Summary:

- Verizon’s shares dropped 6% after missing Q2 revenue targets, but the telecom nonetheless saw growth in wireless, broadband and free cash flow.

- Verizon’s free cash flow supports its high dividend yield, providing income investors with a safety margin.

- Despite revenue miss, Verizon’s valuation is attractive, making it a good long-term investment for income investors.

peshkov

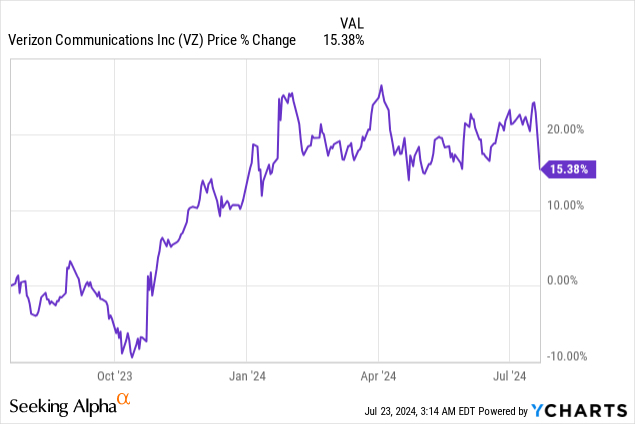

Verizon (NYSE:VZ)’s shares dropped 6% after the telecom submitted its earnings sheet for the second-quarter on Monday, mainly because Verizon missed revenue targets. However, Verizon saw solid growth in its wireless business, acquired a ton of new subscribers in broadband and generated very solid dividend coverage. Shares of Verizon are currently trading at a 12% earnings yield, implying a high safety margin for investors. In my opinion, Verizon’s dip after Q2 earnings creates a new engagement opportunity for investors that want to add a high-quality 6.8% yield to their portfolios!

Previous rating

I rated shares of Verizon of buy in May, after the telecom’s first-quarter earnings scorecard, as broadband remained a growth driver for the company and Verizon had a revaluation catalyst in the form of accelerating down-payments of its large net debt. In the second fiscal quarter, Verizon generated solid free cash flow growth and coverage, and the business saw continual momentum in broadband. I believe the market is overreacting to the revenue miss on Monday and I see the drop as a clear buying opportunity for investors.

Mixed Q2 Verizon earnings

Verizon reported lower than expected Q2 revenues, but matched estimates on the bottom line: the telecom earned $1.15 per-share in adjusted earnings in the second fiscal quarter while the top line came in at $32.8B, missing the average prediction by $240M. It was largely the revenue miss that caused shares of the telecom to nose-dive on Monday. However, Verizon’s overall earnings sheet was quite solid, showing growth in key areas while the dividend was well-supported by free cash flow.

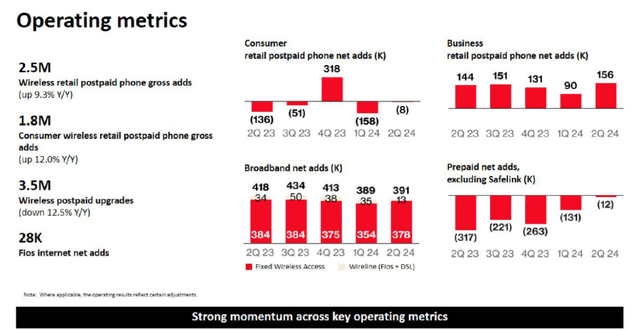

Broadband continues to crush it for Verizon as the telecom added 391k new subscribers, on a net basis, to its broadband business in Q2’24 which brought the total customer base to 11.5M. On a quarter-end basis, Verizon has increased its subscriber count by a massive 17% since the year-earlier period. It was also the 8th straight quarter of net additions of at least 375k new broadband subscribers.

New fixed wireless subscribers totaled 378k which was the highest amount in three quarters. Fixed wireless represents a unique growth opportunity for Verizon: its total fixed wireless subscriber base increased 69% year over year to 3.8M.

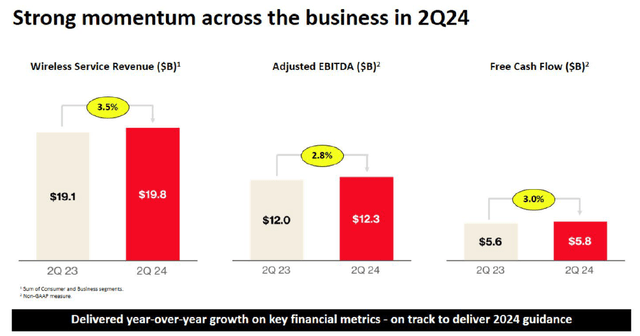

Verizon wireless service revenue growth was a solid 3.5% in the last quarter, causing segment revenues to hit $19.8B. Wireless service revenue growth also led to 0.6% consolidated top line growth, although investors should expect low-single digit growth in Verizon’s revenue growth going forward. Low revenue growth rates and high free cash flows are the identifying characteristics of a mature telecom market in the U.S. However, areas of growth, like broadband and 5G, are pockets of strength for the telecom and I believe Verizon’s Q2 earnings were overall quite solid… and should not have resulted in a 6% price drop.

