Summary:

- WMT’s massive size limits growth potential, making today’s 20-year high valuation even more worrisome.

- 2% free cash flow and 1% dividend yields are almost laughable as the U.S. economy slows, and 5% risk-free cash rates remain an alternative.

- The current Walmart, Wall Street, and U.S. economic backdrop reminds me of the early 2000s, right after the Dotcom technology boom and Wall Street equity bubble ended.

Dimitri Otis/DigitalVision via Getty Images

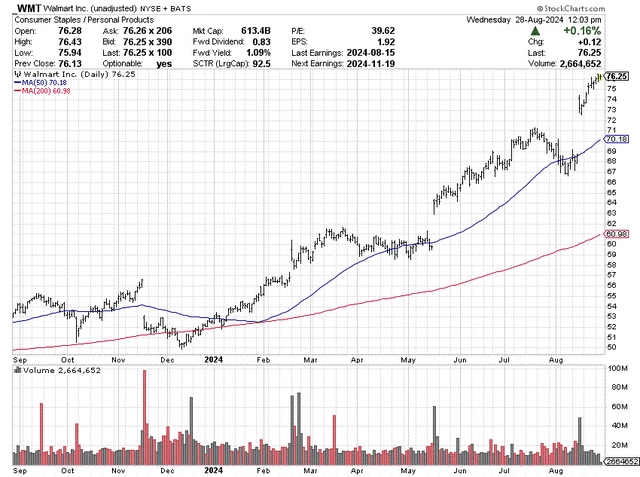

Walmart (NYSE:WMT) has just enjoyed a terrific run higher in price, up a solid +45% for total returns since January 1st, 2024, amid better-than-expected operating results and some defensive investor buying in America’s largest box-store retailer.

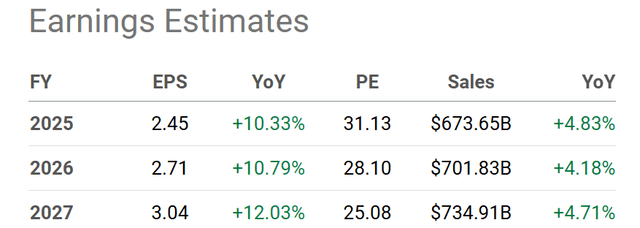

However, the valuation is now incredibly stretched, while expected annual growth rates of +5% for sales and +11% for EPS (projected by Wall Street during 2024-26) are not exactly outstanding. My logical investment conclusion is investors should sell or avoid the stock, until a smarter risk-reward setup appears. Such will likely take time to play out. From today, I fully expect Walmart to be a chronic “underperformance” choice, perhaps for many years.

Seeking Alpha Table – Walmart, Analyst Estimates for 2024-26, Made August 27th, 2024

To be honest, I haven’t had much of a bullish or bearish opinion on the stock in 2023-24. My last WMT article was a Buy rating in November 2021 here when the price was under $50. However, after the monster price gains this year, I do feel it prudent to outline the “risk” side of the equation at $76 per share in August. Let’s go through the bearish data points, almost entirely centered around the valuation.

Seeking Alpha Table – Walmart, 12 Months of Price & Volume Changes

Overvaluation Leaves Little Upside

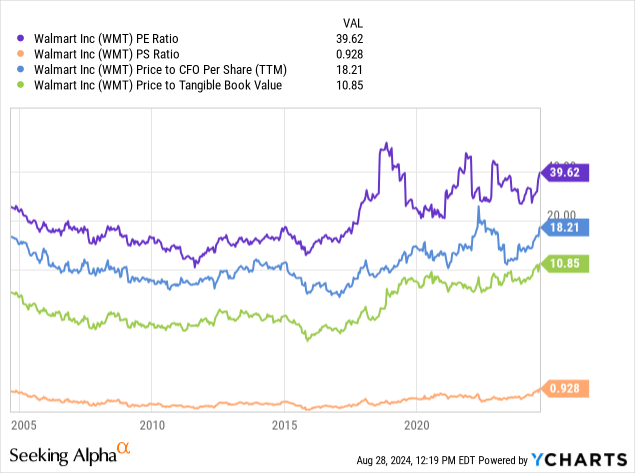

Believe it or not, Walmart is sitting at a 20-year-high valuation today, using price to trailing earnings (39.6x), sales (0.9x), cash flow (18.2x), and tangible book value (10.8x) as our benchmarks. We are talking about a 40% premium to 10-year averages, 60% premium to 20-year averages, and 120% premium to its 2016 low valuation (using an average of all 4 basic fundamental/financial ratio stats).

