Summary:

- After supporting the industry since the late 1990s, I have done an about-face and currently avoid the water utility segment except as part of a larger utility.

- Negative water trends include lack of affordability, huge investment needs, water as a human right, and Flint-like financial risks.

- Algonquin Power has ~20% of its regulated utility assets and ~10% of its corporate assets invested in water, providing exposure to water opportunities without putting the entire company at risk.

- I am not convinced pure water utility investors are receiving adequate compensation for the risks being taken.

bombermoon

Algonquin Power & Utilities (NYSE:AQN) is the only water utility in my portfolio of 14 utility sector selections. While I like the sector for its stability and income opportunities, I am not sure conventional water utility investors are being adequately rewarded for the unique risks associated with the potable water industry. I have done an about face on water investments, from recommending them as important investment trends in the late 1990s and in my two personal finance books published by McGraw Hill in 2000 and 2001 to my current position of avoiding the sector except as part of a larger utility. Algonquin Power fits the bill.

Adverse water issues are bubbling to the surface and should not be ignored by investors. In much of the US, 2022 will be the hottest temperatures on record leading to extreme drought in the West, shriveled crops, more intense wildfires, and substantially lower water reservoir levels. For some cities who own their municipal water districts, a lack of water could become both a fiscal and an environmental disaster in the making. Prolong droughts are threatening the creditworthiness of local governments as they struggle with the high costs of providing potable water to their ratepayers. While cities and utilities can withstand a year or two of drought conditions, the current shortage is producing water inventories at their lowest level in a generation – with no end in sight.

Negative trends for the water industry include:

Affordability – In 2020, Consumer Reports and the Guardian published a series of articles on the condition of the US water industry. According to the report, in 12 cities reviewed the combined price of water and sewage increased by an average of 80% between 2010 and 2018, with more than two-fifths of residents in some cities living in neighborhoods with “unaffordable” water bills. The threshold of “affordability” is considered at 4% of disposable monthly income. According to the study, in 2018, almost three out of every ten low-income residents lived in areas where the average water bill cost more than 12% of household income. It is also critical for water utility shareholders to appreciate the cost impacts of higher electric rates. The single largest operating cost, behind wages, is the cost of electricity to power pumps needed to maintain water pipe pressures and to move water from Point A to Point B. The same forces pushing up the cost of electricity for households is also negatively affecting the profitability of water utilities.

Investment – The US needs to invest between $110 billion and $130 billion a year until 2040 to replace aging and deteriorating water infrastructure and to improve water quality. According to a report by the American Society of Civil Engineers titled The Economic Benefits of Investing in Water Infrastructure found that in the US there is a water main break on average every 2 minutes. While the industry is currently investing tens of billions a year in infrastructure upgrades, it falls uncomfortably short of what is needed. For instance, the ASCME report total water infrastructure investment in 2019 amounted to a sizable $50 billion, but also created a capital investment shortfall of $60 to $80 billion in that year alone. While the numerous Congressional infrastructure spending bill fund additional $50+ billion in investment spread out over the next few years for the replacement of thousands of lead service pipes from the street to the meter and replacement of municipal water mains, the total capital allocated for improving our nation’s water infrastructure remains truly just a drop in the bucket.

Water as a Human Right – There is a growing popular notion that availability of potable water is a “human right”. Unlike other utility services of natural gas/heat and electricity, water is a basic need for survival. Food, water, clothing, sleep, and shelter are the bare necessities for human existence. This has led the UN to declare access to water and sanitation to be a “human right” whereby citizens have the right to demand affordable water supplies and governments have the obligation to provide such. Within the US, if the political effort for a “human rights” approach to accessible and affordable water begins to take root, both public and private water utilities could come under regulatory pressure to reduce prices. A decline in profitability will restrict the availability of investments to make the necessary upgrades outlined above.

Flint-like risks – All water utility investors should be fully appreciative of the 2014 Flint Michigan water crisis. Through a series of management missteps, the Flint Municipal Water District failed to continue adding anti-corrosive agents to their water supply, which caused substantial lead leaching into the potable water supply of thousands of Flint residents. While still not totally litigated, the city, state and Feds have agreed to pay over $685 million to water users to settle class action lawsuits. To put this agreement dollars into perspective, even the proposed incomplete settlement represents between 23% and 200% of the market capitalization of all but the top two investor-owned traditional water utilities.

Jackson, Mississippi water issues have been in the news recently. I fully expect similar lawsuits to arise, and the municipal, state, and federal agencies will again cough up hundreds of millions of dollars to settle these cases. Last March, before the flood-induced issues of the past several weeks, residents filed suit against the city and state for actions which led to exposure to toxic lead and violated local children’s 14th Amendment right of equal protection. Traditional water utility investors should follow this case closely and determine if their water utility selection could survive a similar onslaught of legal cases.

