Summary:

- Google is one of the highest conviction picks that I own in my portfolio.

- The company’s advertising model is more resilient in an economic downturn than most others.

- Google’s impressive liquidity earns it a AA+ credit rating from S&P on a stable outlook.

- The tech giant offers a significant margin of safety to investors at the current valuation.

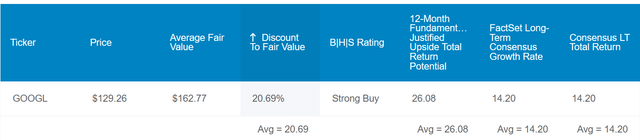

- Google’s 75% total return potential could nearly quadruple the S&P 500 through 2025 and double the index over the next 10 years.

A heap of U.S. banknotes. malerapaso

Those who have followed my work over the last five years on Seeking Alpha know that I am a dividend growth-oriented investor at heart. That’s why it may seem counterintuitive that the second and third largest holdings in my portfolio don’t yet pay dividends.

Excluding my mutual fund holding in a retirement account from a previous employer, Amazon (AMZN) comprises 2.7% of my portfolio value. Alphabet or Google (NASDAQ:GOOGL)(GOOG) makes up another 2.6% of my portfolio weighting.

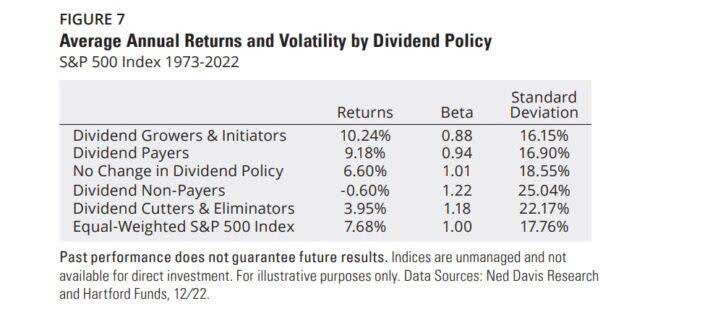

To an extent, dividend growth investing is backward-looking or retrospective. Of course, you’re betting that future fundamentals can build on the strong dividend growth of the past when you buy a stock. But you’re also relying on the proven dividend growth track record.

Hartford Funds

Nearly two years ago, I had an epiphany that somewhat changed my perspective as a dividend growth investor. Over 50 years from 1973 to 2022, dividend growers and initiators generated 10.2% annual total returns. That far exceeded the 7.7% annual total returns of the S&P 500 index (SP500) during that time.

I still plan on anchoring my portfolio around established dividend growers. However, I’m going to be focusing a bit on the initiator part of the equation moving forward. I plan on doing this by buying a select few growth companies with the means to eventually pay a dividend as growth potential slows down and cash piles up.

For today, I am initiating a strong buy rating on Google. Please allow me to highlight the company’s fundamentals and valuation to explain why.

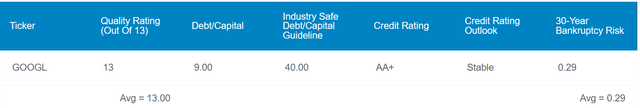

Google earns a 13/13 ultra SWAN rating from Dividend Kings for many compelling reasons.

As I’ll explain further, the company is the top digital advertising company by a country mile. Google’s debt-to-capital ratio of 9% is also far less than the 40% ratio that rating agencies are comfortable with for its industry. The company’s financial condition is so vigorous that it earns an AA+ credit rating from S&P on a stable outlook.

This matches the credit rating of the U.S. government itself. The U.S. government may have the power of taxation at its disposal, but its unsustainable spending runs contrary to Google’s excellent fiscal management. The company is a well-managed free cash flow machine improving its balance sheet by the day. That is why there is just a 0.29% probability that Google will default on its debt and go bankrupt within the next 30 years.

As if these unbelievably strong fundamentals weren’t enough to like Google, its stock is priced for expectations that should be manageable for the company to clear. Relative to its $163 fair value per share using historical fair values like the P/E ratio, Google’s $134 share price (as of November 15, 2023) implies it is 18% undervalued.

If the company can live up to growth expectations and return to fair value, here is what total returns could be for the next decade:

- 14.2% FactSet Research annual earnings growth consensus + 1.9% annual valuation multiple expansion = 16.1% annual total returns potential or a cumulative total return of 345% (excluding any modest dividends that may be paid in the latter half of that time frame) versus the 10% annual total return prospects of the S&P 500 or a cumulative total return of 160%

Dominating In Digital Advertising And Ascending Into The Clouds

Since its founding just 25 years ago, Google has emerged as one of the most relevant companies on the planet. The company’s most well-known products include Google Search, the social media platform YouTube, the official app store for the Android operating system known as Google Play, and so much more. This is how Google’s $281.4 billion brand value as of 2023 was topped by only Amazon’s $299.3 billion and Apple’s (AAPL) $297.5 billion. These popular products used by billions of people each day are lumped into its largest segment, Google Services. Through the first nine months of 2023, this segment accounted for 89.8% of the company’s total $206.8 billion in revenue.

The vast majority of the remaining revenue (9.2% of total revenue) was derived from the Google Cloud segment. This segment provides a host of products to organizations, such as cybersecurity, analytics, data, and artificial intelligence, which helps to keep businesses, non-profits, and governments running (details from pages 6-7 of 123 of Google 10-K filing and page 12 of 60 of Google 10-Q filing).

