Summary:

- Unity Software Inc. spent $1.5 billion buying back stock in Q4. This was nearly 15% of its market cap.

- Meanwhile, Unity Software Inc. management has been selling their stock. There have been no insider buys in 1 year. Plus, Unity’s founder sold 1.5% of the company in the past few days.

- Unity Software Inc.’s guidance is discussed.

Urupong

Investment Thesis

Unity Software Inc. (NYSE:U) has guided investors to $1 billion of EBITDA by 2024. What does this actually mean in practical terms?

In Q4 2022, Unity’s bought back $1.5 billion worth of stock at $35. With the share price down more than 20% since the buyback was completed, is Unity Software Inc. stock now undervalued?

From multiple angles, I recommend that investors avoid this name.

What’s Happened In The Past Year?

Before we go further, I believe that it’s important to remind readers of my position on U over the past year.

Why has the stock been such a challenging investment? Back in 2022, the main impact on its business came from Apple’s (AAPL) change on its iOS preventing companies from targeting users.

But there’s a much simpler story afoot.

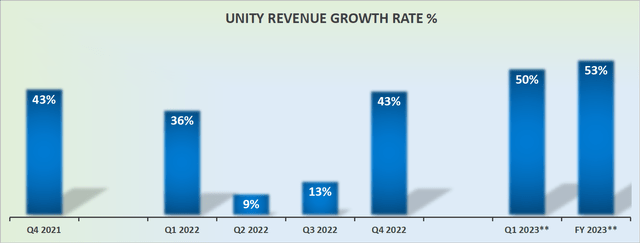

Revenue Growth Rates Require Interpretation

On the surface, we see that Unity’s revenue growth rates are accelerating significantly. Case in point, Q1 2023 is guided to grow by 50% y/y compared with Q4 2022 which reported 43% y/y growth rates. That’s a massive amount of acceleration.

The problem here is that this acceleration comes from Unity’s acquisition of ironSource in November 2022. Recall, Unity paid more than 40% of its current market cap for ironSource, which is obfuscating its underlying growth trajectory.

Actions Count More Than Words

Before we go much further, consider this.

How many buys can you count on the table above?

Personally, I find most interesting Ms. Lee’s sales. After being promoted to the Board’s audit committee a year ago, whatever petty holding Ms. Lee held, even in those few shares, were not worthwhile keeping.

Recall, during Q4 2022, Unity spent $1.5 billion, or close to 15% of its market cap buying back shares at an average price of $35.10. Can we presume that those shares were accretive to long-term owners of the business? I believe the answer is no.

And what about Unity’s founder? After seeing his company’s shares fall more than 80% from their highs, surely he should see value in his company? After all, right now, the stock is nearly at an all-time low. After all, that’s why Unity was so aggressively repurchasing shares in the past quarter.

And yet, in the past several days, Joachim Ante sold down his position in Unity from approximately 6.3% to 4.8%. And you know what happens next right? Once an entity’s holding of a stock goes below 5%, you no longer need to report a 13D.

I’m not saying that everyone is running in the same direction. What I am saying, is that I personally would approach Unity Software Inc. stock with care.

Let me put it this way: even if you hold a position in this name, don’t believe that just because it’s down significantly from its highs, this means that the stock is undervalued.

Let’s press forward.

$1 Billion EBITDA Target on the Horizon

Unity declares that it can get its profitability profile to $1 billion in EBITDA over the next 2 years. That would put the stock at 10x EBITDA a couple of years away, and the stock appears to be a bargain, right?

Let me provide a quote from U’s guidance from February of last year (emphasis added):

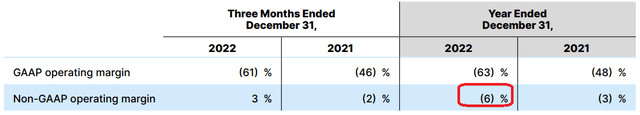

Unity expects revenue to grow at or above 40% for the long-term and to expand operating margins sequentially, breaking even on a non-GAAP basis within 2023.

And how did Unity actually end the year?

I recognize that the macro environment became very challenging in the past 12 months.

However, the fact of the matter here is that Unity is guiding for one set of targets, to reach breakeven on a non-GAAP basis in 2023, and its results actually ended 2022 in worse shape than 2021, on a non-GAAP basis.

Consequently, how strong a conviction do we now truly want to put on Unity’s guidance that in 2024 they’ll reach $1 billion of EBITDA?

The Bottom Line

This is my contention, that Unity Software Inc.’s stock is fully pricing in the hope of a strong recovery. Unity has a very compelling narrative and guidance. But when we compare and contrast what Unity Software Inc. management is guiding for, versus delivering upon, there appears to be a mismatch. However this unfolds from here, good luck.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.