Summary:

- AbbVie’s Humira sales may hold up better against biosimilars in the USA than they have in Europe.

- The pharmaceutical giant has a diverse portfolio of blockbuster drugs that should help to offset declining revenues in its leading therapies.

- AbbVie offers a safely growing dividend with a current yield near 4%.

- I examine AbbVie’s current outlook, dividend strength, and valuation to determine whether ABBV stock is a buy at current levels.

Mohammed Haneefa Nizamudeen

Amidst the current market turmoil largely driven by the Fed’s rapid rate hike campaign and its potential near-term ramifications across the financial sector, many investors are seeking safer places for their capital, both in equities and fixed income, to ride out the storm.

Today I’ll be looking at one of the few healthcare holdings in my Sky High DGI Portfolio, AbbVie Inc. (NYSE:ABBV), which I believe offers a great blend of safety and income that should remain fairly immune to fluctuations in the macroeconomic environment, whether it be inflation and job reports, Fed rate hikes, or uncertainty in the banking sector.

Overview

Originally the branded pharmaceuticals division of Abbott Laboratories (ABT), AbbVie was spun off from Abbott in 2013 with a mandate to continue growing Humira, its blockbuster treatment for inflammatory autoimmune diseases such as arthritis, Crohn’s disease, and psoriasis, while continuing to develop a variety of pipeline drugs and bringing them to market. The company’s Achilles’ heel has always been its reliance on its top-selling drugs: first Humira, and now also Imbruvica, a blood cancer treatment bought by AbbVie via its 2015 acquisition of Pharmacyclics, which together comprise around half of the company’s massive $60B in annual sales.

The main concern for AbbVie investors has always been the inevitable arrival of competition for Humira and Imbruvica. Although Humira’s main patent expired back in 2016, the company’s well-documented legal manoeuvring helped to extend the drug’s exclusivity in the USA until this year. 2023 will bring the arrival of up to ten Humira biosimilars to the US, the first of which is marketed under the name Amjevita by fellow pharmaceutical giant Amgen (AMGN). Despite some dire predictions of these biosimilars quickly stealing significant market share from AbbVie as they did in Europe, early signs suggest that AbbVie may fare better in the USA, largely due to a lower final pricing disparity between Humira and its biosimilars than expected. Data from the UK revealed that over 10% of biosimilar patients eventually switch back to Humira as well, although in Europe the company’s revenues eventually fell to about a third of their pre-biosimilar levels.

Perhaps more concerning is Imbruvica’s competition from China-based Beigene’s drug Burkinsa, which has shown superior performance treating leukemia in head-to-head trials and is projected to reach nearly $4B in sales by 2030. Of course, Beigene is a much smaller company whose limited footprint has slowed Burkinsa’s rollout, and Imbruvica already faces competition from AstraZeneca (AZN), so the full impact of Burkinsa on AbbVie’s hematology portfolio may not be apparent for some time. In 2022, Imbruvica and Venclexta (another leukemia treatment) contributed just over $6.5B to AbbVie’s top line.

On a brighter note, CEO Rick Gonzanlez believes that two of AbbVie’s other blockbuster therapies, Rinvoq and Skyrizi, will surpass Humira’s peak sales of ~$21B by 2027, and indeed the pair seems to be on that trajectory with nearly $8B in 2022 sales. Botox and Juviderm continue to deliver solid results in aesthetics as well, totalling over $4B in 2022 despite a difficult economic environment.

Dividend Strength

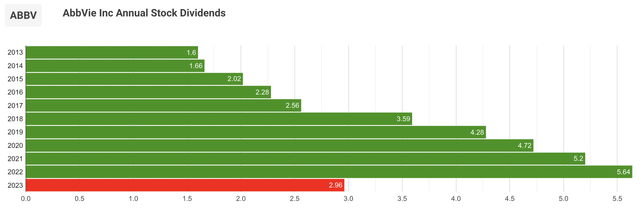

It’s no secret that AbbVie offers one of the highest dividends in the healthcare sector; however, its current 3.9% yield may be less attractive in today’s higher-rate environment, with short-term Treasuries offering a risk-free yield upwards of 4.5%, and remains below its 5-year average yield of 4.36%. Still, AbbVie has maintained an unbroken dividend growth streak since its spinoff from dividend king Abbott Laboratories in 2012, and although AbbVie’s most recent 5% dividend hike was about half of its long-term dividend CAGR, it is still in line with fellow blockbuster drug-making peer Merck’s (MRK) dividend CAGR, and there is potential for AbbVie to return to higher dividend growth in the future should Humira sales turn out to be more resilient than both the company and analysts currently project.

ABBV Historical Dividends (dividendinvestor.com)

AbbVie’s dividend payout ratio is relatively high compared to its peers, which isn’t surprising given its significantly higher yield than most pharma giants. The current payout ratio stands at 86% versus a long-term range between 60-100%, excepting the brief spikes in 2014 and in 2020 following the Allergan acquisition. Were revenues and earnings to drop significantly from current levels it could put further downward pressure on or even stall AbbVie’s dividend growth rate, but for now I’m optimistic that Humira sales will exceed current expectations and the company will be able to continue to raise its divvy each year, albeit possibly at a low-to-mid single-digit rate for the next 2-3 years.

