Summary:

- There is widespread concern about the impact of Humira biosimilars being available in the U.S.

- The consensus outlook is that ABBV’s earnings will decline.

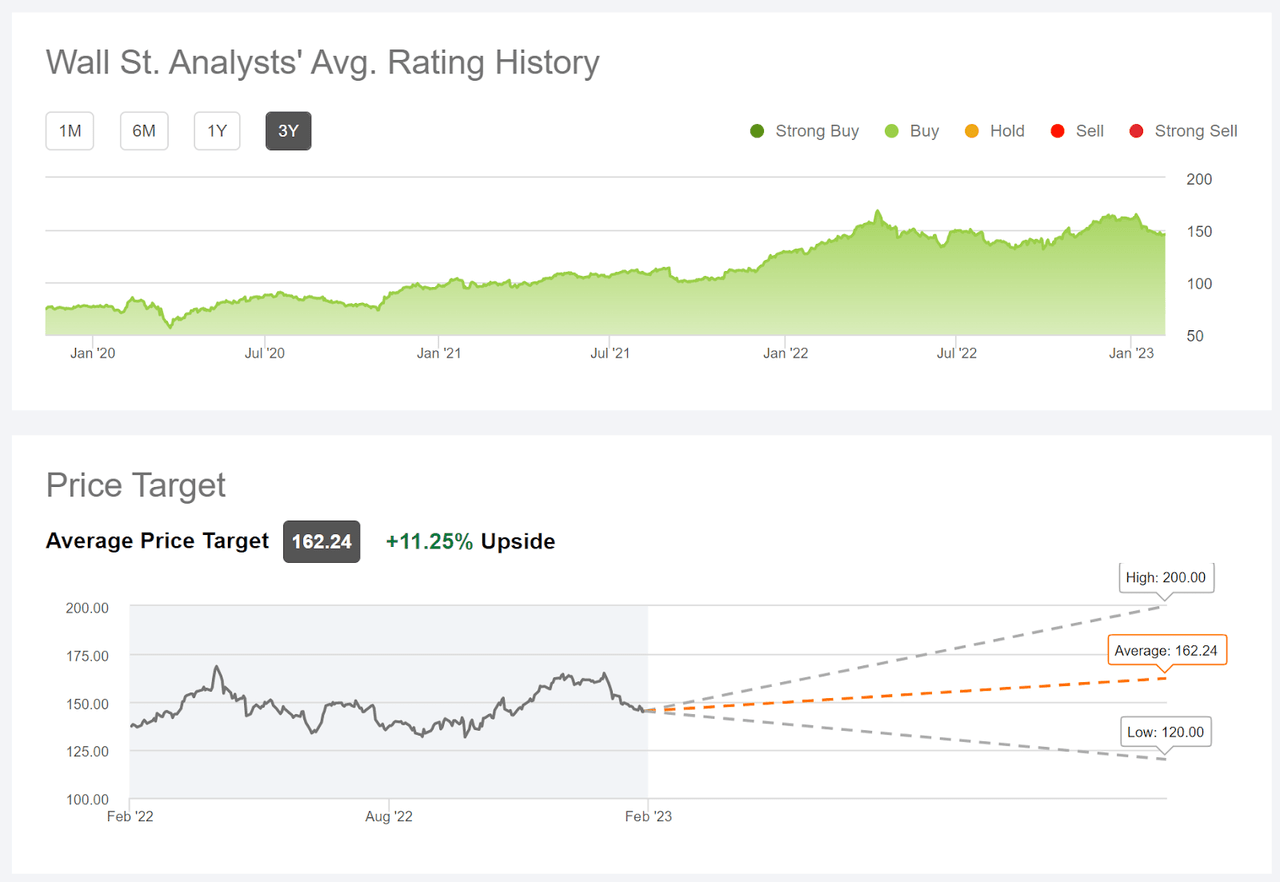

- The Wall Street consensus rating is a buy, with a consensus price target that corresponds to 15% in total return.

- The market-implied outlook (calculated from options prices) has gotten more bullish since September.

JHVEPhoto

In early 2023, Amgen (AMGN) entered the U.S. market with a biosimilar drug to AbbVie’s (NYSE:ABBV) Humira. Humira has been the best-selling drug in the world for the past 10 years and is expected to become the best-selling drug in history, so the introduction of biosimilars is a major transition for AbbVie. Granted, the waning of Humira’s patent protection is not a surprise to the market, and ABBV earnings expectations all incorporate the forecasted effects. AbbVie has a diverse portfolio of products, along with a deep development pipeline, that will offset declining sales of Humira, led by Skyrizi and Rinvoq.

