Summary:

- GameStop is due to report earnings this week.

- This company has huge long-term issues, but short term, the balance of risk and reward has shifted.

- I’m upgrading GameStop from sell to hold ahead of the report.

RiverNorthPhotography

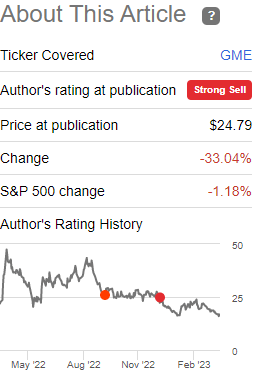

While earnings season is winding down for Q4, former short squeeze legend GameStop (NYSE:GME) is due to report on Tuesday. I’ve covered GameStop a handful of times, and most recently, we looked at the company’s Q3 earnings results back in December. At the time, I said there was no short squeeze coming, and I placed a strong sell on the name following my look at Q3 earnings results.

Seeking Alpha

Shares have lost a third of their value in the time since, so I’ll call that one a win. Now, with earnings due out shortly, I believe we have an entirely different setup to what I saw after Q3 results. Let’s dig in.

Charting the way

I always start with the chart, and this time is no different. Technical analysis takes the guesswork and emotion out of investing (for me, anyway), and that’s why I always use it as the basis for any decision I make with my own money. GameStop’s chart looks much better than it did last time, so let’s take a look.

When I say it looks better, I am not saying this is a screaming buy; far from it. However, I do think the balance of risk/reward has shifted firmly into the hands of the bulls, whereas I saw it the other way back in December.

The downtrend is very much intact, as you can see above, so that’s why I’m not pounding the table. But to my eye, the odds of a double bottom having been put in look quite high. The key for the reaction from the market to the earnings report is this: is the double bottom respected, or does it break?

I marked a zone of support where I used the candle bodies, and then the spike lows, for the double bottom. You can use either, and I always tell subscribers that support levels are areas, not specific points down to the penny. With that in mind, we have support in the area of $15/$16.

Why do I think this is a double bottom? Price action, for one. We also have the PPO and the 14-day RSI both putting in positive divergences along with the double bottom. That essentially means bearish momentum is waning while price is bouncing off of support. That generally means the trend is more likely to change, and in this case, that would be bullish.

To sum up the chart, I was very bearish on GameStop in the mid-20s, but the stock has ceded a third of its market cap since then. That’s made it more attractive, and the double bottom has only bolstered the bull case. I’m not suggesting you run out and buy it, but I am suggesting that being bearish here is too risky.

Fundamentals still not inspiring confidence

Let’s now turn our attention to what I still think are quite concerning fundamentals. The pre-squeeze GameStop had continuously worsening revenue and margin trends, as well as a huge amount of debt. However, the company – to its credit – used the enormous run up in its share price to issue shares and eliminate its debt. That’s a significant headwind removed, but the core business is still struggling.

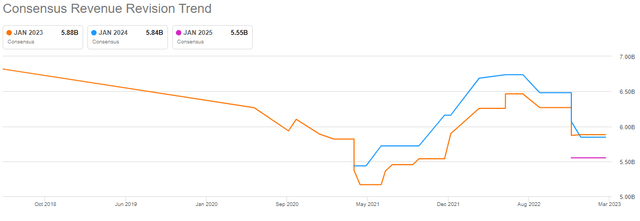

Revenue estimates remain quite weak, and while the declines have stopped, it isn’t like there’s much to be excited about here. The company remains highly dependent upon console and game release schedules, but more than that, GameStop has no value proposition for consumers. Why should someone use GameStop? I haven’t been able to answer that for years, because there’s no advantage, no moat, no reason for GameStop to exist. It’s a commodity dealer at this point, and to me, I struggle to understand why this business should be around in the years to come. It’s a relic of physical disc game sales, which hasn’t been relevant for years.

The perma-bulls will scream at me about how the company sells things besides games, and that’s true. But the fact is that GameStop has no competitive advantages or moats, and over time, I expect the lines above to continue to trend lower.

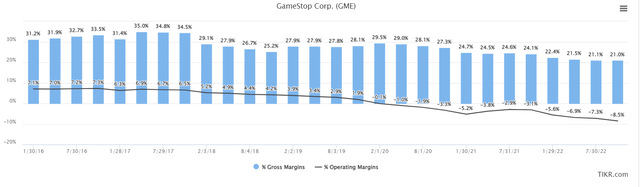

Worse than that, and indeed, very much tied to the above, is margins. Below we have trailing-twelve-months gross and operating margins to illustrate just how bad things have gotten.

Gross margins for the past four quarters are 21% of revenue; that’s grocery store territory, and that’s not a compliment. Operating margins are now down to -8% of revenue, and importantly, continue to get worse. GameStop has been thus far unable to match its SG&A profile to its consistent gross margin declines, and this introduces all sorts of issues.

