Summary:

- Amazon receives a lot of criticism for its valuation, but how should we look at the valuation in the right context?

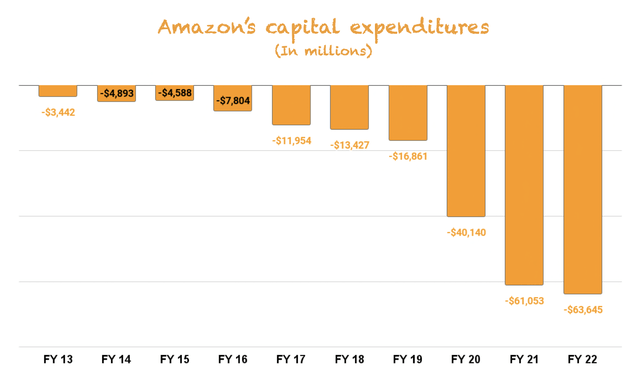

- The company started a massive capex cycle during the pandemic, which seems to start normalizing.

- An analysis of Amazon’s balance sheet follows.

hapabapa

Introduction

Amazon (NASDAQ:AMZN) is a gigantic company, and its financials and valuation are where investors (bulls and bears) tend to differ in their theses. We believe that the criticism towards Amazon as an investment has primarily fallen in one of the following two points:

-

The company does not generate enough free cash flow to justify its valuation

-

The stock’s PE ratio is too high

In our opinion, these points are understandable but miss the big picture, which is that Amazon has made a conscious choice to generate less cash flow today to invest in growth.

For point #2, we have always believed that looking at a valuation ratio, in this case the PE ratio, without context is often misleading. Hopefully, by the end of this article, you’ll understand what we mean.

The financials

We’ll review the company’s three most important financial statements: the income statement, the cash flow statement, and the balance sheet.

Amazon’s income statement – Highlights and lowlights

The company’s income statement is a mix of good and bad news. The good news can be found in the top line, and the “bad news” can be found in the bottom line. Let’s start with the former.

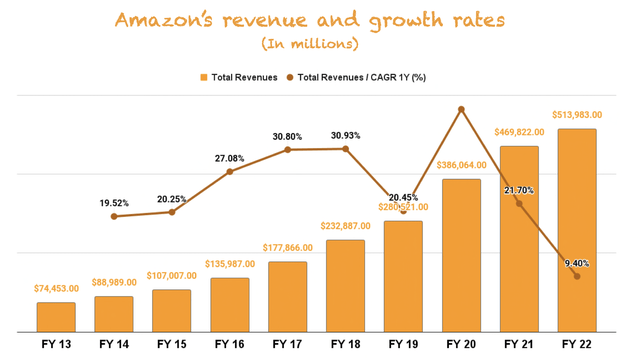

Despite being a massive and fast-growing company in 2019, Amazon accelerated its revenue growth in 2020, the pandemic year. 2020 was a year when many physical retail companies had a challenging year due to store closures and lockdowns. However, Amazon was on “the other side” of physical retail (i.e., e-commerce) and thus benefited from it:

Zooming out helps us see how Amazon has grown and how much it has benefited from the pandemic. The company entered the pandemic with around $280 billion in annual revenue and reported almost $514 billion in revenue in 2022. That’s an 84% increase in just three years. This is impressive for any company, but more so for one coming from more than $200 billion in revenue.

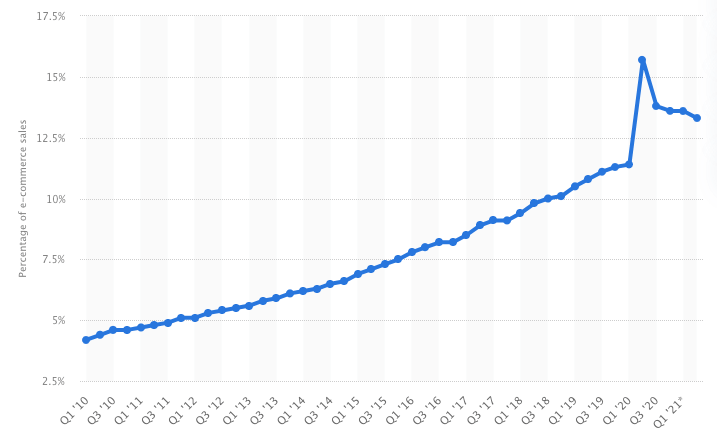

As impressive as this may be, top-line growth is now cooling down. There are several reasons for this. For starters, Amazon saw a pull forward during the pandemic as consumers had to resort to e-Commerce to purchase items. However, this changed with the COVID vaccine rollout, and the e-commerce trend is now returning to “normal”:

Smart Insights

This return to normal stems from consumers returning to physical retail and spending more on services such as travel (which they couldn’t do during the pandemic). For obvious reasons, Amazon is not as exposed to services spending as it is to product spending.

