Summary:

- Visa’s stock has performed well, outpacing the S&P 500, and still appears reasonably priced.

- The company has shown strong financial growth, with increasing revenue and free cash flow, and management continues to buy back shares.

- Visa has experienced growth in partnerships and is expected to continue to see double-digit sales growth in the future.

- The stock’s recent technical breakout is fuel on the upside fire – we see shares reaching $350 by next fall in an optimistic scenario.

- We reiterate our “Buy” rating on the stock.

2Ban

In May of 2023, we published an article titled: “Visa: A Great Entry Point In This Compounder“, where we made the case that Visa (NYSE:V) was not only a high-quality compounder, but that the company was also attractively priced, and long-term investors should take notice and consider buying into a position.

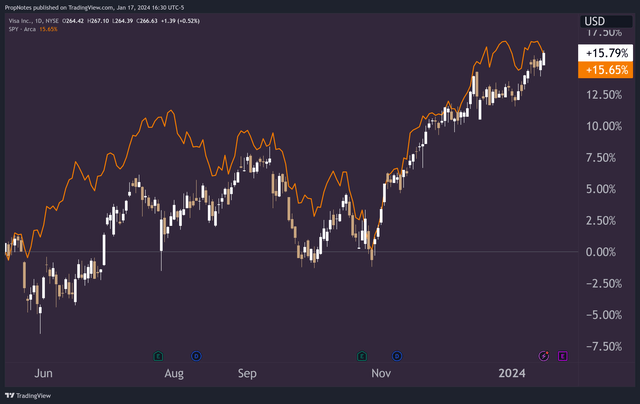

Fast forward to the present, and the pick has done well, up more than 15%, slightly edging out the S&P 500 over the same span of time:

Now, the S&P 500 appears expensive and somewhat overbought following a rally in many of the big tech names that we all know and love.

However, Visa still appears to be reasonably priced, and recently experienced an earnings and technical breakout which we think should lead to continued outperformance over the medium and long term.

Today, we’ll be exploring what’s been going on with Visa since we last checked in with the company, and explain why the stock’s recent strength possibly foreshadows what’s coming next.

Sound good? Let’s jump in.

Where We Left Things

Before diving into all of the recent updates surrounding V, let’s take a minute and provide some context from our last article that led to us issuing a ‘Buy’ rating on the company in the first place.

Here’s a summary of the main points from our previous article:

-

Visa Is A Compounder:

-

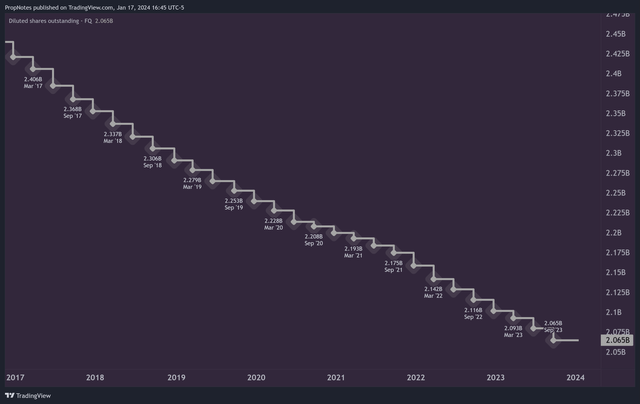

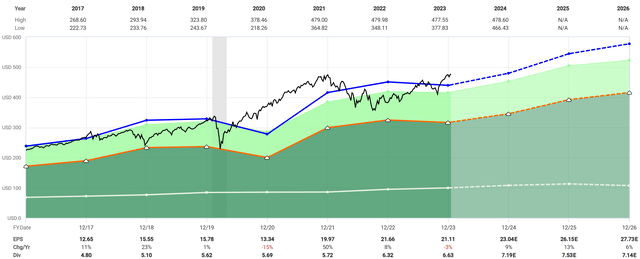

We identified V as a “compounder,” a stock that consistently increases its revenue and free cash flow while reducing its share count over time.

-

The company had displayed strong financial growth over the past five years, with a compound annual growth rate (CAGR) of 8.4% in revenue and a CAGR of more than 9.5% in FCF.

-

Additionally, Visa had actively reduced its outstanding share count, enhancing the value of remaining shares.

-

-

Investment Opportunity:

-

We suggested that now (last May) was a favorable time to invest in Visa due to its compelling characteristics as a compounder and the current valuation.

