With A Forward P/E Of 28, Is Tesla Now A Value Stock?

Summary:

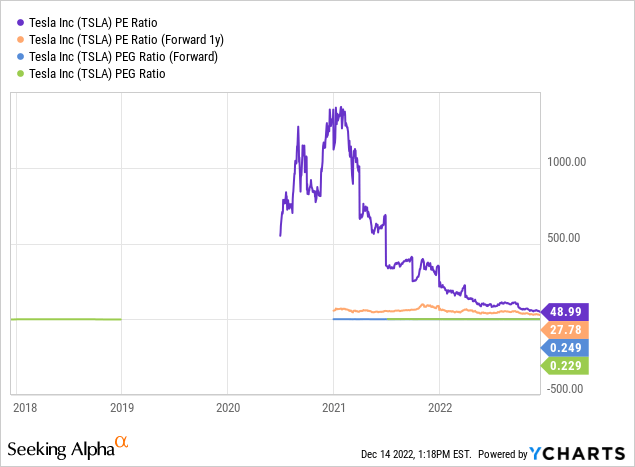

- Down ~60% YTD, Tesla now trades at 39x this year’s earnings and 28x next year.

- Most would agree the decline is not just macro, as the Twitter distraction and Musk’s political statements are weighing heavily on the price.

- Regardless of controversy, today’s valuation is cheaper than the Covid lows, based on sales multiple and P/E. If you missed the boat and want in, now might be your chance.

Joe Raedle

Not looking the best. That sums up the above pic of Elon, as well as the perception of the Tesla (NASDAQ:TSLA) brand right now. For better or worse, the two go hand in hand.

On Tuesday, Mark Fields – the former CEO of Ford (F) – was interviewed on CNBC and asked about Musk’s behavior.

As a CEO he is so associated with that brand, that the positions he’s taking on social and political things, on balance that’s a net negative for a company. I mean when I was running Ford, or any CEO today, you have to pick and choose what either social or political issues you dive into, and they have to be very tied to your values as a company. And maybe it’s one, maybe it’s twice a year, but no more than that.

Hmm, it’s hard to fathom how this Tweet about his pronouns and Fauci are very tied to the company.

But at the same time, that’s what differentiates Musk from Fields and almost every other current and former automotive CEO. Like it or not, Musk’s larger than life personality is why Tesla hasn’t had to advertise.

Due to Seeking Alpha’s political comment rules, I will not be discussing Musk’s latest opinions here but will say this; if he dials it back, once again his personality will be used for positive benefit.

Twitter and Musk rants aside, are things that bad?

This too shall pass. It’s one of the few adages which is always true. One way or another, these distractions will be in the rearview mirror. Once they are, the focus will be back on the company. I always like bad news first, so let’s summarize the negatives in the headlines right now:

- Supply chain normalization and higher interest rates means that both new and used car demand is going down here in the US. We see this in the CPI prints each month.

- Zero Covid policies, weak macro, and increasing competition from local competitors like NIO (NIO), XPeng (XPEV), and Li Auto (LI) means they are facing headwinds in a very important market. Furthermore, EV subsidies go away at the end of this year.

- Here in the US, in most cases, you need to take possession of your new Tesla in 2023 to qualify for the new $7,500 tax credit. In turn, this actually has discouraged people from taking possession in Q4 of this year.

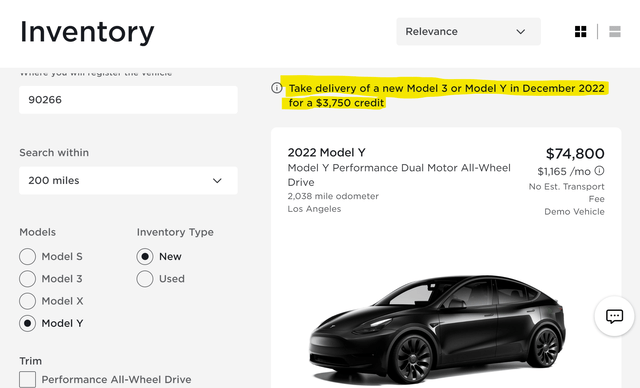

To counteract that last thing, Tesla has been doing something they’re not known for… discounting.