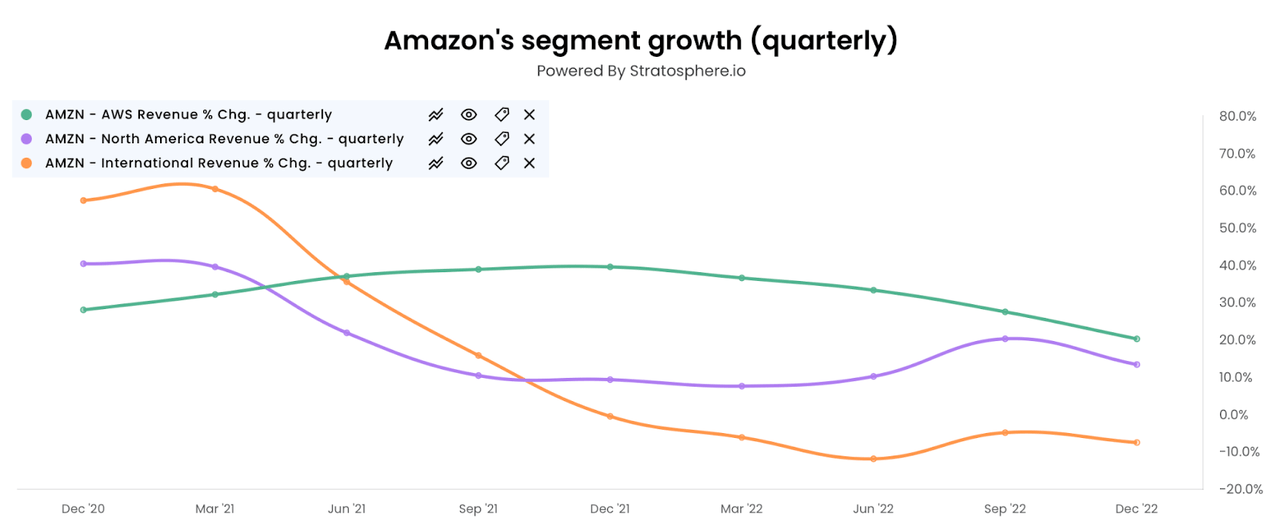

Another reason for the cool-down might be the macro backdrop. Consumers have become more cautious with their spending and are spending less on average on discretionary items. This has happened at both the e-commerce level as for AWS (Amazon Web Services), where Amazon is helping its customers rationalize their spending due to the uncertain economic environment:

Stratosphere (international revenue growth impacted by currency too)

The AWS deceleration might be somewhat self-chosen, but Amazon is trying to play the long game here. There are switching costs in cloud solutions, and management wants to secure customers rather than “milk them” early in their transition. This makes sense, considering how early we still are in the shift to the Cloud. Another headwind was foreign exchange, which shaved off 4% of growth in 2022.

So, as you can see, there’s nothing too worrying from a top-line perspective. Yes, revenue is decelerating now, but some of the headwinds are temporary in nature. The real “problem” regarding Amazon’s income statement resided in:

-

How this growth was achieved through expansion

-

Inflation

Let’s look at the first of these points.

