Summary:

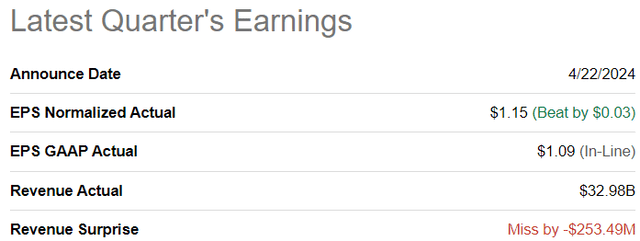

- Last week, Verizon presented a mixed set of numbers for Q1 2024, with revenues missing consensus estimates.

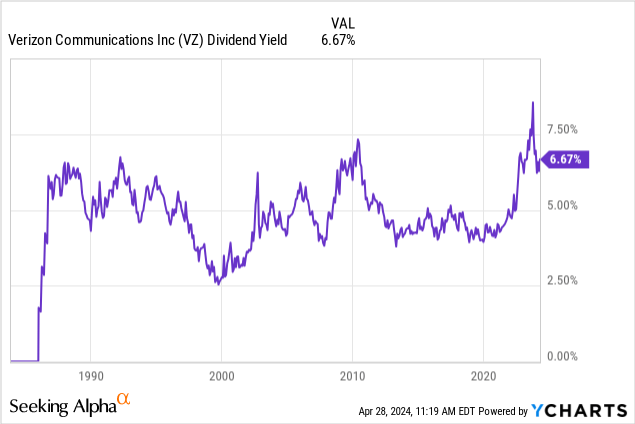

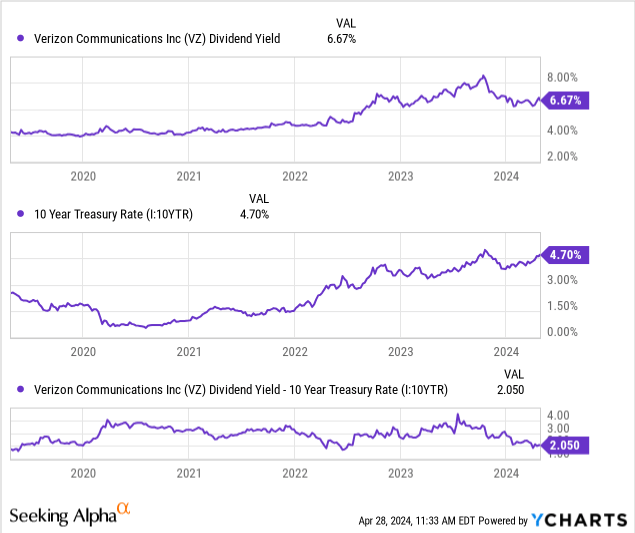

- The company’s dividend yield of 6.7% is still attractive in the current interest rate regime and uncertain macroeconomic environment; however, surging treasury yields are making it less appealing.

- Verizon’s stock is undervalued at current levels, and its 5-year price target of $67.72 implies an expected CAGR return of ~11% over the next five years.

- I continue to rate VZ stock a “Hold” in the high $30s.

JHVEPhoto

Introduction

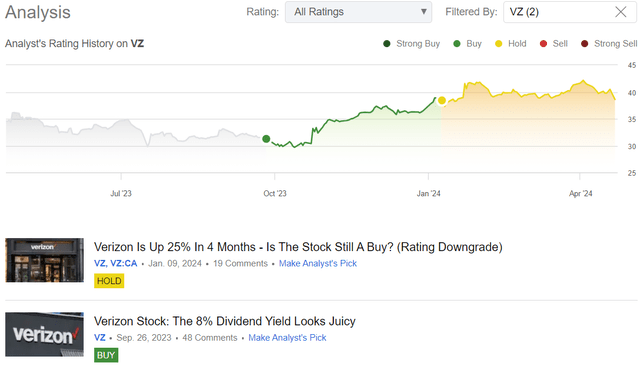

In early January 2024, I downgraded Verizon Communications Inc. (NYSE:VZ) to a “Hold” rating, citing significant deterioration in long-term risk/reward on the back of a quick-fire year-end rally in its stock:

In light of a rapid +25% jump in its stock, Verizon’s long-term risk/reward has shifted drastically, with a 5-year expected CAGR falling from ~16% to ~11%. For investors willing to accept lower returns in exchange for lower volatility offered by Verizon, VZ stock is still a decent buy given its double-digit expected CAGR. However, Verizon Communications Inc.’s expected return has dropped under our investment hurdle rate of 15%, and so, I am downgrading Verizon’s stock to a “Hold” rating.

