Summary:

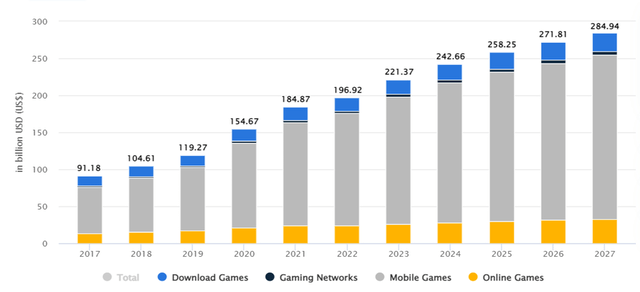

- Revenue in the Video Games segment is expected to grow at a CAGR of 9.5% over the 2022-2024 period.

- Unity’s core business possesses high barriers to entry, but the management seems to take the wrong direction.

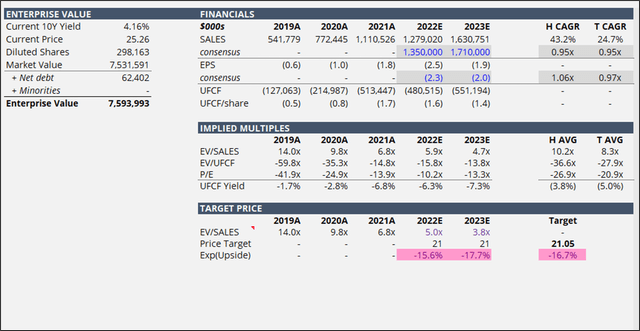

- I rate shares as SELL with an estimated fair value of $21.05/share, which would represent 16.7% downside from the current price of $25.26.

Sundry Photography

Description

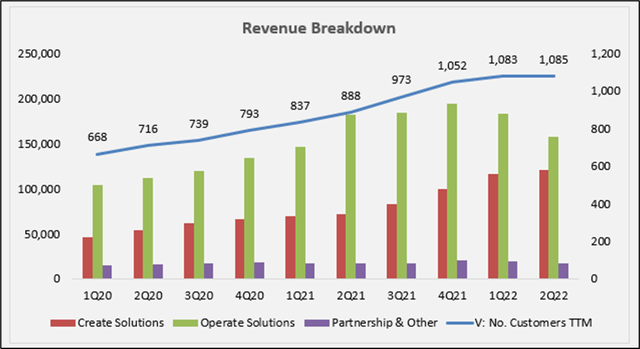

Unity Platform (NYSE:U) (“the company”) is a content creation and operating platform made up of two complementary solutions, Create Solutions and Operate Solutions, with the former driving the adoption of the second one. The Company generates revenue through three sources:

- Create Solutions, or tools for developing real-time 2D and 3D content. This product generates revenue through two sources: subscription revenue (Unity Pro & Unity Plus) with a typical term of 1 to 3 years, and professional services revenue mainly composed of consulting & similar services.

- Operate Solutions, or a set of solutions that offer customers the ability to grow their user bases, and to run and monetize their content. This product generates revenue through two sources: monetization or advertising revenue (revenue share model), and cloud & hosting services (fixed fee or consumption-based model).

- Strategic Partnerships and Other, or arrangements with technology providers for the customization and development of Unity’s software to enable interoperability with the customer’s platform (the revenue model being used varies from client to client).

The three sources are represented in the chart below.

Author’s Estimates

Video Games – Market Outlook

According to Statista’s estimates, revenue in the Video Games segment grew at a CAGR of 24.5% over the 2019-2021 period, while in the same time frame the company’s revenue grew at a CAGR of 43.2% (1.76x the market’s CAGR). Going forward, revenue in the Video Games segment is expected to grow at a CAGR of 9.5% over the 2022-2024 period, which I personally see as a very reasonable growth given the slowdown in the overall economy.