-

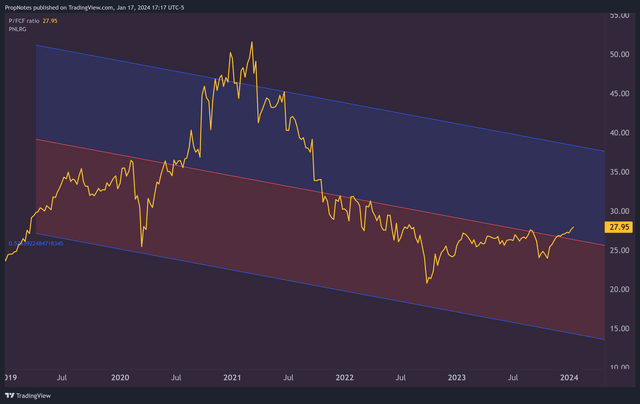

The stock was trading at a 27x multiple of free cash flow, lower than its five-year average of ~33x. The price-to-sales ratio was also relatively attractive at 15x, considering the company’s large profit margins.

-

We viewed accumulating shares at this level as a good opportunity.

-

This thesis still largely remains in place. Revenue and FCF have continued to rise over time, and the company continues to buy back shares quarter after quarter:

Let’s take a look at some of the recent earnings releases and developments which cement this.

What’s New

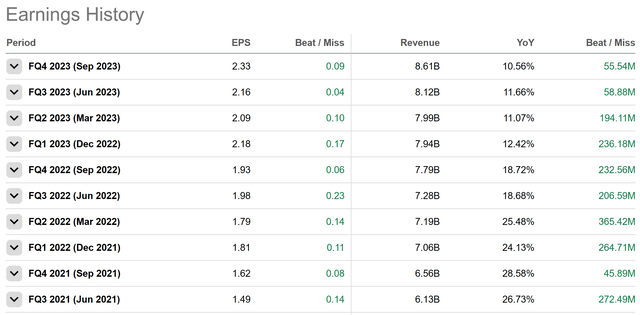

In the time between last May and today, Visa has released 2 new earnings reports, which were largely in line with our expectations.

In each of the reports, Visa beat estimates by 4 and 9 cents respectively:

These beats were accompanied by a $58- and $55-million-dollar top line beats, and a consistent low double digits YoY sales growth rate.

Interestingly, while the top line only expanded, Visa continued to see strong growth in terms of partnerships, both with issuers as well as network merchants & vendors growing considerably in FY 2023:

We signed over 500 commercial partnerships with fintechs globally from early-stage companies to growing and mature players, up 25% versus last year. Merchant locations were up 17%, helped by strong growth in Latin America and CEMEA.

…

In terms of our capabilities to serve fintechs, in Colombia, we expanded our partnership with Nequi, the first digital wallet in the country to enable their 17 million-plus account holders for tap to pay with digital credentials.

…

In North America, Costco (COST) has chosen Visa Acceptance Solutions, including CyberSource, for all of their US and Canadian e-commerce transactions. Alaska Air (ALK) has selected CyberSource to process their kiosk payments in support of their initiative to transform the airport lobby experience.

These growth rates are well above what the company is delivering on a sales growth basis and should take some time to scale, which means the potential for continued double-digit sales growth well into the future as V’s ubiquity improves globally.

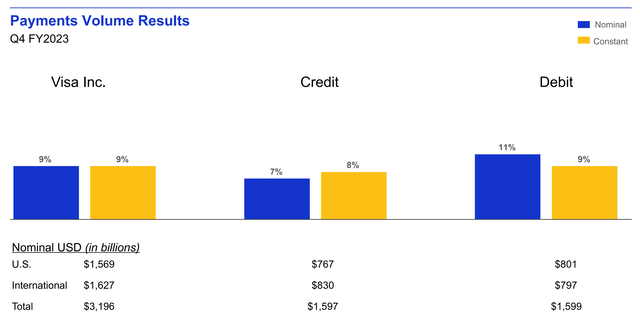

This growth has also been backed up by a stable overall level of payment velocity, which highlights the inflation-resistant nature of visa’s core business:

Clearly, the company has continued to execute on partnerships, and should see continued growth well into the future.

Looking ahead, Visa is planning on releasing its Q1 2024 results next week, and frankly, due to the predictability of the business, we think results will largely follow the pattern of continued top and bottom-line beats, combined with around a ~10% top line growth rate. It seems too soon to say whether or not V’s top line growth will re-accelerate, but expecting ~10% seems reasonable to us given V’s market position.

The Opportunity

The key thing to note here is that unlike the market, Visa has only gotten slightly more expensive from a multiple standpoint.

From a sales perspective, V’s valuation has expanded from 15x revenue to 16x, and the FCF multiple has only increased from 26x to 28x:

This means that a majority of the growth experienced by investors over the last 8 months has been a result of organic business growth, which means the opportunity to buy roughly the same multiple still exists.

Contrast this with the S&P 500, which has seen its multiple expand considerably since May of 2023, from 18x to 23x, up and outside of what has typically been considered “fair value” for the index – the range between the light green and the blue lines below:

This means that V simply sits in a better position to the index when it comes to margin of safety.

