Summary:

- Intel reported strong Q3 earnings and raised its guidance outlook.

- Recent insider activities are dominated by buying transactions, suggesting confidence in the company’s future.

- To me, such confidence is well-placed.

- Its Q3 results provide further signs that its turnaround efforts are working effectively.

- Yet, the stock is still trading at heavily discounted multiples.

hapabapa

INTC Q3 highlights

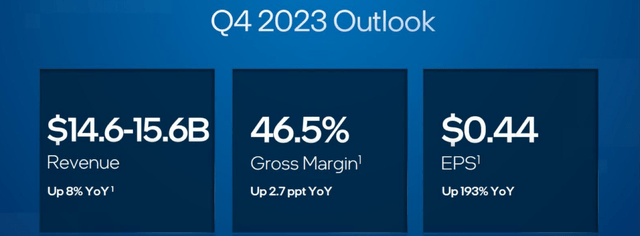

Intel (NASDAQ:INTC) just reported its 2023 Q3 earnings report last week. Overall, the Q3 earnings report was very positive. I saw some encouraging signs of a turnaround for the company. The company beat analyst expectations on revenue and EPS. Furthermore, Intel raised its Q4 revenue guidance to the $14.6 billion ~ $15.6 billion range (see the chart below), representing a robust 8% YoY improvement.

INTC 2023 Q3 earnings report

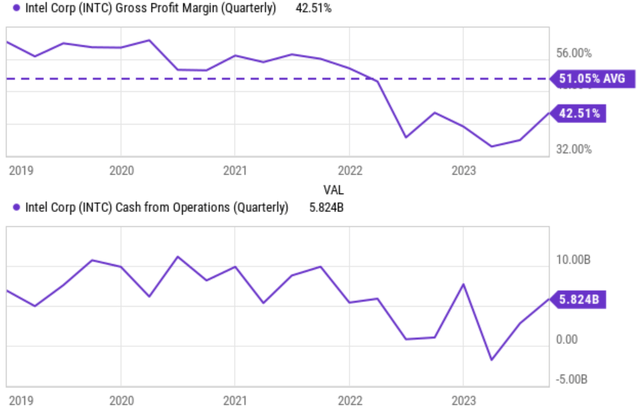

More importantly, both its gross and operating margins improved. Its gross margin improved to 45.8% in Q3 and its Q4 outlook is an even higher 46.5%. To put things under perspective, the chart below (top panel) shows its historical gross margin in the past five years.

As seen in the chart, INTC’s gross profit margin has been recovering rapidly over the past few quarters, rising from a bottom of ~34% in early 2023 to the current 45.8%. The current outlook level is still a bit lower than its long-term average of ~51%. But I read the recovery as a very positive sign, indicating the company’s turnaround plan is working.

More specifically, there are a few key efforts worth mentioning. The company has been putting in a strong effort to cut costs. This year alone, Intel plans to cut costs by $3 billion. Besides curbing the operation costs, I anticipate its investment in new manufacturing processes that are more efficient and less expensive to provide a fundamental edge to its profitability. In the meantime, I also view the improving margin as a sign of its pricing power.

Against this background, I will analyze its recent insider activities next.

Seeking Alpha

Insider activities

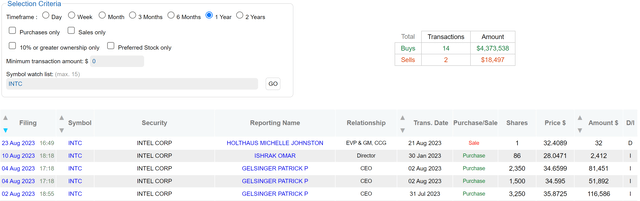

The next chart summarizes the insider activities on INTC stock in the past year. The activities have been completely dominated by buying activities. To wit, there were a total of 16 insider transactions and 14% of them were buying transactions. The buy transactions’ dominance is even more pronounced in terms of dollar amount. These buying transactions have an accumulated amount of more than $4.3M, in contrast, the selling totaled only $18.5k.

In the month of August alone, one of its directors (Omar Ishrak) and its CEO Pat Gelsinger made several purchases. The only one selling activity could as well just be a reporting glitch. As seen, Michelle Johnston (INTC’s EVP and GM of CCG) was reported to have sold 1 share on Aug. 23, 2023. As explained in my earlier article,

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. The reason is that selling activities can be triggered by a range of factors irrelevant to business fundamentals (such as divorce or buying a new house). In contrast, insider buying activities usually have only one explanation – the insiders think the stock is undervalued.

Next, I will explain why I think this is indeed the case. The fundamentals reviewed in the previous section certainly provide good reasons for insiders to be confident about the company’s future. The stock also is undervalued by a large margin.

