Summary:

- Behind Broadcom, Amazon remains the second-biggest holding in my portfolio.

- The tech giant’s revenue and diluted EPS climbed higher in the fourth quarter.

- Amazon possesses a net cash position that should keep growing.

- Even after the recent rally, the company’s shares could be substantially undervalued.

- Amazon could have a viable path to doubling in the next two or three years.

An Amazon delivery driver on their route. NurPhoto/NurPhoto via Getty Images

I don’t want to take time for granted. But since I’ll be turning 27 years old in April, probability dictates that time is on my side.

That’s why, at my age, I believe it’s prudent to have at least some allocation to growth stocks with seemingly unstoppable growth trends on their side. Five of my top 10 holdings are tech stocks.

That includes my largest holding, Broadcom (AVGO), my second-largest holding, Amazon (NASDAQ:AMZN), third-largest holding, Alphabet (GOOGL)(GOOG), ninth-largest holding, Microsoft (MSFT), and my 10th largest holding, Texas Instruments (TXN). Together, this quintet of tech stocks comprises 13.4% of my total portfolio value.

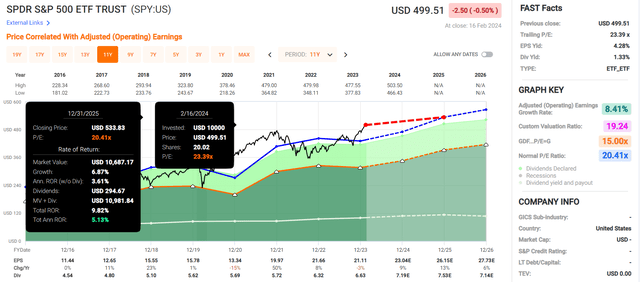

These companies, among others I plan on eventually owning, such as Meta Platforms (META), are so dominant that I would like to up this weighting to 30%+ of the portfolio in the coming years. After all, the SPDR S&P 500 ETF Trust (SPY) is weighted approximately 30% in tech. My conviction in the sector and resolve to more than double my weighting moving forward is the result of a simple observation. Barring total catastrophe, technology is bound to play an increasing role in the global economy.

One of the ways that I plan to bump up my technology weighting is to build out my position in Amazon this year. Since I initiated coverage in December, shares have surged 17% higher as the S&P 500 (SP500) rose by 9%.

In that time, the company also shared its financial results for the fourth quarter that ended Dec. 31. Today, I will be highlighting those results and Amazon’s valuation to support why I am maintaining my strong buy rating.

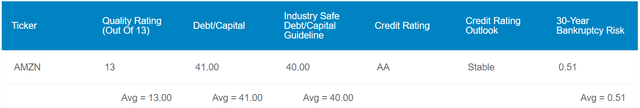

Dividend Kings Zen Research Terminal

Amazon’s 41% debt-to-capital ratio is about in line with the 40% industry-safe guidelines that have been set forth by major rating agencies. This is improved versus the 46% debt-to-capital ratio when I last covered the company.

Better yet, Amazon’s financial positioning is much better than the debt-to-capital ratio alone communicates. Later, I’ll expand on how the company’s net cash position and free cash flow generation earn the company an AA credit rating from S&P on a stable outlook. Based on data from rating agencies, this suggests the probability of Amazon defaulting on debt in the next 30 years is only 0.51%.

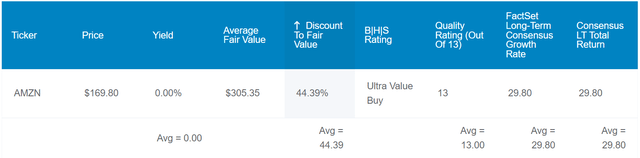

Dividend Kings Zen Research Terminal

Amazon’s fundamentals also don’t look to be fully appreciated by the market right now, either. Based on its 10-year and 25-year P/OCF and P/EBITDA ratios, the company’s shares could be worth $305 each. Relative to the $166 share price (as of February 20, 2024), that could mean Amazon stock is 46% undervalued.

