Summary:

- Google’s stock has fallen by around 13% since its last earnings report, but investors are missing the bigger picture.

- Google has two main competitive advantages to help it thrive in the era of generative AI – a rich data treasure trove and a multi-service platform.

- Nexus believes that the current valuation of Google stock is attractive and upgrades it to a ‘buy’.

vzphotos

Google’s (NASDAQ:GOOG) (NASDAQ:GOOGL) stock has gotten clobbered since its last earnings report, falling by around 13%. Google Cloud was the clear disappointment, which was perceived as the most promising area of AI-related growth. But Google Cloud only accounts for around one-tenth of total revenue. It is important not to miss the bigger picture, which is Google’s advertising business. Now despite the advertising segment performing well, which makes up the lion’s share of Google’s earnings, investors are likely still cautious of its future growth prospects amid the uncertainties surrounding generative AI. Though Google has certainly been making progress on this front, and its treasure trove of user data strongly positions the tech giant for the era of generative AI in our view. Despite the looming risks, Nexus believes a valuation of 18.5x forward earnings is an attractive price to pay for the stock. Nexus is upgrading Google stock to a ‘buy’.

In the previous article covering Google’s advertising prospects amid the shift to conversational search, we discussed how Google is making notable progress in designing ad solutions around its new generative AI-powered search tools. While at the same time there remained risks surrounding competitive pressures and regulatory hurdles. While these risks are still present, Google also has solid strengths to leverage in the era of generative AI, which the current valuation is not reflective of, creating a compelling entry point.

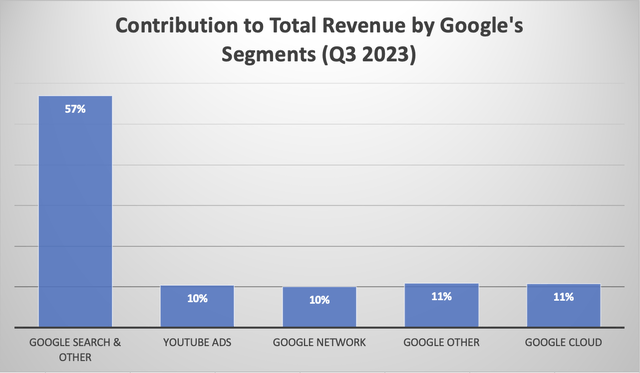

Google remains the largest digital advertising platform globally, with its market share projected to be 39% in 2023. Last quarter, Google Search & other contributed 57% to total revenue, making it the most important driver of Google’s financial performance.

Nexus, data from company filings

On the Q3 2023 Google Earnings Call, Chief Business Officer Philipp Schindler shared that:

“In Google Advertising, Search and Other, revenues grew 11% year-on-year, led by solid growth in the Retail vertical.”

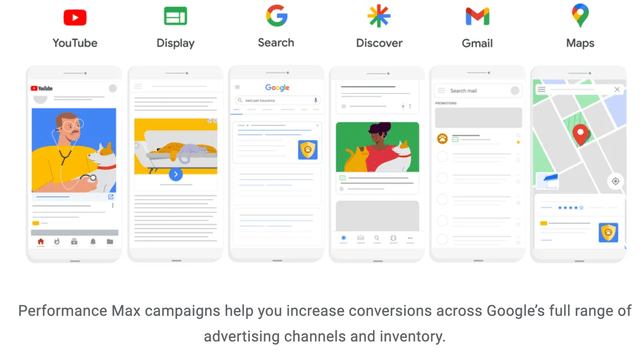

Google’s consumer-oriented services continue to be important advertising channels for retailers looking to sell goods and services, with Google’s Performance Max playing a crucial role in helping drive conversion rates higher (i.e. help merchants advertise their products in a way that leads to more sales).

Introduced in 2020, Performance Max is an AI-powered advertising campaign enabling advertisers to reach high-conversion audiences across Google’s various channels, such as Search, YouTube and Maps. AI is used to automatically display relevant ads at the right time based on real-time data regarding users’ behaviors, intentions, and context.

Chief Business Officer Philipp Schindler had mentioned on the Q1 2023 Google Earnings Call that “advertisers who use PMax are, on average, achieving over 18% more conversions at a similar CPA [Cost Per Action].”

Hence, Google is already successfully offering AI-powered advertising tools that yield success for retailers, and is well-positioned to leverage its powerful platform to continue winning in the era of generative AI.

Advertising in the Era of Generative AI

Amid the increased interest in conversational search, earlier this year Google introduced Search Generative Experience [SGE], and is slowly rolling it out across the globe while experimenting with ads. On the Q3 2023 earnings call, CEO Sundar Pichai highlighted:

“Direct user feedback has been positive with strong growth and adoption…People are finding ads helpful here as they provide useful options to take action and connect with businesses.”

People’s generally positive response to Google’s experimental ads in SGE is certainly encouraging, enabling investors to be confident that the search giant is moving in the right direction to effectively monetize its conversational search features. Pichai went onto say that:

“We’ll experiment with new formats native to SGE that use generative AI to create relevant high-quality ads customized to every step of the Search journey.”

