Summary:

- We were mighty pleased to hear about Exxon Mobil’s latest update that called for earnings and cash flow from operations to double by 2027 compared to levels reached in 2019.

- In light of strengthening energy resource prices, we also like that Exxon Mobil expects to spend up to $50 billion buying back stock through 2024 (including $15 billion in 2022).

- Shares still look cheap on the basis of our fair value estimate, and its current forward estimated dividend yield of ~3.4% isn’t too shabby.

- What a great stock Exxon Mobil has been the past 12-18 months! We think there still may be room for shares to run.

zodebala

By Valuentum Analysts

2022 has not been kind to high-yield dividend investors, and it has been especially painful for those that fell into the equity REIT and mortgage REIT traps. Deteriorating REIT economics have pummeled the portfolios of many retirees, and those that bought high yield for high yield’s sake are regretting it now. Remember: A dividend is capital appreciation that otherwise would have been achieved had the company not paid a dividend. As a business owner — the owner of the stock — you already own the cash on the balance sheet that is used to pay the dividend before it’s paid.

One company that has bucked the high yield trend in 2022 has been Exxon Mobil (NYSE:XOM). During most of 2021, the energy giant was yielding a very juicy 6%+ dividend yield, and so far year-to-date, shares are up nearly 70% during 2022, on a price-only basis. Meanwhile, other high-yield dividend investors such as those investing in equity REITs and mortgage REITs are down huge so far this year, and as energy resource prices have bounced back considerably, REIT investors are finding out that society just doesn’t need as much office space and retail space as we thought we once did. Employees want to work from home, not in offices, and consumers want packages to show up at their doorstep, not go shopping at the mall.

We’ve been bullish on Exxon Mobil. (Image Source: Seeking Alpha)

When the time was ripe in 2021 and early 2022, we wrote a number of prescient articles on Exxon Mobil Seeking Alpha, and we hope that you may take a read of them. During this time, Exxon Mobil fit many of the things we were looking for in a Valuentum style stock, as our January 6, 2022, article noted. Shares looked cheap at the time, they were breaking out of a downtrend, and the company’s lofty dividend yield was simply too hard to pass up. Things continue to get better for Exxon Mobil, too, now that energy resource prices have firmed up and look to remain at levels that will allow it to continue to generate gobs and gobs of free cash flow.

On December 8, 2022, Exxon Mobil released its corporate plan through 2027. Earnings and cash flow from operations are expected to double by 2027 compared to levels reached in 2019, annual capital outlays will remain in the range of $20-$25 billion through 2027, while it expects to spend up to $50 billion buying back stock through 2024 (including $15 billion in 2022). The energy giant is also paying close attention to cost items and expects to deliver ~$9 billion in structural cost reductions by year-end 2023, again relative to 2019. Exxon has increased its dividend for 40 consecutive years.

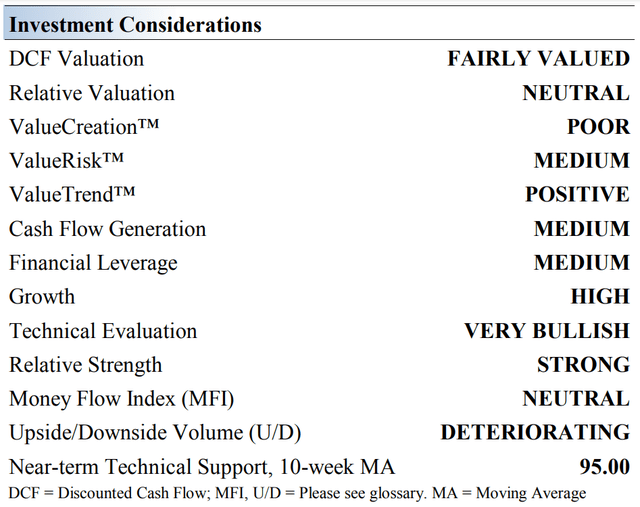

Exxon Mobil’s Key Investment Considerations

Investment Considerations (Image Source: Valuentum)

Exxon Mobil remains an integrated oil & gas company powerhouse. Its asset base includes exploration and production operations, pipelines, storage facilities, oil refineries, petrochemical plants, LNG export and import facilities, retail operations, and a sizable marketing division. Exxon Mobil had ~18.5 billion BOE of total proved reserves at the end of 2021.