Now, I continue to believe that Verizon is a good hideout for long-term focused dividend investors due to its utility-like cash flow generation and a solid ~6.5% dividend yield. As such, we will continue to hold all of our Verizon shares at TQI.

Source: Verizon Is Up 25% In 4 Months – Is The Stock Still A Buy? (Rating Downgrade)

Author’s history on Verizon (Seeking Alpha)

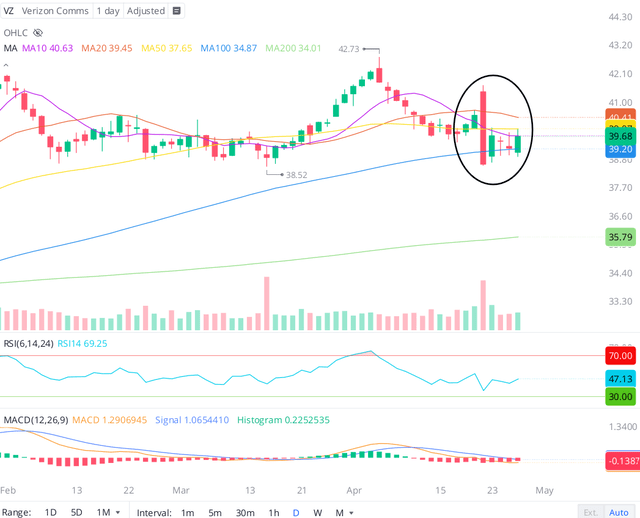

With the stock hovering around the same levels as early January, I believe our rating downgrade was prescient. Last Monday, Verizon reported stronger-than-expected earnings, and the stock did jump up by ~4% to $41+ in the pre-market hours. However, VZ stock failed to hold on to that gain and ended the day lower by more than 4%. Then, Verizon went on to bounce around the $39 mark throughout the week, but earnings were more or less a non-event as the stock continued going nowhere!

In today’s note, we will briefly review the telecom giant’s Q1 2024 print and then reevaluate Verizon’s long-term risk/reward to see if the near four-month time correction we just went through is enough to warrant a rating upgrade.

Brief Review Of Verizon’s Q1 2024 Report

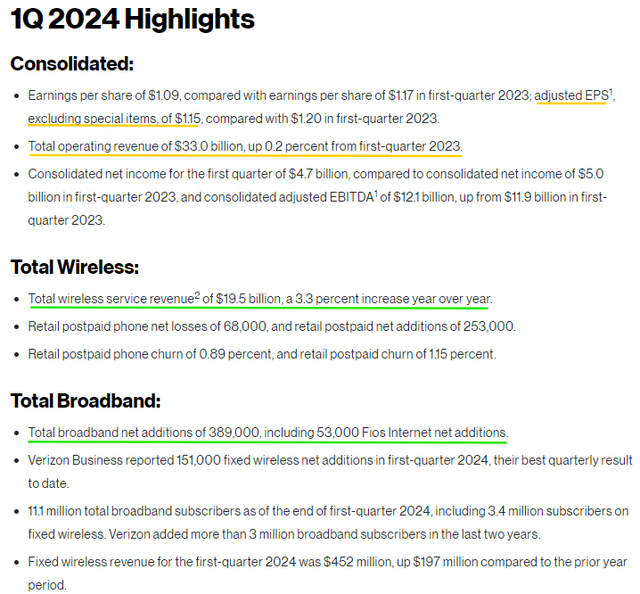

For Q1 2024, Verizon delivered revenues of $32.98B, missing top-line estimates by $250M. While its top-line growth of +0.2% y/y is nothing to write home about, Verizon has finally ended a streak of four consecutive quarters of negative revenue growth on the back of +3.3% y/y growth in wireless service revenue to $19.5B and healthy growth in broadband net additions (+389K).

Seeking Alpha Verizon Investor Relations

Despite Verizon’s slightly disappointing revenue performance, the telecom giant met bottom-line estimates, with GAAP EPS coming in at $1.09 per share and non-GAAP EPS coming in at $1.15 per share [vs. est. $1.12].