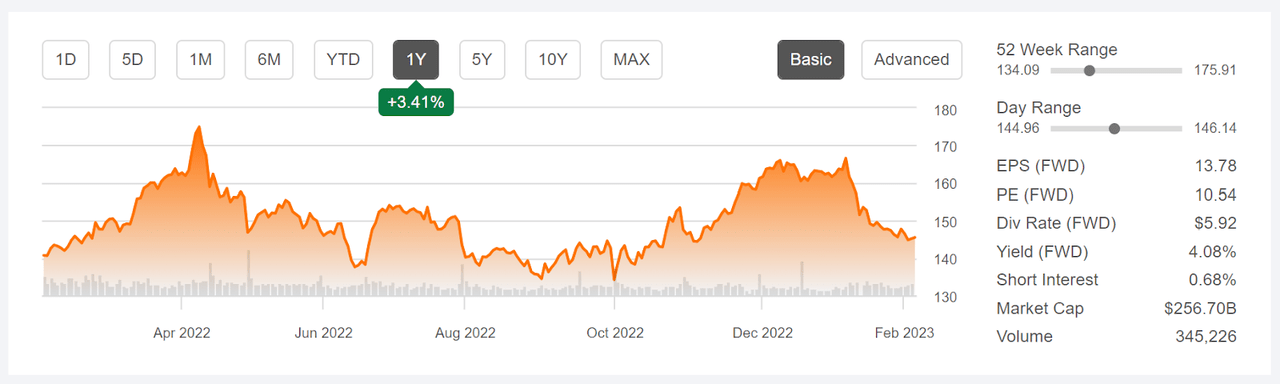

AbbVie’s share price has dropped since early January, following an 8-K filing that delineated payments to partners for acquired in-process R&D. ABBV has returned -9.2% over the past month. Even with this recent drop, ABBV has returned a total of 3.4% over the past year.

12-Month price history and basic statistics for ABBV (Seeking Alpha)

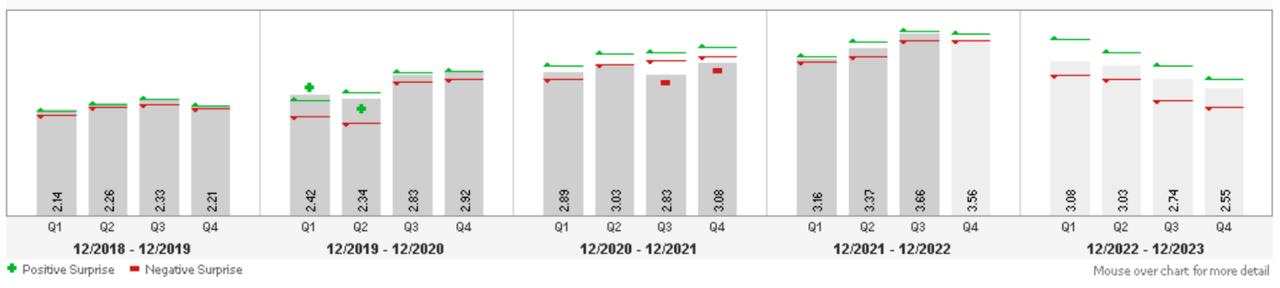

ABBV reports Q4 2022 results on February 9th. While earnings have risen substantially over the past three years, the consensus outlook is that earnings are on a downward trajectory. ETrade reports that the consensus for annual EPS has 2023, 2024, and 2025 full-year earnings that are 11% or more below the current estimate for 2022 earnings. The consensus outlook for the next 3-5 years is annualized EPS growth of 0.97% per year.

Trailing and estimated future quarterly EPS for ABBV. A + (-) sign indicates EPS that exceeded (missed) the highest (lowest) price target (Ameritrade)

ABBV has obvious appeal to income investors, with a 4.08% forward dividend yield, and trailing 3- and 5-year dividend growth rates of 9.2% and 16.9% per year, respectively. Given the fairly low payout ratio of 41.8%, the company is not stretched in covering the dividend or maintaining recent increases.

