Summary:

- Despite mixed results, the company is taking steps to set itself up for future success.

- PayPal’s consumer head recently gave some good color on how PayPal can drive growth from the currently installed user base.

- Outgoing CEO Dan Schulman just purchased $2 million of stock on the open market.

Justin Sullivan

Overview

PayPal (NASDAQ:PYPL) announced its Q4 and 2022 annual earnings on February 9th to a mixed reception. Longtime CEO Dan Schulman announced he would be departing the company by the end of the year, and the company projected free cash flow for 2023 of around $5 billion, a decline year over year which the company said was based on their expectations of slowing consumer spending through the year. (For our previous write-up on PayPal and our expectations for 2023, please click here.)

In this article we will review the full year 2022 results from PayPal and review how management’s forecasts affect our original thesis.

Paying Up

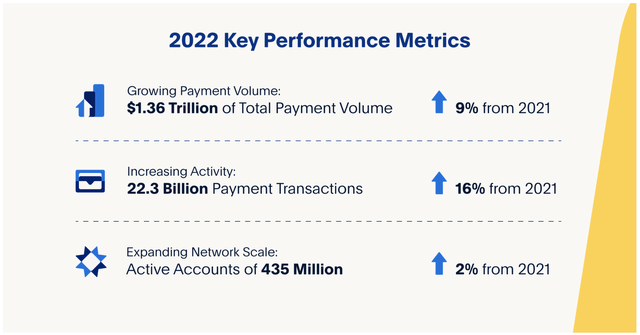

Revenues for 2022 at PayPal increased by almost 9% year over year to $27 billion, while operating income contracted to $3.8 billion from $4.2 billion, driven primarily by higher overall transaction expenses. Transaction expense rates increased seven basis points year over year from 0.83% to 0.9%.

While transaction expenses are driven by processor mix, which is largely outside of managements hands, the operating expenses which can be controlled were controlled well, growing only 2.7% year over year. Management highlighted this in the call and we point it out as well because we think that in PayPal’s case, a more granular view of operating expenses is warranted rather than just a simple ‘costs went up’ or ‘costs went down.’ Seeing that management controlled the operating costs that they could reinforces our idea that the current team takes a thoughtful and disciplined approach to cost management in the current environment.

Payment transactions for the year increased nicely, up 21% to 22.3 billion for the year. We were also very heartened to see that PayPal’s number of payment transactions per active account grew at a healthy clip as well-from 45.4 in 2021 to 51.4 in 2022 (more on transaction volume growth in a moment).

More disappointing, however, is the fact that active accounts grew only 2% to 435 million.

Management also noted in the earnings call that they are not expecting large growth in active accounts for the year, and-interestingly-stated that they would no longer provide guidance for the metric.

Of all the data points we’ve analyzed, this is the most concerning one for us-with qualifications. We can only assume that this decision was made at very high levels and probably has activist input from Elliott Management. We also suspect that this decision is tied to two factors-one being that the company is undergoing cost-saving initiatives, and the second being the pending departure of Schulman. With all that in mind, we will be watching closely to see if the focus from cost savings and margin expansion shifts back to growth once the new CEO is onboarded.

There’s An App For That

With PayPal’s focus currently on expanding customer offerings and margin, let’s take a step back and discuss how the company might accomplish that.

PayPal’s customer ecosystem is comprised of around 35 million merchant accounts (customers who make payments) and roughly 400 million individual consumer accounts. Douglas Bland, PayPal’s consumer business head, recently spoke at the KBW Fintech Payments Conference where a considerable amount of color was provided on the company’s strategy to grow revenue from existing consumer users.

Key to this strategy is PayPal’s ability to have consumer adoption of the PayPal mobile app, and to integrate PayPal into their digital wallet. According to Bland, PayPal sees “60% more transactions per user who adopt the mobile app.” Growing this base, then, is of supreme importance to PayPal.

Bland estimates that 50% of PayPal’s current consumer base have the mobile app, and he expects adoption rates to grow in the double digits for 2023.

This is critical for growing PayPal’s top line without a material expansion in the base of active accounts. It’s also, in our opinion, a great strategy for the current environment-it costs much less to develop an existing client than acquire a new one, and with a current runway of around 200 million accounts to adopt the mobile app, this could provide a significant bump in transactions over time.

Valuation

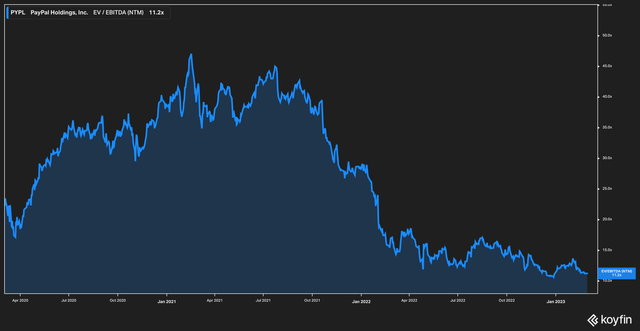

Since our previous article, PayPal’s valuation has only gotten cheaper. Today the stock trades at a 15x forward earnings valuation and 11x on a forward EV/EBITDA basis.

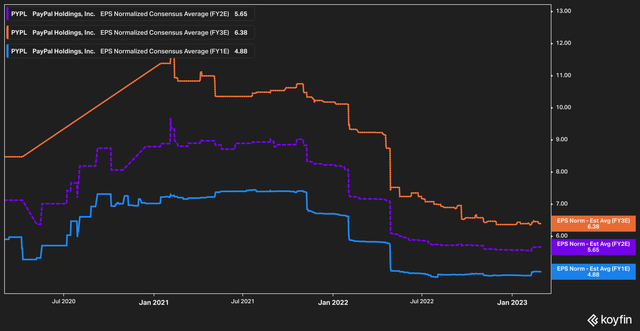

Importantly, we’d like to point out that earnings expectations looking out over the next three years have flattened and are no longer declining.

PYPL 1-3 Year EPS Estimates (Koyfin)

This is vital. Preserving earnings estimates is a key way for the company to establish a floor on its stock. Delivering and beating those expectations should then create the forward momentum that propels the stock upward.

Interestingly, we also note that Schulman recently purchased $2 million of PayPal stock on the open market. While we aren’t generally great fans of reading the tea leaves when it comes to insider buying, we think investors should be aware.

The Bottom Line

In sum, we believe that our PayPal thesis remains intact based on what we’ve learned from recent earnings and the prospect of new management.

With a leadership change on the horizon, we think that a focus on cost reduction, margin expansion, and growing revenue from the existing customer base makes sense.

Risks to our thesis include inability on PayPal’s part to grow mobile adoption in its installed user base, and a protracted or botched search for a new CEO. We are less concerned about the second risk, however, given the presence of Elliott management.

We will continue to monitor PayPal, but for now we remain bullish on its outlook.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.