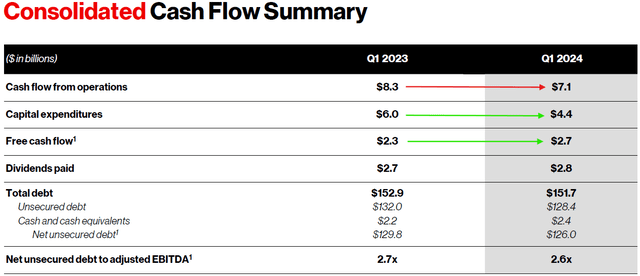

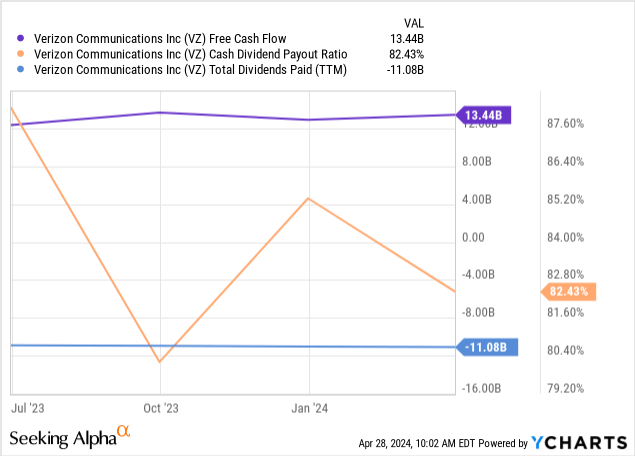

While Verizon’s operational cash flow generation left much to be desired, its free cash flow rose from $2.3B in Q1 2023 to $2.7B in Q1 2024, driven by reduced capital expenditures.

Here’s what Hans Vestberg [Verizon’s CEO] had to say about the company’s Q1 2024 numbers:

Our strong results show that our team is delivering. Our performance in the first quarter sets us up for a successful 2024. We are on track to meet our financial guidance and to deliver positive Consumer postpaid phone net adds for the year. Our fixed wireless subscriber base is continuing to grow rapidly, and our network remains the best in the industry, by far.

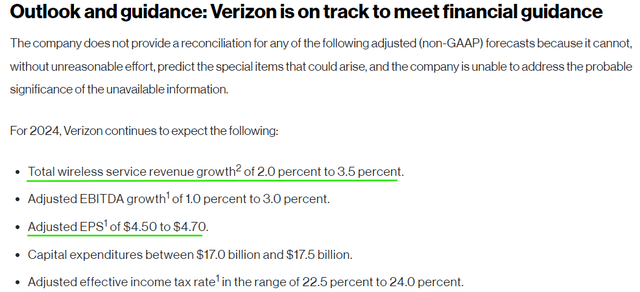

For 2024, management’s outlook for the business remains unchanged, i.e., Verizon is still on track to hit its financial objectives:

While Verizon’s top and bottom line performance isn’t enticing, improving business trends bode well for future profitability growth and cash flow generation. In the past, I have highlighted Verizon as a good hideout for long-term focused dividend investors due to its utility-like cash flow generation and solid 6.5%+ dividend yield. Given that management’s current capital allocation priorities focus on business re-investment, dividends, and deleveraging [no M&A plans], I believe Verizon’s dividend is safe.

As we discussed in the introduction of this note, Verizon’s stock has gone nowhere since our last update in early January. However, the ongoing surge in long-duration treasury yields has rendered Verizon’s stock less attractive as a dividend play!

Now, with that said, a ~6.7% dividend yield from a reliable (utility-like) cash flow machine like Verizon is still quite attractive for a certain subset of income-seeking investors [especially in an uncertain macroeconomic environment]. Let’s re-run Verizon through TQI’s Valuation Model to understand the long-term risk/reward and make an informed decision.

VZ Stock’s Fair Value And Expected Return

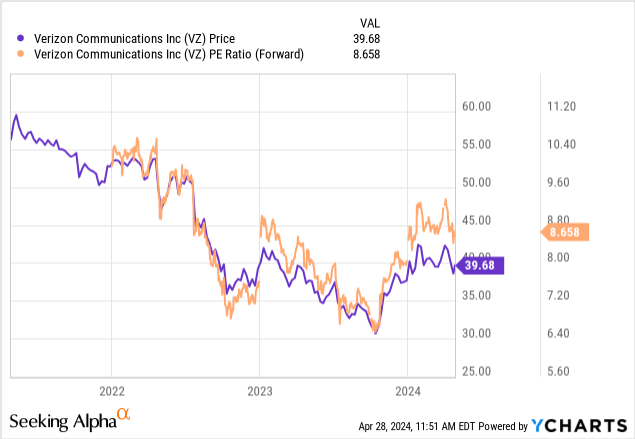

From a relative value standpoint, Verizon’s discount to the S&P 500 (SPX, SPY) has widened in recent weeks, with VZ’s forward P/E staying flat at 8.7x and S&P-500’s forward P/E rising to ~21x. Given Verizon’s massive debt load of ~$152B and sluggish growth, I do not expect this gap to fill out, but even if we consider Verizon’s valuation on an enterprise value-to-earnings basis, then VZ looks much cheaper than the S&P-500 index despite Verizon boasting much higher earnings and dividend yields.