I last wrote about ABBV on September 15, 2022, at which time I maintained a buy rating on the shares. The central issues were exactly the same as they are today. The market was weighing the anticipated loss of revenue from Humira with the growth potential of the company’s diverse portfolio and pipeline. The Wall Street consensus rating was a buy and the consensus 12-month price target mapped to an expected total return of 15.1%. The market-implied outlook, a probabilistic price forecast that represents the consensus view from the options market, was bullish to early- and mid-2023, with moderate volatility in the range of 27% to 28% (annualized). As a rule of thumb for a buy rating, I want to see an expected 12-month return that is at least half of the expected volatility. Taking the Wall Street consensus price target at face value, ABBV met this criterion (15.1% > half of 28%). In the period since this post, ABBV has returned a total of 3.85%, lagging the S&P 500.

Previous post on ABBV and subsequent performance vs. the S&P 500 (Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate the probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper discussion than is provided here and in the previous link, I recommend this outstanding monograph published by the CFA Institute.

As we approach the Q4 report, I have calculated updated market-implied outlooks for ABBV and I have compared these with the current Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook for ABBV

Seeking Alpha calculates the Wall Street consensus outlook for ABBV by aggregating the views of 26 analysts who have published ratings and price targets over the past 90 days. The consensus rating is a buy, as it has been for all of the past three years, a period over which the stock has annualized total return of 25.2% per year. The consensus 12-month price target for ABBV is 11.25% above the current share price, which maps to an expected total return of 15.3% over the next year.

Wall Street analyst consensus rating and 12-month price target for ABBV (Seeking Alpha)

When I last wrote about ABBV, the consensus outlook was very similar to the situation today.

Market-Implied Outlook for ABBV

I have calculated the market-implied outlook for ABBV for the 4.3-month period from now until June 16, 2023 and for the 11.3-month period from now until January 19, 2024, using the prices of call and put options that expire on this date. I selected these specific expiration dates to provide a view to the middle of 2023 and through the entire year.

