Summary:

- The airline industry is massively undervalued and many investors start to take a look at which company could be the best choice for the upcoming years.

- Both American Airlines and Southwest Airlines reported record second quarterly earnings.

- All the signs point to one direction: the industry is recovering from the pandemic; profits return and previously accumulated debts are shrinking.

- Only one question remains: which is the better choice AAL or LUV?

gremlin

Investment Thesis

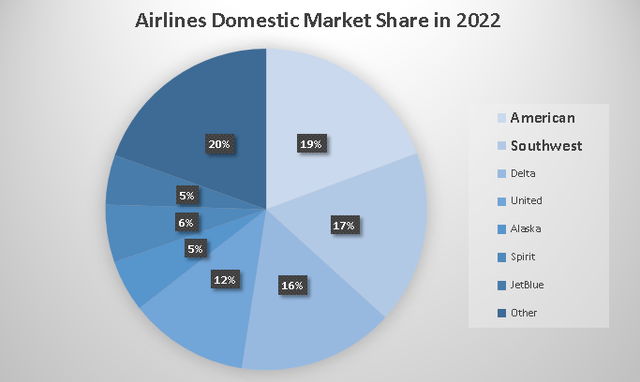

The airline industry has been showing great signs of recovery despite the general fears of recession and economic slowdown. American Airlines Group Inc. (NASDAQ:AAL) and Southwest Airlines Co. (NYSE:LUV) are dominating the airline industry with 19.3% and 17.4% market share in 2022. They are the current leaders in the U.S. by domestic market share and both of them reported record second-quarter earnings. However, I believe one of these companies has greater potential in the long term and will be able to show a more significant increase in share prices in the next 2-3 years.

The financial position of American Airlines vs. Southwest Airlines

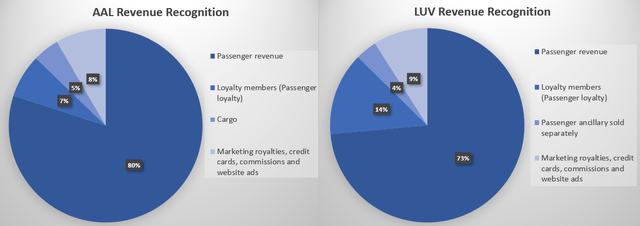

Both AAL and LUV recognize their revenue from 4 major sources. Passenger revenue is responsible for the lion’s share of their operating income (80% vs.73%). The only major difference is that AAL has a cargo revenue source that LUV does not have so American airline’s portfolio is a bit more diverse. Investors can see the same diversification in terms of destinations and international flights.

The chart is created by the author. All the figures are from the companies’ financial statement.

LUV recognizes 93% of its income from domestic flights and only 7% comes from international destinations while AAL is traditionally more focused on international flights. 84% of their revenue comes from domestic flights and 16% comes from Atlantic-Latin America-Pacific flights. That is why after the lockdown eased in 2021 Southwest Airlines’ stock could have recovered faster because domestic travel rebounded much faster than international travel (also fewer restrictions were in place). International travel is still lagging and will not recover fully by 2025 according to expectations. At the same time, domestic travel spending will be only 5% behind 2019 numbers in 2022, and by 2023 the spending is expected to surpass pre-pandemic levels.

From sales, and revenue growth perspective AAL is leading the major airline carrier market and beating LUV. Its passenger revenue per available seat mile (13.93 cents) is 30% higher than Southwest’s 10.66 cents. AAL achieved the highest quarterly revenue in the company’s history, and its second-quarter schedule was more than 25% larger than its closest peer. But from a balance sheet perspective, things are remaining not too great for AAL for now and things are getting better for LUV. After the pandemic, AAL’s debt situation has been getting only slightly better despite the management’s plan to reduce the company’s debt by $15 billion by the end of 2025. The company has the most debt among its peers totaling more than $36 billion, (it is usually noted by many analysts) but keep in mind that AAL has the youngest fleet of the Big 4 U.S. airlines which is important during a recovery phase of the industry. The management can slow the company’s CAPEX and its fleet spending to reduce its debt without hurting its fleet and that is why I believe that the $15 billion debt reduction is likely to be successful in the upcoming years without any shareholder value destruction. In addition, at the end of the second quarter, the company had an almost $16 billion liquidity balance.

