Summary:

- Visa is one of Warren Buffett’s stocks that he owned for almost 12 years.

- The earnings report for the first quarter of 2023 showed us strong results with net revenues up 12% and net earnings up 17%.

- Visa’s management has always been shareholder-friendly, as the company pays dividends and repurchases shares. Therefore, Visa is of interest to both growth and income investors.

- Visa and Mastercard offer great value with expected earnings per share growth in mid-teens and high-teens. The forward P/E ratio is attractive at these high growth rates.

Introduction

hatchapong

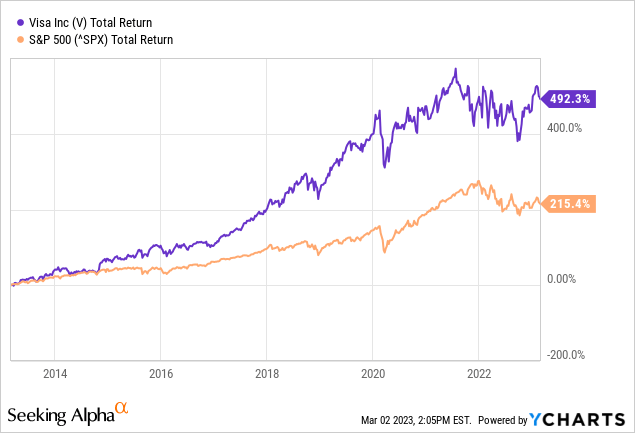

Visa (NYSE:V) has been in Warren Buffett’s stock portfolio for a long time. Warren Buffett first bought Visa in the third quarter of 2011, buying only a small position. The stock price rose significantly, as shown in the chart below; it far outperformed the S&P 500. Visa’s total return averaged 19.5% per year over the past decade, while the S&P 500 returned only 12.2% annually. The stock is still held in his stock portfolio, but in the fourth quarter of 2021 Warren Buffett reduced his stake by 13%.

Visa showed big gains and the future looks bright as consumer spending increases significantly. Management is shareholder-friendly, returning almost all free cash flow to shareholders. In addition, Visa is currently trading at a discount, making it an ideal candidate for both growth and income investors.

Fiscal 2023 First Quarter Earnings Were Strong

Visa’s fiscal year begins in September, so the recent quarterly results cover the first quarter of fiscal year 2023.

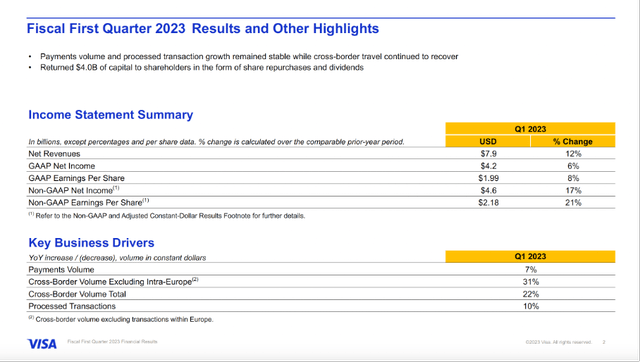

First-quarter earnings were strong, with net income up 12% year-over-year and non-GAAP net income up 17% year-over-year. Non-GAAP earnings per share rose even more, by 21% year-on-year, thanks to its generous share repurchase program.

Fiscal First Quarter 2023 Results and Other Highlights (1Q23 Visa Investor Presentation)

Digging deeper into the fundamentals of the business, we see that payment volume increased 7%, total cross-border volume increased 22%, and transactions processed were up 10%. Visa reported strong growth in each of its revenue segments. In consumer payments, credentials were up 8% overall and 11% excluding Russia, with strong double-digit growth in the United States, India and Brazil. In the United States, Visa renewed its partnership with Bank of America (BAC), Commerce Bank (CBSH) and Capital One (COF). And Visa also expanded its partnerships in other countries. Visa is a world leader in co-brands and extended its partnerships with Qatar Airways and Southwest Airlines, among others. Net flows continued to grow strongly by 20% thanks to the volume of B2B payments and Visa Direct transactions. Visa’s value-added services were up more than 20% in constant dollars. Alfred F. Kelly, Jr. stepped down as CEO of Visa on Feb. 1, but remains optimistic about Visa’s future:

We will continue to manage our business for the medium- to long-term and will invest in initiatives that are compelling and will provide future growth, all while being very mindful of the current environment. I continue to see a bright future for Visa as we look ahead to the rest of this year and beyond, and I believe we have the right strategy to continue to deliver great results.