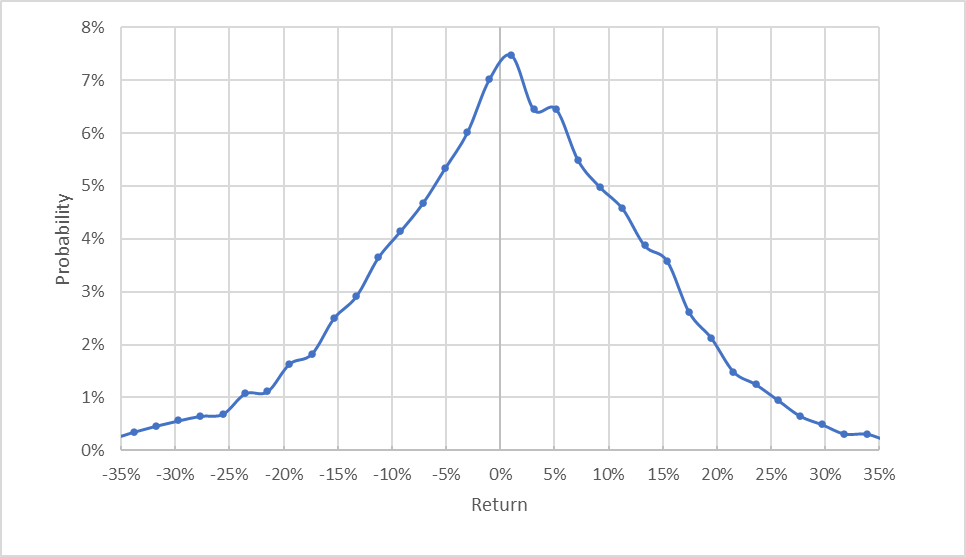

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

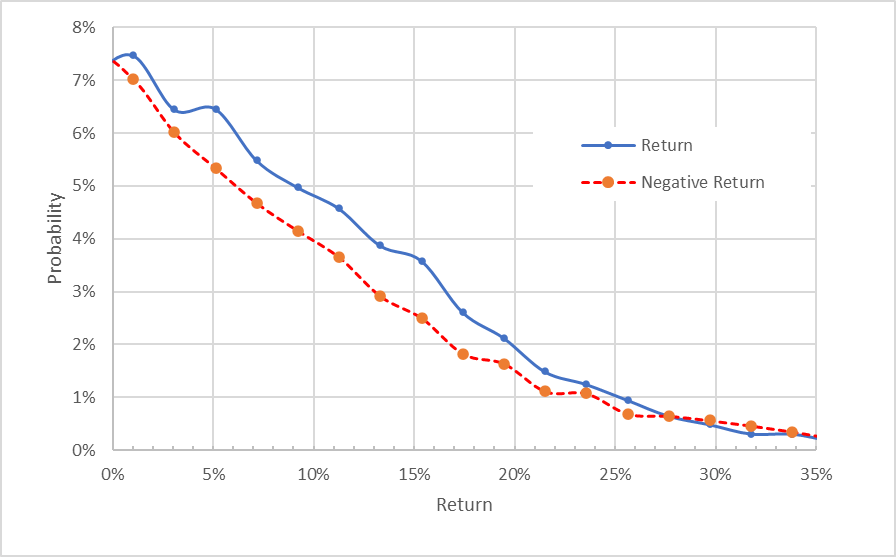

Market-implied price return probabilities for ABBV for the 4.3-month period from now until June 16, 2023 (Author’s calculations using options quotes from ETrade)

The market-implied outlook to the middle of 2023 is generally symmetric, with the peak in probability very close to zero. A closer inspection shows that the probabilities favor positive returns. Compare, for example, the probability of a +5% return to that for a -5% return. This asymmetry is evident for a range of possible outcomes. The expected volatility calculated from this distribution is 23.5% (annualized), somewhat lower than in my September post. For comparison, ETrade calculates a 23% implied volatility for the options expiring on June 16th.

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Market-implied price return probabilities for ABBV for the 4.3-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Author’s calculations using options quotes from ETrade)

This view shows that the probabilities of positive returns are consistently higher than for negative returns of the same size, across a wide range of the most-probable outcomes. This is a bullish market-implied outlook to mid-June.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the bullish interpretation of this outlook.

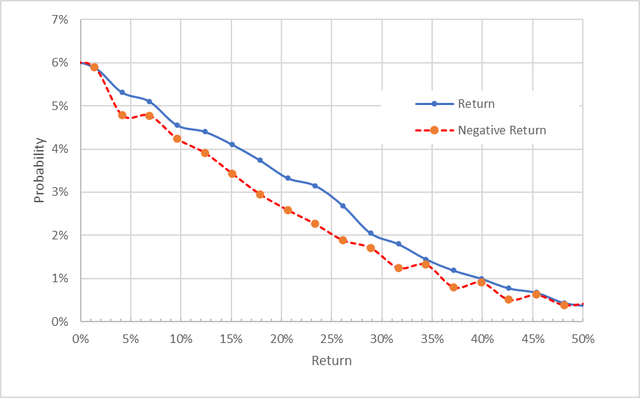

The market-implied outlook for the 11.3-month period from now until January 19, 2024 is also bullish, with expected volatility of 23.9% (annualized).

Market-implied price return probabilities for ABBV for the 11.3-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Author’s calculations using options quotes from ETrade)

The market-implied outlooks to the middle of 2023 and into the start of 2024 are more bullish than the outlooks to these same two dates were in my last analysis. In addition, the expected volatility has fallen.

At the time that I pulled the options quotes for this analysis, ABBV was trading at $145.76 and the bid price for a $145 call option, with a January 19, 2024 expiration date, was $13.95. Buying ABBV and selling this call option provides an option premium income yield of 9% (($13.95-$0.76)/$145.76) over the next 11.3 months. The expected dividend payments between now and January 19, 2024 (three payments of $1.48) brings the total income from this covered call position to 12.1%. With expected volatility of 23.9% over this period, this is an attractive level of income.

Summary

ABBV is approaching the Q4 earnings report facing a widely-recognized challenge. Can the company substantially replace reduced Humira revenues with growth from other drugs? Wall Street analysts and the implicit consensus from the options market agree that the company is priced to reflect the current situation and that, even with expectations for lower earnings over the next year, the shares have room to appreciate. The Wall Street consensus rating is a buy, with a consensus 12-month price target corresponds to an expected 15.3% total return. This level of return is comfortably above half the expected volatility, suggesting an attractive risk-return trade-off. The market-implied outlooks to the middle of 2023 and into the start of 2024 continue to be bullish and have gotten more bullish since my last analysis in mid-September. For income investors or those who want some cover if earnings come in lower than expected, selling covered calls is worth considering.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.