Summary:

- Roku stock had a 2022 to forget, with share prices collapsing more than 80%.

- ROKU’s revenue is stalling without a clear path back to growth.

- Costs at the company are rising far faster than revenue growth.

Justin Sullivan

Streamer or Bleeder?

2022 was a year that Roku (NASDAQ:ROKU) shareholders want to keep in the rearview mirror. The year of the tech-wreck was not kind to the stock: shares lost 82% of their value compared to the S&P 500’s (SPY) loss of 20%.

With full-year reporting from the company right around the corner, we want to assess what a successful 2023 would look like for Roku and outline what we’d like to see from the company in order to, hopefully, restore share prices to their former glory.

Revenue

Roku’s business is likely to have suffered in Q4. The company operates in the video streaming business, which, apart from being incredibly cutthroat and capital intensive, is largely reliant upon advertising to keep the top-line on the income statement supported. Unfortunately for Roku, decreasing ad budgets impacting business has been a bit of trend this earnings season.

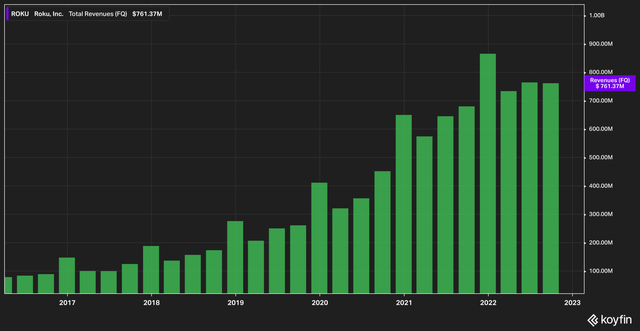

A look back at Roku’s quarterly revenue reveals a level of seasonality, with Q4 clocking In consistently higher than the first three. This means that the stakes for Roku–and shareholders–are considerably higher as we wait for earnings. Current analyst estimates peg quarterly earnings to come in around $802 million, a 7% decline from Q4 2021, and, as we can see, the first Q4 revenue decline in the company’s history.

Now, we typically take the approach that internal and external factors affect companies, with internal factors being within management’s control, and external factors being outside. Unless a company is simply not competitive in its industry, there are lots of reasons why revenue can be negatively impacted while management is simply left to ride things out.

In Roku’s case, however, there’s a combination of external factors at play. While a decline in advertising budgets has affected streamers and social media companies across the space, questions linger about Roku’s ability to maintain a competitive edge. When Roku launched, after all, Netflix (NFLX) was arguably its biggest competitor. Today Amazon Prime Video (AMZN), Disney (DIS), and several other media Goliaths possess their own streaming services.

To this end, KeyBanc recently downgraded Roku citing concerns about market share loss. Furthermore, Roku has had to contend with an increasing scarcity of third-party content as media giant streamers with large catalogs of movies and television shows rein in licensing agreements and lock up properties in their own streaming worlds (think: when Comcast (CMCSA) pulled The Office from Netflix to lock it up within its Peacock streaming service).

How has Roku fought back to keep eyeballs on its own shows? Has it invested in acquiring digital properties that will keep people coming back? Well, the company in 2021 paid $97 million for… This Old House. That show, if you remember, was the home renovation show that once starred Bob Villa. Roku does stream popular shows and movies, but the media business can be a what-have-you-done-for-me-lately enterprise, with viewers (and investors) expecting home run after home run. A swing and a miss in this industry means that people simply change the channel.

What we’d like to see from management heading into 2023 is a plan to ensure that content remains fresh and relevant, that popular content isn’t set to cycle off the platform, and that the company is investing smartly in original content.

Customer Acquisition Costs

How much you make in revenue is of course just one part of the picture–we also have to consider how much a company spends to bring that customer through the proverbial door in the first place.

So, let’s take a look at Roku’s operating costs over the reported period for 2022 so far.

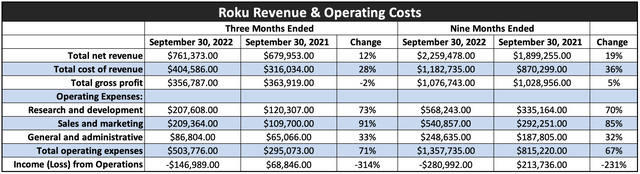

So off the top we see that for the full reported nine months of 2022, revenue increased by 19% year over year. Scrolling down the columns, however, a non-pretty picture emerges. Operating costs have rapidly risen (over both the three months and the nine month time frame).

It goes without saying that this is problematic. First let’s take a look at Sales and Marketing. While we can’t drill down to the dollar-for-dollar level, we know that the vast lion’s share of sales and marketing goes to bringing new eyeballs to Roku’s service. So what we would want to see ideally is for the cost of bringing new eyeballs to, at a minimum, scale with revenue, and at best to actually decrease as a proportion of revenue. This would show that Roku can effectively manage its growth and scale effectively.

Unfortunately, the numbers so far have gone the wrong way, growing by 85% over a nine month period. In that period, Roku spent almost $541 million in marketing dollars to bring revenue of $2.25 billion through the door. That means that Roku paid $0.25 for every $1 of revenue it generated.

Compare this with 2021, when Roku spent $292 million in marketing and posted top-line revenue of $1.89 billion. In that timeframe, Roku spent $0.18 for every $1 of revenue generated.

This sort of trend is obviously unsustainable. Also, we want to emphasize that we are analyzing the 9-month timeframe instead of the 3-month timeframe for this calculation because it is likely that Roku has a much higher outlay of marketing cash in Q3 as it prepares to go into its busy Q4. Looking at the first three quarters together gives us a smoother overall picture.

Free Cash Flow

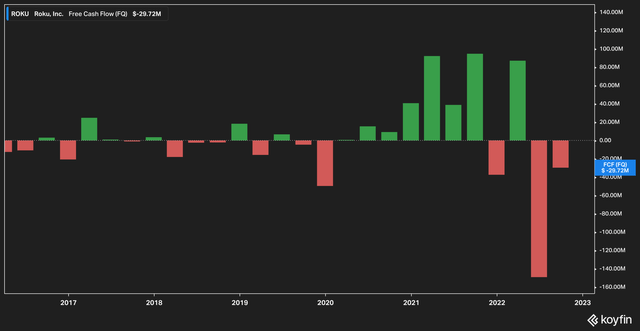

Free cash flow at Roku has been spotty over the years. The pandemic, overall, was kind to the company: as people were forced to stay at home with not much to do except drink and watch TV, Roku benefitted big time.

Prior to 2020, the company generated spotty free cash flow at best, which is not surprising. The big spike in FCF however, came, as discussed, in 2020 and 2021.

Interestingly, Roku posted negative free cash flow in Q4 2021, despite it being the highest quarterly sales in the company’s history. This was not due to copious capital expenditures (they were only $12 million for the quarter). Indeed, the Roku actually posted negative operating cash flow for the quarter.

Seeing as how Q2 and Q3 of 2022 were free cash flow negative, this does not give us hope that Q4 will be a bright spot, especially given the increase in operating expenses explored above.

The Bottom Line

Roku has, in our opinion, a long way to go to re-earn investor trust. Investors need to see – in the upcoming earnings call and in the execution of 2023 – that the company has a sustainable, executable plan to:

- Reign in customer acquisition costs.

- Control overall operation costs which are outpacing revenue growth by 48% currently.

- Show that the company has a feasible plan to achieve consistent profitability.

We’ll be watching the upcoming earnings call closely. For now, however, we must remain on the sidelines.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.