In Dec 2020, I penned a SA article titled The Growing Risk for Regulated Water Investors which outlined these risks in more detail and poses the question: Are water utility investors getting paid for the added risks to their industry? I think not. Hence, I own only one utility offering water services – Algonquin Power – with no intention of reentering the industry anytime soon.

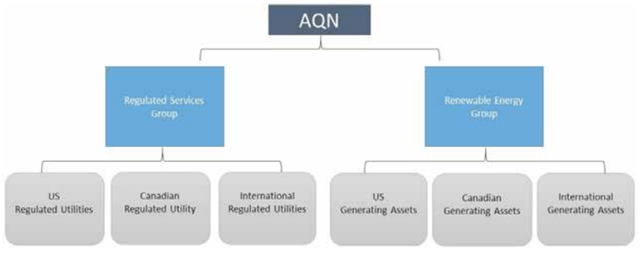

Algonquin Power operates several subsidiaries. The corporate structure is outlined in the 2nd qtr. 2022 investor presentation.

Algonquin Power Corporate Structure (2nd Qtr 2022 Investor Presentation)

AQN’s water business lies in its US Regulated Services and falls under the brand name Liberty Water Utilities. Regulated services include Liberty Electric serving 307,000 electrical connections, Liberty Natural Gas serving 370,000 customer connections and Liberty Water serving 552,000 customers. Annualized YTD June 2022 revenues should translate to $746 million for Electric, $402 million for Natural Gas, and $324 million for Water.

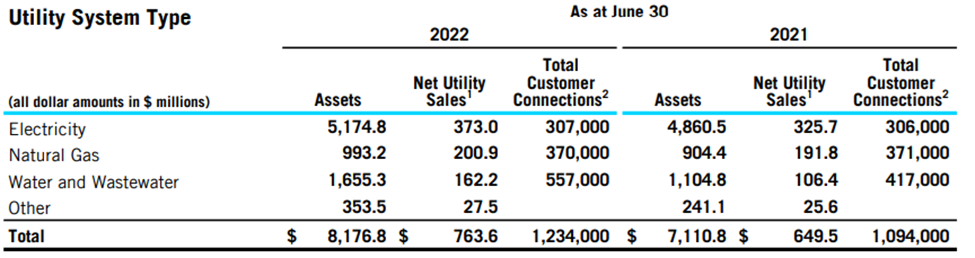

Also in the 2 nd Qtr 2022 presentation is a recap of the assets, YTD revenues and total customers as of June 30. These are listed below:

AQN Regulated Financial Results YTD 6/22 (AQN Investor Presentation)

On Jan 1, 2022, AQN completed the Liberty NY Water acquisition from American Water Works (AWK) for a purchase price of approximately $608 million, adding 125,000 water customers and annual revenues of ~$120 million. Most of the Liberty NY customers live in Long Island, which is heavily populated by smaller towns and suburbs of NYC, with 98% of customers located in Nassau County.

AQN provides potable water distribution and wastewater services to customers in Arizona, Arkansas, California, Illinois, Missouri, New York, and Texas. In addition, AQN owns a 53% interest in ESSAL, a Chilean water and wastewater utility, serving 230,000 households in Chile. AQN’s regulated electrical distribution systems and generation assets and its regulated natural gas distribution systems operate in California, Georgia, Illinois, Iowa, Massachusetts, New Hampshire, Missouri, Kansas, Oklahoma, and Arkansas, as well as in Bermuda and the Canadian province of New Brunswick.

As most reader know, I am a strong advocate of reviewing specific state’s regulatory environment before investing in utilities. As the ultimate gatekeeper to utility profits, and especially with the current seismic shift in financing costs and ratepayer pricings, it will be increasingly critical for utility investors to appreciate the level of support historically demonstrated by specific state utility regulators. For multiple decades, Regulatory Research Associates, a service of S&P Global Market Intelligence (SPGI), has a rating system to evaluate specific state’s financial support of the utilities under their jurisdiction.

