Summary:

- The recent Boeing lawsuit against Virgin Galactic could delay its timeline to starting commercial Delta class spaceflights in 2026.

- Virgin Galactic is unlikely to reach its target cadence of 2 Delta class spaceflights per spaceship per week in 2026 due to its existing mothership’s limitations stemming from its age.

- Virgin Galactic’s decision to pause Unity flights in Q2 2024 means that the company may not generate any revenue until commercial flights of Delta class spaceships commence.

- Virgin Galactic’s cash runway is only enough to last less than 2 years and the lawsuit could accelerate its need to raise capital, in my opinion.

- Bankruptcy is a strong possibility for Virgin Galactic, in my view, if it’s unable to start commercial Delta class spaceflights in 2026 with $418.7 million of debt maturing in 2027.

Sandy Huffaker

With its stock already down 40% YTD, Virgin Galactic Holdings, Inc. (NYSE:SPCE) was recently dealt a huge blow after The Boeing Company (BA) filed a trade secret and breach of contract lawsuit against it in light of a previous agreement between both parties. A Virgin Galactic spokesperson has since told SpaceNews that the lawsuit is baseless in both facts and law and shared that the company intends to defend itself vigorously. In my opinion, this signals that both companies could be headed to a fierce battle in the courtroom that could take several months to resolve.

I expect this development to delay the company’s plans to commence commercial Delta class spaceflights in 2026 as it now doesn’t have the required mothership to support the expected Delta flight cadence of 2 flights per week. Moreover, since the company intends to defend itself, it may not be able to develop a new mothership until a verdict is reached which could take nearly 28 months. Given that Virgin Galactic’s cash balance is only enough to last less than 2 years at the current annual burn rate of $500 million, I expect it to raise more capital in 2025, further diluting shareholders, or even possibly file for bankruptcy if it can’t start sending Delta class spaceflights at the targeted cadence due to Boeing’s lawsuit. As such, I’m rating Virgin Galactic as a Strong Sell.

Boeing Lawsuit

In July 2022, Virgin Galactic entered into an agreement with Aurora, a Boeing subsidiary, to design and manufacture its next-generation mothership. A new mothership clearly seems essential to Virgin Galactic in its goal of frequently sending space tourists to suborbital heights on its upcoming Delta spaceship since its current mothership, Eve, is allegedly unable to accomplish that mission, per the lawsuit filing.

The filed lawsuit alleges that Virgin Galactic’s expectations for the design of the new mothership had expanded substantially which means that Aurora had to do more reverse engineering than expected to advance the design of the new mothership. As a result, Aurora estimated that the new mothership couldn’t be completed before 2027 and would cost nearly twice the amount Virgin Galactic had hoped for.

This led both parties to agree to not execute any further task orders, with Virgin Galactic allegedly refusing to pay Aurora $26 million for work it already performed. Moreover, the lawsuit alleges that Virgin Galactic has refused to destroy math model documents which contain trade secrets developed by Boeing and Aurora over the years. Meanwhile, Virgin Galactic maintains that it’s entitled to use the math model documents in further development efforts including a new partner.

The lawsuit also alleges that Virgin Galactic shared that it expects the new mothership to be ready by 2027 in the Q3 2023 earnings call, the same timeline Aurora projected, indicating that the company is developing a replacement for the mothership Aurora was working on. From Boeing’s point of view, this would destroy its exclusive ability to deliver a unique product. Boeing used Capital One Fin. Corp. v. Sykes as a precedent, stating that “Once confidential information is disclosed to a competitor, the information cannot regain its secret status.”

Given the precedent used by Boeing in the lawsuit, the possible outcomes, in my view, would be Virgin Galactic losing in court or both parties reaching a settlement that would impact the company financially. That said, the lawsuit could be dismissed or Virgin Galactic could win in court.

Limitations of VMS Eve

However, what’s worse for Virgin Galactic is that the litigation process means that it could be difficult to produce a new mothership by 2027, which is crucial to scale up Delta class spaceflights due to the limitations of its Eve mothership.

According to the Q3 earnings call, Virgin Galactic plans to start test flights for the Delta class spaceship in mid-2025 and start commercial flights in 2026. The company also expects its existing mothership, Eve, to carry the first 2 Delta class spaceships during their testing and revenue service in 2026 as management expects the 2 new motherships to enter service in 2027. The company believes commencing Delta class spaceflights in 2026 through Eve will “support meaningful revenue and cash flow positivity”, with a target of each Delta class spaceship flying twice a week.

In my opinion, this is extremely unlikely due to the limitations of Eve stemming from its old age. Eve is now 15 years old as it was first launched in 2008. Since then, the mothership has completed more than 330 flights, per the company’s latest 10-K filing, which could be a sign that Eve may be on its last hurrah. I believe that’s the case since management reduced its flight cadence from a flight per month to a flight per quarter, as shared in the Q3 earnings call.