Expansion

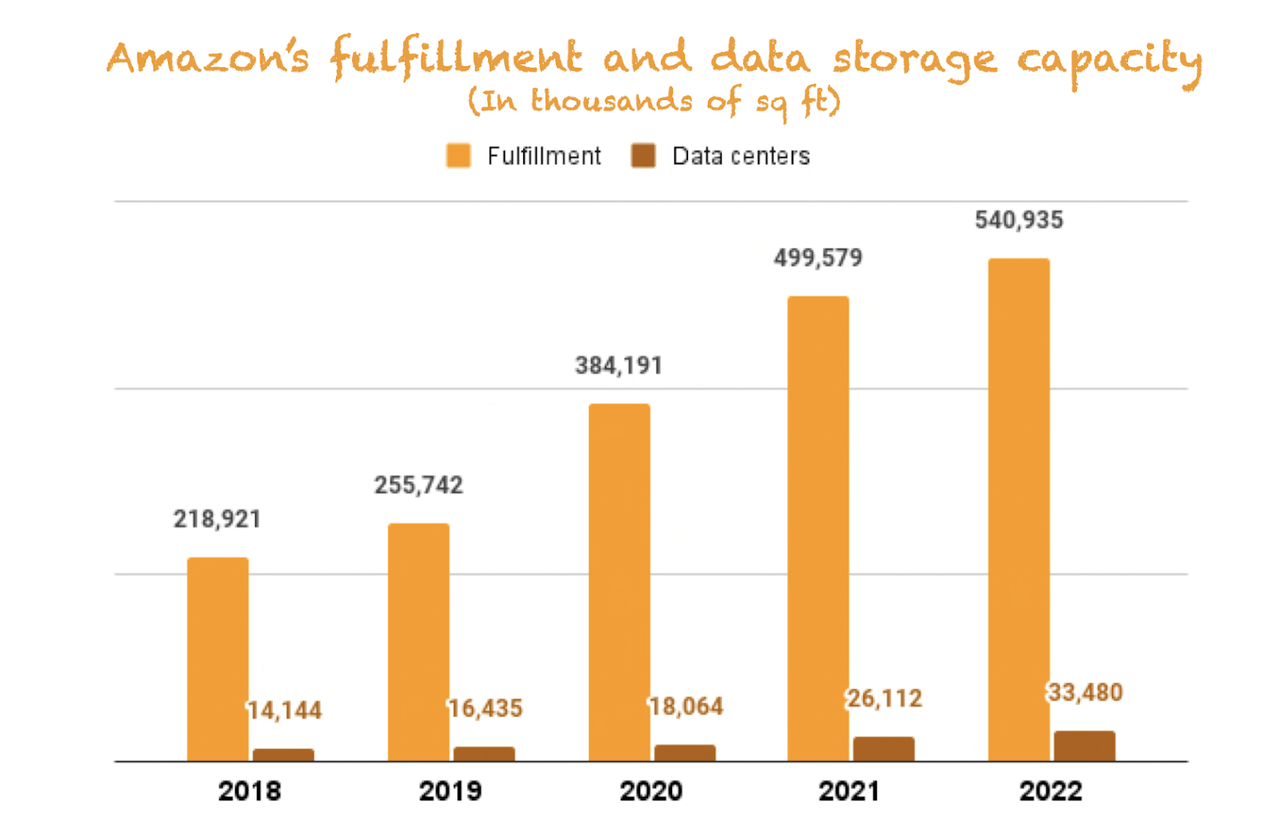

Amazon aggressively expanded its supply to meet the higher-than-usual expected growth of the pandemic period. The company has almost doubled its retail and data center capacity in just three years!

Made by Best Anchor Stocks

These massive investments in supply were probably made under the belief that:

-

People would continue to shop online at an accelerated pace after they discovered the convenience of e-commerce during the pandemic

-

Companies would continue to shift their workloads to the cloud to accelerate digitization

The first of these beliefs turned out to be false, and we’ve already shared a chart that shows how e-commerce is back at its trendline. E-commerce as a percentage of total retail sales is still growing, but not at an accelerated pace. The second trend remains intact, but as we’ve also discussed, macro uncertainty is slowing down the inevitable shift considerably.

