Summary:

- Inflation concerns are rising in the United States, particularly in healthcare.

- Abbott Laboratories is a healthcare company with pricing power and a strong dividend growth track record.

- Despite recent challenges, ABT’s core business remains robust, with impressive performance in segments like Nutrition and Medical Devices.

PM Images

Introduction

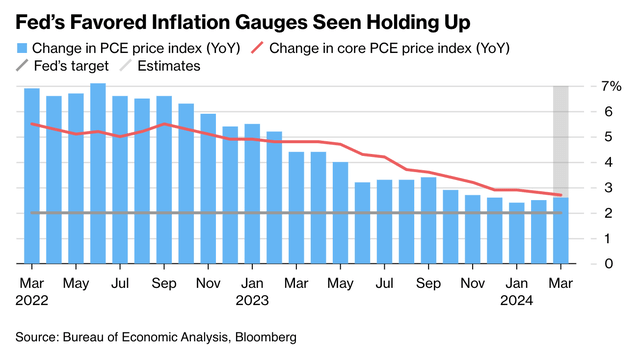

Inflation has become an issue again. In the United States, all-item inflation has come in higher than expected for four consecutive months, with new upside momentum reported in March.

Expectations are the Fed’s favorite indicator – the PCE price index – will show its third-consecutive increase in March as well.

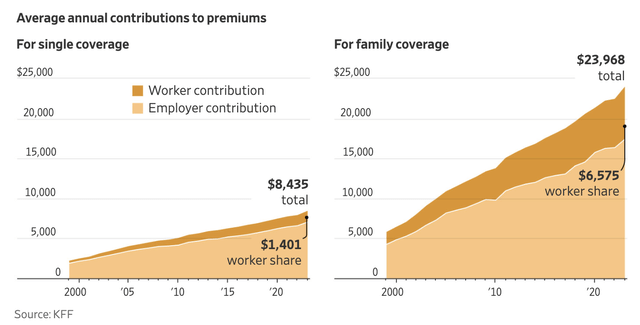

Zooming a bit out, one of the biggest issues for investors and consumers is healthcare inflation. My own healthcare insurance premiums, for example, went up by double-digits this year.

The biggest issue for insurers and the entire healthcare industry is rising costs. As reported by The Wall Street Journal last year, “A family’s health insurance costs nearly $24,000 this year after the biggest increase in more than a decade.“

The reason I’m bringing this up is because I’m a big fan of healthcare companies with pricing power.

Not only can these companies help us to protect our wealth against what could be a prolonged period of elevated healthcare inflation due to general inflation issues and secular drivers like an aging population, but also to reach our retirement goals.

That’s where Abbott Laboratories (NYSE:ABT) comes in.

On April 20, I wrote an article titled “20 Years to $300K? Building A $10,000 Dividend Portfolio From Scratch.”

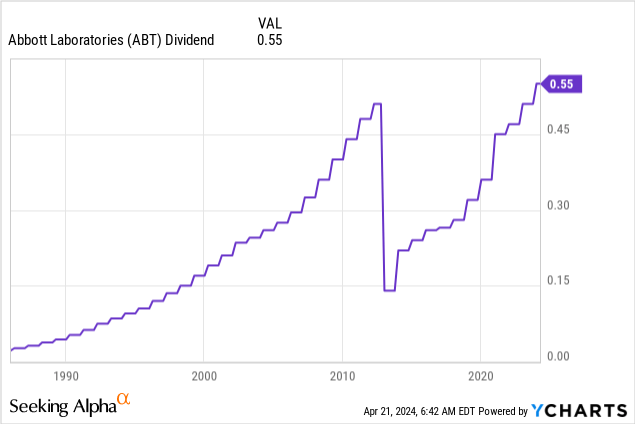

Abbott was one of the holdings I presented in that article, as it has a strong healthcare business portfolio, a 2.1% dividend yield, a 12.1% 5-year dividend CAGR, a sub-50% payout ratio, and more than 50 consecutive annual dividend hikes, making it one of the few Dividend Kings on the market.

Note that the big decline in the dividend chart below is caused by the AbbVie (ABBV) spin-off. ABT did not cut its dividend. Since the spin-off, ABBV has hiked its dividend every single year as well.

My most recent article on this stock was written on January 29, when I went with the title “The King Is Back: Abbott Laboratories’ Path To >11% Annual Returns.”

