Summary:

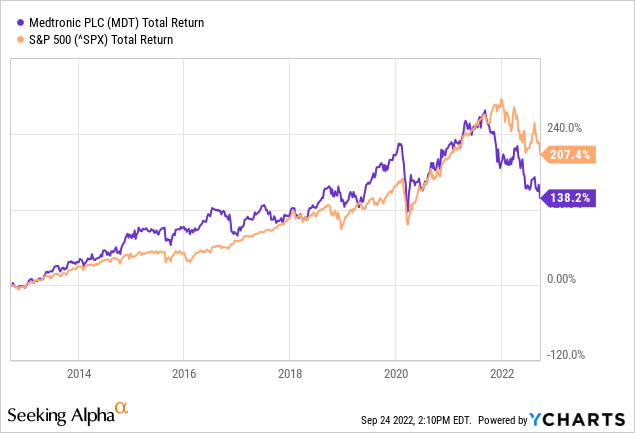

- Medtronic entered a bear market and has fallen more than the S&P 500 since the last quarter of 2021.

- Since I see few strong growth catalysts, I compare investing in Medtronic to investing in a 10-year US Treasury bond.

- The management is shareholder friendly by both paying dividends and buying back shares.

- Medtronic seems cheaply valued, but I’m waiting to buy until there are clear growth catalysts.

JHVEPhoto

Introduction

Medtronic (NYSE:MDT) has risen sharply over the past 10 years and the total return is comparable to that of the S&P 500. In the last quarter of 2021, the shares entered a bear market and has since fallen more than the S&P 500.

Medtronic’s PE ratio is 15, which is undervalued compared to the S&P 500. The reason for this is probably because sales have stagnated and earnings per share are expected to remain unchanged in 2023 as in 2022. According to Medtronic’s SA ticker page, 19 analysts have revised their expectations downwards.

Since I see few strong growth catalysts, I compare investing in Medtronic to investing in a 10-year US Treasury bond. From this I conclude that the 10-year government bond is currently more attractive. If it turns out that Medtronic has strong growth catalysts, I will consider a position in Medtronic.

Quarterly Earnings And Outlook

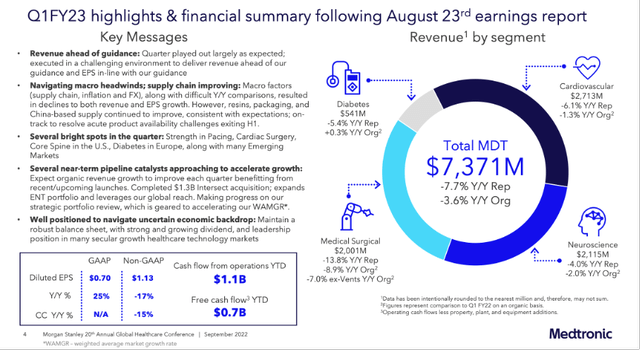

The quarterly results of 1Q23 did not look rosy. Revenue fell by 7.7%, of which 3.6% was organic. Non-GAAP EPS was down 17% year over year due to supply chain issues, higher costs due to inflation and the appreciation of the dollar.

1QFY23 highlights (Medtronic 1QFY23 Investor Presentation)

Some growth catalysts are the acquisition of Intersect, the expansion of their ENT portfolio and the international expansion of their activities.

In their FY23 guidance, they expect organic revenue growth of 4% to 5%, and an EPS guidance of $5.53 to $5.65 (0% to 1.8% growth).

Dividends And Share Repurchases

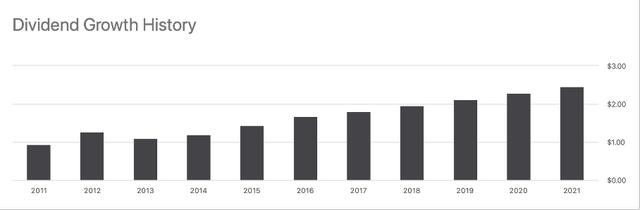

Medtronic’s dividend has been growing steadily for years at an average of 10% yoy over the past 10 years. Over the past 4 years, non-GAAP EPS has grown 24%, while the dividend has increased 36% over the same period.

