Summary:

- The growth of Tilray’s craft-beverage brands will likely become the main driver of its stock returns in the years ahead.

- Cannabis continues to be a loss-making endeavour with Tilray’s net losses for its last reported quarter up by nearly 100%.

- Cash and equivalents of $490.6 million as of the end of its last reported quarter will provide the liquidity for continued accretive beverage alcohol acquisitions.

kmatija

Tilray (NASDAQ:TLRY) looks set to close out 2022 on a low note, with its common shares down 62% year-to-date. I last covered the company in the early months of the pandemic with a bearish tone that reflected its historical overvaluation compared to its peers. The bears have broadly taken 2022 with one of the largest cannabis ETFs, ETFMG Alternative Harvest (MJ), also down 62% year-to-date. Tilray has changed drastically over the last two years and looks set to enter 2023 with a strong suite of brands and great expansion opportunities in the US. The company recently closed on an acquisition of Montauk Brewing Company, a New York-based craft brewer with distribution across several national retailers including Whole Foods, Trader Joe’s, and Costco (COST).

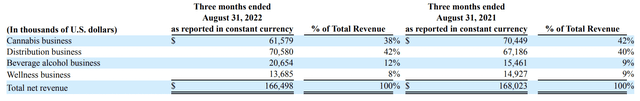

The company’s craft-beverage brands now include the 10th largest craft brewer in the US, SweetWater Brewing Company, as well as Alpine Beer Company, Green Flash Brewing, and bourbon and spirits brand, Breckenridge Distillery. The beverage alcohol business drove revenue of $20.6 million for the company’s last reported earnings for their fiscal 2023 first quarter ending August 31, 2022.

A More Alcohol-Based Future

This was 12% of total revenue, up from 9% of revenue in the year-ago quarter. The acquisition of Montauk is expected to immediately boost the revenue of the segment and be accretive to earnings. I’d expect Montauk to also be able to piggyback on SweetWater’s distribution network to further boost sales growth. All in all, beverage alcohol sales are moving to become an even larger part of Tilray’s growth, and shareholders should expect to see more acquisitions on this front.

Indeed, the company has created a new position titled ‘President of Tilray’s U.S. beer business’ and appointed beverage industry executive Ty H. Gilmore to the role. Tilray’s ability to maintain and build out its beverage distribution network to use as a platform to grow the footprint of its acquired US beverage brands will be one of the core drivers of its value creation in the years ahead. It should also ultimately provide a platform for the company to launch THC-based products upon US federal legalization. Fundamentally, Tilray will increasingly no longer be just a cannabis company but a diversified cannabis lifestyle company with a growing consumer packaged goods business.

Canada, Recreational Cannabis, And The Future That Wasn’t

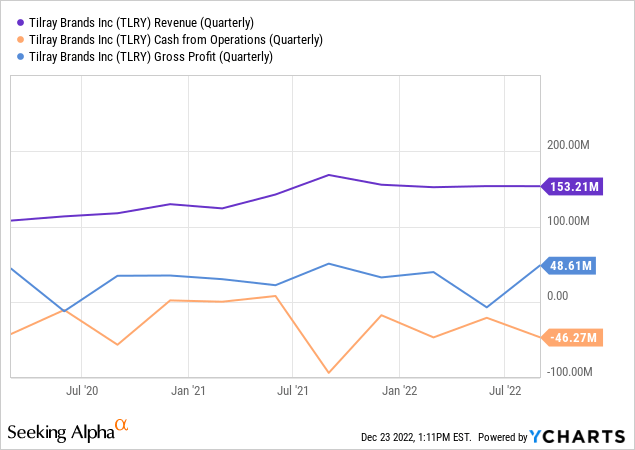

Tilray’s fiscal 2023 first quarter earnings saw revenue come in at $153.2 million, down 9% from $168 million in the year-ago comp. Management blamed the decline on brand and SKU rationalization as well as foreign currency rates.

Whilst the company recorded gross profit of $48.6 million, a 5% decrease from $51 million in the year-ago period, adjusted gross margins actually increased by 200 basis points to 32% from 30%. This was on the back of the success of their cost-cutting initiatives, most notably the cost synergies from their combination with Aphria. The company expects $100 million in annualized cash cost synergies from the Aphria business combination and realized 95% of this guidance at the end of its first quarter. Tilray expects to deliver the remaining 5% by the end of its fiscal 2023.

However, net losses continue to be sticky and came in at $65.8 million during the quarter, a 90% increase from a net loss of $34.6 million in the year-ago period. Tilray has quite a way to go to reach profitability with SG&A expenses coming in at $57.4 million, 37.5% of revenue, up from the SG&A being around 37.1% of revenue in the year-ago comp.

With the cannabis sector currently undergoing intense consolidation, Tilray as one of the largest companies in the space by market cap will find itself as a strong kingmaker. Against this, the early 2021 acquisition of Aphria has been somewhat transformational, allowing Tilray to leapfrog the previous ‘big three’ Canopy Growth (CGC), Aurora Cannabis (ACB), and Cronos Group (CRON).

The near future will likely see more acquisitions in the space, with 2022 alone bringing a long number of bankruptcies in Canada. It’s now clear that initial total addressable market estimates prior to the October 17, 2018 start date for recreational Canadian cannabis sales were too bullish. Canada’s centralized government-controlled distribution system, high taxes, and restrictions on marketing have so far created a legal market that has failed to fully replace the black market. This would see its peer Canopy Growth Corporation (CGC) quit cannabis retailing in Canada and try to reformat itself around the US market, which is still pending federal legalization.

With cash burn from operations at $46.3 million as of the end of its first quarter against cash and cash equivalents of $490.6 million, the company has more than a two-year runway and the liquidity required for more bolt-on acquisitions. Tilray is looking a lot more attractive than it did amidst the pandemic with its pivot to more stable CPG sales. I’m finally now neutral on the company’s near-term future.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.