Exxon Mobil is looking to revive its upstream production base by investing heavily in Guyana, the Permian Basin, and Brazil. It also owns economic interests in major growth developments in Kazakhstan. Exxon Mobil is exiting the Russian market given the Russia/Ukraine flare up.

In the wake of the recovering global energy complex, Exxon Mobil took advantage of its strong free cash flow generating abilities to aggressively pare down its net debt load in 2021. Now, Exxon Mobil is focused on buying back sizable chunks of its stock while continuing to invest in the business and further improve its cost structure.

Exxon Mobil carries a large net debt load which weighs negatively on its Dividend Cushion ratio (more on this later). If raw energy resources pricing were to remain subdued for an extended period during a future downturn in energy resource prices, it may potentially have to consider its dividend policy. That’s always a risk when it comes to commodity producers, and while we don’t think any cut is feasible anytime soon, it’s definitely a risk that we can’t completely ignore and worth mentioning. Exxon Mobil continued to make good on its dividend obligations during COVID-19, however, and even raised the payout more recently.

Exxon Mobil has seen its upstream production base dwindle over the past decade, largely due to meaningful natural decline rates. The company’s Guyana operations are top-tier and represent a major growth opportunity. The company, along with its partners, discovered vast amounts of crude oil off Guyana’s coast in 2015 and production operations had commenced by 2019.

Exxon Mobil is focused on improving its cost structure through work process simplification initiatives, the optimization of its logistics and supply chain operations, and through workforce reductions. Though it operates in a capital-intensive business and must contend with sizable capital expenditure requirements, management has placed a greater emphasis on better managing the company’s capital investment programs in recent years. The integrated nature of Exxon Mobil’s business model supports its cash flow outlook, as weakness at its upstream business can at times be offset by strength at its chemical and downstream businesses.

