Summary:

- Walmart Inc. inventory-to-sales ratio had the best quarter of the last 8 – returning to normal.

- Quarterly comps – thanks to average ticket – remain in high single digits.

- Grocery inflation still remains an issue. WMT management said that it hasn’t really tempered much in last three quarters;

- Walmart is now in a position in 2023 to fix the externally-generated issues from Covid, supply chains issues, etc.

Justin Sullivan

Prior to the awful EPS guidance for fiscal ’24 (ends January ’24), the Street was expecting Walmart Inc. (NYSE:WMT) to print $1.48 in the first fiscal quarter (or April ’23 quarter) of ’24. Instead, that number has been slashed to $1.30, and the expectation is that Q1 ’24 revenue will grow 4.5% while EPS will be flat.

Walmart has a history of lowering expectations with guidance, but given the Q4 ’23 actual results that were released Tuesday morning, 2/21/23, it was somewhat surprising at the degree to which EPS estimates were reduced:

Positives to the last quarter:

- The inventory-to-sales ratio returned to normal, with its best quarter in the last 8, as the bloated inventory issue that reared itself in early 2022 is now “normalizing”;

- Walmart USA and Sam’s comps were both solid, with USA being up +8.3% and Sam’s comp’s up +12.2%, the tenth straight quarter of double-digit comps.

- “Average ticket” was up mid-single-digits for the 3rd quarter in a row, printing +6.3% in the Jan ’23 quarter.

Negatives about the quarter:

- Margins are still under pressure, possibly due to “grocery inflation,” which the Q4 conference call noted that grocery inflation hasn’t subsided to any material extent in the last 3 – 4 quarters.

- Even though fiscal ’24 and ’25 revenue estimates were revised sharply higher for Walmart following the latest earnings release, EPS estimates were reduced sharply, presumably from margins, but also possibly due to the inevitable weakening of the U.S. economy and the U.S. consumer (which is not yet in evidence);

Revised EPS and revenue estimates:

WMT EPS estimate revisions (IBES data by Refinitiv )

While the 2023 fiscal year is now closed and Walmart is in their fiscal 2024, readers can see that fiscal 2024’s EPS estimate has been reduced 15% since early 2022, while fiscal 2025’s EPS estimate has been revised lower by 13%.

Walmart revenue estimate revisions (IBES data by Refinitiv )

The fiscal 2024 revenue estimate has been revised higher by 4% while the fiscal 2025 revenue estimate has been revised higher by 5%.

Mathematically-inclined readers can probably figure out that if revenue estimates are being taken higher but EPS estimates are being revised lower, then chances are Walmart has a margin problem.

Fortunately, though the bloated inventory issue of early 2022 is starting to unwind and Walmart can now start to revert back it’s best-in-class merchandising, and moving product through the stores.

This topic on inventory-to-sales and it’s importance to Walmart was covered in the Walmart earnings preview last week, but let’s flush it out a little more:

With $600 billion in annual revenue Walmart moves a LOT of product through its stores, and with grocery being anywhere from 50% to 70% of revenue (I’ve heard analysts say grocery is anywhere from 53% to 70% of revenue recently, while 50% has been the standby figure the last few years), so “asset turnover” and inventory-to-sales is a key aspect to the day to day management of Walmart stores. (Think of the Dupont ROE model taught in the basic finance course in business school).

The faster revenue can flow or assets can turn over a fixed asset base, the greater those return on those assets.

When Walmart inventory swelled in early 2022, it was like throwing a wrench into the engine of a new Ferrari – it completely slowed down turnover, reduced returns and even heavily impacts cash-flow-from-operations since “changes in working capital” is a key component of cash-flow-from-operations, i.e., net income + non-cash-expenses + the change in working capital being the three major components of cash-flow-from-operations.

Again looking at this data from on inventory turnover at Walmart:

WMT inventory-to-sales ratio (quarterly earnings )

(click on above s/sheet)

To give readers a feel for turnover’s impact on cash-flow, look at the latest’s quarter cash flow of over $13 bl, with YOY sales +7% on 0% inventory growth, and then look at a year ago, when Walmart encountered swollen inventory (1% revenue growth on a 26% increase in inventory) and cash-flow for the quarter was just $7.2 billion.

Inventory to sales ratio has now been remedied or is in the process of returning to normal.

Ultimately that’s a positive for Walmart.

Operating margin: has been shrinking for years:

| # of Qtr’s | Avg op mgn |

| 4-qtr avg | 4.02% |

| 8-qtr avg | 4.05% |

| 12-qtr avg | 4.05% |

| 20-qtr avg | 4.10% |

| 40-qtr avg | 4.60% |

Source: earnings releases and valuation spreadsheet.

