Summary:

- I have not been optimistic on Tesla, Inc.’s price future for several years, with a normalized growth-valuation price target of $100.

- Elon Musk’s Twitter management chaos and related Tesla share selling (to fund its take-private purchase) have hurt both the Tesla brand and stock quote.

- All is not lost for Tesla investors. I suspect a decent share price uptrend may resume next year, after the severity of a developing recession in car/EV demand becomes clear.

- I am upgrading my Tesla Sell rating to Hold, with the possibility of a Buy rating under $100 per share coming into view.

Sjoerd van der Wal

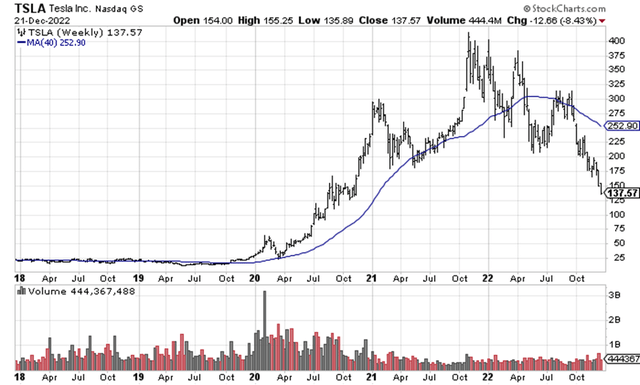

I have written about Tesla, Inc. (NASDAQ:TSLA) on several occasions over recent years, mostly to explain its bubble-like valuation. At its zenith, Tesla was valued at $1.3 trillion, a level of equity worth DOUBLE the entire global auto industry combined. These writing efforts have been cautionary in nature for retail investors wanting to earn a quick buck during the Federal Reserve’s crazy money printing experiment to combat the COVID-19 pandemic. Well, the saying is “easy come, easy go” for many endeavors in life, and the Big Tech stock mania of 2020-21 has proven out this truism once again, as a boom morphed into a bust.

StockCharts.com – Tesla, 5 Years of Weekly Price & Volume Changes

Since the beginning of 2022, the Fed has been draining liquidity and raising interest rates aggressively. For a name like Tesla, not only has the U.S. central bank taken away the punchbowl support for its out-of-this-world valuation, but the bank credit tightening effort is starting to directly affect demand for Tesla’s revolutionary electric vehicle (“EV”) products. While sharply higher Big Tech, cryptocurrency and real estate wealth funneled cash flow to high-end car buyers in 2021, the opposite is now reality.

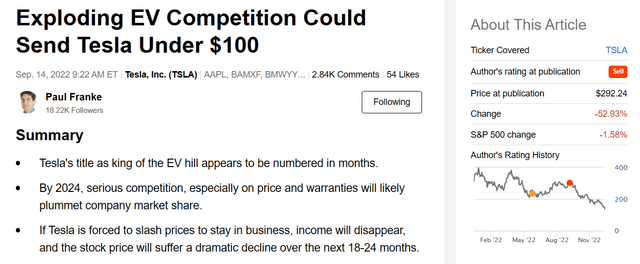

The extra post-pandemic wealth creation to support consumer confidence and buying excitement for expensive EVs has disappeared (or soon will). Now, I expect a trend of Tesla owners looking for cash to pay off debts will appear in 2023. So, not only is an amazing level of competition about to hit the EV market (taking away Tesla’s near monopoly position of 2020, the focus of my last article in September here), but “used” EV Tesla supply could theoretically explode in a prolonged Wall Street bear market and recession scenario over future months.

Seeking Alpha – Paul Franke, Tesla Article, September 14th, 2022

Then, came the Twitter fiasco, where for some odd reason Tesla CEO and founder Elon Musk believed he could singlehandedly bring back the Wild West for free speech on this popular social media application. What he has quickly discovered is we live in a world of repercussions and consequences (science and math). The early days of social media were fun and interesting, but we are not going back to uncensored, unmoderated, anything goes content broadcast to the masses (any believer in common sense and basic decency should understand this fact).

In fact, the large dive in Tesla price between September and December is being blamed directly on Elon Musk’s ill-conceived takeover effort of Twitter. First, he was forced to raise liquidity (sell Tesla shares, his main source of wealth) to make the purchase. Second, he has upset so many Twitter users with his heavy-handed policy changes, tens of thousands are calling for a boycott of Tesla product. So, not only is Musk finding it next to impossible to change the media platform in a positive fashion to generate stronger viewership and profitability, he is shooting Tesla shareholders in the foot with his actions. Remember: consequences, accountability, and reactions do exist in the real world.

