Summary:

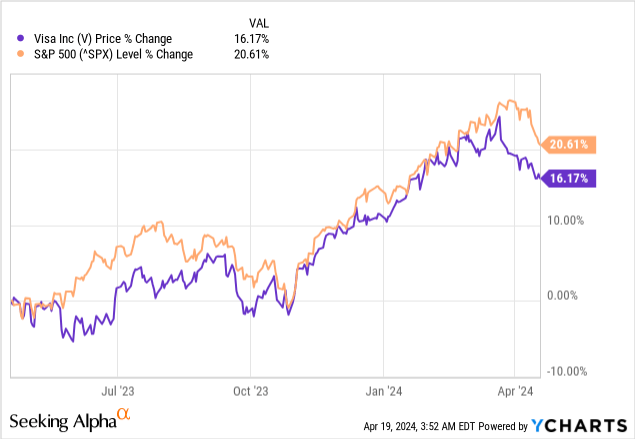

- Visa’s share price continues to trail the market as the company is about to report Q2 2024 results early next week.

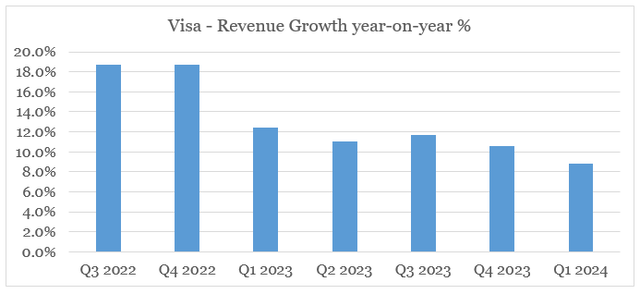

- Abnormal post-pandemic revenue growth already is normalizing as some tailwinds dissipate.

- All eyes will be on guidance for the second half of the year.

2Ban

Visa (NYSE:V) is scheduled to report its Q2 2024 results early next week. And as some important macro tailwinds are dissipating, investors should be looking for clues that the current growth and margins can be sustained.

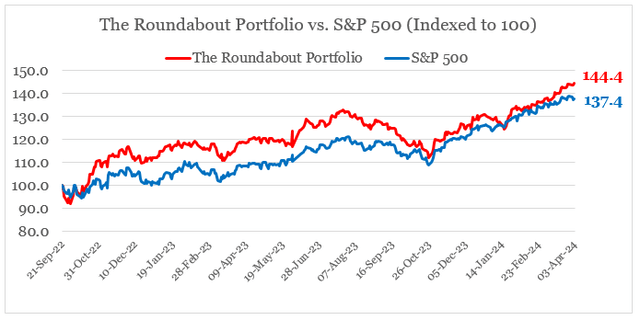

In spite of Visa’s strong competitive positioning and highly profitable business model, the stock has been mostly trailing the broader equity market over the past year and has even underperformed the S&P 500 on an absolute basis.

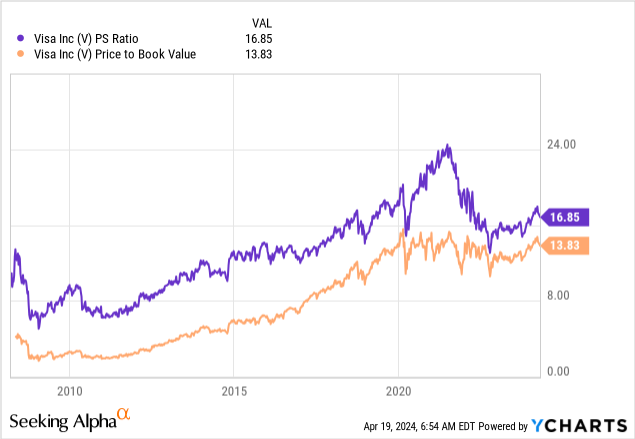

Visa’s share price performance also has been accompanied by strong annual revenue growth and margin improvements in recent years which kept valuation multiples relatively low when compared to their medium-term averages.