Moreover, I believe attempting to increase Eve’s flight cadence poses safety risks to passengers since in Virgin Galactic’s most recent spaceflight, Galactic 06, an alignment pin detached from the launch pylon of Eve after the spaceship was released from the mothership. While the detached pin didn’t particularly pose a safety impact to the crew on board, the FAA has decided that Virgin Galactic will be grounded until an investigation into the pin’s detachment is completed, stating that “A return to flight is based on the FAA determining that any system, process, or procedure related to the mishap does not affect public safety”.

Eve’s condition was also the center of a lawsuit filed by investors in 2021 alleging that “Unity and Eve were so rickety that every flight could be their last. Cracks appeared on Eve’s wings after every flight, and some were not fixed – so much so that a Virgin Galactic employee said the wings looked like spiderwebs or cracked eggshells“. The same lawsuit also claims that Scaled Composites, the company that built Eve, never provided the company with “accurate or reliable engineering drawings” for Eve and the Unity spaceship.

Given that Virgin Galactic plans to launch 2 flights per week per Delta class spaceship, I believe Eve is simply incapable of achieving this target since a quarterly cadence for Eve means that the company can only launch 4 spaceflights of Delta class spaceships in 2026 if the test flights are successful. Meanwhile, the company’s plan of operating 2 Delta class spaceships and flying them twice a week means that it should send 208 spaceflights in 2026, 104 times per spaceship.

Virgin Galactic’s CEO Michael Colglazier even acknowledged a new mothership’s importance to the company’s long-term plans when he previously said “Our next generation motherships are integral to scaling our operations. They will be faster to produce, easier to maintain and will allow us to fly substantially more missions each year” in the Aurora agreement announcement. Thus, I don’t believe Virgin Galactic can reach its long-term goal of sending 300 to 400 annual Delta spaceflights without an Eve replacement. This in turn makes it nearly impossible for the company to reach $1 billion in annual sales, a main pillar of its future profitability prospects.

Possible Bankruptcy Scenario

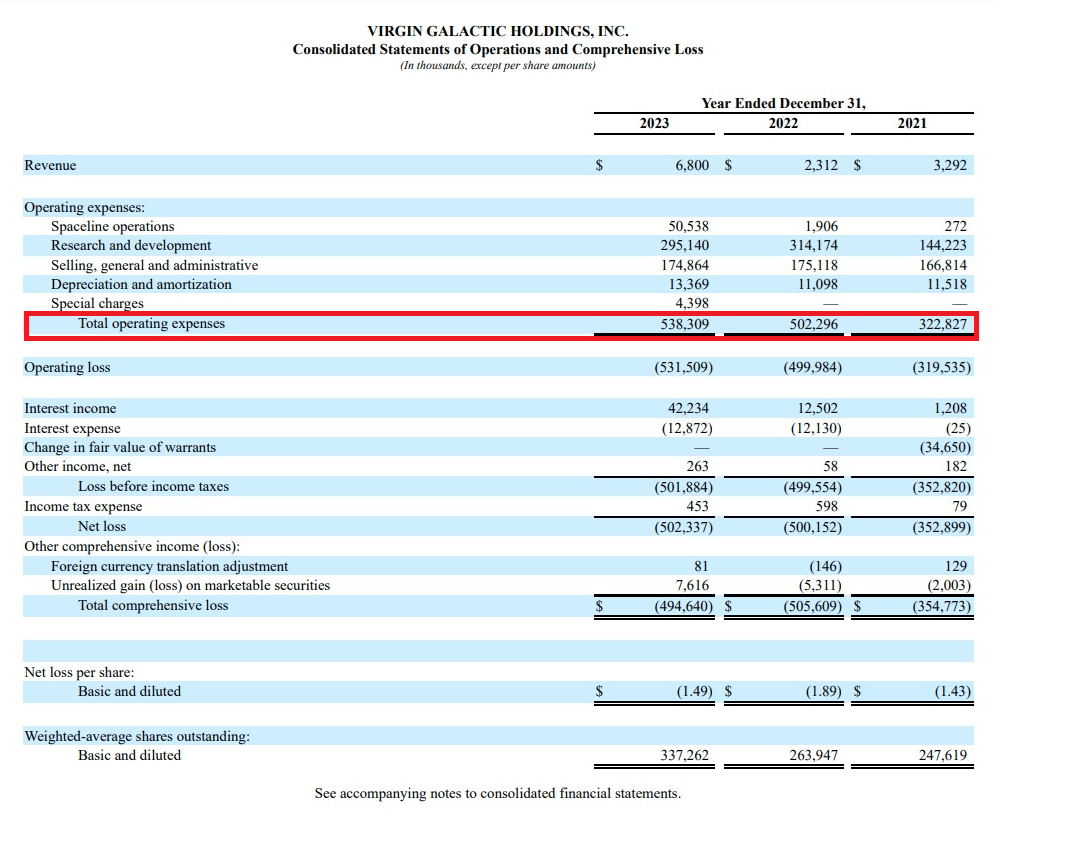

Considering Eve’s limitations and the potential delay in launching Delta spaceships in mass due to Boeing’s lawsuit, bankruptcy is a serious risk facing Virgin Galactic, in my opinion, in light of its cash burn rate. In 2023, the company started generating revenue from commercial flights. However, this has caused its operating costs to increase YoY from $502.2 million to $538.3 million.

