Unraveling Chevron’s Edge: How It Outperforms Exxon Mobil And ConocoPhillips

Summary:

- In the midst of falling oil prices and financial turmoil, investors can find opportunities in oil and gas companies, which offer the potential for stable income and growth.

- Differentiating between Proved Developed Reserves “PDRs” and Proved Undeveloped Reserves “PURs” is crucial in making informed investment decisions, with PDRs being more economically attractive and less risky.

- Chevron, Exxon, and ConocoPhillips have different reserve profiles and strategies; Chevron’s natural gas focus aligns with the green economy’s push for cleaner energy sources.

- Investors are paying a higher premium per PDR barrel for Chevron compared to Exxon and ConocoPhillips, primarily due to Chevron’s superior production efficiency.

CreativeNature_nl

Investment Thesis

In the bleak landscape of falling oil (CL1:COM) prices, last week marked a new nadir as the 15-month low was breached, deepening worries that the ongoing turmoil in the banking sector may spawn more significant challenges for the global economy. The maelstrom of financial uncertainty took an unsettling turn as Credit Suisse (CS) reached an all-time low as the tribulations of Silicon Valley Bank (SIVB) cast ominous doubts on the stability of the banking sector. This culminated in an orchestrated merger with UBS (UBS), signaling a desperate attempt to stem the tide. Since these troubling revelations, crude oil futures have diminished by a disconcerting 15%.

Yet amid this rapid decline in oil prices, the temporary nature of banking disruptions, the proactive measures undertaken by Central Banks to bolster the financial sector, and China’s insatiable appetite for energy, there lies an opportunity for the discerning investor to place a speculative wager in the oil market. Indeed, investing in oil companies presents a more enticing prospect than merely acquiring oil futures. Unlike inert barrels of oil, these corporations often reward shareholders with dividends and the promise of stable income. The wise words of Warren Buffett encapsulated this idea when he said:

[Gold] doesn’t do anything but sit there and look at you

While the Oracle of Omaha doesn’t explicitly mention oil and gas, the principle he highlights extends to all commodities. Thus, in the face of financial turmoil and the shifting tides of the oil market, an astute investor may find a hidden opportunity to capitalize on the resilience and potential growth of the oil companies, defying the temporary chaos that currently engulfs the global financial market.

In this analysis, we unveiled the intriguing observation that investors are currently paying a higher premium per barrel of PDR for Chevron (NYSE:CVX) compared to both ConocoPhillips (COP) and Exxon Mobil (XOM). This apparent discrepancy, upon closer examination, can be attributed to CVX’s superior production efficiency. We don’t see an opportunity for arbitrage; instead, the price premium of CVX will likely persist in our view.

Narrowing The Scope

In the realm of oil and gas investments, a wealth of analysis has meticulously examined factors such as the financial health and dividend stability of oil and gas companies. However, a significant blind spot persists: the critical distinction between Proved Developed Reserves “PDRs” and Proved Undeveloped Reserves “PURs” remains underappreciated. A thorough understanding of these two factors is indispensable for informed investment decisions, and comparing the respective PURs and PDRs of oil and gas companies offers a more insightful approach to valuation.

PDRs are reserves accompanied by established production facilities and infrastructure, either currently producing or requiring minimal investment to initiate production. Economically, PDRs hold an edge over PURs, having already navigated the development process, including licensing, drilling, and infrastructure. PDRs also generate cash flow more rapidly than PRUs, as the latter necessitates a longer development timeline before yielding any returns. Lastly, PDRs present a less risky investment profile due to their established infrastructure, permits, and production history. In contrast, PURs are laden with uncertainties, including potential productivity shortfalls or unanticipated technical, regulatory, or financial hurdles. Consequently, PDRs entail lower associated costs compared to PURs which carry more uncertainty and demand substantial capital expenditure to kickstart production. Serbia’s decision to revoke Rio Tinto’s (RIO) development permits for the Jadar lithium mine due to environmental concerns highlights the necessity to differentiate between productive and undeveloped wells in terms of valuation.