In the meantime, the double-digit post-pandemic recovery is now behind us, and with that, top-line growth rates are slowly normalizing, with the year-on-year growth rate during Q1 2024 standing below 9%.

Prepared by the author, using data from Seeking Alpha

The second quarter of each fiscal year marks the seasonal lows for Visa’s total payment volumes, and with that, it’s less likely to be meaningful for how the rest of the fiscal year would play out.

Having said that, however, there are some important areas investors should keep a close eye on when evaluating the expected returns for 2024.

Fading Tailwinds

The 16% annual return that we had for Visa’s share price over the past year is not something that investors should extrapolate into the future. Even though the company is one of the best-positioned businesses in the sector, the post-pandemic recovery tailwinds are no longer with us.

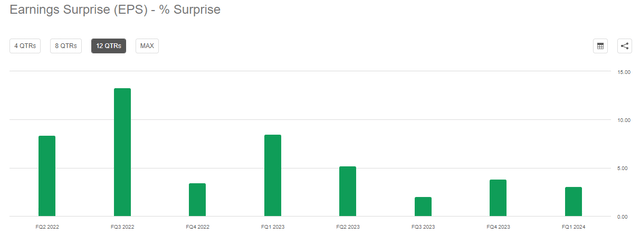

Inflationary pressures are also coming down, albeit not as quickly as expected. And as a result, Visa’s quarterly earnings surprises are no longer as high as they used to be in the 2022-2023 period.

Thus, we’re likely entering a period when revenue and earnings would be more in line with expectations, provided that a recession is to be avoided in 2024.

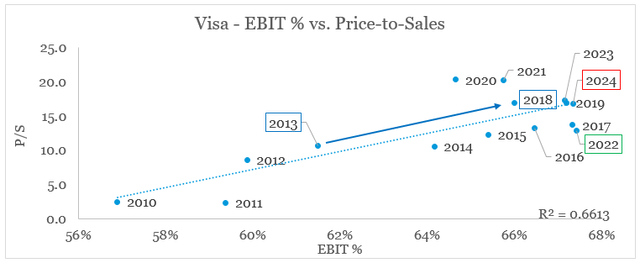

Another key consideration for Visa shareholders is that the company’s operating margins already are at record highs, which leaves little upside from multiple repricing. At the end of fiscal year 2022, for example, Visa’s stock was trading at a much lower sales multiple when compared to the one implied by its margins, which ultimately led to the strong returns in the following year.

Prepared by the author, using data from SEC Filings and Seeking Alpha

Right now, however, the sales multiple already reflects the record high margins, and as topline growth normalizes the potential upside for V stock is fairly limited.

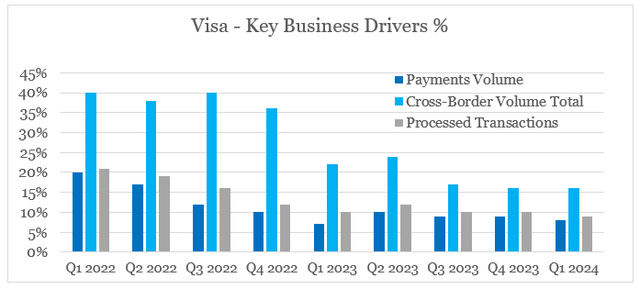

This revenue growth normalization is clearly illustrated by the company’s quarterly payments and cross-border volume growth as well as the level of processed transactions.

Prepared by the author, using data from quarterly presentations

A Stale Quarter Ahead?

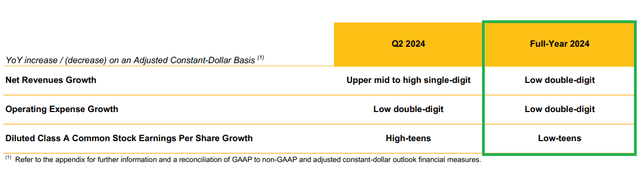

During the upcoming earnings release, all eyes will be on the guidance for the rest of FY 2024.