Adjusting for a 20% margin of error on the current long-term growth consensus, here are the total returns that Amazon could produce at even a static valuation multiple over the coming 10 years:

- 0% yield + 23.8% FactSet Research annual growth consensus = 23.8% annual total return potential or a 746% 10-year cumulative total return versus the 10% annual total return potential of the S&P or a 159% 10-year cumulative total return

Another Strong Quarter

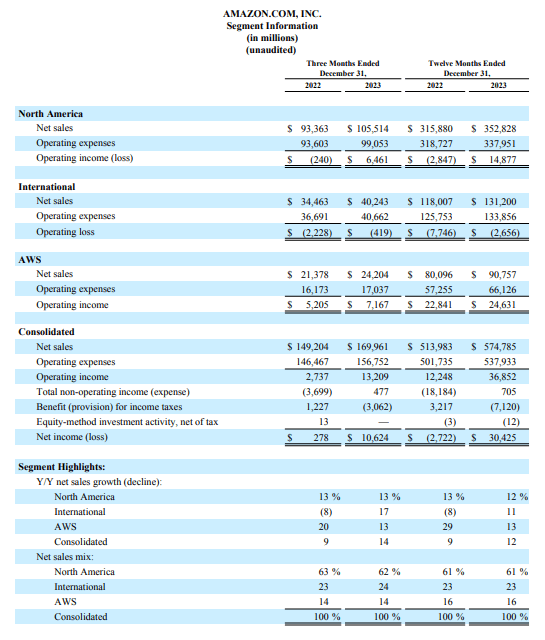

Amazon Q4 2023 Earnings Press Release

True to the form of a world-class business, Amazon churned out another quarter of satisfying results. The company’s total net sales climbed by 13.9% year-over-year to $170 billion during the fourth quarter. Put into perspective, this was $3.7 billion ahead of the analyst net sales consensus for the quarter.

Strength across the board is what played a role in the company’s tremendous topline growth. Amazon’s three segments each posted double-digit net sales growth: The International segment led the way at 16.8% year-over-year growth to $40.2 billion in net sales in the fourth quarter. AWS wasn’t far behind, recording 13.2% growth to $24.2 billion in net sales. North America’s 13% growth rate to $105.5 billion in net sales was the lowest percentage growth rate but accounted for the majority of Amazon’s overall net sales growth during the quarter.

Growth within the International and North America segments was driven by a record-breaking Black Friday and Cyber Monday 11-day event. The company sold over 1 billion items worldwide in this span, with over 500 million items in the U.S., mostly from small and medium-sized businesses. This massive influx of customers helped to add millions more Prime subscriptions to its subscriber base into the hundreds of millions.

As consumer engagement and Amazon Prime subscriptions continue to grow, the company’s advertising services should also only become more valuable over time.

Moving to AWS, the company’s growth was driven by volumes of bigger contracts that were recently inked. According to CEO Andy Jassy’s opening remarks during the Q4 2023 earnings call, $1.1 billion in incremental revenue was added over the third quarter alone. This was driven by recent deals with the likes of Salesforce (CRM), Amgen (AMGN), and Merck (MRK).

Transitioning to the bottom line, Amazon’s diluted EPS grew more than 33-fold to $1 for the fourth quarter. That was well above the analyst consensus of $0.80 per Seeking Alpha. Thanks to operational discipline, the company’s total operating expenses only grew by 7% in the quarter. This allowed Amazon’s net profit margin to expand from 0.2% in the year-ago period to 6.3% during the quarter.

Looking ahead to the first quarter of 2024, Amazon is anticipating $140.8 billion in net sales at the midpoint ($138 billion to $143.5 billion or 8% to 13% comparable growth). This would represent approximately 10.5% year-over-year growth (unless otherwise noted or hyperlinked, all info in this subhead as per Amazon’s Q4 2023 Earnings Press Release). Analysts anticipate the company will come in at the high end, at $142.5 billion, with 44 upward revisions in the last 90 days and one downward revision according to Seeking Alpha.

I’m inclined to agree that results will be near the high end of the guidance range provided by both the company and analysts. Amazon’s operating momentum throughout its businesses should translate into a reasonably high probability of such an outcome, in my opinion. Macroeconomically, consumers remain resilient. Also, the company keeps growing its engagement with consumers and adding more Prime subscribers. Lastly, the value proposition and name recognition of AWS is retaining customers and winning over new ones.