To enhance comparability and minimize discrepancies, our analysis centers on the three largest US Oil companies: Exxon Mobil, Chevron, and ConocoPhillips. These industry titans adhere to Securities and Exchange Commission “SEC” regulations governing reserve reporting, which standardizes an otherwise heterogenous process influenced by a myriad of variables. By focusing on these giants, we ensure a high degree of comparability.

PDRs

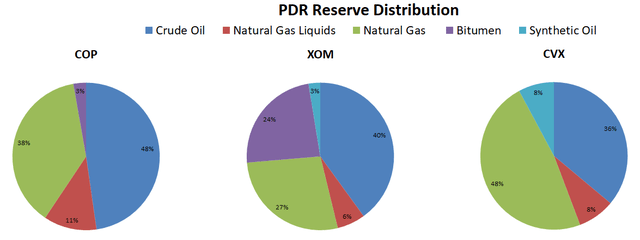

XOM, CVX, and COP are three prominent players in the oil and gas industry, each with its unique reserve profile. A comparison of their reserves as of December 2022 reveals interesting insights into their respective positions and strategies. First, we should note that 62%, 65%, and 70% of total proven reserves are of XOM, CVX, and COP, respectively, are PDRs. Developed and Undeveloped reserves data are from the respective company’s annual report. In the rare instances where oil-equivalent data wasn’t readily available, we used the standard natural gas to oil-equivalent ratio of 6000:1. In the following paragraph, when discussing reserves, we will be referring to PDRs unless otherwise stated.

COP reserves are primarily concentrated in crude oil, with a total of 2,175 million barrels. The majority of these reserves are located in the United States (1,695 million barrels, followed by Africa, Europe, Asia pacific/middle east, and Canada. The company also has significant natural gas reserves amounting to 10,334 billion cubic feet (1,724 million oil-equivalent barrels), along with 531 million barrels of natural gas liquids and 127 million barrels of developed and proved bitumen reserves in Canada.

XOM, on the other hand, has a more diversified reserve portfolio. The company’s total oil-equivalent proved and developed reserves stand at 11,143 million barrels, including 4,211 million barrels of crude oil, 729 million barrels of natural gas liquids, 2,288 million barrels of bitumen, 248 million barrels of synthetic oil, and 21,998 billion cubic feet of natural gas. Exxon has a strong presence in the United States, Canada, and Asia, with reserves spread across various regions and categories.

Chevron reserves also showcase diversity with 2,642 million barrels of crude oil, 574 million barrels of synthetic oil, 597 million barrels of natural gas liquids, and 21,056 billion cubic feet of natural gas. The company has a significant presence in the United States, Africa, and Australia, among other regions. Chevron’s affiliated companies, such as Tengizchevroil, contributed additional reserves, further strengthening its reserve base.

Each company’s reserve profile reflects its strategy and focuses on specific regions and resources. ConocoPhillips appears to prioritize crude oil, while Exxon demonstrates a more diversified approach with investments in crude oil, natural gas liquids, bitumen, and synthetic oil. On the other hand, Chevron sits on a reserve balance favoring natural gas, which contributes to about half of its oil-equivalent barrel reserves.

Author’s estimates based on SEC filings

In the pursuit of a greener economy, natural gas has emerged as a frontrunner, often hailed as “bridge fuel” as it offers a more environmentally friendly option compared to traditional fossil fuels, emitting significantly fewer greenhouse gases and air pollutants. For example, Walmart’s (WMT) Senior Vice President of Transportation cites Natural Gas in a white paper on the retailer’s plans to lower its carbon footprint. UPS (UPS) made similar moves. Thus, in terms of reserves’ strategic focus, I give the point to Chevron due to its high natural gas exposure.

How Much Are You Paying For Proved Reserves?