So, Tesla is sitting at a point of a damaged brand with several major shareholders questioning if Musk is the best person for the CEO job going forward, with a recession approaching (based on the 40-year record inversion of Treasury yields) and EV competition exploding (which will undoubtedly hurts sales growth and profit margins). Yet, today’s $440 billion in equity market capitalization still stands at a number only slightly less than the value of all other automakers in the world. Is $137 a share reasonable, based on current fundamentals and future growth prospects?

Valuation Slide Ruler – I Am Becoming Less Bearish

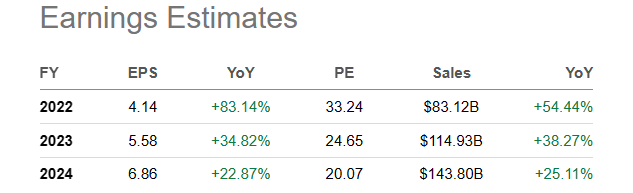

I came up with my $100 share valuation price target months ago, looking at actual business results and Wall Street projections for EPS and sales growth. Since then, the recession theme has picked up steam for industrywide forecasts during 2023. Now, most every major automaker is projected to see a significant drop in operating income. Consequently, Tesla’s forecasted growth really stands out as a positive data point. Below is a table of the current analyst consensus for EPS and sales gains between 2022 and 2024.