According to the Aug 2020 RRA publication, the states served by Liberty Water are not considered the most supportive. As an update to the linked map, Washington DC and North Carolina have been upgraded while Arizona has been downgraded to the lowest rating. According to the RRA, state regulators are listed as Above Average (1), Average (2), and Below Average (3), with each category segregated into the same designation. For example, Alabama is rated the highest state for regulatory support at 1-1, which translates to Above Average-Above Average, and Arizona as the lowest at 3-3, or Below Average-Below Average. Of the states serviced by Liberty Water, Arkansas and New York are rated 2-1 (Average-Above Average), California, Illinois, and Texas 2-2 (Average-Average), Missouri 2-3 (Average-Below Average), and Arizona 3-3 (Below Average-Below Average). Personally, I prefer my utilities to be in the Above Average major category (1-1 to 1-3), which include AL, FL, IA, GA, MI, PA, TN, WI, and NC. Most pure water utility peers have multi-state regulatory exposure, but there are also smaller water utilities that focus on a specific state such as California, Connecticut, or New Jersey. Overall, Algonquin’s Regulated Water segment operates in Average regulatory environments, which is a Neutral perspective as a water investment selection.

As shown, Liberty Water is a small, but growing, part of AQN regulated utility business. Liberty Water assets as of 6/22 of $1.6 billion represents 20% of AQN’s Regulated assets and 10% of total corporate assets. In light of the increasing industry-specific investment risks, AQN’s water exposure seems manageable.

I have owned AQN since 2007 and its restructuring following the Halloween Massacre of Canadian unit trust structured stocks in Oct 2006. Under the belief that AQN’s move to acquire a majority stake in Atlantica Sustainable Infrastructure plc (AY) in 2018 made it an unlikely acquisition candidate in the ongoing consolidation trend of US utility sector (preferably by another of my holding Emera Inc (OTCPK:EMRAF)), I pared down my decade-long holding of AQN. Seeing the error of my ways, I took a position in the Equity Units (AQNU) when first offered in June 2021.

It is important to understand the math behind collared equity units as these hybrid “preferred” stock terms are closer to a convertible preferred whereby on June 15, 2024, each share of AQNU will be exchanged for common shares of AQN, with the conversion ratio depending on the value of AQN on the day of conversion. Each $50 par value AQNU share will be exchanged for 3.33 shares of AQN if AQN trades at $15 or lower and 2.77 shares if AQN trades at $18 or higher. If AQN trades between $15 and $18, the conversion ratio is $50 par value divided by the AQN price. AQNU pays a coupon of 7.75% on a $50 par value, or $3.875 distribution annualized. The math I used in June 2021 was as follows: from June 2021 to June 2024, I will receive 10% more in dividends from AQNU than AQN. The added 10% income reduces the conversion lower price breakeven to $13.50 ($15 conversion price minus 10% income advantage). If the conversion price is at or above $13.50 in June 2024, but below $19.80 (same 10% income advantage), I am better off with AQNU. If AQN traded either below $13.50 or above $19.80, I would have been better off owning the common rather than buying AQNU at $50.

Fast forward to Sept 2022. With a $1 billion in equity dilution from the conversion of AQNU into AQN combined with the proposed acquisition of American Electric Power’s (AEP) Kentucky assets added to cost pressure from rising interest rates, AQN stock prices have declined quite substantially. AQN is currently trading at $12.50 and offers a $0.72 annual dividend, or 5.8% yield. AQNU trades at $41.26 with a $3.88 dividend, or a 9.4% yield. Over the next 2 years, AQNU will pay 7.2% more income than AQN and with AQNU trading at $41.26 and convertible into 3.33 shares of AQN, the conversion value of AQNU is $12.40, or approximately the same as the common. In total, I believe AQNU is a better investment vehicle if the goal is to own AQN in June 2024.

Of interest to AQN investors should be the long-term plan by management to deal with the legacy KY coal-powered generating assets. With the renewable energy expertise of management, AQN investors should look towards the Vistra (VST) approach to coal conversion. Vistra has announced a program to close 7 coal fired plants in Illinois and Ohio, but rather than abandoning the assets, VST will convert the property into a utility-sized solar powered facility with electricity storage on site. The advantage of this conversion is the ability to use the existing access to the grid and the lower investment needed to bring more renewable energy onto the grid. I think management has/will evaluate similar options for the legacy coal facilities AQN is purchasing from AEP.

The roll-up strategy of acquiring under-invested and troubled municipal water districts is still the main source of most water company’s growth plans, but as troubles continue to brew as outlined above, this could turn out to be a disastrous expansion strategy. Investors looking for exposure to the growing opportunities in the water industry are better off seeking lower-risk ancillary industry exposure. This would include water metering, pumps, and wastewater chemical industries. I am not sure the current meager dividends and high stock valuations based on p/e ratios are adequately rewarding pure water utility investors.

Due to the higher income, my portfolio has twice the value invested in AQNU than in AQN and I just entered a good-until-canceled order for more AQNU at a price of $39.95. A drop below $40 for AQNU should provide a good entry point to establish or increase exposure to AQN in 2024.

Disclosure: I/we have a beneficial long position in the shares of AQN, AQNU, EMRAF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.