Taking into account the current stock price, outstanding shares, PDR and PUR in oil-equivalent terms, we can see that the price investors are paying per reserve barrel varies significantly among the companies. COP offers the cheapest option at $25.24 per PDR barrels of oil-equivalent “BOE,” while CVX presents the highest at 39.67 per BOE. This ranking remains consistent even when factoring in undeveloped reserves.

| Figures in millions except per BOE prices | CVX | XOM | COP |

| PDR (Millions Oil-Equivalent Barrels) | 7,322 | 11,142 | 4,557 |

| Market Cap | $ 290,460 | $ 406,450 | $ 115,040 |

| Price per Barrel (PDR) | $ 39.67 | $ 36.48 | $ 25.24 |

| Price per Barrel (Total Reserves) | $ 25.87 | $ 22.91 | $ 17.43 |

Valuation discrepancies above may be attributed to the district unit economics of each organization. For instance, COP has the highest extraction cost per barrel compared to its counterparts. On the other hand, CVX boasts the most cost-effective production process per barrel, showcasing a consistent competitive advantage in this regard that warrants a premium price on its reserves in our view.

| Average production costs per BOE | 2022 | 2021 | 2020 |

| COP | $ 11.27 | $ 9.99 | $ 10.99 |

| % change | 13% | -9% | |

| XOM | $ 13.09 | $ 12.15 | $ 11.57 |

| % change | 8% | 5% | |

| CVX | $ 10.16 | $ 9.90 | $ 10.07 |

| % change | 3% | -2% |

Looking at the table above, we can see that the average production costs per BOE have increased for all three companies in 2022, with COP experiencing the highest increase in production costs, going from $9.99 to $11.27. However, when considering the period between 2020 – 2022, XOM appears to have experienced the highest cumulative increase, with costs rising 5% in 2021 and again 8% in 2022.

It is important to remember that the figures above are averages of a mix of assets with varying degrees of production costs, including some that are relatively more expensive to produce. For example, XOM has high exposure to bitumen, which is expensive to process. In February 2017, XOM announced a reduction in its proven oil reserves by 3.3 billion barrels due to lower fuel prices. This marked the largest reserve cut in the company’s history, and it primarily impacted the Kearl bitumen oil sands project in Canada. The proved reserves were removed from the books as the project was deemed uneconomical at the lower oil prices prevalent at the time.

Chevron and COP also have some pockets of assets that are of less quality than their core assets, supporting our idea that costs are distributed on a wider statistical tail. For example, In 2019, Chevron announced a write-down of $10 billion in value of its assets, primarily due to lower natural gas prices. The company adjusted its long-term price assumptions, resulting in the impairment of assets, including its Appalachian natural gas operations and the Kitimat natural gas project in Canada.

COP also had some issues with its oil sand assets, where it had to reduce its reserves. In 2015, the company had to remove 1.15 billion barrels of oil sand reserves from its books because the projects were no longer economically viable at the time.

As an informed observer, I believe that even though companies don’t reveal specific detail about the production cost for each site, examining the average figure still offers valuable insight. A lower average cost not only suggests enhanced profitability but also reduced risk of impairment.

Summary

Investors recognizing the advantages of higher production efficiency appear to be willing to pay a premium for CVX stock. This efficiency can translate into lower operating costs, better margins, and ultimately stronger cash flows and profitability. More importantly, it decreases the risk of a situation in which production becomes uneconomical with commodity price movements. As a result, Chevron is perceived as a more attractive investment opportunity despite its higher price per PDR barrel relative to its counterparts.

It is crucial for investors to weigh these factors when making investment decisions in the oil and gas sector. While the price per PDR barrel is undoubtedly an essential consideration, it should be analyzed in conjunction with other aspects, such as production efficiency, in order to gain a comprehensive understanding of a company’s value proposition.

In conclusion, our analysis demonstrates that the market is willing to pay a higher price for Chevron’s PDR barrels compared to COP and XOM, primarily driven by the company’s enhanced production efficiency. This serves as a reminder for investors to not solely rely on a single metric but to consider multiple factors, such as production efficiency, when assessing the potential value and growth prospects of oil and gas companies.

Disclosure: I/we have a beneficial long position in the shares of CVX, XOM, COP, CS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.