Now there are various initiatives that Google is taking when it comes to generative AI-driven advertising to sustain ad revenue growth for shareholders.

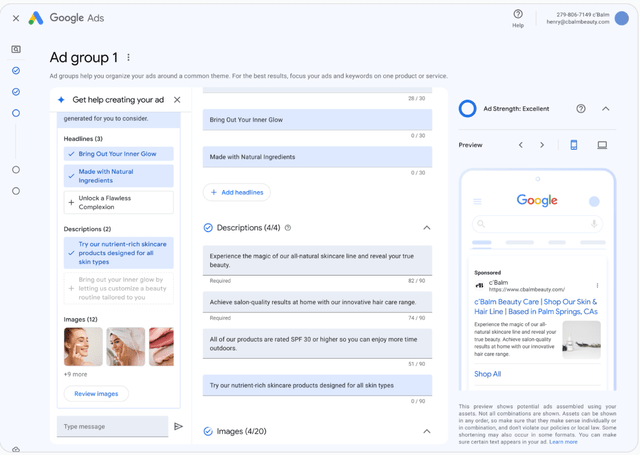

One of the main initiatives taken is introducing the ability for advertisers to set up ads in a conversational manner with Google ads (Google’s advertising platform). On the Q2 2023 Google earnings call, Philipp Schindler had revealed that this feature is “powered by a LLM [Large Language Model] tuned specifically from ads data to make campaign construction easier than ever”.

Conversational experience in Google Ads, example of ad creation for skincare products (Google)

Essentially, Google Ads has a built-in chatbot that can guide advertisers on how best to design their campaigns and ads based on years of Google’s ad performance data. This is extremely powerful, especially considering the massive database that Google is sitting on.

The search giant has years of experience building AI models that can understand user’s intent from search queries, and matching these queries with the most relevant ads to facilitate higher conversions for advertisers. Now combining this rich experience with Google’s deep expertise in Large Language Models and generative AI, the tech behemoth should be strongly positioned to continue matching the right consumers with the right ads at the right time in the era of conversational search.

Therefore, this conversational experience in Google Ads assisting advertisers in the campaign set up process should enable Google to drive conversion rates higher and costs per action even lower for advertisers, enabling the search giant to sustain its leadership in the advertising industry.

Moreover, even if competitors try to replicate such AI-powered tools, Google’s ad solutions are likely to be more powerful simply given the breadth and depth of data it holds for training, inferencing and deploying such AI models, thanks to its dominance in search for so many years. Hence, Google investors can be confident that the tech giant is well-positioned to sustain its largest profit-driver.

Furthermore, Google has also introduced ‘automatically created assets’, generating product descriptions and headlines for ads that better match the phrases that users used in their queries right in that moment.

Example of automatically created product descriptions and headlines based on user query (Google )

This spontaneity can be very valuable in the era of conversational search. If the AI-powered tools can indeed prove to generate higher-conversion ads in a timely and contextually opportunistic manner, it can induce advertisers to spend more ad dollars on Google, conducive to advertising revenue and profit growth for shareholders.

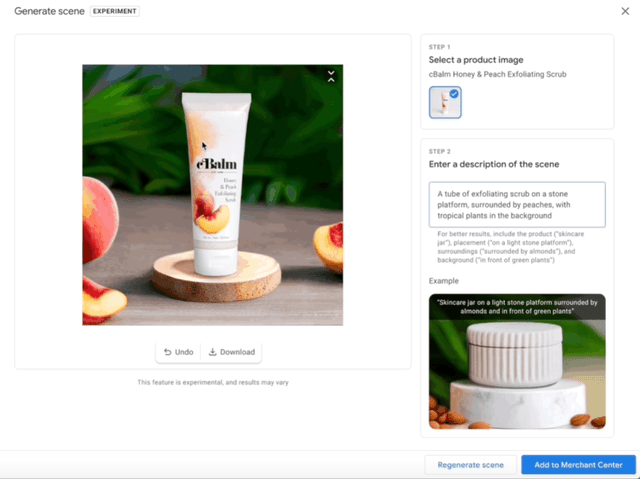

Additionally, earlier this year Google also launched Product Studio, which leverages the power of generative AI to create product marketing images simply through instructional prompts.

Though the opportunity does not stop there. Similar to how Google seeks to automate the generation of product headlines/ descriptions to match users’ queries in real-time through ‘automatically created assets’, Nexus expects Google to extend these auto-generation capabilities to product imagery as well to match users’ preferences. So in other words, if a user has described a product in a certain way during their conversation through SGE, Google should be able to use those details to create an image in real-time that presents an advertisers’ product in a way that is more conducive to conversion.

Moreover, on top of the user’s description of the product they are looking for during the conversation, Google also holds an enormous amount of data on each user through its extensive suite of applications. For instance, the search giant knows what type of content the user likes to watch on YouTube, and what kind of places the user frequently visits or likes to explore through Google Maps activity. Google can indeed leverage this data to automatically create even more enticing product imagery and descriptions in a way that is conducive to higher conversions.

Furthermore, Google has also introduced the ability for SGE users to generate images of what they are looking for using descriptive prompts, which can enable Google to better connect customers with the right products & merchants, and potentially even give rise to new forms of monetization avenues, such as charging merchants commission fees for each sale facilitated through SGE in this manner.

