Summary:

- The Home Depot, Inc. is currently priced to perfection, and this makes us wary in the current macro environment.

- We believe Home Depot’s management team is one of the best around – but it may not be enough to counter a severe recession.

- In our view, Home Depot currently represents a major asymmetric risk to the downside.

M. Suhail

Home Improvements

The Home Depot, Inc. (NYSE:HD) had a great pandemic. As millions of Americans were locked down at home and provided stimulus checks, the massive home-improvement chain benefited tremendously from increasing home-improvement spending. From 2014-2019, the company grew sales at a mid-single-digit pace. In 2020 and 2021, however, sales exploded, up 19% and 14% respectively.

Those halcyon days, however, seem to be over. Analysts estimate that Home Depot’s revenue in 2022 will grow by 4% YoY, and they forecast a meager 1% in 2023.

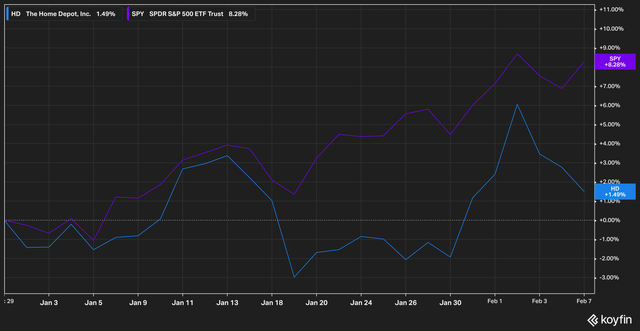

While the stock has outpaced the S&P 500 (SP500) over most long-term time frames by wide margins, investors seem to have woken up to the fact that the party may be over.

While the broader market has rallied over 8% in the new year, HD’s stock price has only improved 1.49%.

In this article, we will outline our case for why we are negative on Home Depot stock in the near term given the broad macro headwinds the company faces and a valuation that does not reflect the risk posed by a recession.

Recession Depot

The labor market simply won’t take the hint. For the last several months, the Fed has been relentlessly raising rates in an attempt to tame inflation. In January, the Consumer Price Index (CPI) decreased by 0.1% — a very, very welcome sign after multiple months of double and high single-digit reports.

One of the key metrics economists watch for in predicting inflation in the labor market. The sad truth is that as more people are employed, a greater amount of money flows through the economy, creating inflationary pressures. If enough people lose their jobs, household spending decreases, which is disinflationary.

The current economic situation is one which has many economists scratching their heads, as the American consumer remained resilient through rising inflation in 2022 for far longer than anyone imagined, but cracks are beginning to appear as household budgets become stretched and savings begin to dwindle in the face of higher prices.

A recession, then, in the form of a hard or soft landing, is now something that most are just patiently waiting for. And home improvement spending–one of the most discretionary of all–is a category that we believe will be hit particularly hard.

Preparing For Yesterday’s Market

There’s an old saying in the military that generals are always fighting the last war. The saying reflects the all-too-human tendency to lend too much credence to the past, of preparing to fight yesterday’s enemy while new adversaries are upending the battlefield.

Investors, unfortunately, are very much the same, tending to believe that market conditions of the recent past will continue to play out in the future (for example, the continued and stubborn optimism that yesterday’s growth stocks will return to their former glory).

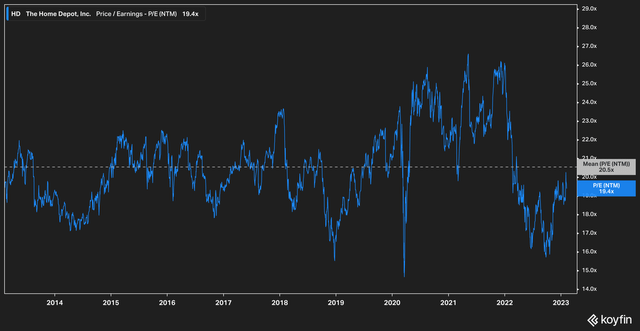

Home Depot is no exception. The company is currently priced to perfection on several metrics.