YCharts – Walmart, Price to Trailing Business Fundamentals, 20 Years

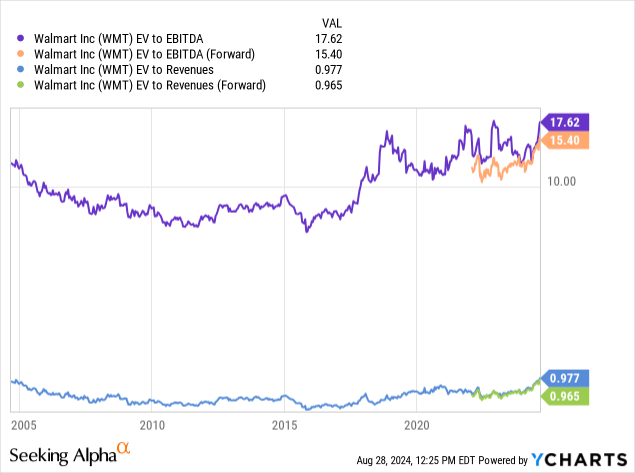

Enterprise Valuations

Taking into account changing debt and cash levels, the enterprise valuation on sales (0.97x) is back to 2004 levels, while the ratio to EBITDA (17.6x) is a new 20-year peak. So, Walmart clearly is nowhere near a bargain valuation buy idea.

YCharts – Walmart, Enterprise Valuations, 20 Years

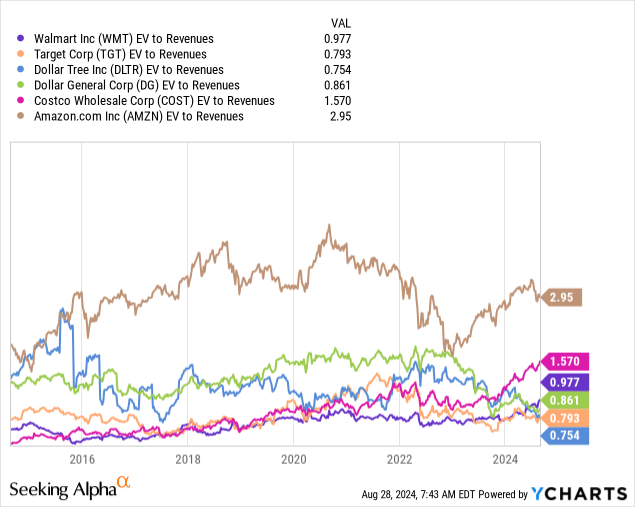

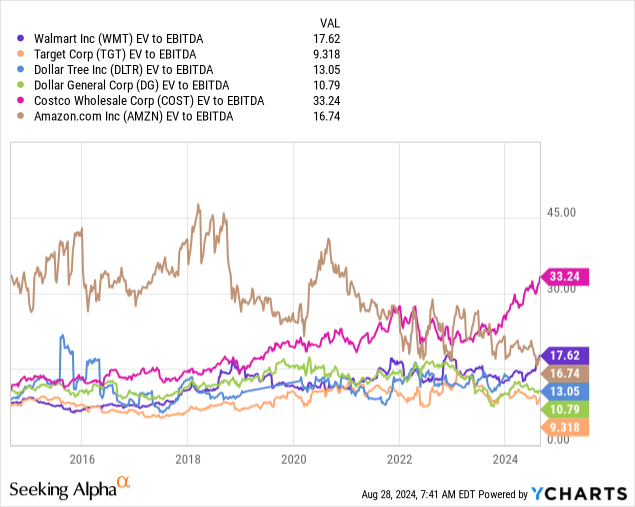

Is Walmart the most expensive in the major retailing group? No, but it has moved off its usual position as one of the cheapest on EV stats to a position catching up to Costco (COST) and Amazon (AMZN). I will interject I am also bearish on these two on valuation concerns. I wrote my latest bearish missives on Costco in July here and Amazon several weeks ago here.

Below you can review how Walmart has moved from one of the cheapest to the most expensive in the major retailing group on EV multiples since 2016, including other names like Target (TGT), Dollar Tree (DLTR), and Dollar General (DG).

