Summary:

- Micron is poised for a strong earnings release on December 18, 2024, driven by a high-bandwidth memory ramp and favorable EPS estimate revisions.

- Micron’s HBM3E chip is expected to significantly boost revenue and could lead to gross margin gains in FY 2025. The market outlook is very favorable as well.

- Micron is buying back a lot of its own shares, and strong market conditions in the memory market in FY 2025 could lead to more capital returns.

- Micron offers a compelling investment opportunity in the memory market, trading at a below 8.0X P/E ratio, which is well below the historical and industry averages.

- Risks include potential disappointments in HBM3E shipments and gross margin growth, but the overall outlook remains highly positive for FY 2025.

mesh cube

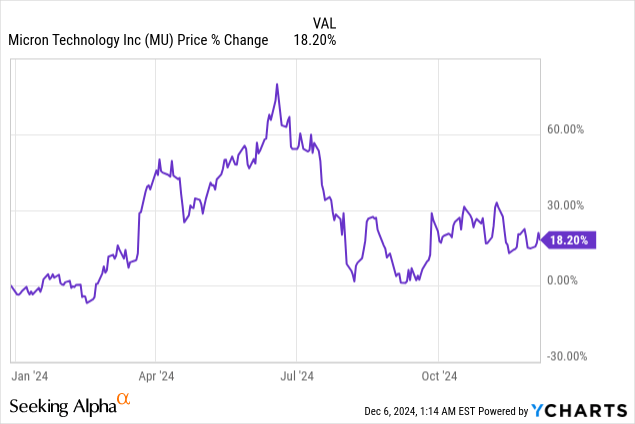

Micron (NASDAQ:MU) is scheduled to submit its first fiscal quarter earnings sheet on December 18, 2024 and I believe the memory maker has a strong chance to beat earnings estimates as well as impress investors with its guidance for FY 2025. The semiconductor firm is likely to see a gross margin expansion related to its high-bandwidth memory product ramp, which Micron has said is expected to be accretive to consolidated gross margins. I believe Micron represents one of the best deals in the semiconductor market to play an increase in AI-related investment spending, especially in the Data Center market. With shares of Micron consolidating and now trading at a much lower P/E ratio, compared to the industry group average, I believe the risk profile is widely skewed to the upside.

Previous rating

I recommended Micron in my last work on the semiconductor firm in September — A 9X FWD P/E Is Unacceptable — due to growing demand for the company’s new high-bandwidth memory product HBM3E. Micron also delivered a significant earnings beat in the fourth fiscal quarter and submitted a robust guidance for Q1’25. With shipments of the company’s HMB3E solutions set to ramp up in 2025, I believe Micron, given its low valuation based off of earnings, is one of the best deals that investors who want to bet on accelerating top line and margin growth can make.

HMB3E ramp could lead to revenue growth acceleration and higher gross margin

Shipments of Micron’s HBM3E 12-high 36GB memory chip are set to ramp up in FY 2025 and the company expects to see considerable demand growth. While the company has not released specific guidance for its latest AI-capable memory chip — which is expected to deliver strong memory performance and up to 20% improved power efficiency — management has said that it expects a significant volume ramp for HBM shipments next year. Because of the demand ramp in high-bandwidth memory solutions, management has stated that it sees a 6.25X factor increase in the size of the high-bandwidth memory market between FY 2023 and FY 2025… with the total market size growing to $25B by the end of next year.

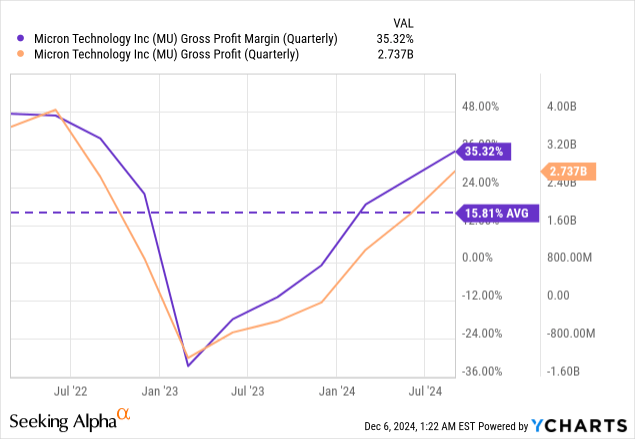

This expected surge in demand for the next generation of AI-capable memory products could lead to an up-lift in Micron’s gross margins… which are already in an up-trend. In the most recent quarter, Micron generated a gross margin of 35% which compares to a 3-year average gross margin of 15.8%. Compared to the 3-year average, Micron’s gross margins have already doubled and, according to the company’s projections for Q1’25, the memory maker expects a sequential margin expansion to 39.5% +/- 1 PP.

Nvidia (NVDA)’s last earnings report showed that the market is not seeing any slowing in AI spending, and corporations continue to spend freely on graphics processing units. In fact, Nvidia has submitted a strong revenue outlook for the current quarter as it starts to ship its high-in-demand Blackwell GPUs. Since GPUs need high-bandwidth memory, Micron has strong potential to expand its gross margins in FY 2025… and potentially see a revenue growth acceleration here as well.