Going back ten years, The Home Depot, Inc. is currently trading just shy of its average NTM price-to-earnings at 19.4x.

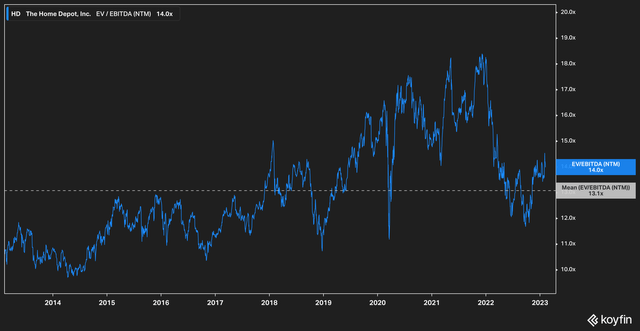

The NTM EV/EBITDA valuation tells the same tale.

We prefer EV/EBITDA over P/E for several reasons (namely that it provides a better snapshot of the company’s worth to a potential buyer and de-skews earnings that can be easily adjusted), and, arguably, the picture painted by EV/EBITDA is even worse than the NTM P/E.

What we can see is that pre-pandemic Home Depot traded roughly between 11-12x EV/EBITDA. In 2019 and through the pandemic (with the exception of the March 2020 flash recession), however, the valuation jumped as high as 18x.

Keep in mind the earnings growth we described earlier — that Home Depot’s steady state of growth has historically been in the mid-single digits, while pandemic growth was double-digit. With the recent rebound in price over the past few months, the market has effectively re-priced higher levels of growth for Home Depot than its pre-pandemic average going forward into the next twelve months.

Rational market theory, anyone?

It should be clear at this point that we find the current valuation ascribed to Home Depot by the market to be, well, quite high.

The Counterpoint

We always like to consider two main factors with every company we evaluate–what factors affect the business that management cannot control, and what internal factors does management have to blunt or exploit those outside factors?

Those who are currently bullish on Home Depot are likely to point to the company’s exceptional leadership. On this point we agree. In fact, we think you’d be hard pressed to find a more diligent, disciplined management team than what you’ll find at Home Depot.

To wit, the company expanded its footprint in 2022 by only 3 stores–a fraction of 1% footprint growth despite record-smashing sales. We like this because it demonstrates management’s awareness that the business was likely over-earning during the pandemic. Their ability to throttle growth during this time is commendable.

The Home Depot, Inc. also has prudent financial management, and masterful inventory and accounts receivable management. One thing we look for, especially in times of distress for retail, are signs that accounts receivable and inventory levels are growing out of pace with revenue. On these fronts, Home Depot’s leadership has again done a great job.

It’s Not Management

This brings us to the core of our argument – we do not fault management for our current negative outlook on the stock. Rather, we believe the market has not recognized the risk facing Home Depot, from either its retail home-improvement customer or a softening in business for its professional customer as the housing market remains in price discovery mode.

The Bottom Line

To be clear: we are not “bearing” on The Home Depot, Inc. long-term, but we believe that a repricing of the stock should recessionary winds materialize could put it in the doldrums for a few years after a long march upward.

Thus, we see The Home Depot, Inc. stock’s current level as high asymmetric: a lot of potential risk for very little remaining upside.

Home Depot’s earnings are coming up towards the end of February, and here are the two major things we’re watching for.

- Any significant inventory build due to weakening demand.

- A top-line beat on revenue due to price increase, but a lower transaction volume overall. We have seen this in other industries during this earnings season, and it indicates that fewer customers are able to sustain buying at current levels.

We will continue to watch and believe investors should wait for a repricing of The Home Depot, Inc. stock before initiating any new positions.

Thank you for reading our article. If you enjoyed it and would like to read more like this, please consider following Ironside Research.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.