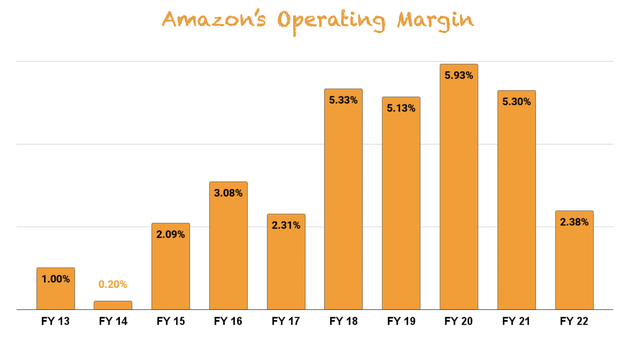

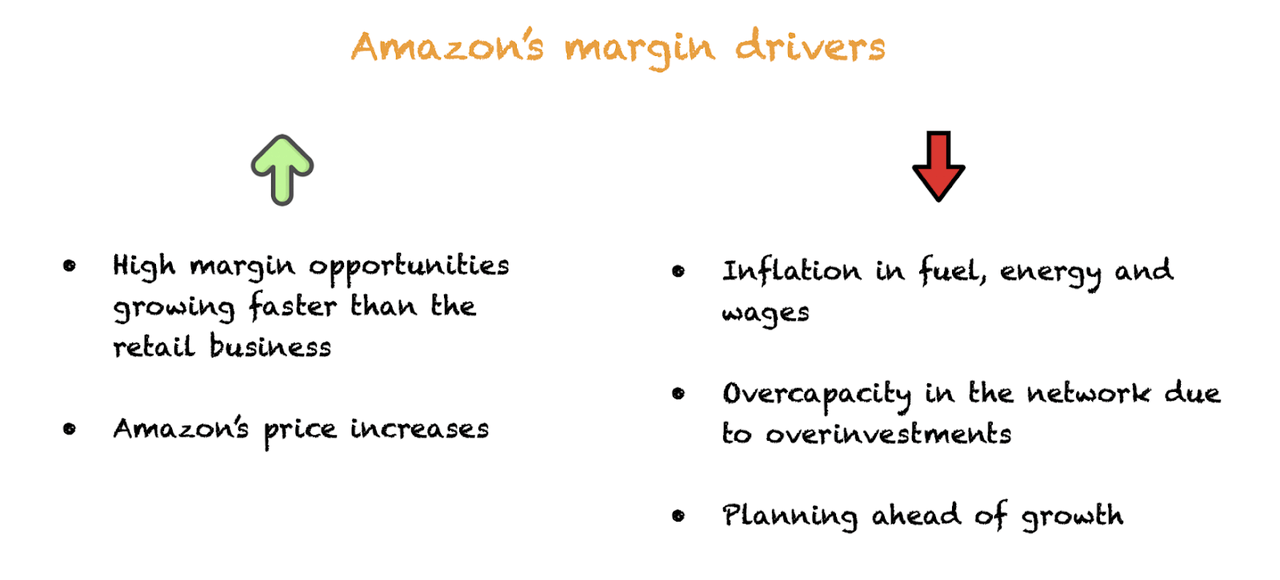

So, what happens when you aggressively invest in capacity to capture plenty of growth but this growth doesn’t come? Margins are under pressure. During the pandemic, Amazon was operating at full capacity, so margins reached a “peak” sometime in 2020. Operating at full capacity is not normal for Amazon, as management typically invests in building capacity in advance of growth:

The impact on margin lagged the investments because capacity typically takes time to come online, whereas demand came online almost immediately. However, this capacity eventually came online at the same time when sales slowed, depressing Amazon’s margins.

Note that investments in capacity happen through the cash flow statement (in the form of capex), but their impact is eventually felt in the income statement through depreciation and amortization (D&A) and higher warehousing and data center costs.

So, what happens now? Management is well aware that they overinvested during the pandemic and have announced a “rationalization” plan to cut supply until it’s at a level that better matches the current demand.

Of course, in the same way it takes time to build supply, it will take time to not only downsize the company’s network but also to make it efficient across its additional nodes:

And then I think at the same time, if you think about doubling the number of fulfillment centers you have and then adding a very large transportation network and you realize that all of those facilities have to link together to get products to customers, that’s a pretty big expansion in the number of nodes in the network. It becomes a little bit different network. And so to figure out how to be really efficient across all those links and have them be highly utilized and to get the flows in those facilities working the right way, it takes time.

Source: Andy Jassy, Amazon’s CEO, during the Q4 earnings call

The positive impact of this downsizing is already showing up in the margins, but there’s a long way to go.

Inflation

The other reason for the margin contraction was inflation, especially in fuel, energy, and wages. Fuel and energy prices and wages skyrocketed after the pandemic. Amazon is fuel, energy (in AWS), and people-intensive, so rising prices in these items put upward pressure on costs and, thus, downward pressure on margins.

Margins

To counter the impact of inflationary pressures, Amazon increased 3P seller fees and its Amazon Prime subscription prices. While inflation will likely be temporary, these price increases are most likely permanent, especially those for Prime subscriptions. Inflation puts a dent in every company’s income statement, but companies with pricing power tend to come out of these situations with stronger margins. The rationale is that inflation is Amazon’s excuse to exert its pricing power, which the company is unlikely to pull back in the future.