Statista.com

Company Valuation

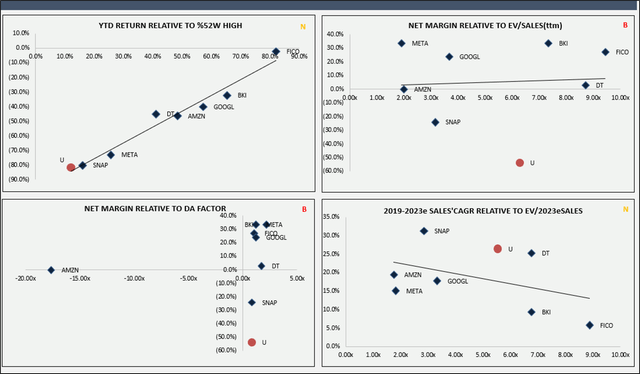

Competition

To define the competition, we should distinguish between the two solutions offered by the Company:

- Create Solutions. Here, the primary competition is: proprietary game engines built in-house by large game studios, as well as Cocos2d-x (Chukong Technologies) and Unreal Engine (Epic Games). Here, I also decided to include other types of application software companies like Fair Isaac Corporation (FICO), Dynatrace (DT), and Black Knight (BKI).

- Operate solutions. Here, the primary competition is represented by established and well-known companies. In particular, Amazon (AMZN), Meta Platforms (META), Google (GOOG) (GOOGL), Snapchat (SNAP), and Tencent (OTCPK:TCEHY).

Valuation

The company is trading at an EV/SALES of ~ 6.28 TTM, which represents a significant premium relative to the peer’s median EV/SALES of ~ 4.97x TTM.

Author’s Estimates

I believe that such a premium can be justified when we consider the Company’s core business as represented by its Create Solutions, which is a proxy for the engine used by creators to create content.

It is the engine itself, in my opinion, the Company’s biggest asset on which it should focus the most. In fact, Unity’s core business (i.e., Create Solutions) possesses high barriers to entry: proprietary technology (on the supply side), consumer habits, and high switching costs (on the demand side). It has also the ability to increase its margins fast through the economy of scale and the SaaS revenue model for its Create Solutions offers recurring and highly predictable revenue. In fact, I appreciated the acquisitions like:

- Weta Digital, 2021, is a company specializing in visual effects tools (a deal valued at approximately $1.5B).

- Ziva Dynamics, 2021, is a company that provides services and simulation software for the development of characters to film, gaming, virtual, and augmented reality industries (a deal valued at approximately $128M).

The above are two strategic acquisitions that brought additional tools to the content creators for the development of the 3D content.

However, I didn’t like their latest deal or the acquisition of ironSource (IS) valued at approximately $4.4B. In my opinion, such a high price means not only overpaying for a company that generates $79M TTM in Free Cash Flow but also means deviating from its core business (i.e., Create Solutions) to go into a highly competitive advertising market (i.e. Operate Solutions). But the management, as stated during the 2Q22 Earnings Call, seems to have a different view of the opportunities ahead:

First, we intend to accelerate our path to becoming a leading end-to-end platform combining creation and growth in a way that creates great value for our customers.

Second, we expect to capture synergies from combining our platform driving greater customer success and enabling the new Unity to deliver $1 billion adjusted EBITDA run rate by the end of 2024.

Having said that, I expect convergence to the median EV/SALES of ~ 4.97x driven by a multiple and earnings compression.

Author’s Estimates

Moreover, going forward, the Company faces different headwinds (i.e., investments risks), among others:

- China Crackdown on the gaming industry (currently China accounts for ~15% of total revenue).

- Apple’s iOS changes, which affects the Operate Solutions.

- Macroeconomic factors (i.e. the war in Ukraine).

- Competition (especially from Unreal Engine).

While, as to the upside risks, among others:

- Better than expected synergies from the combination with IronSource

- Better than expected volume growth (i.e., growth of customers contributing more than $100,000 of Revenues)

Q3 2022 Earnings

Going into the 3Q22 (release expected Wednesday 11/09 after market close), I expect the following:

- Top-line at $318M versus the market consensus of $326.66M, driven overall by the volume (up YoY) and dragged down by the price (down YoY).

- Bottom-line (EPS GAAP) at -0.60$/share vs the market consensus of -0.59$/share.

Final Remarks

I rate shares as SELL with an estimated fair value of $21.05/share, which would represent 16.7% downside from the current price of $25.26. Having said that, even for a risk-tolerant investor, such a short position may not be a good investment given the high realized and implied volatility.

I believe that ironSource’s acquisition is a big mistake, not only because the company is overpaying but, more importantly, because it is deviating from its core business. Moreover, in a liquidity tightening cycle “Cash is King”, hence every dollar is important; and since the Company itself is free cash flow negative, it should use its cash more wisely.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.