Summary:

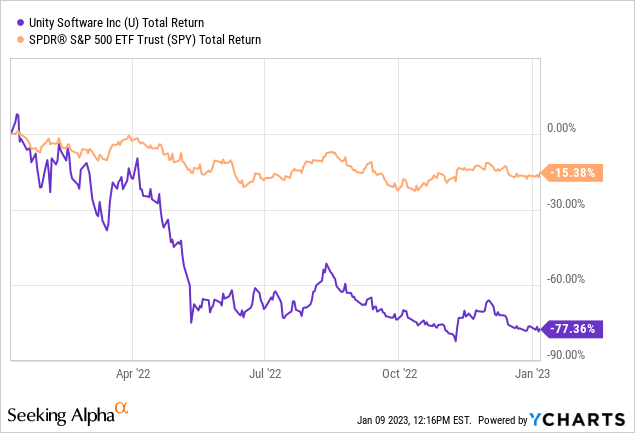

- Investors may be tempted to buy the dip in Unity stock after it has declined by 77.36% in the past year.

- There are many worrying trends in their financial results such as shrinking gross margins and rapidly increasing operating costs.

- They face ballooning net losses and have yet to prove their business model can be profitable as currently constructed.

- We believe there are better opportunities out there and investors can wait this one out.

hobo_018/E+ via Getty Images

We believe that investors should not buy the dip in Unity Software (NYSE:U). Their business is financially deteriorating and their balance sheet is mediocre at best. The risk/reward is highly unfavorable at this time.

Deteriorating Financials

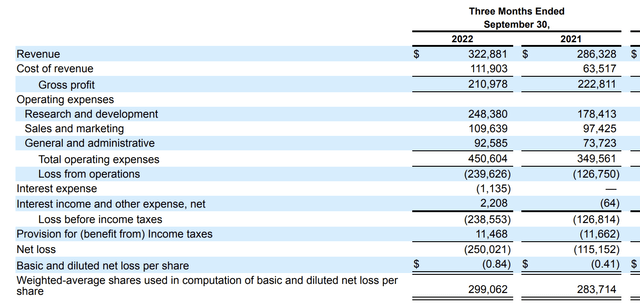

In their most recently reported quarter Unity managed to grow revenues by 12.76% year over year. While this appears to be good growth on the surface, when looking deeper there are many troubling signs. While their revenue increased their gross margin declined from 77.81% to 65.34% in the quarter. This led to a slight decline in gross profit of $11 million.

Unity’s operating expenses ballooned in the quarter by 28.90% from the year ago period. Operating expenses as a percentage of revenue were 139.55% and increased from 122.08% a year ago.

The increase in operating expenses combined with the decrease in gross profit led to a net loss of $250 million, increasing 117.12% from last year.

To put the troubling trends in perspective, their net loss was equal to 77.43% of revenue when last year their net loss was 40.21% of revenue. To put it simply their business was not anywhere as efficient as it had been in the past. This isn’t great considering Unity has never had meaningful profitability to begin with.

Income Statement (Unity Q3 Earnings Report)

All of these operational trends are incredibly concerning especially since Unity has yet to prove that their business model can be profitable. At this point they need to focus more on stemming their accelerating losses and rapid margin compression and less on revenue growth.

These are a bad signs for a tech company that is supposed to benefit from scale efficiencies. The direction Unity’s financial results are headed in adds far too much risk to the bull case. In addition to their operational struggles, their balance sheet is doesn’t provide much of a cushion for the business.

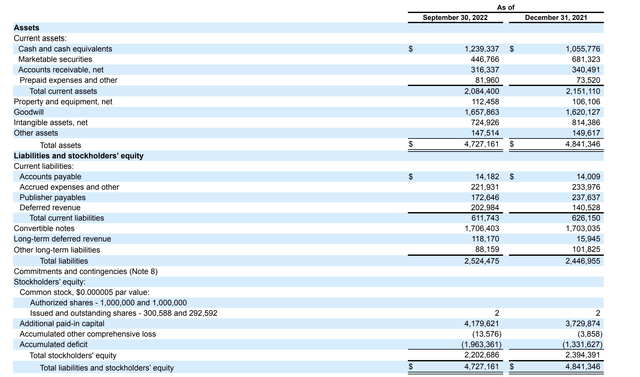

Suboptimal Balance Sheet

If their operating performance wasn’t bad enough, their balance sheet is mediocre at best and might be unable to sustain these heavy losses if they continue. Unity has a convertible debt load of $1.7 billion and a cash and marketable securities position of $1.68 billion. This debt reduces their long-term flexibility. As long as their business is operating at a loss the company is unable to make the most of their cash position because the debt repayment looms over them. If they have to refinance this debt at a higher interest rate it would put even more strain on the business. The balance sheet also has a large amount of goodwill and intangible assets on it. Given the direction their business has been going it’s entirely possible that the goodwill and intangible assets listed on the balance sheet are not worth what they think they are and a write-down could occur.

Balance Sheet (Unity Q3 Earnings Report)

Price Action

Unity has heavily underperformed the S&P 500 over the past year and it doesn’t seem like this trend will reverse until they can stabilize the business.

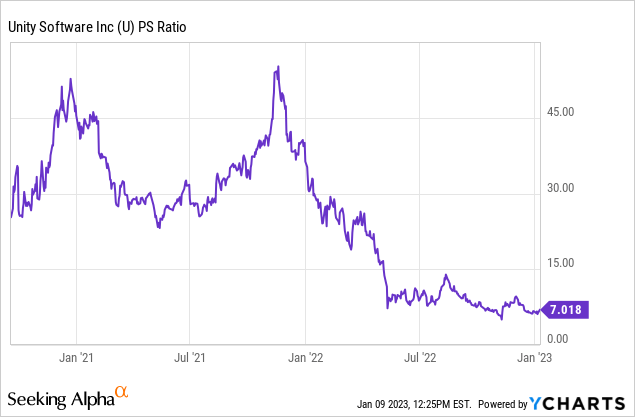

Valuation

Unity is currently losing a massive amount of money so valuing them on a PE basis is pointless. On a price to sales basis Unity looks cheap relative to where it has traded in the past.

The problem with evaluating Unity using the price to sales ratio is that each sale the company makes is becoming less profitable due to their gross margin compression, making the comparison to past multiples less relevant.

Until Unity can fix their business and improve financial results there doesn’t seem to be a good reason to own it, especially at these levels. The risk doesn’t match the potential reward especially given the current macroeconomic environment. There are better opportunities for investors to allocate their capital.

Risks

A risk to this bearish thesis is that Unity is able to activate the operating leverage in their model and significantly improve profitability.

Another risk is that if Unity has only been struggling because of the macro environment, and once the macro stabilizes the company performs above expectations.

In these scenarios we would be dead wrong and in hindsight the stock would likely appear cheap at these levels.

Key Takeaway

Unity Software has seen a dramatic decline in their stock price but we still feel like investors should stay away. Their operating results have gotten significantly worse and the business has yet to prove it can achieve profitability. Until Unity can fix their financial issues by improving margins and achieving profitability, this is a dip that isn’t worth buying.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.