This said, we are a bit worried that Amazon might be squeezing sellers too much after the price hikes. A 3P seller, on average, is paying around 40%-50% to sell on Amazon (including Ads). Despite these sellers caring more about volume than profit margins, what this eventually means is that sellers with lower than 40% gross margins are now unprofitable on Amazon’s marketplace. These sellers are looking elsewhere, and thus, Amazon might lose market share in lower-margin products, a lot of which are bought every day by Prime members.

Margin pressure was also slightly offset by the underlying growth across the different segments. High-margin opportunities, such as Ads, AWS, and subscriptions, are growing faster than the retail segment, so the underlying margins of the business, ignoring the above temporary pressures, might be improving significantly. AWS is a +20% income margin business, and, although we don’t know the margins of Ads and subscriptions, they are likely high.

We prepared a visualization so you can understand how the different aspects of the business are impacting margins and why we believe they are artificially depressed today. The bottom line is that Amazon is under significant margin pressure, some of which is already normalizing:

Made by Best Anchor Stocks

The High PE Ratio

We could argue these pressures are “hiding” Amazon’s true margin potential, which is why we believe Amazon’s PE ratio is quite misleading. This high PE ratio has been Amazon’s “crux” for many years now, but it’s probably a result of the market acknowledging that margins are not where they will be in the future.

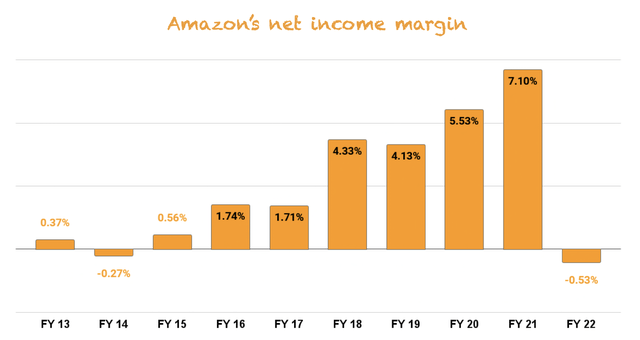

We used operating margin all throughout this section because the net income margin is very misleading due to Amazon’s investment in Rivian (RIVN). When Rivian’s stock did well in 2021, the GAAP net income shot up significantly, and it went the other way when Rivian shares did not do as well in 2022:

These are paper losses, not real losses. That had an impact of $12.7 billion in 2022, which obviously makes the PE ratio even more misleading. If we were to assume a normalized net income margin of around 5%, which is very conservative in our opinion, Amazon would’ve posted a net income of $26 billion in 2022, meaning it would trade at around 37x earnings. This is a premium price but not as high as many investors think it is considering the company’s untapped margin and growth opportunities.

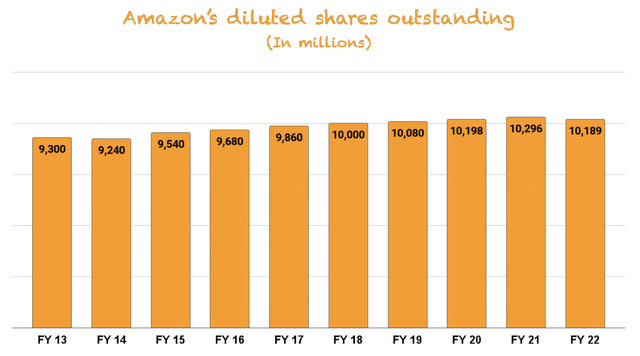

This volatility in net income also impacts Earnings per Share (which have been volatile too), but we wanted to briefly touch on shares outstanding. With all the fuss around stock-based compensation and shareholder dilution, we wanted to show this chart. Yes, Amazon does indeed issue shares for its employees, and this creates dilution every year:

The company has made some repurchases lately, but it’s not the norm. Overall, we see just 9.5% overall dilution over 10 fiscal years, which is not high. But over the last 5 years, there’s just 1% dilution, so stock-based compensation is not a worry for Amazon shareholders.