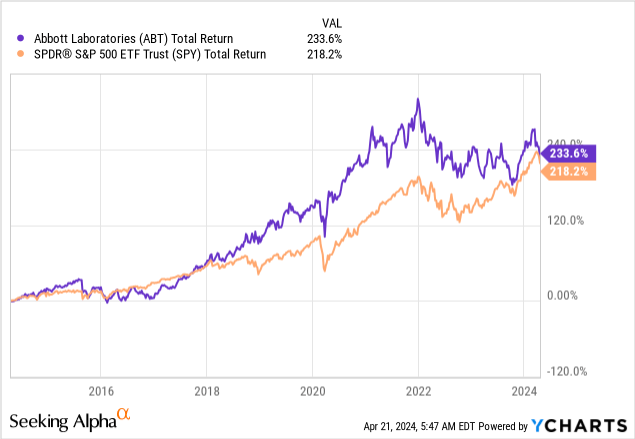

Since then, ABT is down 5%, including dividends, lagging the S&P 500 by roughly 580 basis points.

The good news is that over the past ten years, ABT was still the better investment compared to the S&P 500.

In this article, I’ll re-assess the risk/reward and explain why ABT remains one of my all-time favorite dividend growth stocks that provides both safety and income growth.

Even better, as the company just released its 1Q24 earnings, we have a lot of new data to work with.

So, let’s get to it!

Post-COVID, Abbott Remains Rock-Solid

Abbott is one of the healthcare companies that benefitted tremendously from the pandemic. After all, testing (among other products) demand exploded when the world was trying to figure out how to deal with the new virus.

After the pandemic, demand for these products rapidly declined, which resulted in a somewhat tricky situation where a lot of strong healthcare companies suddenly reported horrible growth rates, and investors were dealing with tricky valuation assessments.

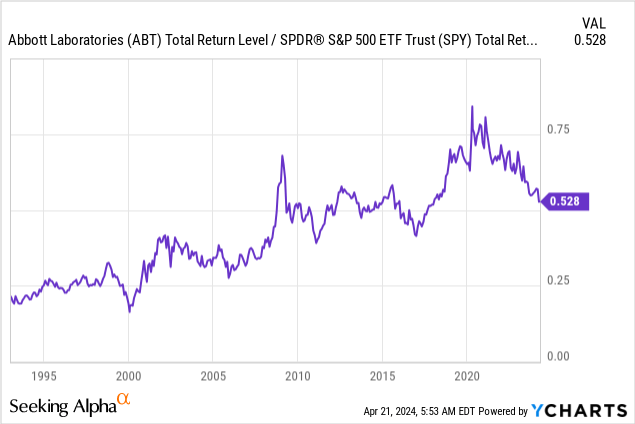

The chart below compares the ratio between ABT’s total return and the total return of the S&P 500. While ABT has consistently outperformed the market, it has been an underperformer since the moment the world noticed that COVID-19 was, in fact, not the end of the world.

While this may be bad news for investors who hoped to make a quick buck with Abbott, I believe this brings new opportunities, as the Abbott core business remains in fantastic shape.

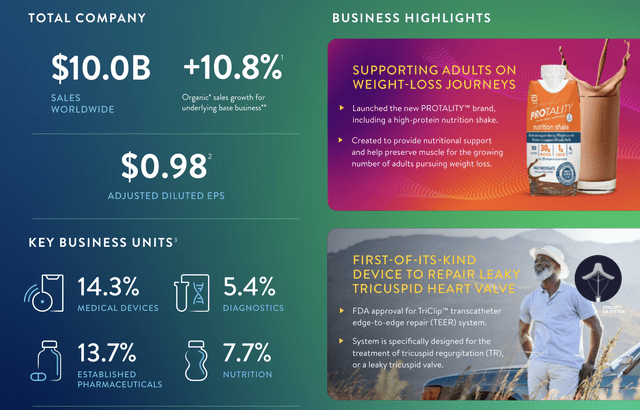

In the just-released 1Q24 quarter, the company reported adjusted earnings per share of $0.98, which exceeded analyst consensus estimates by two pennies. Organic sales of its non-COVID business rose by 10.8%.

Even better, as we’ll discuss later in this article, the strong performance resulted in an upward revision of the midpoint for both earnings per share and sales growth guidance ranges.