ABBV Payout Ratio 2013-22 (Seeking Alpha)

AbbVie’s management is shareholder-friendly to a fault, and the company has shown a willingness to pay out more than 100% of its earnings on occasion to maintain its dividend growth aspirations. It has also repurchased shares each year, although buybacks have dwindled after its $63 billion acquisition of Allergan in 2020 in lieu of paying down its significant long-term debt, which has fallen from $70B at the end 2020 to just above $60B today. Its debt load is high but manageable given the company’s annual revenue of $60B, annual EBITDA of $31B, and $265B market cap. In just the last year alone AbbVie has paid down over $14B of debt, and cash on hand stands at $9.2B, positioning the company well for future acquisitions.

Valuation

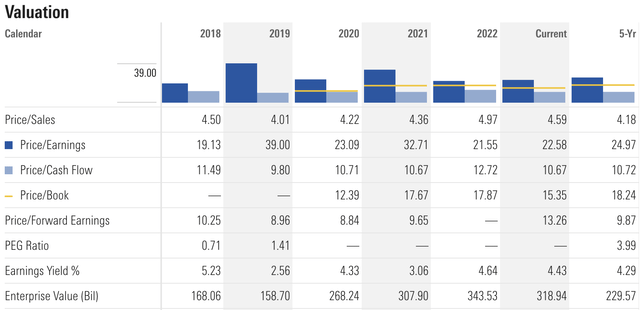

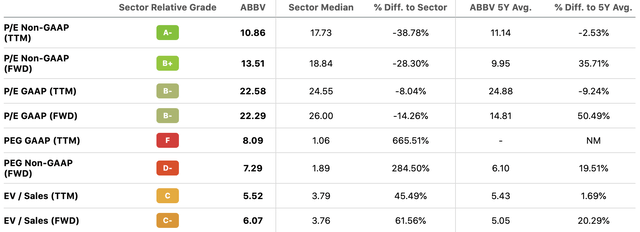

While ABBV is a bit difficult to value on a forward basis due to the uncertainty surrounding future Humira and Imbruvica sales, on a trailing basis it appears to be fairly valued by most metrics.

Its TTM price to sales ratio has remained quite consistently in the 4-5.5x range since its IPO, and currently ABBV is near the lower middle of that range at 4.59x. Its 22.58 PE ratio is about 10% below its 5-year average, and its price to cash flow ratio is in line.

ABBV Valuation (Seeking Alpha)

We can see that its forward PE and PS / EVS metrics are significantly higher than average, largely due to projected falling Humira and Imbruvica revenues in the coming years. Since ABBV’s actual 2023-25 sales are hard to predict and may surpass analyst estimates, I don’t put as much weight on these forward figures when considering the company’s overall valuation, although I think its safe to assume that the consensus forward estimates for declining revenue and earnings in 2023-24 are already priced into the stock, and thus that investors are likely more optimistic about the company’s outlook than current projections suggest.

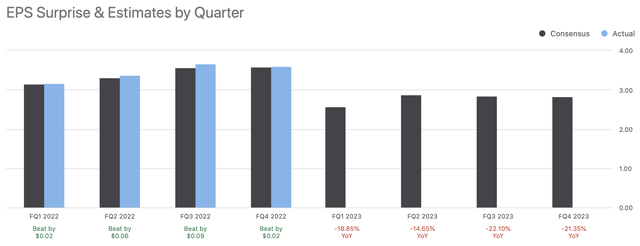

ABBV 2023 EPS Projections (Seeking Alpha)

In this case, I side with ABBV’s investors and view the company as fairly valued, with its high forward sales and earnings metrics counterbalanced by its resiliency to inflation and interest rate uncertainty. A lower-than-average dividend hike has left its current yield below its 5-year average, but I think management’s caution with the dividend was warranted given the company’s uncertain sales outlook. Either way, its yield and dividend growth is still either higher than or in line with the majority of its peers, with the possible exception of AMGN, whose investors must contend with a looming mountain of debt and a pause in share buybacks should its pending acquisition of Horizon Therapeutics (HZNP) be approved by regulators.

Conclusion

For those seeking relatively safe dividend growth stocks to ride out the current market uncertainty, AbbVie is a solid option that offers a 4% yield, share price upside potential, a strong pipeline, and a stable of multi-billion dollar blockbuster drugs providing relatively stable revenues while the company works to replace declining revenues from its top two drugs. Management is extremely shareholder-friendly and legally savvy, and long-term investors will likely be rewarded for their patience while the company focuses on paying down its debt and developing and possibly acquiring new drugs to drive top line growth beyond 2025.

Given the market’s low expectations for Humira and Imbruvica sales over the next few years, I rate ABBV a buy at its current price near $150 based on the worst-case Humira sales scenario likely having been priced in already as well as the factors I’ve listed above. I don’t expect massive share price appreciation or a return to double-digit dividend growth for at least a few years, but in a high-interest-rate environment rife with significant macro risk factors, I think ABBV’s robust portfolio, solid yield, and skilled management will help you sleep well at night.

Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.