Summary:

- Northrop Grumman Corporation stock underperformed the S&P 500, returning less than 2% compared to the index’s 22% return.

- The company reported a $1.56 billion charge on the B-21 program last year, leading to a significant decrease in earnings per share.

- Q1 2024 earnings showed modest margin expansion, with sales growing 9% and operating income increasing 25%. However, Northrop Grumman stock is still rated as a hold with limited upside.

Matthis Arrivet

In November 2023, I covered Northrop Grumman Corporation (NYSE:NOC) stock, assigning it a Hold rating as I believed the stock was fairly valued. That call seems to have been about right given that the stock returned less than 2% while the S&P 500 (SP500) returned nearly 22%. In this report, I will discuss why shares have underperformed, analyze the most recent results, and assess whether the stock is any more compelling today to warrant a Buy rating.

B-21 Stealth Bomber Is Seeing Increasing Growth

Northrop Grumman stock tumbled following its Q4 earnings release on a $7.68 per share or $1.56 billion charge on the B-21 program. That pressure was significant, as it drove down the Northrop Grumman earnings per share by almost a third.

During the Northrop Grumman Q4 2023 earnings call, the following was said about the charge:

As you know, like all industries, we and our suppliers have experienced cost pressure from recent global macroeconomic conditions, which are significantly different from the assumptions the team made when bidding on these five production lots in 2015.

So, what we are seeing is just about the same as we see with some other defense contracts and that is the pressure of fixed-price contracts agreed on years ago drive higher costs on programs now as the framework laid out years ago is not valid today due to the significant supply chain disruptions over the past few years as well as inflation on labor and materials. As it stands now, the 5 tranches of low-rate initial production will drive $1.56 billion in losses.

Northrop Grumman Q1 2024 Earnings Show Modest Margin Expansion

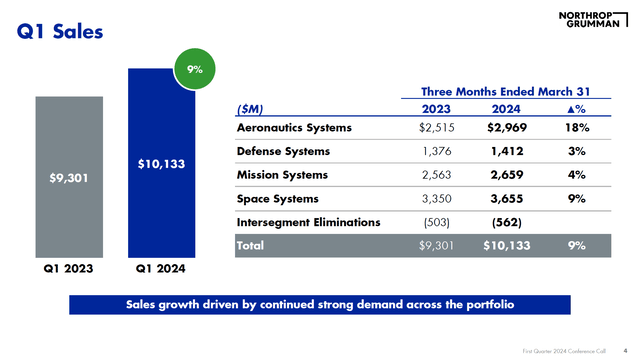

During the first quarter, Northrop Grumman sales grew 9% to $10.1 billion, beating analyst estimates for NOC Q1 2024 revenues by $340 million. Aeronautics sales increased by 18% driven by higher volumes on classified programs and the F-35 as well as the E-2 and unmanned aerial vehicles. Operating income increased $60 million or 25% driven by $76 million in EAC adjustments offsetting lower margin programs with strong sales growth.

Defense Systems sales grew 3% to $1.41 billion driven by higher volumes of the Stand-in Attack Weapon, the Guided Multiple Launcher Rocket Systems, ammunition, and cannon systems. This reflects some demand driven by the war in Ukraine as well as new weapon system development. Mission System sales grew 4% to $2.66 billion driven by higher classified program sales and advanced microelectronic sales, partially offset by the Scalable Agile Beam Radar program. Advanced microelectronics also drove the profit by 5% to $378 million, partially offset by lower EAC adjustments.

Space System sales grew 9% driven by the Tranche 2 Transport layer and higher volume on classified programs, hypersonic, and the Glide Phase Interceptor program. Profits grew by 6%, and that was below the revenue growth rate as margins last year benefited from a license sale.

So, overall, we are seeing 9% growth in revenues and 10% growth in segment operating earnings with strong margin expansion in the Aeronautics and Defense Systems segments, modest margin expansion in the Mission Systems and a margin contraction in the Space Systems segment. On an earnings per share level, we saw earnings increase from $5.50 to $6.32.

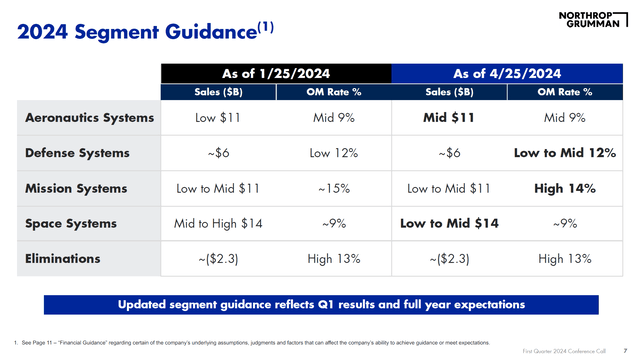

Northrop Grumman Maintains 2024 Outlook But Changes Segment Guidance

On a company level, Northrop Grumman continues to guide for $40.8 billion to $41.2 billion in sales with $4.475 billion to $4.55 billion in segment operating income and $2.25 billion to $2.65 billion in free cash flow. In Aeronautics, the sales guide has increased from low $11 billion to mid $11 billion, driven by strong first quarter sales. Defense Systems margins have been updated from low 12% to low to mid 12%, but at the same time, Mission Systems margin outlook decreased from around 14% to high 14% while Space System sales are now expected to be lower in the low to mid $14 billion range.

Is Northrop Grumman A Good Stock To Buy?

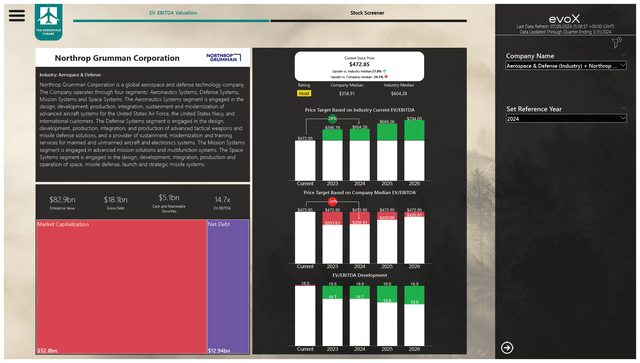

Q1 2024 earnings were looking quite good, but with the guidance being kept constant at the company level, one would think there is little reason to alter the hold rating. However, we also have to keep in mind future projections and balance sheet changes. When doing so, we found that EBITDA projections were more or less stable while free cash flow projections came down by roughly 3% driven by higher capital expenditures. As a result, the price targets against the company median have come down somewhat while EV/EBITDA expansion for the peer group is driving some upside. As a result, I am maintaining my Hold rating for the stock with a $482 price target, representing around 2% upside.

Conclusion: Northrop Grumman Stock Remains A Hold

As expected, the Q1 2024 performance, while strong, has not altered my rating on the stock. However, based on lower EBITDA and primarily because of lower free cash flow projections, the price target for Northrop Grumman does not have an attractive upside when allowing for 50% margin expansion towards peer group valuation. As a result, I am maintaining my hold rating but do note that Northrop Grumman can be seen as a dividend compounder with 20 years of dividend growth. So, while Northrop Grumman Corporation is not necessarily attractive for its stock price upside, the solid dividend growth record might be attractive to dividend investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.