Summary:

- Under the leadership of CEO Bob Iger, investors were looking forward to his first earnings call since his monumental return as CEO in late 2022.

- Iger is battling activist investor Nelson Peltz in a high-stakes proxy fight.

- Management’s bold move to propose a return of a “modest dividend” by the end of 2023, pending board approval, aims to appease investors.

- Disney takes significant measures with a bold $5.5B cost-cutting drive, including slashing 7,000 jobs, in its quest to reach its profitability goals.

Jerod Harris

The Walt Disney Company (NYSE:DIS) released its FQ1’23 earnings yesterday (February 8), as CEO Bob Iger helmed his first earnings call since returning after the ouster of ex-CEO Bob Chapek.

Iger’s attempt to placate investors amid the company’s struggle with activist investor Nelson Peltz in a proxy fight for a board seat has been lifted as Disney looks to reinstate its prized dividend.

Management highlighted it’s planning to seek the board’s approval to reinstate a “modest dividend” by the end of the year, as Disney looks forward to welcoming income investors back to the fray.

The company has also restructured its business segments, breaking up Chapek’s legacy in the media division. Notably, ESPN is now a standalone segment, suggesting that the company sees further growth opportunities in sports programming.

However, Disney also highlighted what many keen media investors would have known by now: Linear is in a secular decline. However, management was quick to point out that the company’s legacy TV business is still a highly profitable segment. As a result, it’s expected to proffer the company the much-needed stability as management maintains its guidance on achieving streaming profitability by the end of 2024.

Accordingly, its linear networks suffered a 5% decline in revenue and a 16% fall in operating income in FQ1. However, it still posted a 17% operating margin amid the ad market downturn.

With DTC still nursing losses (-20% operating margin) as it posted a $1.05B operating loss, there’s significant potential for Iger to demonstrate his management prowess for the rest of FY23.

Some DIS bulls could point out a solid performance in its Parks segment. It notched an operating margin of 35% as it continued to drive operating leverage. However, CFO Christine McCarthy also reminded investors that FQ1 is “seasonally one of [Park’s] strongest when you look at it relative to other quarters.” Hence it will be necessary for investors to temper their expectations moving ahead.

Despite that, the company is confident that its cost-cutting efforts should continue to help improve its profitability goals for FY23.

Accordingly, the company announced 7K job cuts as it looks to rein in content and non-content expenses, totaling $5.5B. In addition, the company will focus on higher payoff investments to drive profitable growth and move away from focusing on subscriber growth.

Therefore, it should improve the company’s ability to meet/surpass its FY23 revenue and segment operating income growth guidance in the “high single-digit percentage range.”

Wall Street analysts’ estimates suggest a 9.5% growth in revenue and a 7.8% increase in segment operating income for FY23.

Therefore, Disney’s guidance suggests that the company should continue to gain operating leverage through FY23, as it reported an FQ1 decline in segment operating income of 6.6%.

Moreover, McCarthy also guided that DTC should see a sequential operating improvement in FQ2 by about $200M, despite a challenging ad market outlook.

Therefore, it does seem like Iger came in at the right time, as Chapek’s last earnings call in FQ4’22 likely set the stage for a massive reset in expectations, as DIS nearly collapsed to its March 2020 COVID lows.

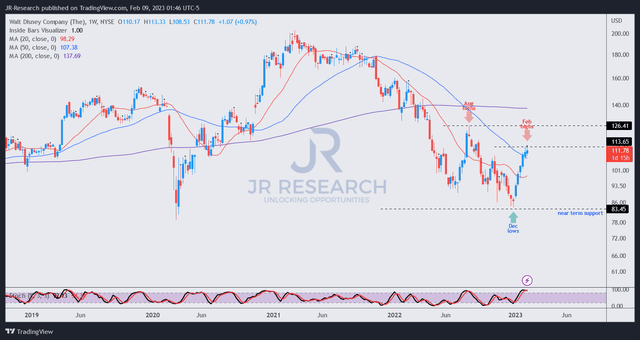

DIS price chart (weekly) (TradingView)

However, before investors start getting excited and decide to jump on DIS’ recent buying frenzy, it may be wise to consider the optimism reflected in its price action.

As seen above, DIS formed its December lows when pessimism over the company’s restructuring peaked, even as Iger returned.

However, we highlighted in our previous two articles (here and here) arguing that investors should ignore the pessimism, as Disney’s valuations and forward estimates have likely been de-risked.

Still, we didn’t expect the extent of DIS recovery from its December bottom (nearly 35% through this week’s highs). But, we believe savvy investors who picked those lows likely anticipated a better-than-expected FQ1 from Iger and his team, as seen earlier.

Hence, the company’s horrendous FQ4 performance helped lay the groundwork for a timely revision in the market’s expectations as Iger looks to spruce up his comeback with the return of Disney’s dividends.

However, investors should be cautious about joining the bandwagon now after such a rapid surge in momentum.

Rating: Hold (Revise from Buy).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!