Seeking Alpha Table – Tesla, Analyst Estimates for 20022-24, December 21st, 2022

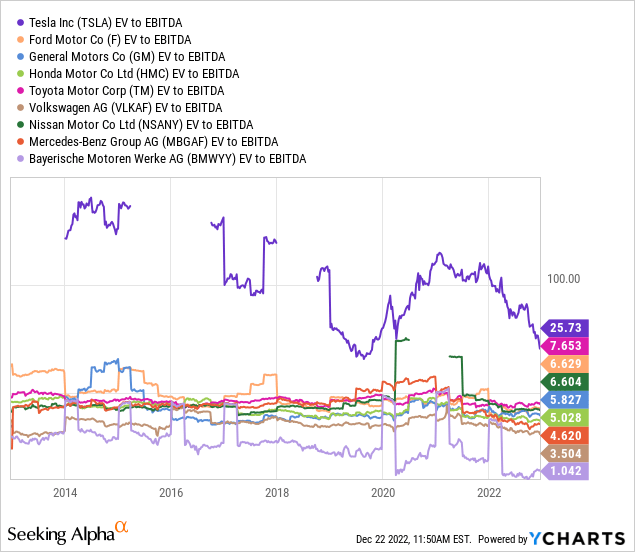

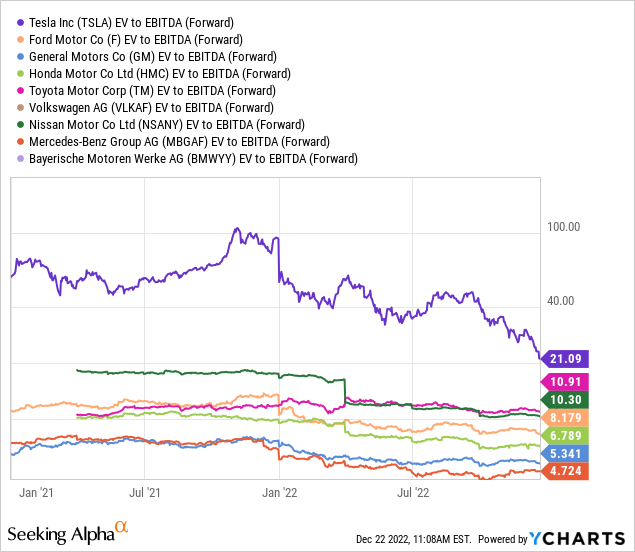

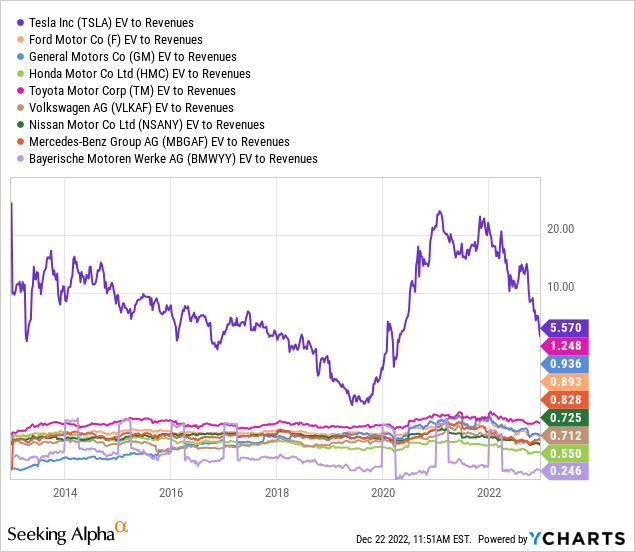

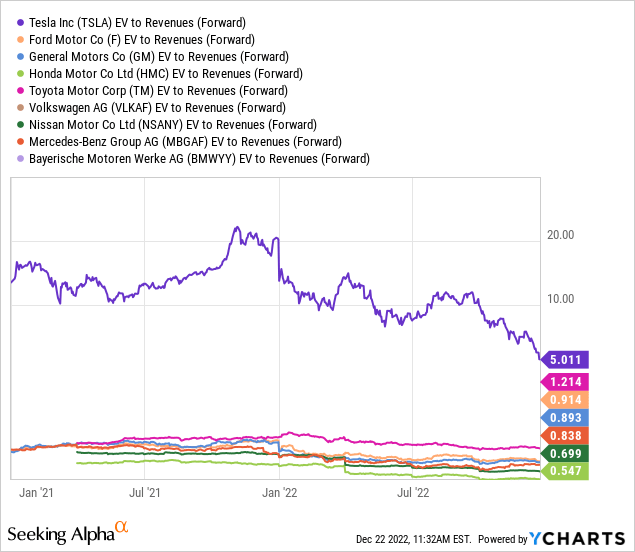

Plus, the clear overvaluation of Tesla shares has been shrinking rapidly in 2022 with its implosion in price. You can see how enterprise value (debt + stock value – cash holdings) stats are coming back to the peer and competitor pack below, on EBITDA and earnings, both trailing and forward looking. The comparison group includes major automakers Ford (F), General Motors (GM), Honda (HMC), Toyota (TM), Volkswagen AG (OTCPK:VLKAF), Nissan (OTCPK:NSANY), Mercedes-Benz AG (OTCPK:MBGAF), and BMW AG (OTCPK:BMWYY).

YCharts – Major Global Auto Manufacturers, EV to Trailing EBITDA, 10 Years YCharts – Major Global Auto Manufacturers, EV to Forward EBITDA Projections, Since 2021 YCharts – Major Global Auto Manufacturers, EV to Trailing Sales, 10 Years YCharts – Major Global Auto Manufacturers, EV to Forward Sales Projections, Since 2021

The good news to report: Tesla is getting closer to buy territory, assuming the Twitter mess and approaching recession in 2023 prove more temporary in nature, and less destructive than now feared by Wall Street. Valuations overall are the best (lowest) since 2019 for new share purchases.

The Investment Decision

The binary investment question you have to answer for yourself may revolve around whether Mr. Musk can refocus on the car company, or has that day passed. If the golden age of Tesla’s EV leadership in the world is closing, more downside to an estimated $80 per share is coming in the first half of 2023.

On the other hand, a refocused Elon that coexists with a mild recession next year could mean a buy argument can be made around $100 per share. The growth-at-a-reasonable-price (GARP) and price to earnings/income growth (PEG) crowd may find the stock an interesting, newly “contrarian” pick in future months. If EPS estimates are hit in 2023-24, producing a forward P/E closer to 25x, that’s not much of a premium over the S&P 500 price to earnings ratio of 20x to 25x in a recession scenario.

My view is today’s $137 price is no longer a screaming sell proposition. Optimistic modeling for the global economy in 2023, experiencing only a mild recession, where inflation and interest rates start to decline, and central banks entertain new rounds of money printing, could mean a Tesla rebound in price into the $150 to $175 range will eventually play out 12 months down the road. If this is the case, selling now may be turn into a long-term decision you regret. Therefore, I am upgrading my overall rating of Tesla to Hold/Neutral.

Would I commit new funds yet? The answer is still NO. Uncertainty about the severity of the recession now beginning in America, still tight Federal Reserve monetary policy, and the resolution of Mr. Musk’s Twitter mess are real-world worries that may drag down price for a few more months. I currently peg Buy territory for Tesla under $100 per share. If we breach the important psychological century mark ($100 used to be the traditional “par” price companies issued public shares in the early days of Wall Street capitalism), investor sentiment may become washed out enough to begin buying again. Plus, valuations on future growth would become even cheaper, tilting the odds of a long-term investment gain (3-5 years) in your favor.

The “easy” Tesla money has already been made. Now investors have to contend with economic cycles and competition. I do not expect fantastical gains from the stock anytime soon. Such statistically may never happen again. I would treat Tesla like any other automaker from today in your investment process. Stick to the growth-based math, follow debt issuance trends, and keep an eye on how competing EV entries gain in popularity.

I personally do not place much value on all the other technology businesses invented and managed by Tesla, as the vast majority of sales come from EVs (83% of Q3 September 2022 revenue). At this stage, if one of them morphs into a high-growth profit center (solar panels, brain chips, rockets, battery storage, etc.), it would be a bonus catalyst for Tesla shareholders.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.