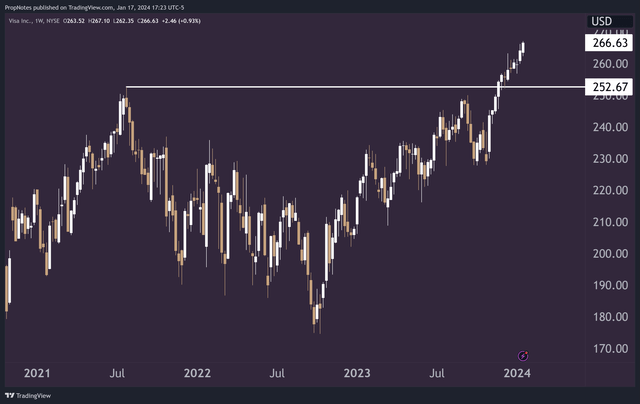

Additionally, in combination with financials breaking out to new all-time highs, V’s stock finally saw a positive technical development in the form of an all-time high breakout that occurred right around Thanksgiving:

Typically, we like to wait to call out a breakout for a little while before one occurs to see whether or not sellers will stuff it.

Presently, it appears as though buyers are firmly in control of the stock, which bodes well for future price increases. V’s stock may come back down to test this level as a support before continuing higher, but we’re very encouraged by this development.

But where does V’s stock go from here? The company’s valuation appears fairly valued (if perhaps a shade above fair value), and the company’s stock keeps hitting all-time highs on the back of continued execution.

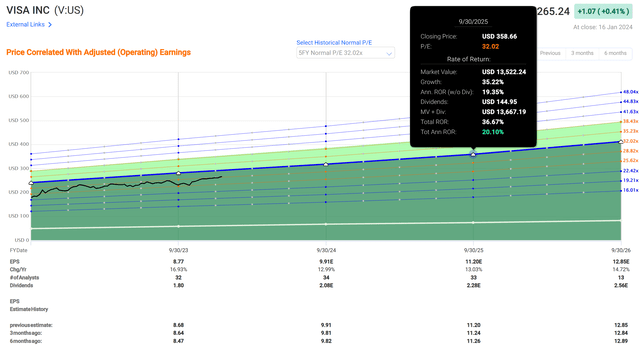

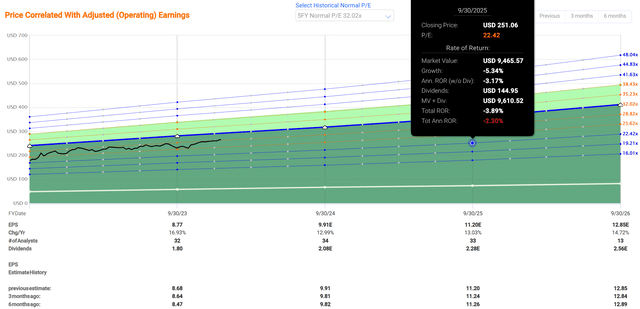

We think that V’s growth trajectory could send it towards $350 per share over the next year and a half, as shares re-rate to their typical 32x earnings multiple:

This represents a 20% annualized rate of return, which appears attractive vs. the market.

Keep in mind that this projection also bakes in two years of ~13% EPS growth, but in our minds that seems highly achievable.

Risks

There are some risks to this thesis worth pointing out.

First, growth could slow. This seems unlikely due to Visa’s continued shipping momentum on the partner side, but a slowdown could also come from Mastercard (MA) gaining market share, or a lack of consumer spending more broadly across the global economy. We’re not particularly bearish on the global economic picture for 2024, but it’s possible that inflation picks back up and consumers simply spend less.

Another risk could come in the form of regulatory headwinds or anti-competitive political allegations that squarely hit Visa. The company does maintain a large market share in a critically important part of the global payments infrastructure, and it knows how to wield it. Amazon (AMZN) recently got upset with the company last year about exorbitant fees in the UK and remains one of the only companies large enough to bargain with them one on one. The U.S. government is also large enough to tackle the problem.

That said, it seems unlikely, in a year with so much other political fanfare, that Visa will find itself the target of political ire.

Plus, headwinds here would likely mean a multiple cut from where things currently sit, which, at a 22x reference point, actually point to relatively small downside over time; only 3% by next September, by our calculations:

Summary

Thus, our thesis.

While the rest of the market has gotten more expensive, Visa has kept pace, but not by seeing significant multiple expansion.

With a technical breakout to consider, consistent earnings growth in the mix, and a lack of serious visible headwinds, we think Visa looks like a solid candidate for investment, especially ahead of its next earnings report, which is due out next week.

Once again, we rate Visa a “Buy”.

Good luck out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.