Obviously, it means there are no profits to speak of. But it also means free cash flow is likely to remain weak, which we’ll come on to in a bit.

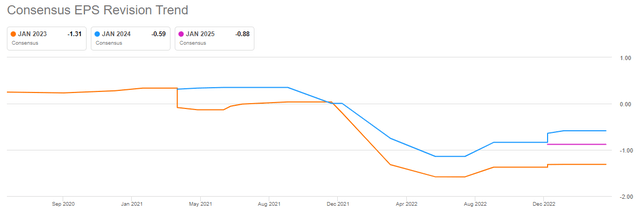

EPS estimates also bottomed last year, similarly to revenue, but this is hardly a bullish story.

I don’t need to beat the proverbial expired steed but the point is that there are no profits now, and there aren’t likely to be anytime soon. In fact, I am comfortable saying that I don’t think GameStop will ever generate consistent profits again.

Cash is king

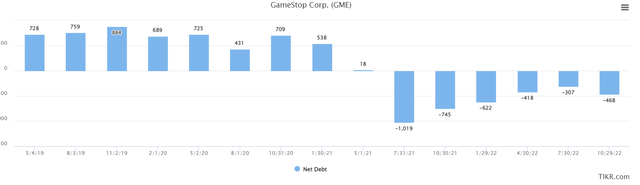

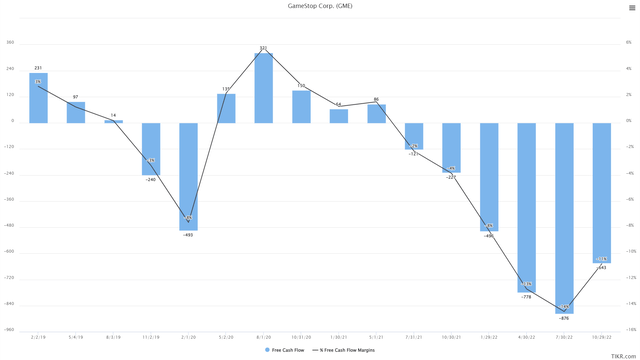

GameStop’s net debt was crushing before the squeeze, but in mid-2021, the company went from crushing debt to a billion dollars in net cash. That bought GameStop some time, but we can see that cash burn has already eaten up over half of the safety net that was created by the short squeeze.

There’s still nearly a half billion dollars in net cash, so GameStop is hardly out of money. I’m not saying GameStop is going out of business tomorrow, because it isn’t. But if we’re looking out years from now, it is my belief GameStop will likely run out of money.

Why? Free cash flow is awful.

GameStop is burning through enormous amounts of cash each quarter, because it is operating at a loss sustainably. The ~$0.5 billion in net cash it has won’t last long at this rate, and to be clear, I see absolutely no reason to think this is going to improve. Now, maybe GameStop offers up super-bullish guidance this week that changes that. I have zero belief that will happen, but it’s possible. But so long as FCF remains negative, this stock is not one you want to buy and hold.

Let’s wrap this up

We can now take a look at GameStop’s valuation heading into earnings, and to be fair, it’s as cheap as it’s been in the past year right now. We cannot use earnings as a valuation tool, because there aren’t any. But we can use price-to-sales, and indeed, we’ve got that plotted below.

The current P/S ratio is 0.9X, and for the past year, the average was 1.3X. By this measure, it certainly looks cheap. Is this enough reason to run out and buy it? No, it’s not. However, it does bolster the case I made in the open about how the stock is oversold at price support, and is more likely to move higher than lower in the near-term. A cheap valuation is generally in place for a reason for any stock, and GameStop is no different. I’m certainly not the only one that understands the immense challenges this company faces, and that’s why the valuation is well off its highs.

One final point that we must discuss given GameStop’s history is short interest. It’s about 22% today, so that’s still quite high. What that means is that moves will be exaggerated in both directions. Should GameStop break the support level I noted in the introduction, it is likely to get really ugly. I don’t think it’s worth the risk to short here, and part of the reason is the high short interest.

Should the support level hold, and the stock begin to rally, it is likely to rally sharply given short interest. It’s worth pointing out that given the current share price, a lot (or maybe most) of the current shorts are sitting on profits. That means the odds of a squeeze are extremely unlikely, because a key ingredient of a short squeeze is panic buying by shorts, which only happens when they begin to absorb high levels of losses. GameStop would need to nearly double for that to occur, so I’ll say the same thing I said in December: there is no short squeeze coming.

However, given the price action, the double bottom, the high short interest, and the better valuation, I’m removing my sell rating on the stock and placing a hold on it. I don’t want to take any position in GameStop stock ahead of earnings because of the balancing factors of the downtrend being strong, but a possible double bottom being put in place. Where I saw a heavily skewed risk to the downside back in December, I now see it as quite balanced heading into Q3 earnings.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.