YCharts – Walmart vs. Major U.S. Retail Peers, EV to Revenues, 10 Years YCharts – Walmart vs. Major U.S. Retail Peers, EV to EBITDA, 10 Years

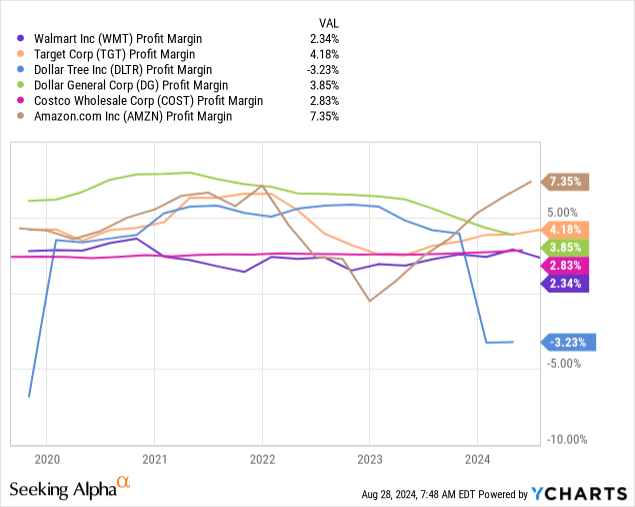

The question I pose: Are low business growth rates and low profit margins the types of business results you want to put a premium industry valuation onto? Walmart remains one of the weakest operating setups in the whole group for net profit margin on sales (at 2.34%).

YCharts – Walmart vs. Major U.S. Retail Peers, Final Profit Margins, 5 Years

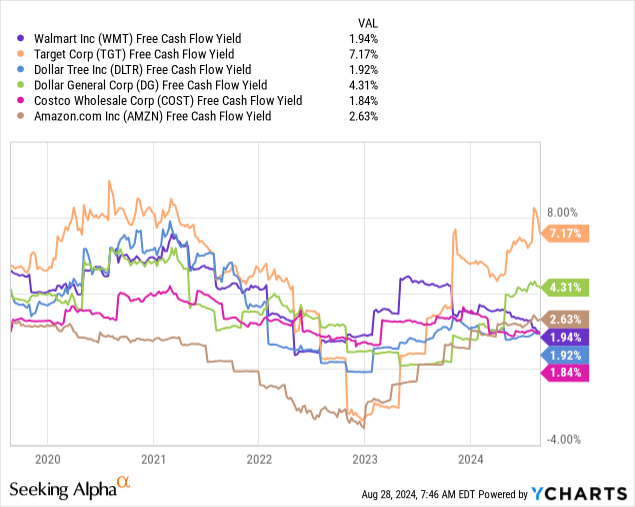

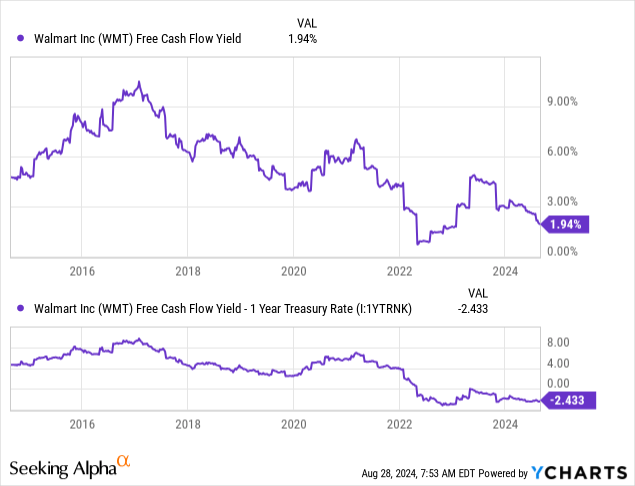

Free Cash Flow Lacking

When you drill down to the bottom line, Walmart’s free cash flow yield of 1.94% on the current $76 quote is nearly the weakest reading for in-your-pocket return out of this major retailing group. And, this situation has completely flipped from 12 months ago, when Walmart was sitting at the leading spot, with a 5% FCF yield.

YCharts – Walmart vs. Major U.S. Retail Peers, Free Cash Flow Yields, 5 Years

How bad is the FCF picture? Well, the yield on share pricing is bumping along at the lowest “relative” yield vs. prevailing cash investment rates over the past decade. If I can get 4.5% from a “risk-free” 1-year Treasury bill, why do I want to take on the real risks of retailing competition and serious economic recession, while pocketing a measly 1.94% for excess cash generation (assuming I owned the whole business)? Then contemplate WMT’s share quote can theoretically decline -100%, while cash investments almost guarantee the 100% return of your upfront capital.

