Summary:

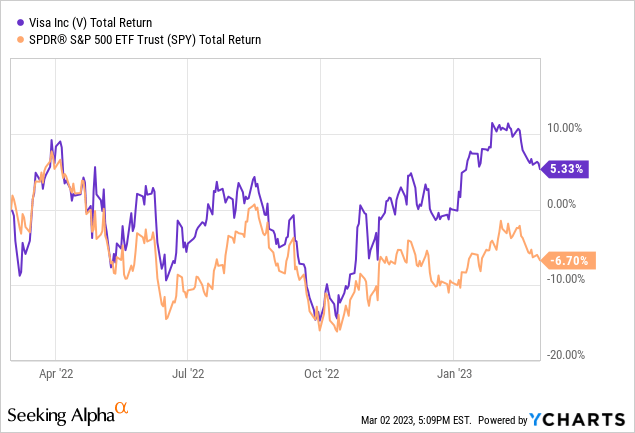

- Visa stock returned only 5% in the last 12 months versus its long-term rate of return of about 20%. However, it still beat the general stock market.

- Higher inflation and interest rates versus recent history continue to weigh on the stock.

- Investors can now buy shares at a fair valuation (if not a slight discount).

- Visa generates substantial free cash flow and can continue increasing its dividend at a good clip going forward.

FinkAvenue

Visa (NYSE:V) stock has delivered lacklustre returns of approximately 5% in the last year, which doesn’t even keep pace with the recent U.S. inflation rate of 6.4% in January 2023.

At least, the stock outperformed the broader U.S. stock market, using SPDR S&P 500 ETF Trust (SPY) as a proxy, which turned about -7% in the period.

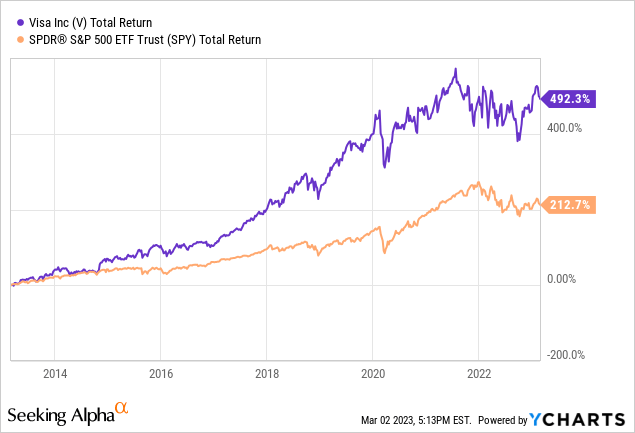

Surely, one year is too short a period of observation. To be sure, we checked the last 5 and 10 years. Sure enough, Visa demonstrated outperformance in both periods. (Below is a graph of its 10-year returns versus the U.S. stock market.)

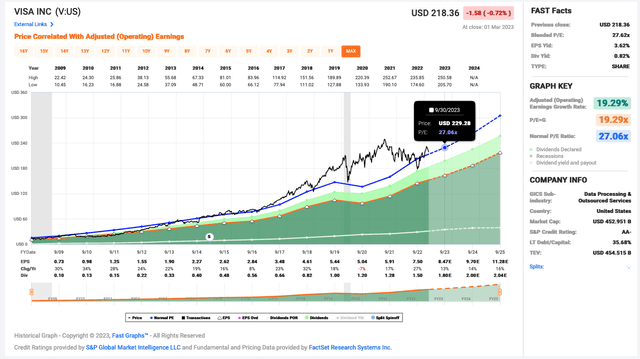

Visa stock’s 5-year and 10-year CAGR returns are about 19% and 22%, respectively. So, its roughly 5% return in the last 12 months is, to say the least, discouraging for investors. What’s weighing on the stock?

What’s Weighing on Visa Stock

The general environment of relatively high inflation and relatively high interest rates to curb inflation is likely to weigh on Visa’s near-term results. The recent higher consumer spending for a certain group of Americans aren’t likely to be sustainable in the current environment. (For reference, for fiscal Q1, U.S. contributed to 46% of Visa’s total volume.)

After all, higher inflation makes products and services more expensive for citizens on Earth who cannot maintain their purchasing power. That is, if these people aren’t earning more money (i.e., raises from their jobs or earning positive real returns on their investments), they’re losing purchasing power.

Higher interest rates also increase the cost of borrowing for consumers and businesses alike. Many businesses have to think twice before passing higher costs (from inflation or otherwise) to their customers. In a higher inflationary and higher interest rate environment, smart Earthlings are likely to be extra cautious on where they’re spending or investing their money.

Visa’s recent results may be telling on the health of Earth’s largest payment processor.

Visa’s Recent Results

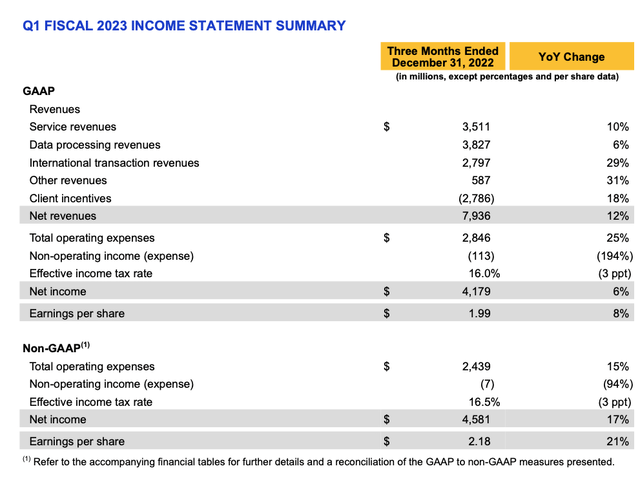

Visa last reported its fiscal Q1 2023 results in late January. Here are some key highlights. Net revenues climbed 12% to $7.9 billion, supported by stable payments volume growth of 7% and processed transactions growth of 10%.

