Summary:

- ABT has been growing its dividends for OVER half a century and is one of only 37 US stocks to do so.

- We examine if ABT has ample elbow room to service the dividend.

- We conclude with some thoughts on the technicals and the valuations.

We Are

Introduction

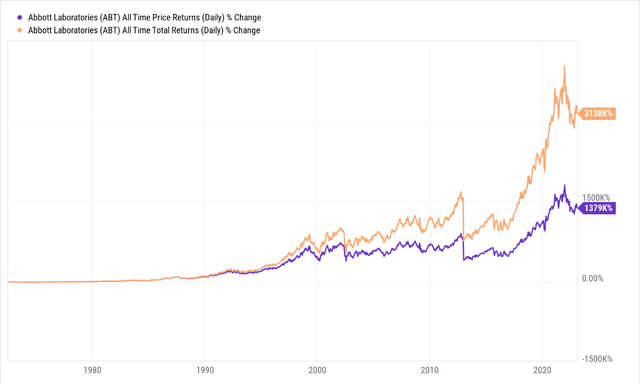

Most investors latch on to Abbott Laboratories (NYSE:ABT) for its growing prowess in the broad healthcare space, but it also helps that this stock has a resplendent dividend theme, which only makes the investment case even more alluring. The image below gives you a sense of the marked differential (over 2.27x) between the total returns (which incorporates dividends and other distributions) and the price returns for Abbott’s stock.

YCharts

Last month, ABT came out with its Q4-22 results whilst also providing an outlook for FY23. Whilst there are some positive and negative nuances to consider, the headline forecasts for FY23 don’t make for pleasant reading, with consensus now expecting an annual revenue decline of 8% and an even bigger contraction on the EPS front (18%). In light of a weakening financial backdrop, could ABT’s dividend credentials dim?

Is Abbott Laboratories Stock A Top Dividend Aristocrat?

Before I examine the dividend outlook, it’s important to reiterate some of ABT’s special dividend achievements. It wouldn’t be an exaggeration to call ABT one of the most illustrious dividend growers in the S&P 500 as it is one of only 65 names (just 13% of the benchmark index) to make up the S&P Dividend Aristocrats Index. To make it to the Dividend Aristocrats index, stocks from the S&P 500 Index are required to have increased dividends for 25 consecutive years, and you wouldn’t normally be able to facilitate this unless you have a strong track record of profit and growth.

In ABT’s case, it’s fair to say that it is not just an aristocrat, but a dividend king, as it has been increasing dividends for 51 straight years! Including ABT, only 37 US stocks (not just the S&P500) have been able to achieve that feat, making the stock one of the most elite aristocrats around.

Is The Dividend Safe?

Whilst the contraction in forward revenue and EPS numbers is not ideal, I believe ABT has ample elbow room to keep its dividend growth track record going.

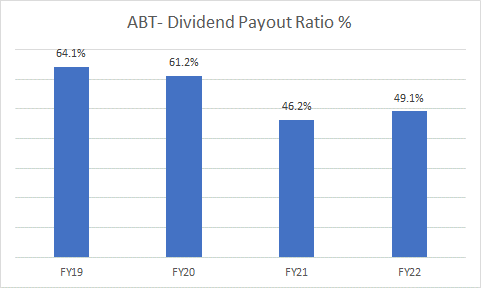

Firstly, it’s worth noting that ABT’s dividend largesse has slowed somewhat, relative to what it was in the pre-pandemic era. In FY19, the company was distributing close to 64% of its EPS as dividends, lately, it has been less than 50%.

Prima facie, you would think that given the likely drop-off in the FY23 EPS ($4.4) from the FY22 levels, ABT would need to lift its payout again next year, but that isn’t the case. Even if we assume a meager ~2% hike (over the last four years, quarterly dividends have been hiked by an average of 13% p.a.) in the quarterly dividend from 0.51 to 0.52, that would still only result in a payout of 46-47% next year.

Seeking Alpha, YCharts

There could have been a lot of ambiguities in ascertaining Abbott’s dividend servicing ability if the management was not clear about where its priorities lie. Typically, most companies would seek to direct their positive operating cash flows towards organic initiatives such as CAPEX; then the onus would shift towards debt pay downs, then you’d have some funds left for inorganic initiatives, and if something was left it would then go to funding the dividends and buybacks.

Luckily for us, ABT management has been very open about their capital allocation plans, with dividend payments taking precedence over all the other alternatives. This means you’d really only want to see if ABT can generate ample operating cash flow (not even free cash flow which accounts for CAPEX) to cover the dividend.