The 10-year average operating margin for Walmart has compressed considerably, probably pressured from Amazon, but also probably party due to grocery becoming a bigger part of Walmart revenue with lower price points and a lower margin.

With grocery inflation, you’d think we’d be seeing better margins at Walmart, but it’s obvious with the double-sided nature of inflation, it’s impacting Walmart’s COGS (cost-of-goods-sold) more so than it’s benefitting revenue, at least for now. This also gets back to inventory and inventory turnover and the inventory-to-sales ratio.

Valuation:

| Valuation metric (stk @$142) | current value |

| Price-to-sales | 0.63x |

| P/E ’24 | 23x |

| Exp EPS gro – 3 year avg | 8% |

| Exp rev gro – 3 year avg | 3% |

| Price-to-book: | 4.6x |

| Price-to-cash-flow | 13x |

| Price-to-free-cash-flow | 31x |

| Free-cash-flow yield | 2% |

| Dividend yield | 1.33% |

| Morningstar moat | wide |

Source: Mstar, and valuation spreadsheet.

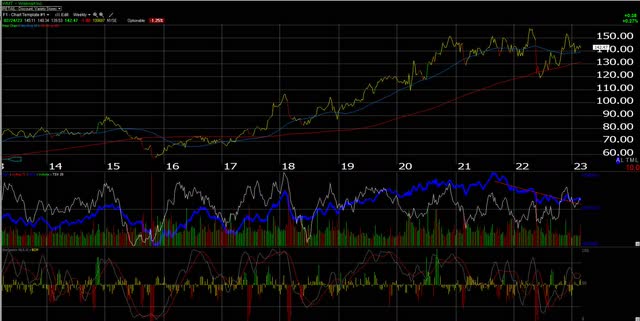

Technical analysis:

Walmart weekly chart (Worden )

The trade down to the mid-$120’s last year tested the monthly moving average, and the trendline held.

Ultimately the stock needs to trade back to and above $160, or stay above $125 in terms of a monthly close.

A close below the 2022 lows of $117 would not be good.

Summary / conclusion: Like all consumer staples, Walmart’s premium valuation is the less appetizing part of the story, but with supply-chain issues causing margin problems the last 24 months, and with the U.S. and global economy now moving beyond that, my own opinion is that it will allow Walmart to unlock more value in the business model and drive better EPS growth, through margin improvement.

Walmart’s dominance in grocery is truly amazing to behold, since Walmart didn’t really becoming a player in grocery until the year 2000. Grocery is the holy grail of retail, since it drives foot traffic with lower cost items, and Walmart is now the largest grocer in the U.S., and probably the world, with their high-volume, low-margin, asset turnover model.

The thing is – given their size – it’s tough to see Walmart driving revenue higher than their “mid-single digit” long-term revenue growth assumption now factored into sell-side analyst models. That’s ok, though. It’s hard from a math perspective to think a company that’s generating $660 billion in annual sales can grow revenue 20% per year. Amazon is now finding that out.

The upside in the stock is likely to come from better margins, which Covid has clearly compressed.

If you look at Walmart U.S., Sam’s and International segments over the last 3 – 4 years, all three segments have seen operating margin compression. Walmart has the ability to recover some of that margin.

In the never-ending debate between EPS growth and revenue growth, I’ll take revenue growth every time. Pricing power and traffic generation for the juggernaut that is Walmart, means margins can inevitably be fixed.

More Walmart was bought last week for clients in small increments, and more will be added when it seems right to do so.

Walmart is now in a position to fix the “externally-generated” issues from Covid.

As a side-note given the Berkshire Hathaway (BRK.A) results announced this weekend, I always wondered why Mr. Warren Buffett never bought Walmart. Like Coca-Cola and Apple, Walmart is an American staple generating $660 billion in annual sales. Possibly because it’s a retailer (read Charlie Munger’s comments on Alibaba), but I think the bigger reason is the Walton family still owns 50% of the outstanding shares, which actually crimps the buyback policy since the family doesn’t want their stock percentage ownership to drift too much over 50%. It’s simply a guess on my part, but Mr. Buffett probably doesn’t want to own a company where he has to share control. While there’s no doubt a Berkshire Hathaway stake would be welcomed by the Walton family, Mr. Buffett wouldn’t have the same sway as the family. That’s just a guess on my part – it could be completely wrong.

Disclosure: I/we have a beneficial long position in the shares of WMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.