Summary:

- Tilray reported Q2 revenue of $194 million, up 34% YoY but slightly below analyst estimates.

- The company continues to lose money and burn cash, with a large amount of debt sitting on its balance sheet.

- Should we get a major equity raise or federal US legalization of cannabis, the stock could be worth a look.

DNY59

On Tuesday morning, we received fiscal second quarter results from Canadian cannabis and beverage firm Tilray (NASDAQ:TLRY). The company was one of the biggest examples of the cannabis boom and bust a number back in 2018, seeing shares surge to $300 before crashing back to nearly zero. While the company is making progress to become a more complete business, it hasn’t made enough strides just yet to get my full blessing.

Back in October, I had a neutral rating on the stock after its first quarter results. While I argued that the valuation here was fair, the company was burning a bit of cash and heavily diluting shareholders to grow its top line. I was curious to see how a couple of acquisitions would fully integrate, and I was a bit worried about the large increase in short interest that we were seeing. I also needed to see progress to improve a weak balance sheet as cash burn was ongoing.

For Q2, Tilray reported revenue of $194 million. While this number was up 34% over the prior year period, the result came in a little shy of analyst estimates. Beverage alcohol net revenue increased 117% to $47 million in the second quarter, driven by the acquisition of multiple craft beer brands, while cannabis revenue was up 35%. The company remained in the #1 spot in the Canadian cannabis market, although its reported market share dipped sequentially from 13.4% to 12.5%.

One of my main issues with Tilray has been its cost structure. The company has been losing large amounts of money over the years, as it has spent a ton to grow the top line. In Q2, the company lost $2.7 million on an adjusted basis, compared to an adjusted profit of nearly $11 million in the prior year period. The GAAP loss did narrow by $20 million over that time, but still came in at nearly $50 million for the second quarter.

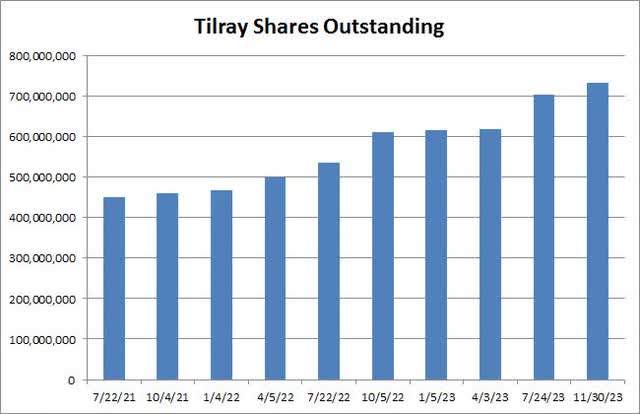

These large losses have led to a bit of cash burn over the years, and Tilray has also used a lot of stock for its acquisitions. The company burned about $36 million in the latest quarter, although its adjusted burn was only half of that. Tilray finished Q2 with about $260 million in cash and investments, but over $434 million of total debt on the balance sheet. As the chart below shows, dilution continues to pile up, but I also think another sizable equity raise is needed here to strengthen the balance sheet until the company can start generating some meaningful positive cash flow, which may be another year or two away. We’ve also seen short interest continue to hit new highs as the number of shares outstanding rises.

Tilray Shares Outstanding (Company Filings)

On a valuation front, Tilray currently trades for about 1.9 times its expected sales for the May 2025 fiscal year. That’s a bit of a premium to the valuation that peer Canopy Growth (CGC) goes for at 1.6 times, which is why I don’t see a tremendous amount of upside for Tilray just yet. Tilray does have a more favorable short term revenue growth profile, but a good chunk of that is just because it hasn’t lapped the anniversary of some of these acquisitions just yet.

At the moment, I continue to rate Tilray shares a hold. While the company is making progress to reduce losses, the numbers just aren’t there yet. The balance sheet remains strained with a bit of debt, a good chunk of which matures in the next year. I can’t recommend buying until we see these losses come down a bit more as well as a potential equity raise is completed to help bolster the company’s cash position. Since my previous article, the stock’s premium to Canopy has also widened quite a bit, adding to my neutrality.

The one item that could really change my opinion in a positive way in the near term would be the federal legalization of cannabis in the US. This has been a political talking point for several years now, and there are growing hopes we could be closer to legalization coming. Tilray does not currently generate any revenues in the US, but if approval comes, the company would use its expertise and distribution capabilities to become a US player. Not only would this be good for the revenue situation, but US legalization could also scare away a number of short sellers, which would be a positive catalyst. Should we get favorable news here, I think the stock could trade up to its average price target on the street of $2.65, which is about 20% upside from current levels.

In the end, Tilray announced an okay second quarter, but the results weren’t strong enough for me to recommend buying just yet. Revenues soared over the prior year period thanks to acquisitions, but overall growth fell short of street estimates. The company continues to lose large sums of money, and is burning through quite a bit of cash. I do think an equity raise is needed here to further lower the debt pile and strengthen the balance sheet, especially if Tilray needs to build up a US based cannabis business should we see federal legalization. Until we get some more of these major losses and ongoing dilution behind us, I will remain neutral on this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.