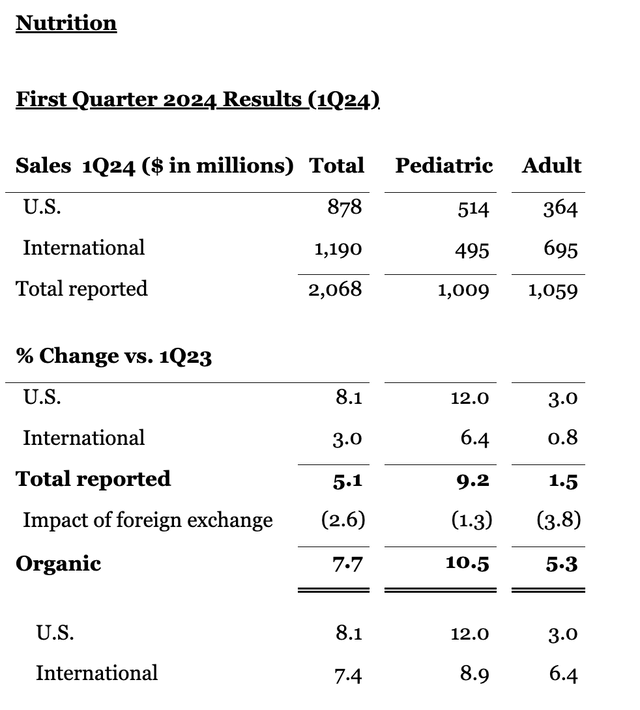

Digging a bit deeper, we find that in the Nutrition segment, sales increased by 8% on an organic basis.

This growth was primarily driven by strong performance in Pediatric Nutrition, which was fueled by ongoing market share gains in the U.S. infant formula business as well as the company’s expansion of the international portfolio of infant formula, toddler, and adult nutrition brands.

Moreover, the launch of Protality, which is a new nutrition shake designed to support adults in weight loss while preserving lean muscle mass, added significantly to growth.

Interestingly enough, this product comes at a great time when weight-loss medications like GLP-1 have turned into growth engines.

Even better than the 8% growth in Nutrition is the 14% organic growth rate in the Established Pharmaceuticals Division (“EPD”).

According to Abbott, this division not only achieved impressive gains in top-line growth but also showed significant improvement in operating margin, with over 350 basis points of improvement compared to 2019.

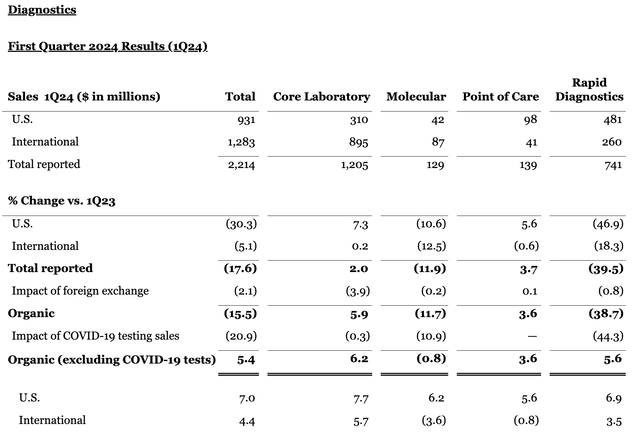

The Diagnostics segment saw 5% sales growth, which excluded COVID-19 testing. Including the 20.9% decline in COVID-related sales, organic growth would have been down 15.5%.

COVID-adjusted organic growth was supported by the adoption of the company’s “market-leading” systems and increased demand for testing from a wide range of customers, including hospitals, laboratories, urgent care centers, physician offices, retail pharmacies, and blood screening facilities.

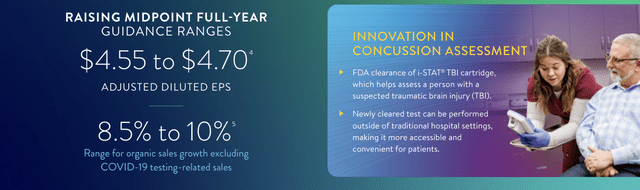

Furthermore, according to the company, a point-of-care diagnostic test for mild traumatic brain injury or concussion received FDA approval during the quarter.

This could potentially transform concussion testing standards.

The whole blood test on a portable instrument helps clinicians evaluate patients 18 years of age and older who present with suspected mild traumatic brain injury or mTBI, commonly known as concussion. Test results can help rule out the need for a CT scan of the head and assist in determining the best next steps for patient care. – Via PR Newswire

Last but not least, the Medical Devices segment saw a massive 14% increase in organic sales during the first quarter.

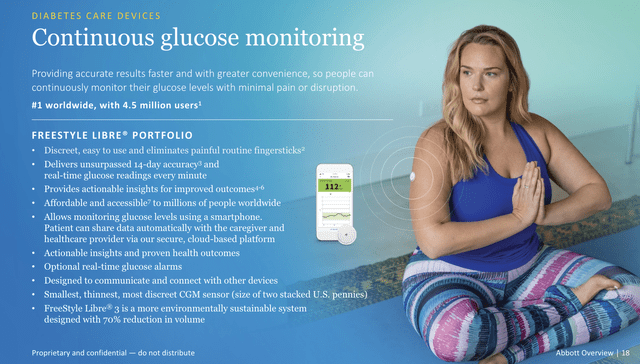

Within Diabetes Care, FreeStyle Libre sales rose to $1.5 billion. That’s a 23% growth rate in one of my favorite healthcare niches. In fact, the company’s glucose monitor has become the best-selling product in its market.

