Summary:

- Several catalysts led to Disney stock price to increase in 2023.

- Iger is getting his ducks in order in his third transformation.

- Disney is relatively overvalued.

- Activist investors continue to play a cooperative role.

- Iger has credibility.

hapabapa

Why I rated Disney DIS a Sell in December 2022

Why I rated Disney (NYSE:DIS) as a Sell in December 2022 is because of weak fundamentals, uncertainty surrounding the return of CEO Bob Iger, competition, and the highly variable financial performance of Disney, which is cyclical.

On 12/29/2022, I gave a sell rating to Disney DIS at $87.18 based on this investment theme. However, Disney’s stock rallied to a high of $118.18 on 2/9/2022 and closed the day at $110.36.

DIS stock closed at $100.45 on 2/27/2023 on the day of writing.

The following catalysts were responsible for the increase in Disney’s stock price from the date of my sell rating until 2/9/2023:

-

On 1/11/2023, Disney announced the appointment of board member Mark Parker, who is also Nike’s executive chairman, as the new chairman of the board. This news was received favorably by investors.

-

Nelson Peltz, an activist investor, continued to engage with and urge Disney’s management to undertake restructuring. In the past, Peltz’s involvement has led to positive changes in the companies he has worked with.

-

Another activist investor, Dan Loeb, advised Disney, took a stake in the company, and pushed for change during the second half of 2022. He ultimately reached an agreement with the Disney Board, which added an ally to the Board.

-

Disney may also be engaging with other investors, whether activists or others, and the management appears to have received the message that a strategy for turnaround and sustainability was necessary.

-

Disney announced a restructuring plan, which could potentially result in cost savings of $5.5 billion, and the company also announced the termination of 7,000 jobs. This will be Iger’s third transformation.

-

In addition, Disney announced solid earnings, with an increase in revenue and beating EPS estimates for the fiscal Q1:2023.

-

Finally, Disney made a decision to work on its pricing strategy.

Disney CEO Bob Iger (Iger, hereinafter) said, “….. but let me also address the pricing side. It’s clear that some of our pricing initiatives were alienating to consumers. I have always believed by the way, that accessibility is a core value of the Disney brand. We were not perceived to be as accessible or as affordable to many segments as we probably should have been.” on Q1:2023 conference call on 2/8/2023.

Thesis for Possible Upside in DIS in the Longer Term:

-

Iger has the task of finding a new CEO for Disney within the next 12-18 months. This announcement could be a catalyst for the DIS stock to find a new direction, with the possibility of it being the single most significant factor impacting the stock price in the next 18 months. Some investors may adopt a wait-and-see approach.

-

Iger’s success in his previous transformations makes it possible for him to succeed in his third transformation. This sets the stage for a long-term vision for the company that focuses on the streaming business, margin improvement, cost reduction, and strategic reorganization. This transformation is focused on operational efficiency. Disney is currently faced with the question of whether these changes can be made before conditions change again, and how far should the changes go? Iger has already answered the second question by tweaking the internal structure and organizing Disney into three core business segments as follows:

- Disney Entertainment: entertainment media and content businesses globally, including streaming.

- ESPN: ESPN Networks, ESPN+, and international sports channels.

- Disney Parks, Experiences, and Products: theme parks, resort destinations, and cruise line, Disney’s consumer products, games, and publishing businesses.

-

Iger has no plans to sell ESPN and should not sell Hulu.

-

Iger’s biggest strength lies in his experience, and both Disney staff and investors believe in him. He has credibility.

-

Disney aims to reduce its debt. “We are intent on reducing our debt,” Iger said on 2/9/2023 during an interview on CNBC.

Hulu Should Not be Sold

I believe Hulu is a strategic fit and should not be sold. During the earnings conference call, Iger implied that he would not sell Hulu. However, the next day, on February 9, 2022, he suggested the possibility of selling Hulu during an interview with CNBC. The day before, on February 8, 2022, he had said:

“When you think about it, Abbott Elementary airs on ABC, then it goes to Hulu. The demographic difference in age is tremendous. It’s like 60-years-old or around, estimating on ABC and then the 30s on Hulu. That’s a perfect example how the linear platforms, while they still have an audience and could help us monetize can still be used effectively, and we have that ability. And so we are going to monitor it very carefully. We are not in any way stepping away from streaming. It remains our number one priority. It is in many respects, our future. But we are not going to abandon the linear or the traditional platforms while they can still be a benefit to us and our shareholders.”