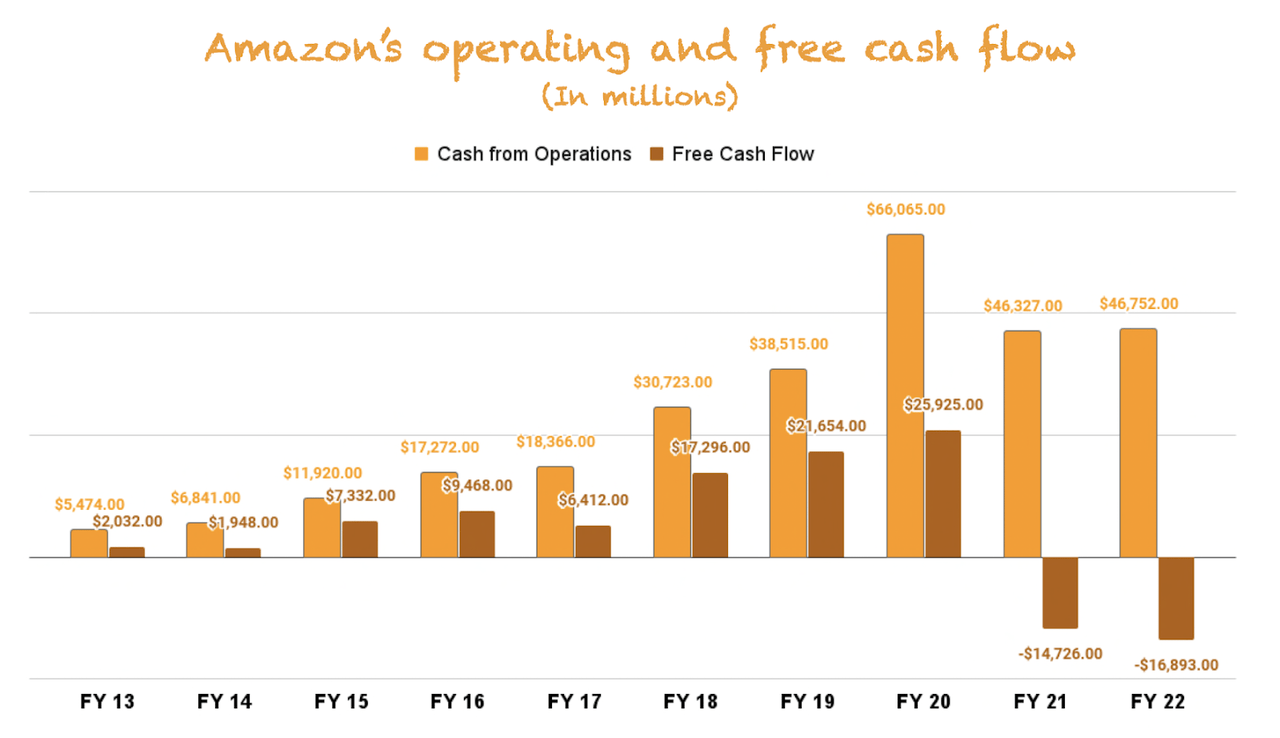

The cash flow statement – heavily impacted by investments

All the aggressive investments in capacity discussed above show up in the Cash Flow Statement through capex. Amazon is known for undergoing significant capex cycles throughout which Free Cash Flow remains depressed, but the one we saw during the pandemic is unprecedented:

Amazon’s operating cash flow remained pretty resilient post-pandemic despite the drop in margins, but capex weighed quite a bit on Free Cash Flow:

