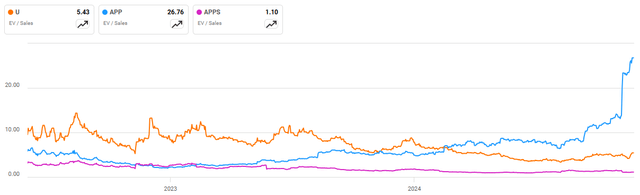

From a valuation perspective, investors are faced with uncertainty. If Unity cannot turn its business around, the stock could have a long way to fall before it begins to find support. On the other hand, if Unity can replicate even a small part of AppLovin’s success, the stock will prove significantly undervalued. At this point I tend to think the former scenario is more likely.

Figure 6: Unity EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.