Visa Returns Almost All FCF To Shareholders

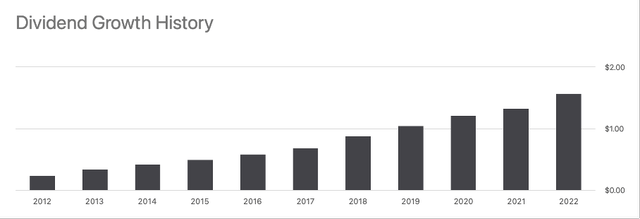

Visa offers a generous shareholder return program that pays dividends but also repurchases shares. The dividend has risen sharply over the past 10 years, averaging 20% per year. Currently, the dividend is $1.80, representing a dividend yield of 0.82%.

Fun fact: investors who bought the stock in 2013 for $40 per share will receive $1.80 in dividends this year. So the dividend yield on the original price is 4.5%, which increases further as Visa increases its dividend per share.

Visa’s Dividend Growth History (Seeking Alpha Visa Ticker Page)

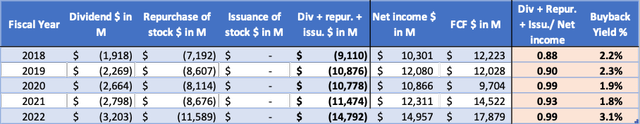

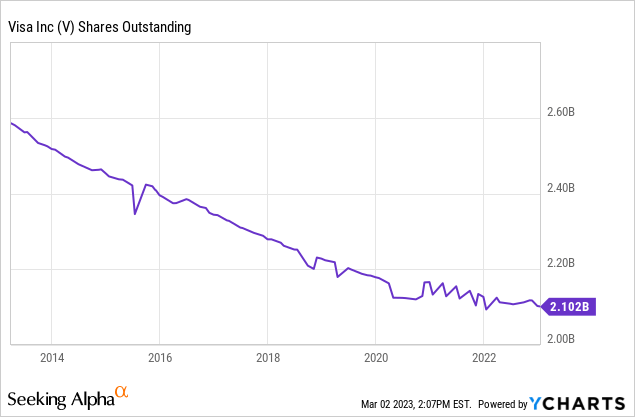

Share buybacks are a tax-efficient way to return cash to investors because the dividend per share increases. And it also has the potential to boost the share price, as shares outstanding decreases while demand increases. The share price fell slightly in 2022, so the buyback yield was high at 3.1%. Total shareholder return is about equal to net income, and Visa’s free cash flow is more. Visa does a good job of returning cash to shareholders in a way that is attractive to both growth and income investors.

Visa’s Cash Flow Highlights (SEC and author’s own calculation)

As a result of its share repurchase activity, Visa’s outstanding shares decreased from 2.6 billion in 2013 to 2.1 billion today (down 2.1% year over year).

Visa Trades At A Discount

Visa’s management is shareholder-friendly, but the share valuation is also an important part of the buying decision.

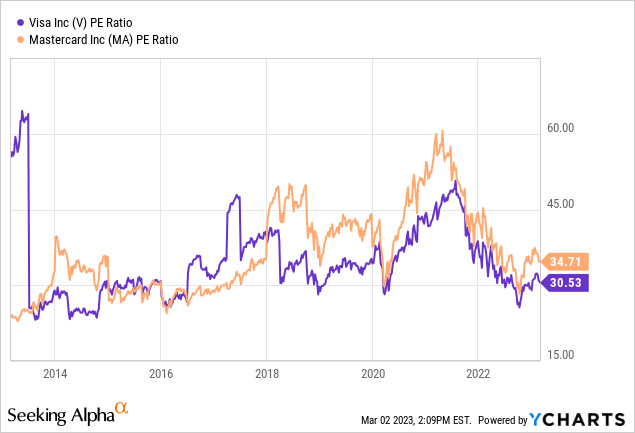

Visa, along with Mastercard (MA), is one of the largest credit card companies in the world. Both Visa and Mastercard derive their revenues from transaction fees rather than from interest rate spreads like American Express (AXP). This makes Visa and Mastercard one of the safer alternatives to invest in compared to American Express. However, both companies are valued more expensively than American Express, as the P/E ratio of both is above 30, compared to only 16 for American Express.