YCharts – Walmart FCF Yield vs. 1-Year Treasury Rate, 10 Years

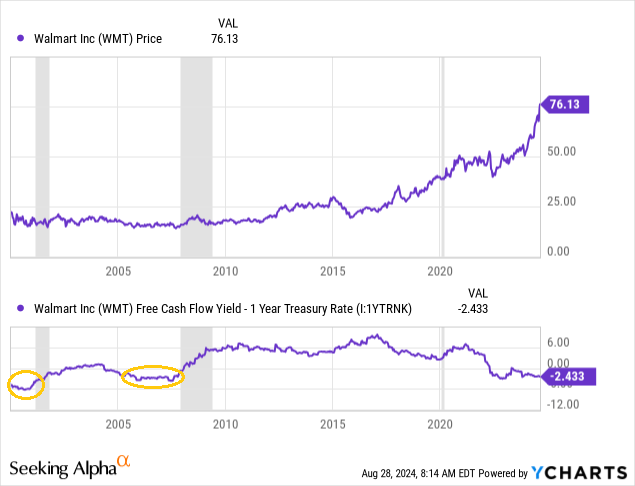

When you go back through history, the negative -2.43% relative FCF yield to cash rates is the same rotten adjusted return as witnessed during 1999-2001 and again between 2006-08 (circled in gold below). Both periods were followed by recessions that helped keep the Walmart stock quote under wraps.

The outlier situation is the 2023-24 rise in Walmart’s price with a largely negative real-FCF yield in place. Do you really think this uptrend will continue, or will a wicked reversal lower in WMT’s quote be next?

YCharts – Walmart Price, Relative FCF Yield to Base U.S. Savings Rate, 20 Years, Recessions Shaded

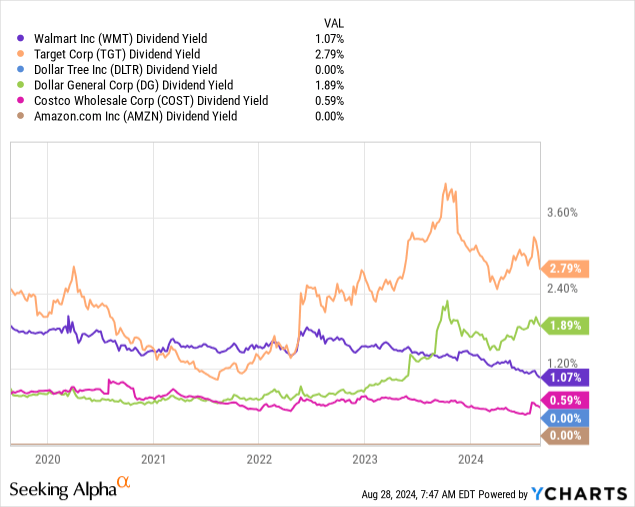

Dividend Yield Disappearing?

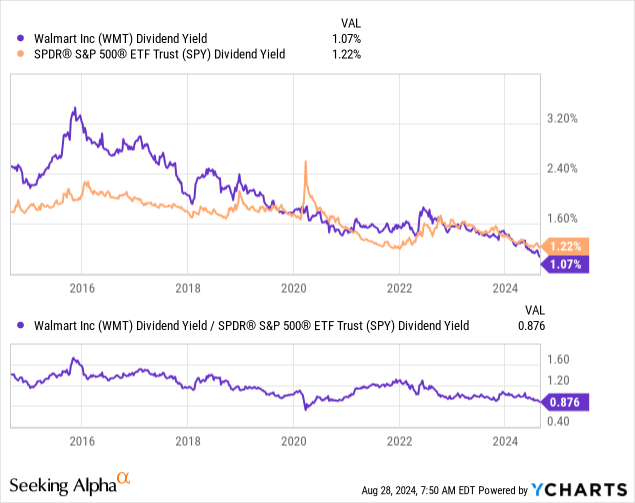

Another issue I have with Walmart is the anemic level of dividend yield at 1.07%. For sure, receiving 4.5% from a 1-year Treasury makes more risk/reward sense for income investors as the economy slows. More bad news is the unusual price jump has pushed the yearly cash-dividend distribution from almost 2% during the summer of 2022 to barely 1% in August 2024.

YCharts – Walmart vs. Major U.S. Retail Peers, Dividend Yields, 5 Years

1.07% is likewise a measurable distance from the S&P 500 blue-chip index average of 1.22%. It’s essentially the worst yield spread since 2009’s Great Recession (not pictured). If you ignore a few months during the 2020 pandemic crash in U.S. stocks, the relative yield story is screaming sell, not buy, for long-term stakeholders.