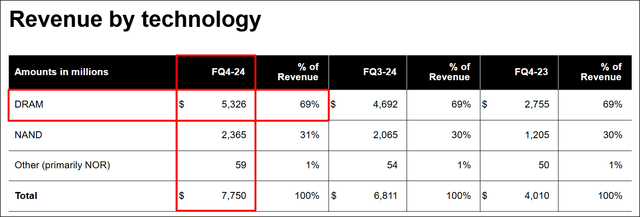

Micron achieves the majority of its revenues from its DRAM portfolio which is where HBM products are already having a positive margin impact. In the most recent quarter, Micron generated $5.3B in revenues just from its DRAM product portfolio which calculates to a revenue share of 69%. However, with HBM shipments set to scale in FY 2025, I believe Micron could achieve a significantly higher revenue share of 70-75% which will be driven both by stronger average selling prices as well as higher volume shipments.

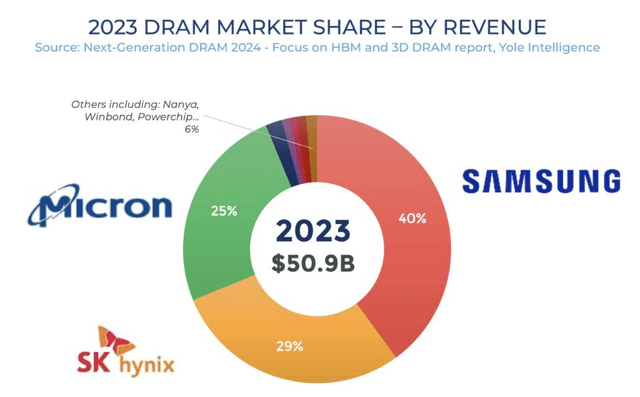

This ramp in HBM shipments could potentially also lead to market share gains for the memory company. Currently, Micron is the third-largest producer of memory chips in the market (with a share of 25%), after Samsung and SK Hynix, which own 40% and 29% of the DRAM market respectively (based off of 2023 metrics). Market share gains, a higher share of DRAM revenues, driven by higher average selling prices, expanding gross profits and increasing capital returns could all be catalysts for a material increase in the company’s valuation in FY 2025.

Favorable EPS estimate revision trend

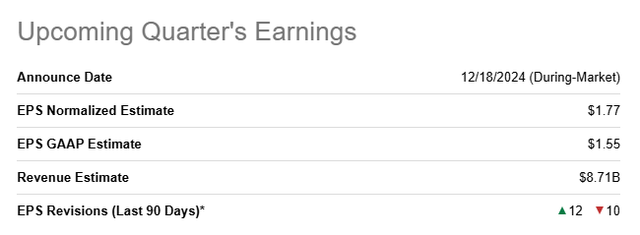

Micron could be set for a strong earnings scorecard, driven chiefly by growing demand for the company’s next-gen high-bandwidth memory solutions. In the last ninety days, analyst have raised their EPS projections 12 times which compares against 10 EPS downside revisions.

The consensus projection for Micron’s is to earn $1.77 per-share while the semiconductor firm lost $0.95 per-share in the year-earlier period. I don’t really see a good explanation for the EPS downgrades for Micron, especially since the demand situation seems to be very strong. Therefore, I would not be surprised to see a strong after-hours share price reaction if Micron beats estimates for the first fiscal quarter.

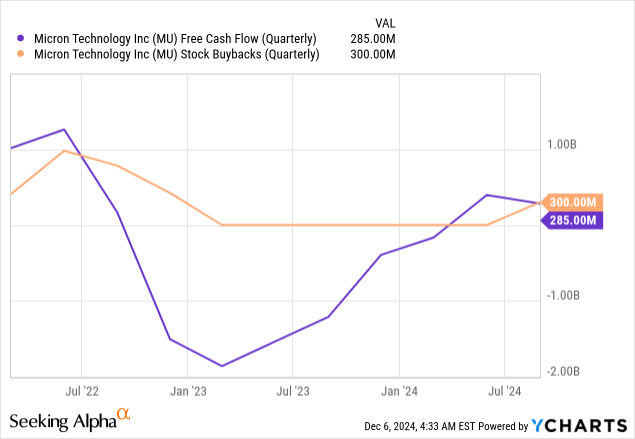

Micron: a capital return play

Many semiconductor companies return a generous amount of cash to shareholders given the booming market conditions. Nvidia, as an example, announced a $50B stock buyback, but even smaller firms like Micron are returning a ton of cash to investors. Micron completed stock buybacks in the amount of $4.4B between FY 2021 and FY 2024 (for 63M shares) and the memory maker could be set to repurchase even more shares in FY 2025, if market conditions for HBM3E remains bullish. In the most recent quarter, Micron repurchased approximately 3.2M shares for a total consideration of $300M.

Stock buybacks obviously make a lot of sense for companies when their shares are undervalued. In the case of Micron, which is currently trading at a below 8.0X P/E ratio (a 12.8% earnings yield), buybacks would actually be a good use of capital, in my opinion.