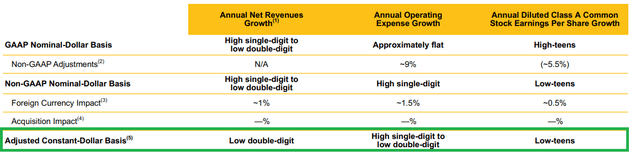

Back in October of last year, Visa’s management provided the following (see below) guidance for the next fiscal year, which assumed net revenue growth for the year in low double digits after adjusting for foreign currency.

The first quarter results, however, came in better than expected, largely due to the falling U.S. dollar in the months of November and December of last year and lower-than-expected incentives. Nonetheless, the guidance for FY 2024 was left unchanged, which was not well-received following the release in January.

It now appears that the FX tailwind could reverse in the second quarter; however, investors will be looking for any clues regarding the second half of the fiscal year.

The forward-looking language would be quite important as Visa’s management previously indicated that growth should accelerate meaningfully in the second half of FY 2024. Thus, whether or not Visa meets or exceeds its full-fiscal year guidance would depend on events happening in the second six-month period.

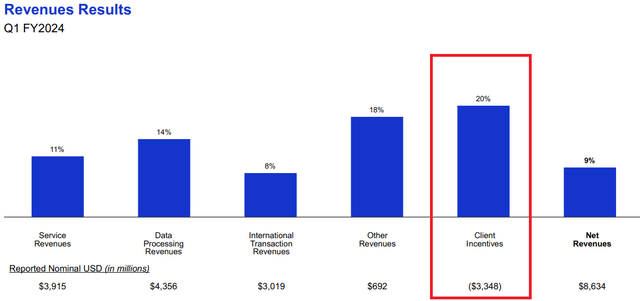

Another key factor that could have a meaningful impact on revenue growth and earnings target for the period is the level of incentives, which are expected to grow less than they did in FY 2023.

On a year-over-year basis, incentives are expected to grow slightly less than what we saw in FY 2023.

Source: Q4 2023 Earnings Transcript

During the Q1 2024 period, incentives were lower than expected, but they still grew by 20%. This was higher than the 19% annual growth reported for FY 2023 which means that we should see a notable decline in the coming quarter.

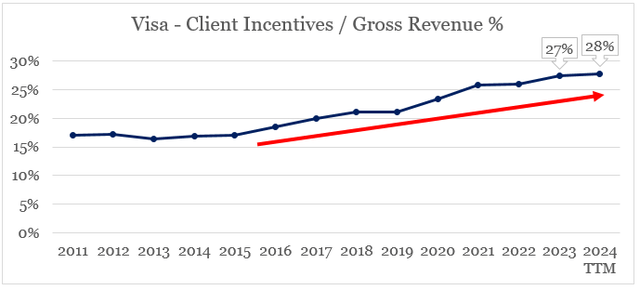

The share of client incentives from Visa’s gross revenue figure has been gradually increasing over the past decade, which is having a negative impact on margins. So far, this hasn’t been an issue as Visa benefited heavily from higher economies of scale over the same period.

Prepared by the author, using data from SEC Filings

When it comes to earnings, the non-GAAP EPS is expected to grow in the high teens during the upcoming quarter which gives us a consensus estimate of around $2.43. Given the seasonally low quarter in terms of volumes, it’s not surprising that this number would not be materially different from Q1 2024 Non-GAAP EPS of $2.41.

Investor Takeaway

As Visa is about to report its second-quarter results for the year, it appears that the market is prepared for a relatively uninteresting earnings release when it comes to reported numbers. All eyes will be on the guidance for the rest of the year, which is already priced in given the current consensus estimates. With the macroeconomic environment no longer being as supportive, Visa would most likely continue to trail the broader equity market for the time being.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for more high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.