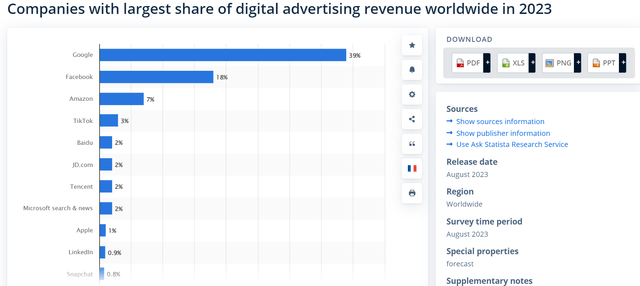

One of the biggest reasons to like the company is its sheer power within its core business of digital advertising via Google Search and YouTube (about 80% of total revenue). Thanks to a highly trusted brand and the compelling value proposition of advertising with Google, 2023 projections suggest it boasts a 39% share of the global digital advertising market per Statista.

Just how spectacular is that? This market share is greater than the next ten companies combined that are each dominant in their own right! Like all types of digital advertising, there is some sensitivity to economic downturns. But because we all remain connected to the internet, digital advertising is arguably the most recession-resilient medium of advertising.

Google is the undisputed king of an industry that is also set up for outsized growth. According to BCC Research, the global digital advertising market is expected to compound by 14.7% annually from $628.8 billion in 2022 to $1.2 trillion by 2027. Factors like greater adoption of high-speed internet and smartphones globally and e-commerce growth are behind this amazing industry growth rate.

Google’s leadership in digital advertising alone would make it a world-class business. Investors also shouldn’t forget about or discount its Google Cloud segment. As Dividend Sensei recently pointed out, analysts expect that segment to grow its sales by a staggering 21% annually to $81 billion in 2028. This will be fueled by both a promising global cloud growth forecast and market share gains. For these reasons, it’s clear how analysts see a path for the company to grow its earnings by 14.2% annually long term.

Google’s Free Cash Flow And Balance Sheet Is Remarkable

Unsurprisingly, Google is a cash cow. In the first nine months of 2023, the company has generated an astonishing $82.8 billion in operating cash flow. That’s after $33.3 billion in research and development spending to boot to arrive at net income. Even after spending another $21.2 billion in capital expenditures, Google has posted $61.6 billion in year-to-date free cash flow in 2023.

If you thought that was mind-boggling, keep in mind that free cash flow in the year-ago period to this point was $44 billion. That’s right – – FCF soared 40% year-over-year. This prodigious free cash flow generation helped Google’s cash and marketable securities swell to $119.9 billion as of September 30. For context, the company’s total liabilities were just $123.5 billion at that point. As long as it keeps growing, it wouldn’t make economic sense for Google to be a debt-free business. But if it wanted to, just know that it has the resources and ability to make that happen.

Risks To Consider

As great as Google is, there is no such thing as a purely perfect business (although Google is about as close as it gets). All companies face risks and Google is no exception.

If a recession were to manifest itself, the company could at the very least see a drastic slowdown in near-term growth. Still, that’s better than many businesses that would see growth invert to the negative territory.

Operating in technology, Google also faces the small risk of growing complacent and eventually becoming irrelevant. As long as founders Larry Page and Sergey Brin remain majority owners of the company by voting power, however, this is probably not going to happen. That’s because the duo is committed to the founding idea that led the company to the promised land in the first place: Google isn’t a conventional company and doesn’t intend to become one.

Summary: A World-Beating Company Priced At An Enticing Valuation

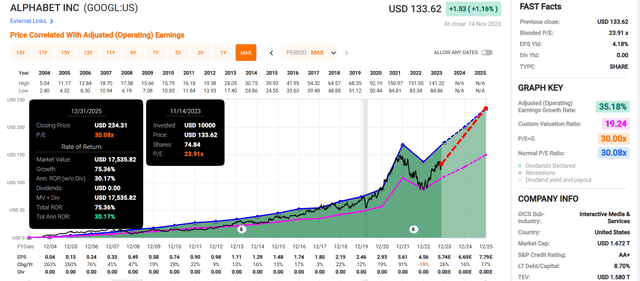

FAST Graphs, FactSet FAST Graphs, FactSet

Google is a reminder that there are plenty of incredible options in the investment universe. Though I don’t yet have children of my own, I can imagine that trying to pick a favorite stock is like trying to pick your favorite child. They’re all great in their unique ways.

Google’s robust operating fundamentals, fortress-like balance sheet, and free cash flow capabilities comfortably place it in the company of my favorite stocks. For me, the valuation seals the deal.

Over its 19-year history as a publicly traded company, Google has historically been valued at a 30.1 P/E ratio. If you want to be very critical, you could make the argument that it perhaps doesn’t deserve to trade quite that high anymore. But undoubtedly, the current 23.9 P/E ratio is a downright steal.

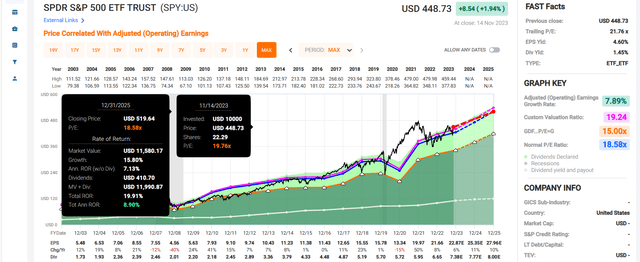

If it were to revert to fair value and grow as expected, Google could grow a $10K investment into $17.5K between now and the end of 2025. That’s way ahead of the $12K that the same investment in the SPDR S&P 500 ETF Trust (SPY) could be worth by that time. Overall, this is why I believe Google is a no-brainer buy right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I don't directly own whole shares of AAPL, but I do indirectly own the stock through my Capital Income Builder (CAIBX) mutual fund.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.