Made by Best Anchor Stocks

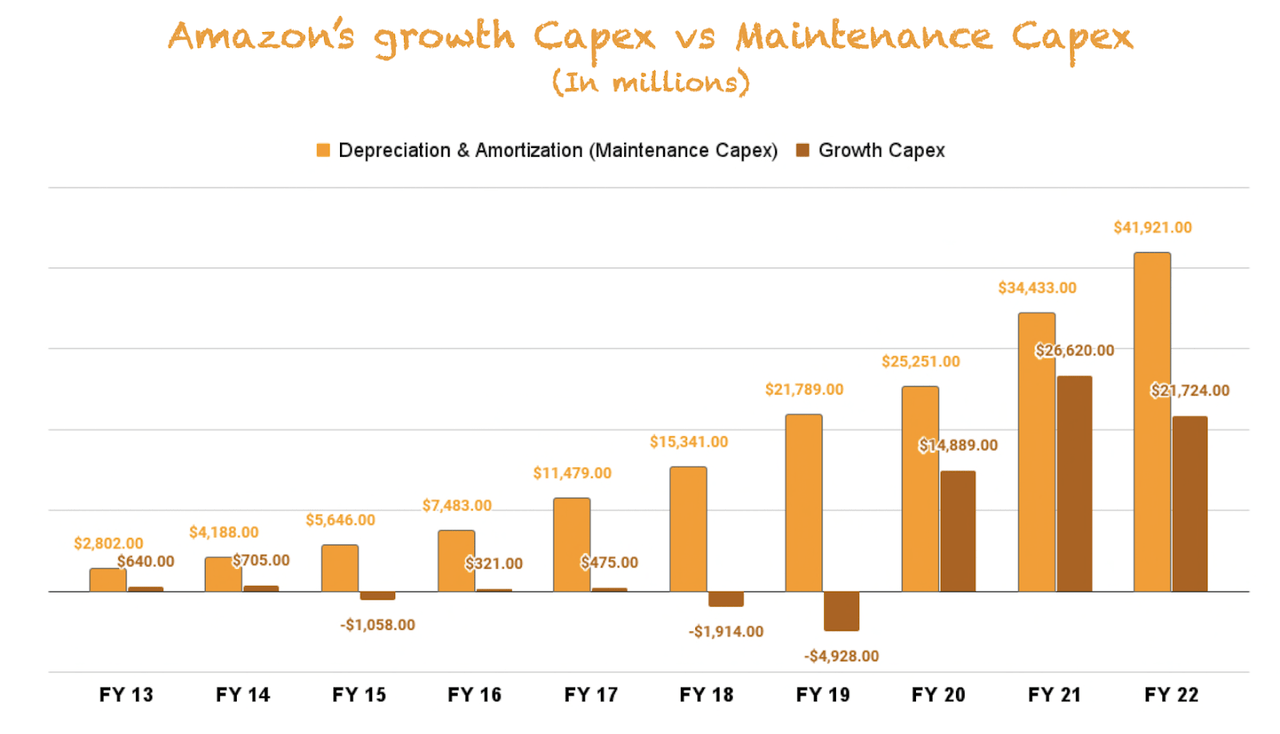

A drop in Free Cash Flow is bad news when it comes from investments that are necessary to maintain the business. This would mean that the business is not cash-generative, something which we don’t believe to be true for Amazon, which invests for growth. Using depreciation and amortization as a proxy for maintenance capex we can see that Amazon is indeed investing for growth, and quite aggressively:

Made by Best Anchor Stocks

The good news for Amazon’s shareholders is that the unwinding of overcapacity that we have previously discussed is already showing up in the capex figures. Q4 2022 capex was down significantly on a year-over-year basis.

We believe margins will remain depressed longer than Free Cash Flow because the company has to work on making the network efficient, whereas decreasing capex is just a matter of halting additional investments, which we are already seeing. This said, Amazon continuously invests for the future, so in the same way that we are unlikely to see the company’s full margin potential in the income statement, it’s unlikely we will see its full cash generation capacity anytime soon. And don’t get me wrong, we think that if we were to see the company’s full margin potential today, it would be bad news because it would mean that the reinvestment runway is over.

Management has received a lot of criticism due to their “lack of foresight” which led them to overinvest in the business during the pandemic. We have a slightly different take because we believe that the risk of underinvesting was much higher (losing market share) than the risk of overinvesting (maintaining or gaining market share at the expense of margins for a couple of years). This, of course, assumes that management had a lack of foresight, just like every one of us who didn’t know what would happen or how long COVID would last. It always seems obvious in hindsight…

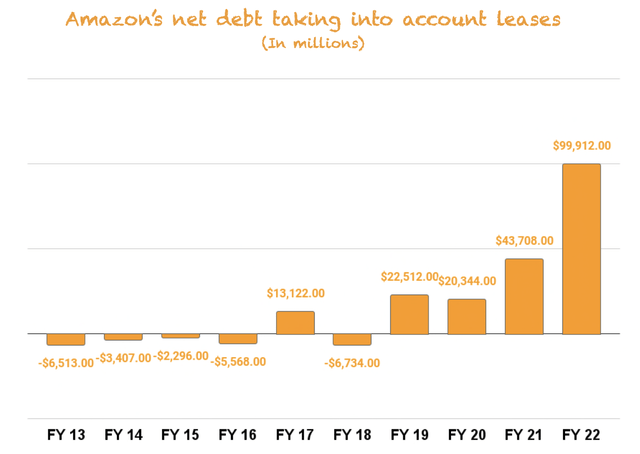

The balance sheet – More debt than ever but not worrying

Amazon is currently in a net debt position, especially if we also consider leases as debt, which we should:

Now, as much as this might look worrying, we think there are few reasons to be worried. First, as we demonstrated above, Amazon is a cash-generative business and the fact that Free Cash Flow remains depressed today is a conscious decision made by management to invest in growth rather than a “requirement” from the business to run its operations as normal.

