Summary:

- The Microsoft/Activision Blizzard deal spread remains wide as the anti-competition reviews continue.

- The acquirer, Microsoft, filed a response to the FTC’s lawsuit.

- Microsoft/ATVI have offered Call of Duty to competitors and maintain the deal isn’t intended to be anti-competitive in nature.

- This is in line with past practices under Microsoft CEO Satya Nadella.

- The dealing parties seem to have a solid position in my opinion.

Lukas Schulze

Microsoft Corporation (NASDAQ:MSFT) has offered $95 per share of Activision Blizzard, Inc. (NASDAQ:ATVI). Because there are antitrust concerns, ATVI trades at $75.79. If the deal closes, that’s 25% of upside from here on out. The deal was initially announced in January 2022 and the process is well under way, with anti-competition agencies in various countries looking into the deal. Today, Microsoft issued a response to the Federal Trade Commission’s lawsuit to block the deal. You can read the full text of the response here.

There isn’t a lot of news in the response. It gives me the impression that Microsoft thinks it has a solid position especially given the promises it has already made around Call of Duty and the olive branch it has extended both Nintendo (OTCPK:NTDOY) and Sony (SONY). Nintendo accepted a deal regarding Activision access, but Sony has, so far, rejected it.

The acquirer also did a good job, in my opinion, of reiterating its position that it isn’t the intent of this deal to make the market less competitive. A few quotes to illustrate this:

Microsoft is buying Activision to meet the billions of gamers who choose to play on mobile devices instead of a console or PC, and to learn how to make games that appeal to and engage them. Xbox also wants to make Activision’s non-mobile games more broadly available. One way is by continuing to distribute Activision’s games everywhere they currently exist and expanding to additional platforms like Nintendo. Another is by adding new Activision console and PC games

And how the deal itself broadens access to products for consumers:

Activision has never before put its new games immediately in subscription. Maintaining broad availability of Activision games is both good business and good for gamers.

Microsoft also argues it is simply in its best interest to continue to make games broadly available because exclusivity “costs” money instead of making it money:

A substantial portion of Activision’s financial value to Xbox comes from business as usual, including the continued sale of Call of Duty—its most popular game—on Sony PlayStation. Paying $68.7 billion for Activision makes no financial sense if that revenue stream goes away. Nor would it make sense to degrade the game experience and alienate the millions of Call of Duty players who play together using different types of consoles. The reputational hit to Xbox would not be worth any theoretical economic benefit from taking Call of Duty away from competitors.

and

…Xbox cannot afford to take Activision’s games exclusive without undercutting the basic economics of the transaction. That is why Microsoft has offered to keep Call of Duty on PlayStation from the moment this deal was announced…

Microsoft also points out that it has expanded access to Minecraft. It is an online multiplayer game and one of Satya Nadella’s first acquisitions.

The market hasn’t responded to the response in a big way. This could be because it is a slow day in the markets with lots of people likely leaving early for Christmas and trying to get home early. On the other hand, Microsoft gives the appearance it thinks it has a good bet as is and doesn’t have to yield anything more. This paragraph illustrates the position it takes:

The Commission is not entitled to relief because none of Microsoft’s conduct identified in the Complaint is actionable—independently or in the aggregate— under the antitrust laws. 13. Microsoft’s offers of binding contractual commitments to continue to offer certain titles like Call of Duty to other gaming companies, including Nintendo and Sony, for at least ten years address all of the alleged anticompetitive effects in the alleged markets and ensure that there will be no harm to competition or consumers. 14. The Commission’s claims are too speculative to support any claim on which relief can be granted. 15. Neither the filing of this administrative action nor the contemplated relief is in the public interest, pursuant to 15 U.S.C. § 45

At the same time, the company doesn’t draw any lines in the sand either. Overall my impression of the response is quite favorable and I continue to think the spread is too wide. There’s potentially 25% upside here.

You could make a credible case that Activision is actually trading below fair value as is. The main reason being that Nadella snapped it up just as the stock bottomed after it came out Activision management allegedly engaged in sexual misconduct and/or CEO Kotick covered that behavior up.

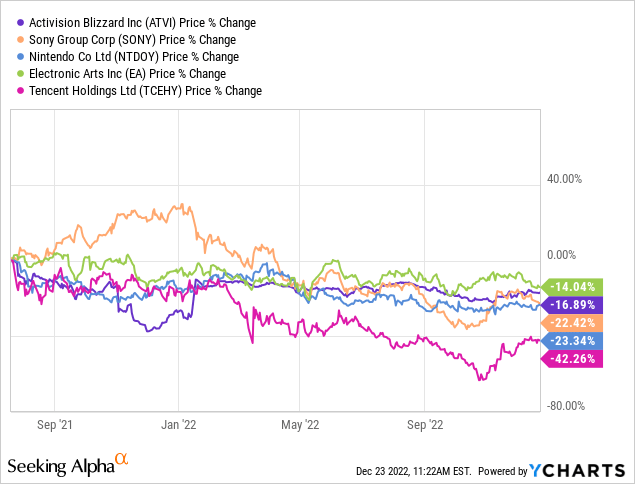

If you look at the share prices of major gaming companies since the lawsuit against Activision was filed in 2021, Activision’s performance is sort of in-line with that of the other gaming companies. Tencent (OTCPK:TCEHY) admittedly did a lot worse. I wouldn’t disregard the Tencent’s performance but it is probably in part due to China-specific drivers.

In case of a break, there’s also a reasonably large break fee equal to 3% of ATVI’s market cap when the deal was announced. Break fees are sometimes larger, but it is on the high end of the range. That helps mitigate the downside in case of a deal break. It would probably still fall quite a bit as arbitrageurs exit. However, it doesn’t have to fall that far. The graph below shows average analyst targets on the stock vs its price:

price target vs analyst target (Seeking Alpha)

Since the deal announcement, the price targets haven’t come down much from $92-$93. That’s likely a blend of the deal price and break price. It is pretty rare for analyst targets to be so much ahead of the actual price. EPS targets haven’t budged much since the deal announcement, either, although the recession probability has definitely increased.

Taking everything together, I think this is an interesting merger deal as part of a diversified portfolio. I’m cognizant there is break risk, but expect it is: 1) overplayed; and 2) the downside may not be all that bad. The risk could look relatively symmetric from here with 25% upside and ~25% downside. Meanwhile I put the odds this closes as planned at ~80%. Timewise there is some uncertainty, but it should be done by mid-2023. In my opinion, the deal is very likely to close or break months before that.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of ATVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Coincidentally I have a MSFT short position on but that idea is not related to this deal.

I write the Special Situation Report. I look at special situations like spin-offs, share repurchases, rights offerings and a lot of M&A events. The point is to make money with risks under control. Check it out here. Follow me on Twitter here