Specifically, gross revenues were primarily divided across 33% Service Revenues, 36% Data Processing Revenues, and 26% International Transaction Revenues. Visa saw growth across all revenue sources with the largest percentage increase of 29% in International Transaction Revenues, which was helped by a continual recovery in cross-border travel.

Visa Fiscal Q1 2023 Income Statement Summary

Notably, Visa saw a whopping 25% increase in operating expenses to $2.8 billion. It explained the jump was primarily driven by increases in personnel expenses and the litigation provision associated with the MDL case. Consequently, GAAP net income increased by only 6% to $4.2 billion, while GAAP earnings per share (“EPS”) rose 8% to $1.99.

Adjusted earnings growth fit the company’s typical double-digit growth rate much better. Specifically, adjusted net income rose 17% to $4.6 billion, while adjusted EPS rose 21% to $2.18. EPS metrics were improved by a year-over-year 2.6% reduction in the share count of the Class A common stock.

Valuation

Despite a higher inflationary and higher interest rate environment, the stock continues to trade at a premium price-to-earnings ratio (P/E) of over 27. This is no doubt due to Visa’s quality and durable earnings and cash flow. At the recent quotation, the stock appears to trade at a fair P/E versus its long-term normal valuation.

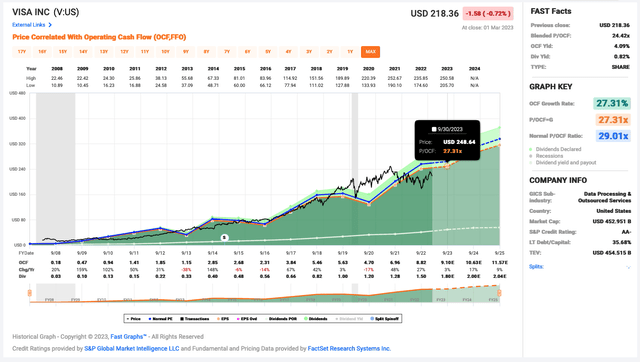

Based on price to cash flow, the stock seems to trade at a slight discount of about 12% on a forward basis. This estimation seems to better align with the consensus analyst target.

Analysts believe the stock trades at a discount of 16% from the consensus 12-month price target of $261.48 per share, which also suggests near-term upside potential of 19%. Analysts generally think the stock is slightly discounted.

Yahoo Finance

Visa is a Cash Flow Machine

Visa’s quality is evident. Clearly, it’s a free cash flow machine. From fiscal 2019 to 2022, it used less than 6% of its operating cash flow for capital spending. In the trailing 12 months, it generated free cash flow (“FCF”) of over $17 billion. So, its payout ratio was <19% of FCF.

This substantial cash flow generation has allowed the stock to easily increase its dividend at a double-digit rate since inception in 2008. For reference, its five-year dividend growth rate is 17.8%. And it last increased its dividend by 20.0% in October 2022.

Investor Takeaway

Visa is a reliable business that is awarded a high S&P credit rating of AA-. It’s worthy of conservative long-term investors to consider holding in their diversified investment portfolios.

The company generates substantial free cash flow through economic cycles. Even during the pandemic that affected economies globally, Visa only witnessed an 18% decline in its free cash flow in fiscal 2020.

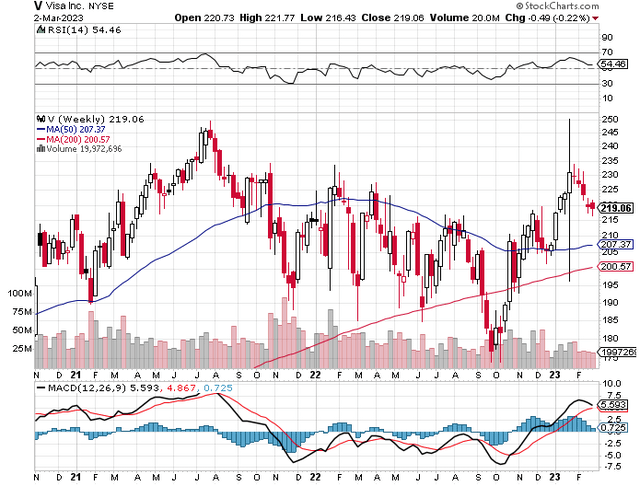

Technically, there’s not much to say about Visa stock, except that it has been trading in a sideways range between roughly $190 and $230 in the last couple of years or so. From a technical standpoint, interested investors could aim to accumulating shares at the midpoint of about $210, if not lower.

As the A-grade stock appears to be trading at a fair valuation, if not a slight discount, I wouldn’t hesitate to rate the stock a buy. I’d consider it a wonderful business trading at a fair valuation.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. – Warren Buffett

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article consists of my opinions and is for informational purposes only. Please do your own research and due diligence and consult a financial advisor and or tax professional if necessary before making any investment decisions.