The point is, Google is very likely to remain an attractive avenue for commercial activity in the era of generative AI. The generative AI-driven opportunities for Google are plentiful thanks to its rich data treasure trove and extensive platform reach, enabling it to sustain its advertising market leadership.

Google Stock Risks

New rising competition: While Google’s generative AI-advancements and data-rich moat position it well to remain a powerful advertising platform, generative AI will inevitably give rise to new rivals with modernized forms of creative search experiences, akin to how the rise of TikTok threatened YouTube.

While Google is strongly positioned to fight back against competitive threats, there is no guarantee that Google will offer the most exciting search/discovery experience in this new era. If consumers end up spending more time on other generative AI-powered applications than Google, then this may undermine the value proposition of its ad solutions, erode market share in the advertising space, and hurt profitability for shareholders.

Regulatory hurdles: Google often finds itself under regulatory scrutiny for various anti-competitive business practices, though the heat has turned up on Google lately. Regulators are currently investigating the deal between Google and Apple, whereby the search giant reportedly paid the iPhone-maker “between $18B and $20B” annually to remain the default search engine on the Safari web browser, allegedly suppressing rival search engines.

The outcome of this antitrust case still remains to be seen, but it could indeed entail restrictions on Google’s business practices at a time when competition is likely to intensify amid the generative AI-revolution, again challenging Google’s market share and profit growth going forward.

Is Google Stock a buy?

Google Advertising remains the most important revenue and profit driver for the tech giant. Despite the looming recession, demand for Google’s ad solutions was strong in Q3 2023, growing by 11.3% for ‘Search’ and by 9.5% for ‘Google Advertising’ overall.

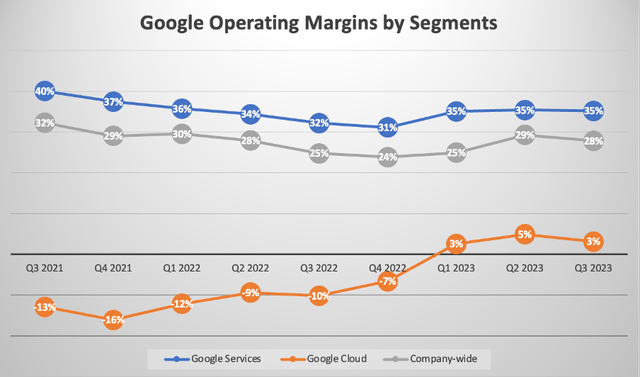

Alphabet does not disclose the profit margin for Google Advertising. Instead, it discloses the profit margin for Google Services, which combines Google Advertising with Google Other (includes YouTube Premium subscriptions, Google Play and Google hardware revenues).

Note that Google Advertising made up around 88% of Google Services revenue, and around 57% of total company-wide revenue last quarter. Google has managed to maintain a 35% operating margin for Google Services over the last few quarters.

Nexus, data from company filings

Nexus believes that Google is strongly positioned to continue driving advertising revenue and profit growth amid the evolution towards conversational search. Google has two main competitive advantages to help it thrive in the era of generative AI.

Firstly, its massive treasure of data relating to Search behaviors/ ad-conversion potency should enable it to build more powerful AI models and generative AI-powered advertising features relative to competitors. Secondly, Google runs a multi-service platform ranging from search, to YouTube entertainment to travel companions like Google Maps. As a result, this broadens the variety of places advertisers can reach consumers at the right moment through ad solutions like Performance Max. Additionally, Google’s suite of applications further bolsters the diverse set of data it is able to collect on its users, again conducive to more powerful ad targeting solutions.

Therefore, even in the face of intensifying competition, Nexus expects demand for Google’s ad solutions to remain strong in this era of generative AI, conducive to revenue and profit growth for shareholders.

There indeed looms the risk of Google losing advertising market share to new players, undermining the search giant’s growth prospects. Any hint of market share loss could weigh on stock price performance.

Though take into consideration also that the global market for digital advertising and marketing is expected to reach $1.5 trillion by 2030, implying a compounded annual growth rate of 13.9% between 2022 and 2030, according to Research And Markets. As per the aforementioned competitive strengths of Google, namely its data treasure and diverse suite of platform services, Google indeed remains strongly positioned to continue growing its own advertising revenue as the total addressable market grows larger.

Moreover, Google has plenty of levers to pull to respond to competitive threats. Just like how YouTube is evolving to fight back against TikTok, Nexus believes that Google will be able to fight back against new rivals through continuously advancing and adapting its own generative AI-powered services.

With the stock trading at 18.5x 2024 earnings, Nexus believes this is an attractive multiple to pay for a tech giant that can leverage its competitive strengths to sustain its leadership in the advertising market. According to Seeking Alpha’s Google stock valuation data, the 5-year historical average for Google’s forward PE ratio is 25.97x, and Nexus believes Google stock can trade closer to this 5-year average multiple as the market gains a better appreciation of Google’s growth prospects in the era of generative AI.

Nexus assigns a ‘buy’ rating to Google stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.