Tesla.com

Speaking of inventory, the days of waiting months for a Tesla are over. In that interview Fields did, he discussed browsing Tesla’s inventory and finding availability for most models and being able to get delivery within days. I experienced the same. To be clear though, custom orders still have a 60+ day lead time.

The bearish side to that would be sales are slow. The bullish would be that supply chains are now under control, so excessive wait times are over.

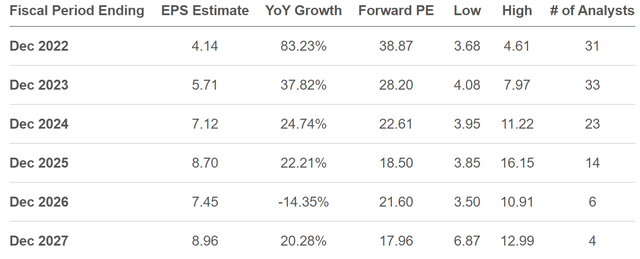

Goldman Sachs (GS) is now predicting 420k deliveries in the 4th quarter, revised down from 440k. For 2023, they’re saying 1.85M deliveries vs. 1.95M prior estimate. This is not the 50-100% YOY of past years but should still be north of 30%. Legacy automakers aren’t doing that.

Tesla vs. automakers

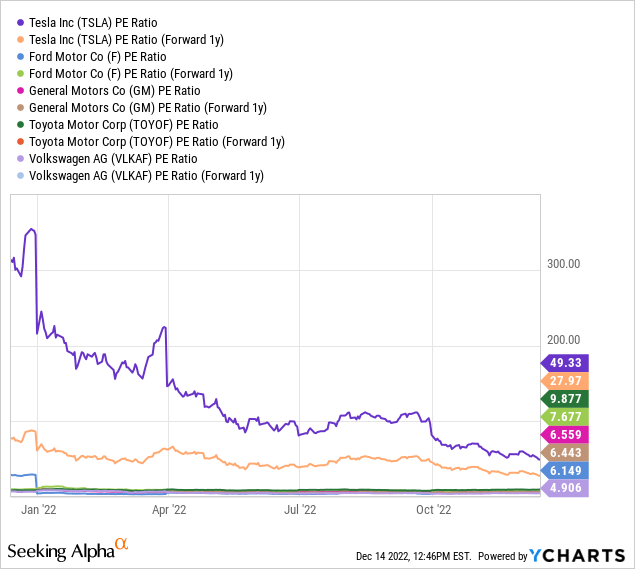

Upfront let me be clear that Tesla is not cheap if you are valuing it as only being an automaker. Not even remotely close to cheap.

An earnings multiple in the mid to high single-digits is the norm for that group, at least ever since the Great Financial Crisis. Sometimes they hit a double-digit PE but it’s something like 10-13x, which is still 1/4th that of Tesla’s multiple right now.

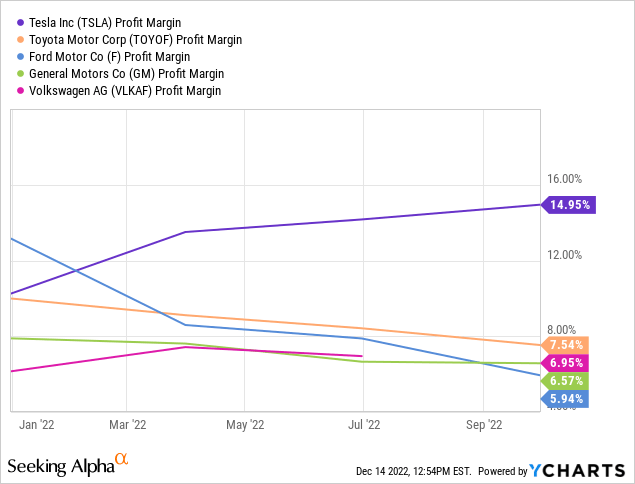

Then again, most automakers are burdened with tons of debt, pension obligations, and the mess of transitioning from ICE to EV manufacturing. Tesla isn’t. The margins demonstrate this:

The bearish rebuttal is that Tesla only has fat margins because of EV tax credits. You see since Tesla is all EV, they get them for free and can sell them to other automakers who can’t fulfill regulatory requirements, because they have to offset ICE production.

Well whether we like it or not, this taxpayer-funded green scheme is just how the system works. You know what they say, if you can’t beat ’em, join ’em. Rather than rant about this, you could reap the benefits by being a shareholder.

Valuing Tesla as something else

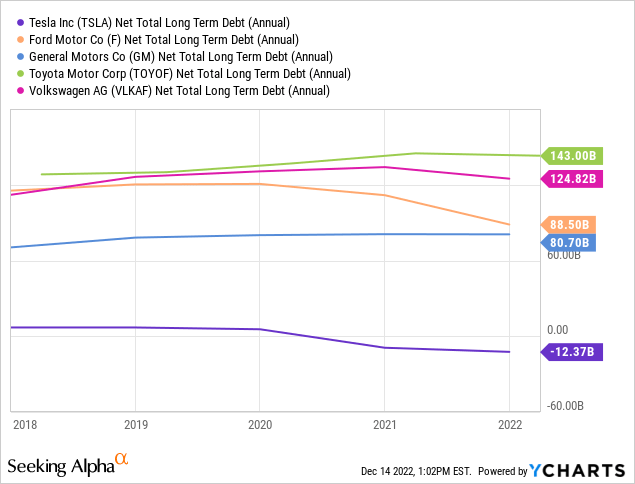

The primary bearish thesis for Tesla has always been that it is an automaker and should be valued as such. In earlier years, financial solvency was also an issue, but the bears know that today they have a solid balance sheet.

When you factor in the debt and consider enterprise value (rather than share price) to earnings, you realize Tesla is valued at least slightly closer to its peers than their PE values alone would suggest.

The bears are 100% right in that today, yes, the vast majority of Tesla’s revenue comes from product sales. No, I don’t mean solar roofs or backup batteries for your home. Rather, it’s almost entirely the sale of vehicles. FSD revenue is minimal in comparison. So yes, based on sales, Tesla is correctly categorized as being an automaker.

But what if it is something else? What if the future revenue mix really does mean that auto sales are only one piece of the pie?

The opinions on FSD and potential future revenue from it is covered ad nauseum so I won’t do the same here. Nor will I pretend to know, unlike many others who make projections.

Furthermore, I will not try and value Optimus (Tesla Bot), boats, planes, and other things which might come to fruition. I mean if we go down that road for any company, sure we can come up with wildly optimistic projections.

Nor will I give Elon Musk credit for his promises. I mean let’s be blunt here, he’s the master of overpromising and underdelivering. At least when it comes to timeframes. However once he does deliver, albeit very late, the results are often impressive.

For those reasons, I don’t know what the future holds for the company. What I do know though is that as a value investor, the stock is finally looking interesting. It has grown to become a company with real revenue and earnings that one can derive a valuation from.

Consensus earnings estimates (Seeking Alpha)

Tesla’s other bets are not being valued as wildly and as such, I don’t mind paying some premium knowing that given the mad genius of Musk, they will probably impress us, eventually.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. This article is general information and for entertainment purposes only. It should not be construed as being investment advice. Please do you own due diligence regarding any security directly or indirectly mentioned in this article. You should also seek advice from a financial advisor before making any investment decisions. A Buy, Sell, or Hold rating in this article does not constitute a Buy, Sell, or Hold recommendation.