Revenues, earnings and dividends have risen steadily in recent years, making Visa and Mastercard interesting for investors who aim to reduce share price volatility.

Comparing Visa and Mastercard, Visa is currently more attractively valued than Mastercard. But this is not without reason. Mastercard’s earnings per share are expected to grow faster than Visa’s.

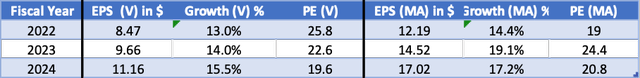

Seeking Alpha gives us earnings per share growth estimates from many analysts on their ticker pages. For Visa, EPS growth is expected in the mid-teens, while for Mastercard, EPS growth is expected in the high teens. For both, the forward P/E ratio for fiscal year 2024 is about 20, which is very attractive at these growth rates.

Mastercard can extend these high growth rates more easily than Visa because its EPS growth is already stronger than Visa’s. So for the next 5 to 10 years, I think Mastercard offers slightly more value than Visa. Still, both stocks are trading at a huge discount, both companies are well suited for every investor’s stock portfolio.

Visa and Mastercard’s EPS Estimates (Seeking Alpha and author’s own visualization)

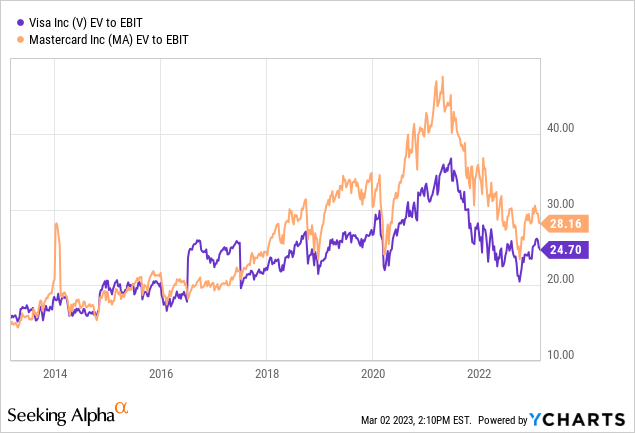

We also look at enterprise value relative to EBIT, since both companies pay dividends and repurchase shares. As we see in the chart below, Visa is valued more favorably than Mastercard. Historically, both companies trade a bit expensive, but if growth continues, I’m not worried.

Conclusion

Visa is one of Warren Buffett’s stocks that he owned for almost 12 years. The position was initially small but rose sharply due to the huge increase in its stock price. Visa had a bad year during the corona crisis, but still managed to be very profitable and cash flow positive. The earnings report for the first quarter of 2023 showed us strong results with net revenues up 12% and net earnings up 17%. The company’s CEO is optimistic about Visa’s future and expects strong growth ahead. Visa’s management has always been shareholder-friendly, as the company pays dividends and repurchases shares. Therefore, Visa is of interest to both growth and income investors. The dividend has increased 20% annually thanks to strong earnings growth and due to its share repurchases. Share repurchases can also boost its share price as the number of shares outstanding decreases while demand increases. In terms of stock valuation, the 2024 forward P/E ratio is about the same as that of nearest competitor Mastercard. However, Mastercard’s earnings per share is growing faster than Visa’s. This means Mastercard is valued more favorably than Visa if its strong earnings growth continues. However, both companies offer great value with expected earnings per share growth in mid-teens and high-teens. The forward P/E ratio is attractive at these high growth rates. Both Visa and Mastercard fit well into anyone’s stock portfolio.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in V over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.