YCharts – Walmart vs. S&P 500 ETF, Dividend Yields, 10 Years

Valuation Summary

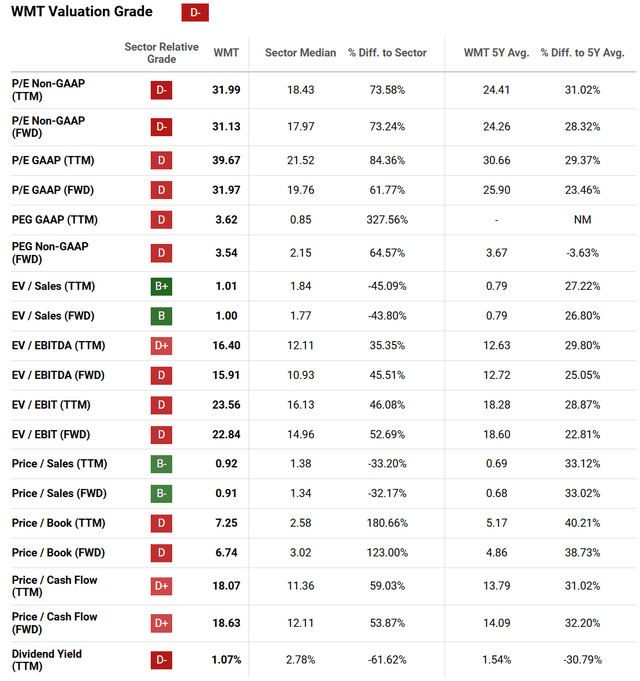

Using Seeking Alpha’s database and computer-sorting system, Walmart’s Valuation Grade of “D-” overall is the type of setup I generally run away from. Compared to industry averages today on an extended list of numbers and WMT’s 5-year history, there’s not much substance supporting your $76 purchase price.

Seeking Alpha Table – Walmart, Quant Valuation Grade, August 27th, 2024

Final Thoughts

You have to ask yourself if acquiring Walmart shares at a 20-year valuation high passes the common-sense test, with interest rates remaining elevated and the economy slowing, perhaps into recession soon. I could easily argue Walmart should be priced at a BELOW-NORMAL valuation, with today’s macroeconomic backdrop working against the company’s immediate results.

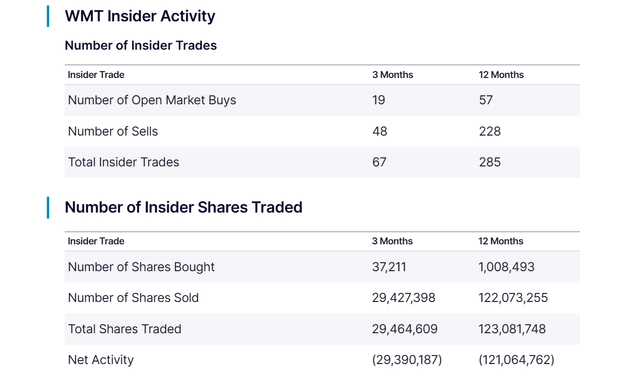

Well, the management team, founding Walton family, and board of directors are far from super-bullish on the stock quote direction at $76. This group of knowledgeable insiders has been large net sellers of stock on the streaking rise in price.

Nasdaq.com – Walmart, Insider Trading Activity, 12 Months

When you pull all the financial overvaluation data points together, then consider Walmart’s incredibly massive business size makes high growth rates next to impossible, I find the statistical odds of serious “outperformance” of the S&P 500 index to be quite low, going forward.

If you have substantial gains on your WMT position and would rather hedge your shares through selling covered calls or even buying puts, I fully understand. But, for the average retail investor owning the stock over the last 3-5 years, taking your profits is likely a better alternative. In addition, if you are contemplating buying a stake, I would rather you wait for a lower share quote that accurately balances recession and competition risks with company-wide income levels. My worry is Wall Street estimates of slight business growth into 2026 may prove overly optimistic.

What could keep Walmart’s share quote above $70 into 2025? That’s an intelligent question. You have to believe in soft landings for the economy, alongside a steady decline in interest rates next year. This “Goldilocks” scenario is honestly now “the” requirement for further stock market gains in most of the mega-cap Wall Street traded U.S. equities. It’s a similar and scary setup to the end of the original technology bubble of 1999-2000, which also proved the peak trade for Walmart shares, not to be broken on the upside until 2013.

Can you handle holding Walmart for 13 years until 2037, before earning a meaningful profit (outside the miniscule 1% dividend yield annually)? If the answer is no, maybe you should focus your attention on smaller and mid-cap names with sound/acceptable valuations on above-average business growth rates. I write about this subset of positive risk/reward choices each week on Seeking Alpha.

I rate Walmart shares a Sell/Avoid at prices above $60.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.