Micron’s valuation

Micron’s key advantage over other AI semiconductor plays is that shares are still very cheap. I already discussed that Micron has considerable upside potential relating to its latest HMB3E product that is set to ramp up in FY 2025, providing the memory maker with an opportunity to uplift its gross margins.

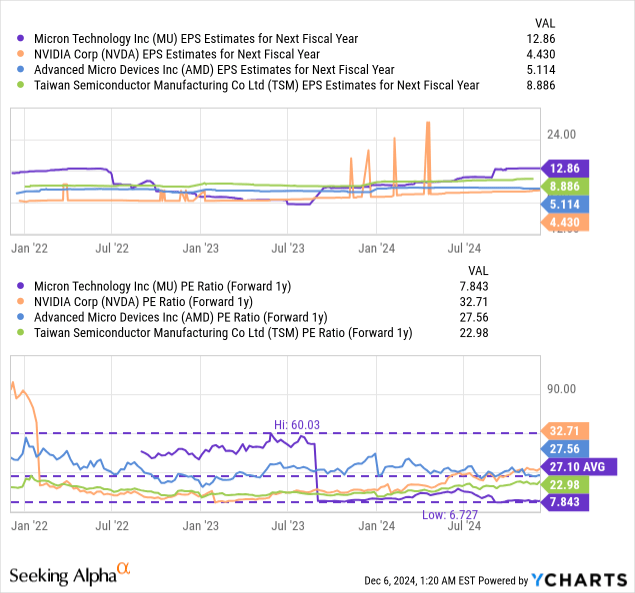

In terms of valuation, Micron is a real steal as well: shares are valued at a price-to-earnings ratio of 7.8X — based off of FY 2025 estimates — which compares against an average price-to-earnings ratio of 27.1X in the last three years. Semiconductor leaders like Nvidia, AMD (AMD) and Taiwan Semiconductor Manufacturing Company (TSM) are all trading at much higher forward P/E ratios than Micron.

Micron could, in my opinion, trade at a 15X P/E ratio fairly easily, under the condition that the memory maker continues to grow its revenues, free cash flows and gross margins. A 15.0X P/E ratio would still significantly below the longer term P/E average of 27.1X as well as the industry group average P/E ratio of 22.8X, but would account for the high volatility in earnings that Micron experienced in the past.

A 15.0X price-to-earnings ratio is not a high multiplier to pay for a company that is expected to grow its earnings as aggressively as Micron in the next several years: based off of consensus estimates, Micron’s earnings are expected to surge 587% in FY 2025 and 44% in FY 2026 (and they are projected to fall 15% thereafter). And even with this break-neck growth, Micron’s 15X fair value P/E is still considerably cheaper than TSMC’s and seems a reasonable compromise to use given that other semiconductor firms trade at significantly higher P/E ratios.

A 15.0X forward price-to-earnings ratio implies about 91% revaluation potential and a fair value of $191 per-share. However, this is only a dynamic number and I could see Micron’s share price more than double in the next twelve months if Micron continues to buy back more stock going forward and if the firm reports strong HBM3E shipment data in the first half of FY 2025. Given the relative undervaluation to other semiconductor firms, I believe Micron has considerable catch-up potential to its rivals. Since Micron is also expected to see truly significant earnings per-share growth next year, as the HBM shipment ramp trickles down to Micron’s bottom line, shares of Micron could easily double in value, in my opinion… and then would not be overpriced either.

Risks with Micron

The biggest risk for Micron, as I see it, relates to the company disappointing on its HMB3E shipment ramp which is sort of key to shares of the semiconductor firm revaluing higher. Further, spending on memory products has often been proven to be volatile, leading to wild swings in Micron’s earnings (estimates) which is making EPS projections more challenging.

What would therefore change my mind about Micron is if the memory maker disappointed in terms of its HBM3E shipment ramp in FY 2025 or were to disappoint in terms of growing its gross profit margins. Another risk factor specific to the bullish case for Micron is that the company may decide to scale back investment spending should demand for HBM products slow… which would likely also indicate a slowdown in spending on stock buybacks.

Final thoughts

I believe Micron is set for a strong earnings release on December 18, 2024. The reasons for these expectations are: as Nvidia’s earnings release for the last quarter as shown, companies continue to spend a ton of money on AI-related CapEx, especially graphics processing units, the kind that need Micron’s high-memory bandwidth solutions in order to handle AI applications.

Further, Micron itself has projected a 6.25X factor increase in the market size for high-memory bandwidth solutions between FY 2023 and FY 2025 which indicates strong pricing power for companies that deliver a next-gen AI-focused memory solution for Data Centers. The EPS revision trend is overall favorable as well.

Most importantly, I believe Micron simply offers investors the best deal in the AI/semiconductor market due to its low valuation based off of earnings. No other major AI company is as cheap as Micron, despite the company having considerable surprise potential in FY 2025 related to the shipment ramp of Micron’s HBM3E 12-high 36GB chip. In my opinion, shares of Micron could easily double in valuation and the risk profile ahead of the Q1’25 earnings report card is very much skewed to the upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA, AMD, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.