However, in terms of ratios, LUV wins. American’s quick ratio is 0.7 and its debt-to-equity ratio is -4.4 while Southwest’s quick ratio is 1.6 and its debt-to-equity ratio is 0.95. I also like to look at ROA measures because the airline industry’s primary assets, (planes) generate the bulk of its revenues, and thus why this metric is an appropriate profitability measure. In the last 12 months, AAL had a ROA of -2.8% while LUV had a ROA of 2.7%. This ROA metric will improve as the airline industry recovers, ticket spending, and traveler numbers return to pre-pandemic levels. The return on asset figures was between 2-3% pre-covid for AAL so there is much room for improvement. LUV had a higher return on assets figures averaging 7-9% pre-pandemic. It is partly due to LUV’s plane types. Southwest only owns Boeing 737s and no other aircraft type which saves unnecessary costs. Pilots do not need to be trained for other types and the same goes for mechanics. At this point, Southwest Airlines has a stronger balance sheet with less debt and can generate better returns than American Airlines. Yet, AAL is slightly more undervalued than LUV at the moment. Looking at a DCF model, AAL is approximately 48% below its fair value while LUV is only 38% below its fair valuation. I calculated a modest 4% growth rate due to high labor and fuel costs and with an EPS of 1.33 for AAL and 3.04 for LUV.

Future outlook

The future seems bright for both of the major carriers due to rising demand and rising ticket prices. U.S. domestic leisure travel spending will surpass pre-pandemic levels by the end of the year and total leisure spending will surpass pre-covid numbers by the end of next year. However, the recovery is not going to be as fast as some analysts have predicted before. Business travel spending is not expected to return to 2019 levels until 2027. The average domestic fare is expected to rise to approximately $350 and international fares to $800 for Thanksgiving, Christmas, and the holiday season.

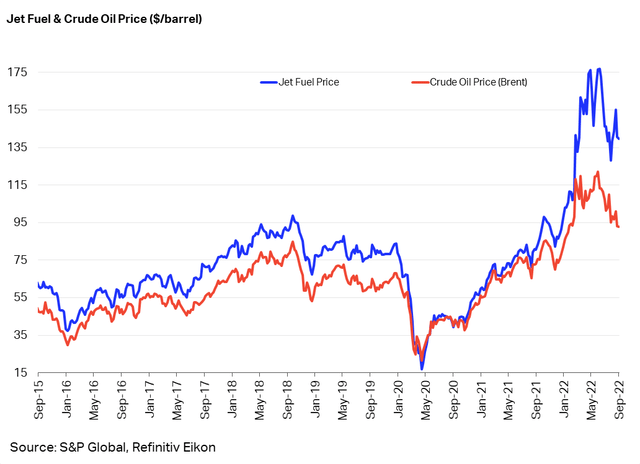

There are some risks associated with the airline industry in general and every major carrier faces almost the same issues. The majority of the costs any airline has to deal with are fuel prices and labor costs. In the last 6 months, every major carrier suffered from extremely high jet fuel prices and has been struggling to hire new employees after the layoffs during the pandemic. In the third quarter jet fuel prices started to moderate due to the crude oil price decline but the current price is still 50-60% higher than pre-pandemic prices. In addition, during the holidays jet fuel demand will pick up and the prices will follow this demand which will shrink airlines’ already laser thin profit margin. This will be especially bad for AAL and for those airlines that have an already high-interest expense record debt on top of other costs such as fuel and elevated labor costs.

LUV is facing some issues as well but I believe they are far less severe than AAL’s problems. Southwest will only receive 66 Boeing 737 Max aircraft in 2022 fewer than the originally planned 114. Southwest is planning to add 10 000 net employees by the end of the year but the management suggested that it might slow down hiring due to the economic slowdown. However, at the same time, the company is adding short-haul flights to capitalize on the growing demand for domestic business travelers.

Conclusion

The airline industry is slowly but gradually recovering from the pandemic and is expected to fully recover within the next years. This trend will help major carriers reduce their accumulated debt and increase their ROAs. However, there are significant differences among major airlines in terms of future shareholder returns. I believe that thanks to its lower debt profile, stronger balance sheet, and better pricing model Southwest Airlines will recover faster than American Airlines and that is why it is a better long-term asset for investors.

Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.