Disney should not divest Hulu because Iger himself has said that Hulu ensures coverage of different age groups and broadens the market for its streaming services. Since the corporate strategy is to continue focusing on streaming for sustainable profitability, Hulu is a valuable asset that supports this strategy.

“Our priority is the enduring growth and profitability of our streaming business. Our current forecasts indicate Disney+ will hit profitability by the end of fiscal 2024 and achieving that remains our goal. Since my return, I have drilled down into every facet of the streaming business to determine how to achieve both profitability and growth.”

Disney should actually acquire the remaining piece of Hulu that it does not already own and should not sell ESPN, as some analysts and activists are pushing. Currently, Disney owns about 67% of Hulu.

Author’s Comment in January 2023. (Author’s comments in January 2023. )

Impact of Dividend Reinstatement

If Disney decides to reinstate its dividend, it may have a minimal impact on shareholder value. The management’s decision to use cash flow to pay dividends instead of paying debts will signal that its capitalization is near optimum. This move could attract yield investors whose mandate is not to buy stocks with no yield to initiate positions.

However, as of 2/27/2023, there are other options for income, such as CDs yielding 4.5% to 5% and 10-year US Treasuries yielding 3.95%, with 1-year yielding 4.75%. Yield investors in Disney now have more choices for income than just Disney stock.

Historically, Disney’s dividend yield ranged from 0.6% to 1.6% between 2011 to 2019. This level of yield is unlikely to attract a significant number of new income investors, and therefore may not increase the shareholder base and value significantly.

Disney Dividend History ( https://www.streetinsider.com/dividend_history.php?q=DIS)

Two Most Recent Emerging Risk

The question above was, whether the transformation work can be completed before conditions change again. It should be noted that conditions have already begun to change.

Netflix (NFLX) is facing increased global competition in the streaming wars has recently cut pricing in over 100 markets worldwide as of February 24, 2023. This move may impact Disney’s streaming service, and it remains to be seen how it will affect subscriber acquisition and retention.

Additionally, Florida Gov. Ron DeSantis signed a bill on Monday, February 27, 2023, which gives him control of Walt Disney World’s self-governing district. This measure against the company poses a political risk, as it may waste management’s time and resources. However, this takeover is not expected to impact Disney’s cash flow.

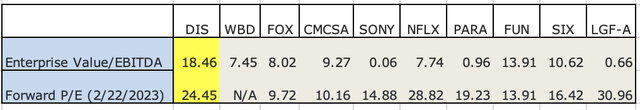

Disney is Relatively Overvalued on Two Common Measures

DIS is relatively overvalued on two common measures compared to its competitors. Currently, DIS is trading at an EV-to-EBITDA multiple of 18.46, which is the highest among its peers. This overvaluation may be due to investors’ confidence that growth will increase following Iger’s restructuring efforts. Additionally, its forward PE ratio is the third highest among its peers, which further suggests that the stock may be overvalued.

Disney Relative Valuation (Yahoo Finance: Disney Relative Valuation 2/27/2023)

What should investors look out for, and how should they position themselves?

Investors should consider buying Disney stock if they are willing to wait for two years and carefully consider their opportunity costs and potential yields in other instruments. However, if you are not currently a holder of Disney shares, it may not be the best time to buy.

If you are already a current owner of Disney shares, it may be advisable to hold onto the stock and give Iger’s transformative restructuring a chance. There are several potential catalysts that could lead to higher share prices, including the announcement of a new CEO in the next 18-24 months (If the new CEO has the same credibility Iger has), potential growth in streaming by gaining market share, a rationalized pricing policy, cost cuts, the success of a new blockbuster show due to increased creativity, lower debt levels, keeping ESPN and buying the rest of Hulu, and, most importantly, having activist managers advising and standing behind Iger.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.