As we also discussed above, maintenance capex is much lower than today’s capex figure, giving the company headroom to manage its debt by investing less aggressively. This, of course, would not be great news either because it would mean that Amazon has to cut investments due to its debt pile.

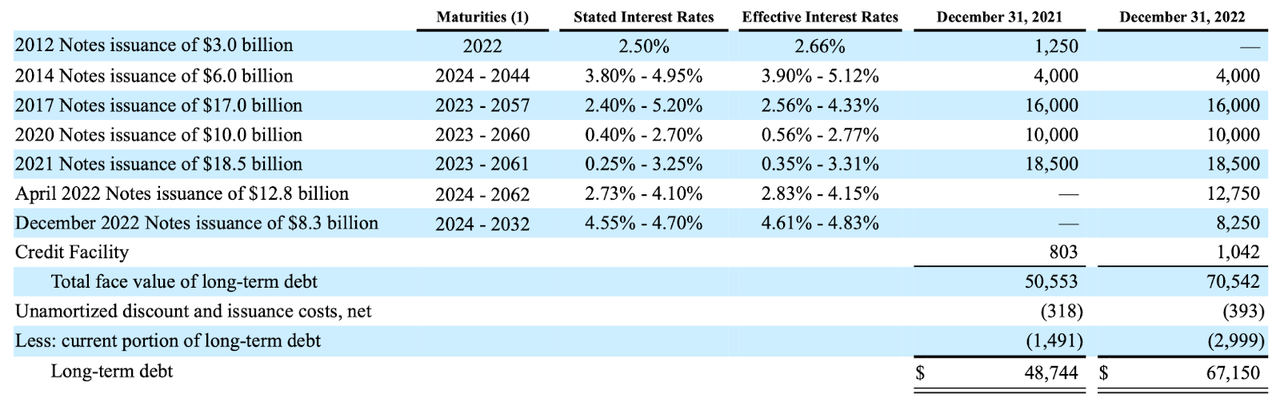

Regarding Amazon’s debt, we should look at two things. First, Amazon took advantage of the low-interest rate environment coming out of the pandemic and secured long-term debt at very attractive rates:

Amazon 10K

These “low” interest rates allow Amazon to pay little in interest every year, giving the company ample room to service its debt. Amazon’s interest expense was around $2.3 billion in 2022. Now that the company is starting to pull back on investments, we don’t think we’ll see debt rise significantly anytime soon.

Leases are also an obligation for the company and they also increased markedly throughout the pandemic. Amazon typically leases its warehouses rather than buying them, so as it expands, lease obligations pile up. The good news is that now that Amazon is unwinding some of these investments, we should see leases normalize in the coming quarters/years as they are a “variable” expense that can be influenced by management. Amazon paid around $8.6 billion for operating leases in 2022.

To this, we have to add the fact that Amazon has $70 billion in cash and short-term investments, which should give the company ample room to wiggle in case it were to be necessary. All in all, we think Amazon’s financial position is strong and will become stronger as the company pulls back on investments and starts showing its true cash-generation capacity.

Conclusion

Amazon boasts a high price earnings and price to free cash flow ratios, which is what keeps many investors on the sidelines. We think these ratios are very misleading due to the company’s misleading financials. Anyone who is able to “see” through the noise in Amazon’s financial statements should understand that Amazon stock is not as expensive as many people claim.

In the meantime, keep growing!

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Best Anchor Stocks helps you find the stocks to outperform the market with the lowest possible volatility but not compromising on growth. We provide deep research (6 thorough articles per pick). Steady compounders can stabilize your portfolio in bear markets and grow during bull markets.

Best Anchor Stocks can serve several purposes: stabilize your high-growth portfolio, or add low-volatility growth to your index, dividend or value investing. But the bottom line is the same: we want growth without high volatility.

Since launching in January 2022, the portfolio outperforms the market.

There’s a 2-week free trial. Don’t hesitate to join Best Anchor Stocks now!