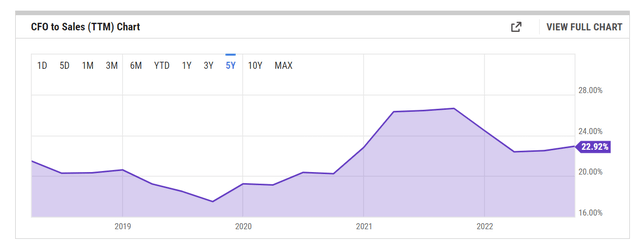

Over the last five years, ABT has, on average, been able to convert 21.6% of its sales into operating cash flow, the most recent figure is healthier at 22.9%. To be on the conservative side, even if we use the 5-year low conversion rate of 17.5% (around four years back), on next year’s lower forecasted sales of $4.4bn, ABT would still end up generating $7bn of OCF.

YCharts

Over the last five years, Abbott’s cash outlay towards its dividends has grown at 13% YoY on average, with the FY22 cash outlay likely to come in at less than $3.4bn (assuming cash outflow of ~$900m in Q4-22, based on the recently announced quarterly DPS of $0.51). A 13% growth rate in the dividend cash outlay would essentially call for $3.8bn next year, a figure that ABT’s likely FY23 OCF (~$7bn) would cover by 1.8x!

To conclude, ABT has the financial profile to comfortably cover its dividend, and after such a long track record (51 years), I’d like to think it would take an egregious turn of events to curtail the dividend.

Closing Thoughts- Is ABT Stock A Buy, Sell, or Hold?

Whilst Abbott Laboratories should likely have enough in the tank to keep its dividend going, I’m not convinced it’s the best time to buy the stock considering the valuations and technical sub-plots one is faced with.

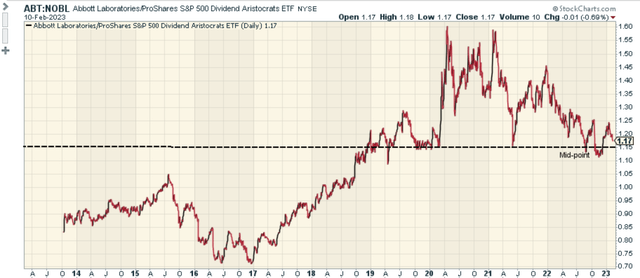

Stockcharts

The chart above juxtaposes the relative strength of ABT and its peers from the S&P Dividend Aristocrats ETF. It’s hard to make a case for ABT as a mean-reversion play in this space, given that the relative strength ratio is above the mid-point of its long-term range.

If we switch our attention to ABT’s long-term chart, we can see that the recent price imprints suggest that the stock is not in the best of health. From 2015 till July 2022, the stock had been trending up in an encouraging ascending channel. The price peaked in December 2021, and since then we’ve faced the first leg down of a downtrend which only eased off in Q4-22. Since then we’ve seen a pullback of sorts, but the lack of bullish positioning can be exemplified by the fact that the last five monthly candles have all failed to close above the lower boundary of the old channel. This may likely embolden the bears.

As things stand, a broad downtrend is still underway and for ABT to negate the downtrend we would need to see it defend the October-22 lows of $93.25, and also close above the January highs of $116.

Investing

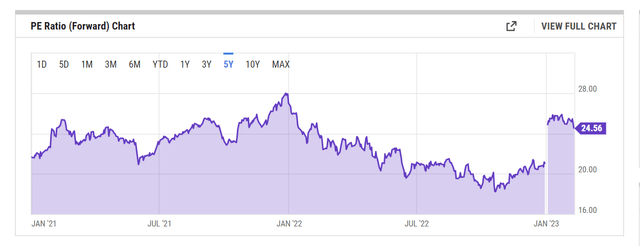

It’s also difficult to turn bullish on ABT when forward valuations don’t look great. As mentioned earlier in the article, Abbott Laboratories looks set to deliver lower earnings growth of ~18% this year. That weaker FY23 EPS consensus estimate of $4.4 means the stock trades at an unappealing forward P/E of almost 25x, pricier than its 5-year average of 22.8x. Even if you feel that consensus is a tad conservative, and you want to take an EPS figure at the upper end of ABT management’s guidance ($4.3-$4.5), one still gets an elevated P/E of 24x!

YCharts

To conclude, ABT is a HOLD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.