Source: DataRoma.com

INTC is mispriced

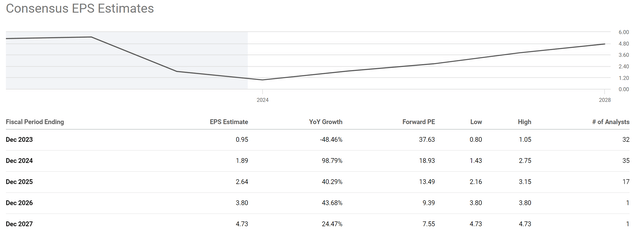

If you recall from the insider activity chart above, recent insider purchases were reported in a price range between $28~$35. Under its updated 2024 EPS forecast of $1.89 (see the next chart below), this price range translates into an implied FW P/E of around 15x to 18x. This range of P/E multiples is very compressed in my mind either in absolute or relative terms. Other chip stocks such as NVDA and AMD are currently trading at FWD P/E multiples of 38x and 35x, respectively, about 2x higher than INTC.

Looking further out, the multiples become simply absurd when the company’s future growth potential is factored in. As seen from the chart below, INTC’s forward P/E ratio is expected to decline into the single digits in ~3 years: 9.4x in 2026 and only 7.5x in 2027.

Seeking Alpha

In my view, INTC is priced at such a huge discount mainly due to the market’s misprice of its AI potential. It’s true that INTC is facing competition from other companies that also are developing AI products and services. However, INTC has been investing heavily in AI for several years, and thanks to its scale and expertise, it has the capability to develop new AI chips, software, and services in an integrated way. The company also is collaborating with other companies and organizations to develop AI applications in a variety of fields, including key growth areas such as healthcare, manufacturing, and transportation.

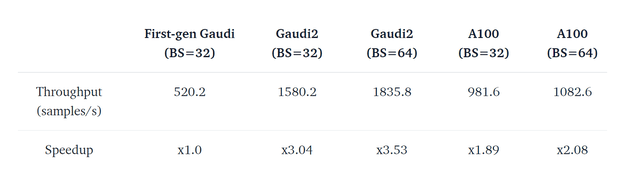

On the performance/cost ratios, INTC’s AI chips compare favorably as shown in benchmark studies to its key competitors. As an example, the chart below shows the test results of its Gaudi Gen 1, Gen 2 chips against NVDA’s flagship A100 AI chips. The tests benchmarked these chips’ performance in AI training with models of different scales and parameters.

Admittedly, the A100 chips indeed demonstrated superior speedup (in a range between 1.89x to 2.08x) compared to INTC’s Gen 1. Gen 2 was able to provide better speedup. I could not get a precise quote on Gaudi 2’s pricing. But based on the information that I was able to look up, I expect it to offer a much better performance/cost ratio than H100 and be a competitive offering in the AI market. Gelsinger’s following comments made during a recent ER echo the same message to my ears.

The surging demand for AI products and services is expanding the pipeline of business engagements for our accelerator products, which includes our Gaudi, Flex, and Max product lines. Our pipeline of opportunities through 2024 is rapidly increasing and is now over $1 billion and continuing to expand with Gaudi driving the lion’s share.

AI benchmark testing (huggingface.co)

Risks and Final Thoughts

INTC faces some risks. Some of these risks are common to the chip sector. Geopolitical risk is a main one common to the sector. As a notable example, China has become a significant market for both INTC and its competitors (such as NVDA). The trade tensions between the United States and China, especially if further escalated, represent a key risk to the sector.

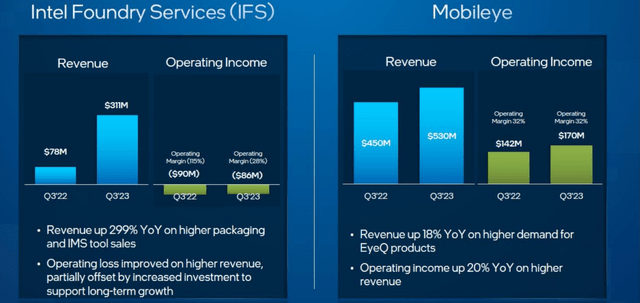

Some of the risks will impact INTC more than its competitors. INTC generates a significant portion of its revenue from the PC market compared to its competitors. However, the PC market is highly cyclical and could face a potential secular decline with the rise of mobile computing and data centers. INTC also is building up its own foundry segment. I view it as a positive catalyst and it’s one of my key considerations for owning its shares. However, there are considerable uncertainties involved in this initiative. Building a foundry operation is a capital-intensive undertaking and can take years and INTC is only at the early stage of this journey. Its IFS generated a negligible amount of revenue as of Q3 ($311M as seen in the chart below).

My conclusion is that the positive catalysts far outweigh the negative ones. As argued above, I think the negatives have been fully priced in its compressed multiple already. In the way I read it, the updated/upgraded outlook from its Q3 earnings report provides further signs that its turnaround efforts are working effectively. Finally, to me, the buying activities from the insiders serve as a reflection of its mispriced growth potential.

INTC 2023 Q3 earnings report

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.