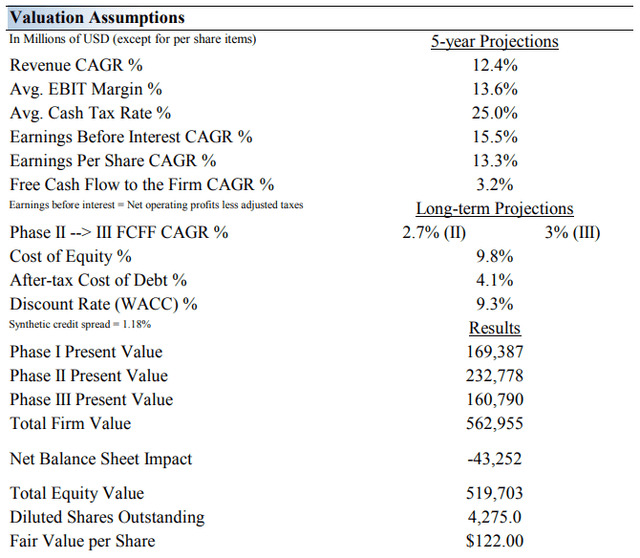

Exxon Mobil’s Cash Flow Based Intrinsic Value Estimate

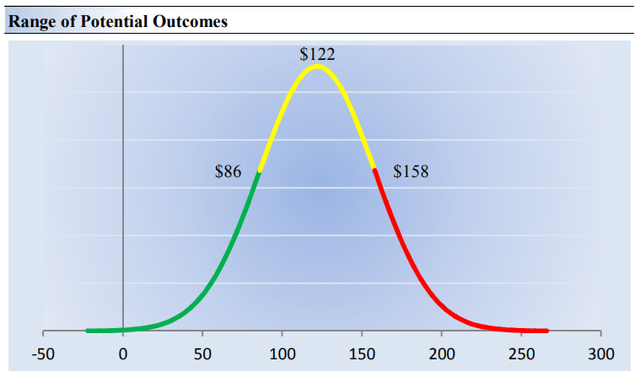

On the basis of our enterprise free cash flow process, we think Exxon Mobil is worth $122 per share with a fair value range of $86-$158 (shares are trading at ~$107 each at the time of this writing). The margin of safety around our fair value estimate is driven by the firm’s MEDIUM ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 12.4% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of -0.3%.

Our valuation model reflects a 5-year projected average operating margin of 13.6%, which is above Exxon Mobil’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 2.7% for the next 15 years and 3% in perpetuity. For Exxon Mobil, we use a 9.3% weighted average cost of capital to discount future free cash flows.

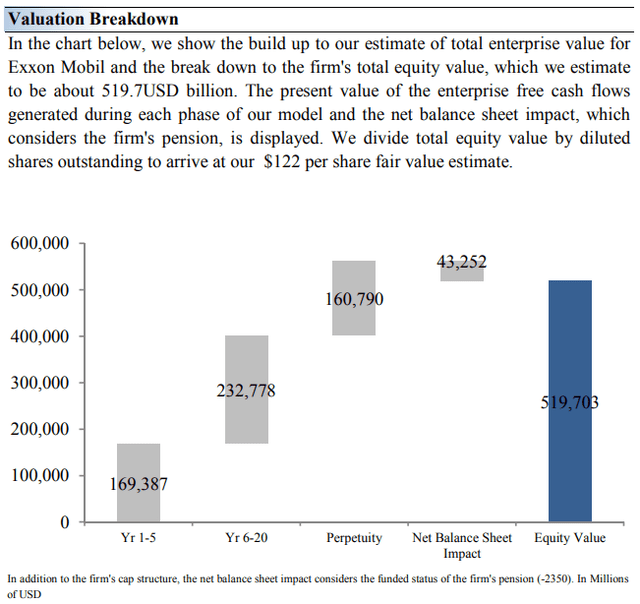

Valuation Assumptions (Image Source: Valuentum) Valuation Breakdown (Image Source: Valuentum)

Exxon Mobil’s Cash Flow Based Intrinsic Value

Range of Potential Outcomes (Image Source: Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Exxon Mobil’s fair value at about $122 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example).

After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Exxon Mobil.

We think the firm is attractive below $86 per share (the green line), but quite expensive above $158 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. We think there’s upside potential on the basis of our fair value estimate.