Dividend supported by free cash flow

Besides solid subscriber and wireless services performance, Verizon did well with regard to its free cash flow. When it comes to high-yielding telecom investments, the most important metric to evaluate is free cash flow, in my opinion.

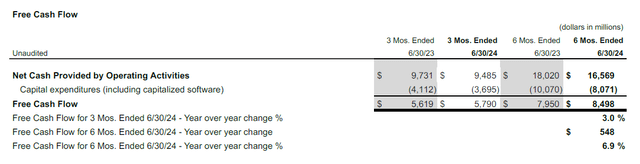

Verizon generated $5.8B in free cash flow in the second-quarter (+3% Y/Y) which compares to a regular quarterly dividend cost of $2.8B. The dividend coverage ratio in Q2’24 was 207% so, as I stated quite a few times in my past work on the telecom, investors that buy Verizon mainly for income, don’t have to be concerned about the company’s payout stability. The dividend, given Verizon’s high amount of recurring free cash flow from its telecom business provides income investors with a high safety margin and the dividend will most likely continue to grow going forward.

Catalysts in FY 2024 and beyond

Verizon has a number of catalysts for an upside revaluation in the next year:

- The continual build-out of its broadband and 5G networks ensures a steady stream of new, paying subscribers,

- Verizon’s wireless service revenues is seeing solid momentum that I expect to continue in the remainder of the year as well as FY 2025,

- Verizon is set to announce a new dividend in Q3’24 which will most likely result in an increase of ~2% and could help attract new investors.

Verizon’s valuation compared to AT&T

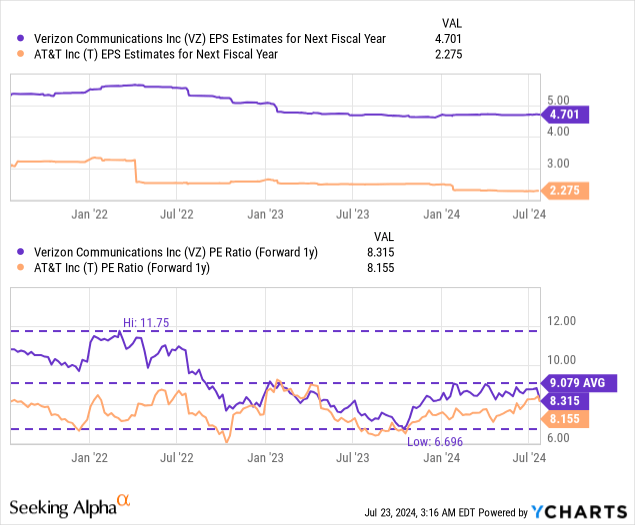

Verizon and AT&T (T) have depressed price-to-earnings ratios. Both telecoms operate in the same markets in the U.S., although some segments — like broadband and 5G — have more attractive growth prospects. Since Verizon and AT&T achieve only low-single digit top line growth and have large amounts of debt to service, their valuation ratios are low. However, they have stable and highly predictable earnings and free cash flows which makes their shares suitable chiefly for income investors.

Verizon is currently trading at a price-to-earnings ratio of 8.3X which is 8% below its 3-year average P/E ratio of 9.1X and it signifies an earnings yield of 12%. Verizon’s biggest rival in the U.S. market is AT&T which is trading at a 8.2X P/E ratio (also a 12% earnings yield).

In my last work on Verizon I laid out my rationale for a fair value P/E ratio of 10.0X for both AT&T and Verizon, mainly because both telecoms are highly free cash flow-profitable and return a good amount of cash back to shareholders. Given the 6% post-earnings drop for shares of Verizon on Monday, I believe the telecom represents even deeper value for investors: a 10.0X P/E ratio continues to imply a fair value in the neighborhood of $47 (20% upside revaluation potential).

Risks with Verizon

The biggest risk for Verizon, as I see it, is a potential slowdown in subscriber growth as broadband is clearly a growth segment for the telecom. While I don’t see Verizon’s dividend at risk, given its sufficient free cash flow, dividend investors should closely follow the telecom’s coverage trend in the future. What would change my mind about Verizon is if the telecom were to see a free cash flow short-fall and failed to support its dividend.

Final thoughts

In my opinion, the 6% price correction after Verizon’s Q2 earnings report was unwarranted and has a good chance of getting reversed in the near term. The telecom’s top line miss was a distraction and created a bit of noise, but Verizon’s Q2 results were actually quite good. The important wireless services business saw solid growth in the second-quarter and free cash flow was more than sufficient to support the telecom’s dividend. Shares of Verizon represent deep earnings and dividend value for long term investors at a price of $39 and I am buying the drop once again!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.