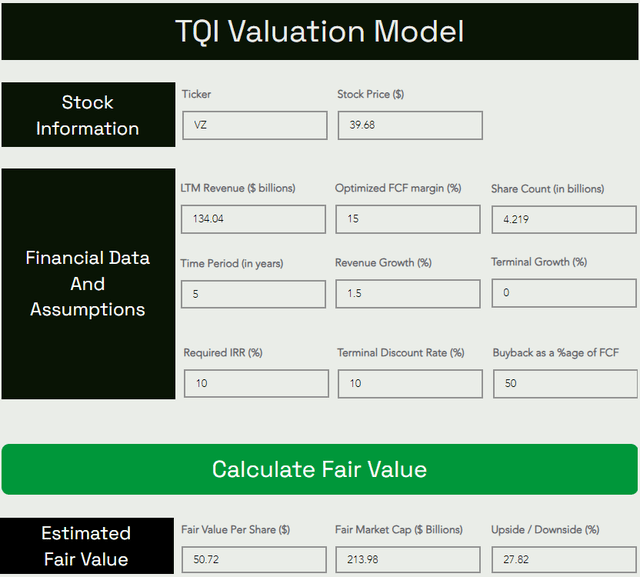

While Verizon’s growth days are probably in the rearview mirror, the stock looks undervalued despite using conservative assumptions in our updated valuation model for VZ stock:

TQI Valuation Model (TQIG.org)

As you can see above, Verizon is worth ~$51 per share (or ~$213B in market cap), i.e., the stock is undervalued at current levels. Please note, I haven’t factored in Verizon’s debt load of ~$150B because I expect the company to carry a big chunk of this debt for many, many more years (potentially decades) to come (any deleveraging will be done using future free cash flows at management’s discretion). Furthermore, we have factored Verizon’s dividend into our calculation, using it under “Buyback as a % of FCF” and effectively treating it as a drip reinvestment. The model assumptions are pretty straightforward, but if you have any questions, please share them in the comments section below.

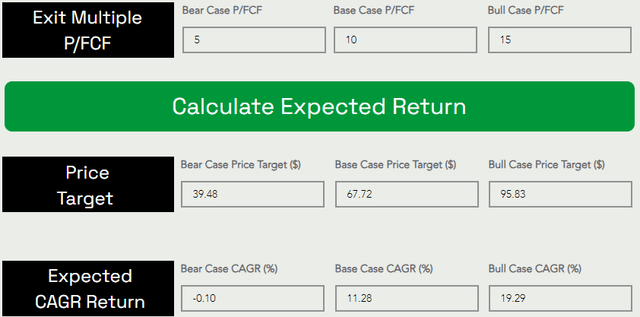

Assuming a conservative exit multiple of ~10x P/FCF for 2028-29, we get a $67.72 price target for Verizon. This updated price target implies an expected CAGR return of ~11.3% over the next five years, which happens to be lower than our investment hurdle rate of 15% per year.

TQI Valuation Model (TQIG.org)

Now, if you are willing to accept a lower return in exchange for the lower volatility offered by Verizon, then VZ stock is still an attractive dividend stock to buy here.

Concluding Thoughts

Despite a mixed Q1 report, the turnaround story at Verizon remains intact. While the stock has now experienced a four-month-long sideways correction, Verizon’s long-term risk/reward hasn’t improved drastically since our rating downgrade in early January, with VZ’s 5-year expected CAGR hovering at ~11%. For investors willing to accept lower returns in exchange for lower volatility offered by Verizon, VZ stock is still a decent buy.

Now, in my view, Verizon is still a good hideout for long-term focused dividend investors due to its utility-like cash flow generation and solid dividend. As such, we will continue to hold all of our Verizon shares at TQI within our Buyback-Dividend portfolio.

Key Takeaway: I continue to rate Verizon a “Hold” in the high $30s.

Thank you for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.