Exxon Mobil’s Dividend Health Analysis

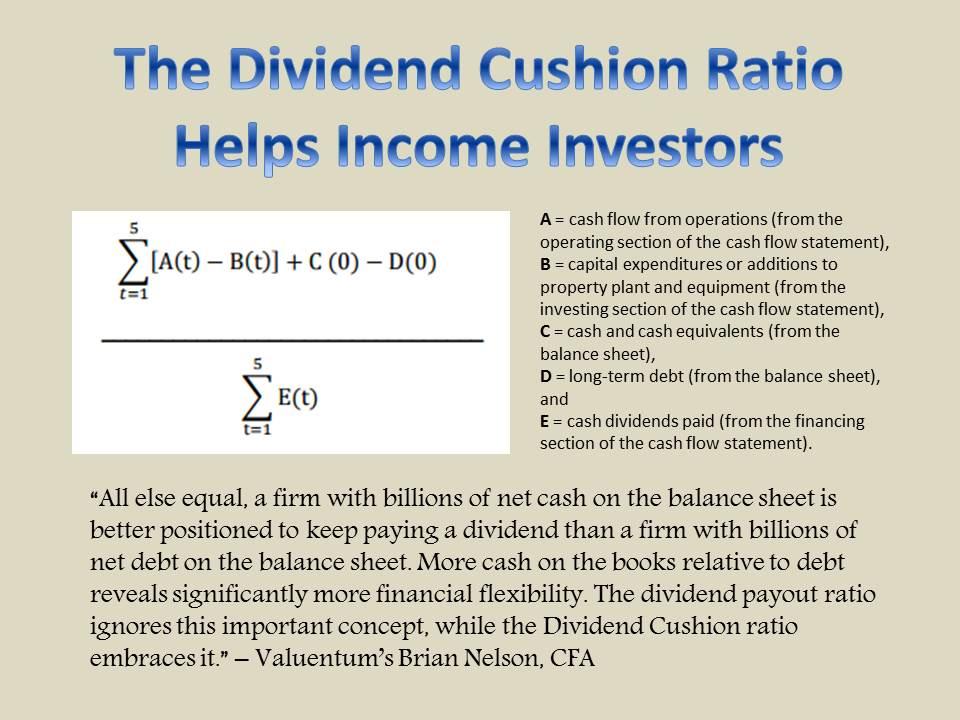

The Dividend Cushion ratio is one of the most powerful financial tools an income or dividend growth investor can use in conjunction with qualitative dividend analysis. The ratio is one-of-a-kind in that it is both free-cash-flow based and forward looking. Since its creation in 2012, the Dividend Cushion ratio has forewarned readers of approximately 50 dividend cuts. We estimate its efficacy at ~90%. (Image Source: Valuentum)

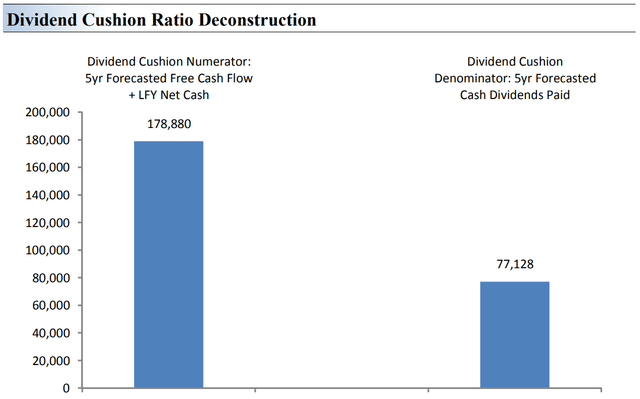

The Dividend Cushion Ratio Deconstruction, shown in the image below, reveals the numerator and denominator of the Dividend Cushion ratio. At the core, the larger the numerator, or the healthier a company’s balance sheet and future free cash flow generation, relative to the denominator, or a company’s cash dividend obligations, the more durable the dividend. In the context of the Dividend Cushion ratio, Exxon Mobil’s numerator is larger than its denominator suggesting strong dividend coverage in the future.

The Dividend Cushion Ratio Deconstruction image below puts sources of free cash in the context of financial obligations next to expected cash dividend payments over the next 5 years on a side-by-side comparison. Because the Dividend Cushion ratio and many of its components are forward-looking, our dividend evaluation may change upon subsequent updates as future forecasts are altered to reflect new information. Right now, Exxon Mobil’s dividend looks okay, but that could change in a hurry if energy resource prices don’t cooperate.

Dividend Cushion Ratio Deconstruction (Image Source: Valuentum)

Concluding Thoughts

We were mighty pleased to hear about Exxon Mobil’s latest update that called for earnings and cash flow from operations to double by 2027 compared to levels reached in 2019. In light of resilient energy resource prices, we also like that Exxon Mobil expects to spend up to $50 billion buying back stock through 2024 (including $15 billion in 2022), though we don’t want the company to be too aggressive with buybacks, as many are counting on that dividend payment for income these days. Shares still look cheap on the basis of our fair value estimate, and its current forward estimated dividend yield of ~3.4% isn’t too shabby. What a great stock Exxon Mobil has been the past 12-18 months!

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.