The management is shareholder friendly by both paying dividends and buying back shares. As a result, each shareholder has more interest in Medtronic each year and the dividend per share grows faster than the earnings per share. Please note that Medtronic is based in Ireland, so a 25% dividend tax is levied. Currently, the gross dividend yield is 3.3%.

Dividend growth history (SA Medtronic Ticker Page)

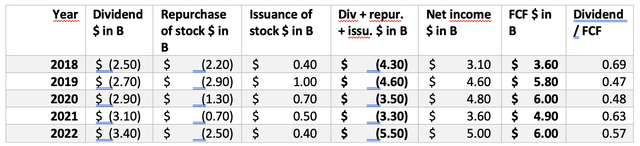

Share repurchases and dividends are paid through their free cash flows. In the table below I have added up the dividend, share repurchase and share issue per year. The table shows that the sum of these is less than the free cash flow (FCF) every year. Management spends their capital effectively and this is sustainable for the long term.

The dividend payout ratio, measured by dividing the dividend payout by the free cash flow, is currently 0.57. It can easily meet the dividend payments.

Medtronic’ Cash Flow Highlights (SEC and Author’s Own Calculations)

Valuation Metrics

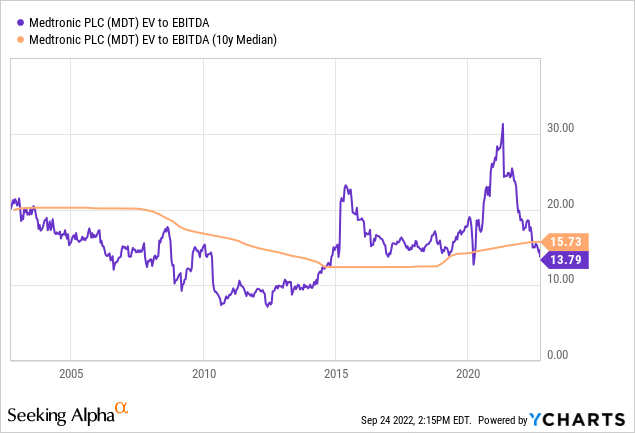

To map the valuation, I choose the EV/EBITDA ratio. This ratio also includes the debt and cash on the balance sheet and compares this to the EBITDA. Medtronic has historically been valued cheaply by this ratio.

Still, I see little growth potential in the share price, investors who buy the shares buy it for their dividends. The net dividend yield after tax is 2.5%.

Investors may be asking, would I rather buy Medtronic with a net dividend yield of 2.5%, growing on average 10% per year, or buy a safe 10-year US Treasury bond currently trading at 3.7%.

Because I see few growth catalysts at Medtronic and the dividend yield is lower than the yield of 10-year government bonds, I prefer to go for government bonds. Medtronic shares seem cheaply valued, but I’m waiting to buy until there are clear growth catalysts.

Conclusion

Medtronic has been in a bear market since the last quarter of 2021, and its share price has fallen more than the S&P 500. The recent quarterly figures did not look rosy. Sales declined year over year due to supply chain issues, higher costs due to inflation and the strong dollar. Despite the recent acquisition of Intersect, I see few growth catalysts. Medtronic management is shareholder friendly by paying a high dividend and buying back shares. A large part of their free cash flow is used for this. As a result, the dividend has risen sharply in recent years and the gross dividend yield currently stands at 3.3%, of which 25% is still subject to Irish tax (2.5% dividend yield after tax). The dividend grew by an average of 10% per year. Investors can choose: buy Medtronic shares or buy a 10-year government bond that currently yields 3.7%. Since I see few growth catalysts in Medtronic, I prefer government bonds and put Medtronic on hold. If Medtronic shows strong growth with great growth catalysts, I will consider buying Medtronic.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.