While that increase could be attributed to its cost of revenue, it’s worth noting that the company stated in the 10-K filing that it began presenting the operating costs associated with its commercial spaceline activities as spaceline operations expenses instead of R&D due to the achievement of technological feasibility. This means that costs related to the manufacturing of rocket motors for instance are now included in spaceline operations, not R&D as in prior years.

With Deltaclass spaceship test flights expected to begin in mid-2025, Virgin Galactic intends to pause Unity flights in Q2 2024, per the Q3 earnings call, so that its team can support the final assembly efforts of Delta class spaceships. As such, the company should record virtually no revenues for 18 months until January 2026 at least, the date set for the first Delta class spaceship commercial flight. At the same time, the company will still incur operating costs every quarter as it continues to develop and test Delta class spaceships. As a result, Virgin Galactic will likely be hemorrhaging cash at an extremely high rate, in my view.

Since the company’s operating costs amounted to about $500 million in 2022 and 2023, I expect Virgin Galactic to incur around $750 million at least during the pause period, $250 million in the second half of 2024, and $500 million in 2025. This figure could be higher than my estimates due to the high R&D costs associated with developing spaceships and motherships.

10-K filing

Having said that, Virgin Galactic’s cash burn could continue for more time in light of Boeing’s lawsuit. From 2018 to 2022, the average time from the commencement of a trade secret investigation to final determination by the ITC was 17.6 months. However, over the same period, the average time to verdict in the US district court, where Boeing filed the lawsuit, was about 27.8 months. This means that a ruling in this lawsuit could be made by mid-2026, meaning that the company could burn through $1 billion in operating costs while generating minimal to no revenue due to Eve’s inability to send 2 Delta class spaceflights per week as management envisions.

With a total liquidity of $982.1 million, I expect Virgin Galactic to continue issuing shares under its ongoing ATM program and potentially announce a new ATM program just to stay afloat due to the uncertainty surrounding its plans for Delta class spaceships. In its latest 10-K filing, Virgin Galactic shared that it raised $287.5 million in gross proceeds under its $400 million ATM offering. At its current share price of $1.48, the company can issue just more than 76 million shares to raise the remaining $112.5 million available under the program which would increase the company’s outstanding shares by 19%.

In my opinion, these actions could delay filing for bankruptcy, however, the aforementioned uncertainty around sending Delta class spaceflights at the targeted cadence could dampen investors’ interest in owning shares of the company which could make it hard for the company to sell shares under its ATM program. This leaves filing for bankruptcy as the most viable outcome for Virgin Galactic, in my opinion, especially when it has $418.7 million in convertible notes maturing in 2027.

Upside Risks

Upside risks to my bearish thesis on Virgin Galactic include the company reaching a financial settlement with Boeing that allows it to continue developing its mothership based on Aurora’s work. As such, the company could commence Delta class spaceflights in 2026 and start generating revenues. In addition, the lawsuit could be dismissed by the court since Boeing’s claims are based on Aurora accidentally sending Virgin Galactic the math model documents. In that case, Virgin Galactic may not be impacted by the lawsuit at all. This could allow the company to raise capital from investors, in which case, it wouldn’t file for bankruptcy.

Moreover, Virgin Galactic could emerge as a buyout target to benefit from its IP, especially its 2 licensed utility patents related to the design of its spaceships and motherships. I believe a potential interested buyer could be SpaceX since acquiring Virgin Galactic will allow it to compete with Blue Origin in suborbital spaceflights. Although this scenario might eliminate the risk of bankruptcy, I don’t believe it’s likely due to Virgin Galactic’s $418.7 million debt maturing in 2027 and the uncertainty surrounding its next-gen motherships that will support a Delta class spaceship flight cadence of 2 spaceflights per week.

Conclusion

Following Boeing’s recent lawsuit, I believe Virgin Galactic’s future is in jeopardy without the necessary mothership to start Delta class spaceflights given the limitations of Eve. Moreover, the company plans to pause Unity flights in Q2 this year to support the development of Delta class spaceships. Based on this, I expect the company to continue burning cash due to the nature of its business, and with $892 million in cash on hand, its liquidity may not be enough to fund its operations if Delta class spaceflights are delayed due to litigation or test failures. This could see Virgin Galactic declaring bankruptcy, especially with a $418.7 million debt wall maturing in 2027, which is why I’m rating it as a strong sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.