In general, besides concussion testing and glucose breakthroughs, the company also launched products like TriClip for heart valve repair and the Aveir leadless pacemaker.

In Rhythm Management, growth of 7.5% was led by Aveir, our recently launched leadless pacemaker. Aveir has rapidly captured market share in the single-chamber pacing segment of the market and is now being used for dual-chamber pacing, which is the largest segment of the pacing market. This revolutionary technology is helping to deliver growth rates in our Rhythm Management business that significantly exceed the overall growth in this market. – ABT 1Q24 Earnings Call

A Rosy Outlook & Good News For Shareholders

As I already briefly mentioned, strong core sales and earnings led to a guidance hike.

It now expects adjusted earnings per share to be in the range of $4.55 to $4.70.

Furthermore, organic sales growth, excluding COVID-19 testing-related sales, is projected to be between 8.5% to 10%.

The “problem” with this EPS guidance was that analysts were disappointed that the company did not raise the ceiling of the guidance range.

The ceiling definitely remains the same, and that’s the whole point. The stock is going to go up if you beat expectations,” said RBC Capital Markets analyst Shagun Singh.

If you’re maintaining expectations, it’s already priced into the stock… So that’s what’s playing right now,” she said, adding that she remains positive on Abbott. – Via Reuters

So, what does all of this mean for investors?

I get that Abbott is in a somewhat tough spot, as it’s hard to put a value on a stock with severe COVID-19 headwinds.

However, I really like the company’s long-term growth potential and its focus on shareholders through consistent dividend growth.

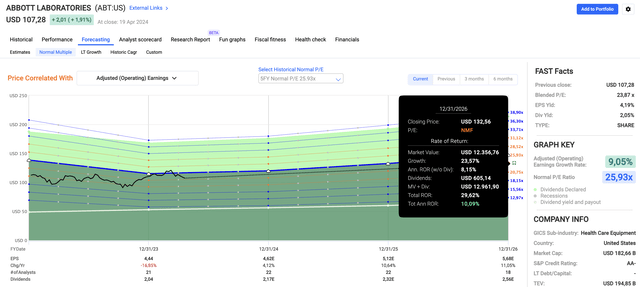

Currently, ABT trades at a blended P/E ratio of 23.9x, which is above its 20-year average of 19.8x.

That said, as I wrote in my last article, I believe the five-year normalized P/E ratio of 25.9x is a fairer metric, as the company is in a situation where temporary post-pandemic headwinds cloud the picture.

The good news is that despite these headwinds, analysts expect 4% EPS growth this year, potentially followed by 11% growth in both 2024 and 2025.

If we apply a 23.3x multiple (below the five-year average), we get a potential total return of 10%, including the company’s 2.1% dividend. A number higher than that is not unlikely, in my opinion.

While ABT may be in rough waters, I believe it is a fantastic dividend growth stock with a high likelihood of long-term outperformance.

Hence, I’m currently figuring out how to fit ABT into my portfolio, as I’m looking to add a few companies to my 20-stock portfolio.

Takeaway

Investing in Abbott Laboratories presents an opportunity for long-term growth and stability in light of inflation concerns.

Despite recent challenges, ABT’s core business remains robust, with impressive performance across its segments, including Nutrition and Medical Devices.

Meanwhile, the company’s focus on innovation, supported by products like Protality and FreeStyle Libre, positions it for continued success.

While short-term headwinds may affect its valuation, ABT’s consistent dividend growth and potential for future earnings growth make it an attractive investment.

With analysts forecasting positive EPS growth and a potential total return of 10%, ABT remains a compelling choice for investors seeking both income and growth in uncertain times.

Pros & Cons

Pros:

- Stability Amidst Inflation: ABT offers stability during inflationary periods, with a diverse portfolio that includes essential healthcare products and pricing power.

- Strong Core Business: Despite recent challenges, ABT’s core business remains strong, proven by its impressive performance in segments like Nutrition and Medical Devices.

- Innovation: The company’s commitment to innovation, with products like Protality and FreeStyle Libre, positions it for long-term growth and market leadership.

- Consistent Dividend Growth: ABT’s track record of consistent dividend growth makes it an attractive option for income-focused investors.

Cons:

- Valuation Challenges: Short-term valuation may be affected by post-pandemic headwinds, potentially impacting short-term returns.

- Uncertainty: Related to the point above, the ongoing impact of COVID-19 on healthcare demand creates some uncertainty regarding future earnings and growth prospects.

- Competition: While ABT has proven to remain strong in light of competition, it operates in attractive markets with eager peers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.