Becoming A Free Cash Flow Machine

As if Amazon’s recent operating results weren’t impressive enough, the company delivered record free cash flow to shareholders in 2023.

The tech giant’s free cash flow surged to $35.5 billion during the year. That’s adjusting for equipment finance leases and principal repayments of all other finance leases and financing obligations.

In absolute terms, this isn’t much for a company with a $1.8 trillion market capitalization. However, such an assessment misses the bigger picture in my view. That’s because this represents a massive improvement from both the $12.8 billion of negative free cash flow in 2022 and the prior record of $21.4 billion set in 2020.

Improved operating income and $10 billion less in capex versus 2022 per CFO Brian Olsavsky’s remarks during the Q4 2023 earnings call swung free cash flow back firmly into positive territory. On the earnings call, Olsavsky wouldn’t yet commit to what its capex will be in 2024. Given the trajectory of its operating cash flow in 2023 (it nearly doubled to $84.9 billion), I would be surprised if the company didn’t post another year of record free cash flow, though.

Turning to the balance sheet, this should bode well for Amazon. Closing out 2023 on Dec. 31, the company had $86.8 billion in cash and marketable securities on its balance sheet. Against its $58.3 billion long-term debt balance, that’s a net cash position of $28.5 billion.

For context, that’s better than the $2.9 billion net cash position at the end of 2022 (unless otherwise stated or hyperlinked, all details in this subhead were sourced from Amazon’s Q4 2023 Earnings Press Release and Amazon’s Q4 2020 Earnings Press Release). This indicates that Amazon’s already vigorous financial health is improving even further.

Risks To Consider

Amazon is a remarkable company, but it still faces risks.

One of the more notable risks that the company faces is nothing new to the tech sector. As technology plays a more influential role in the economy and our lives, there is bound to be more of a demand for consumer privacy protections. If substantive legislation is passed into law, it could take time for the likes of Amazon to adapt (pages 14-15 of 94 of Amazon’s 10-K filing). Additionally, if Amazon is found to be non-compliant with such regulations, it could be hit with materially significant fines. These scenarios could end up being a hit to the company’s fundamentals.

Another risk to Amazon is that even with its massive operating cash flows, the company is devoting mind-boggling resources to capex. The company’s dedication to improving the customer experience is admirable. However, this could come at the cost of efficiency if it ultimately opens up too many fulfillment networks (page 10 of 94 of Amazon’s 10-K filing). That could weigh on Amazon’s financial results.

Summary: Amazon Remains A No-Brainer Buy

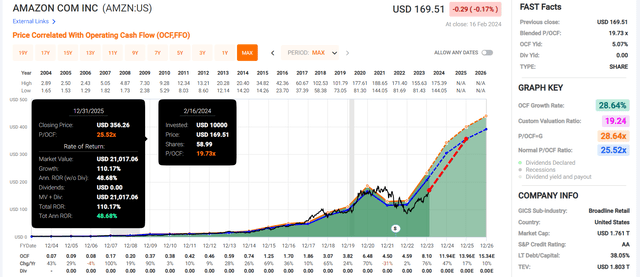

FAST Graphs, FactSet FAST Graphs, FactSet

For my money, I believe Amazon is one of the best businesses on the planet. Very few businesses can lay claim to dominance throughout their respective industries, an AA credit rating, and firmly double-digit growth potential.

It’s almost unbelievable to claim that a member of the 13-digit club could be underrated, but I think that’s the situation with Amazon. At the current 19.7 P/OCF ratio per FAST Graphs, the tech juggernaut is trading below the normal P/OCF ratio that it has been 25.5 throughout its history.

This is why Amazon could deliver 110% cumulative total returns through 2025 if it grows as expected and returns to its normal P/OCF ratio. In my opinion, that’s hardly unrealistic for a company with its fundamentals. If that came to pass, it would be roughly 11X the 10% cumulative total returns that are anticipated from SPY by the end of next year per FAST Graphs. For these reasons, I plan on buying more Amazon throughout this year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMGN, AMZN, AVGO, GOOGL, MRK, MSFT, TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.