Summary:

- Although META is trading at historically low valuations, I wouldn’t bet on it rebounding in 2023.

- The main concern is that it has lost more than $36 billion and counting betting on the metaverse, an idea that has potential but unclear commercial prospects.

- Meanwhile, net income has declined by more than 25% in the last 2 years and the company has taken on $10 billion in debt in its first ever bond issuance.

- Add to this the opportunity costs, including saving the $36 billion to instead acquire a metaverse company, or investing it in the core business, and you see the scale of the problem.

- While META is still a digital ad leader, it is facing increased competition and a host of regulatory issues, making the chances of a rebound in 2023 slim.

Alex Wong/Getty Images News

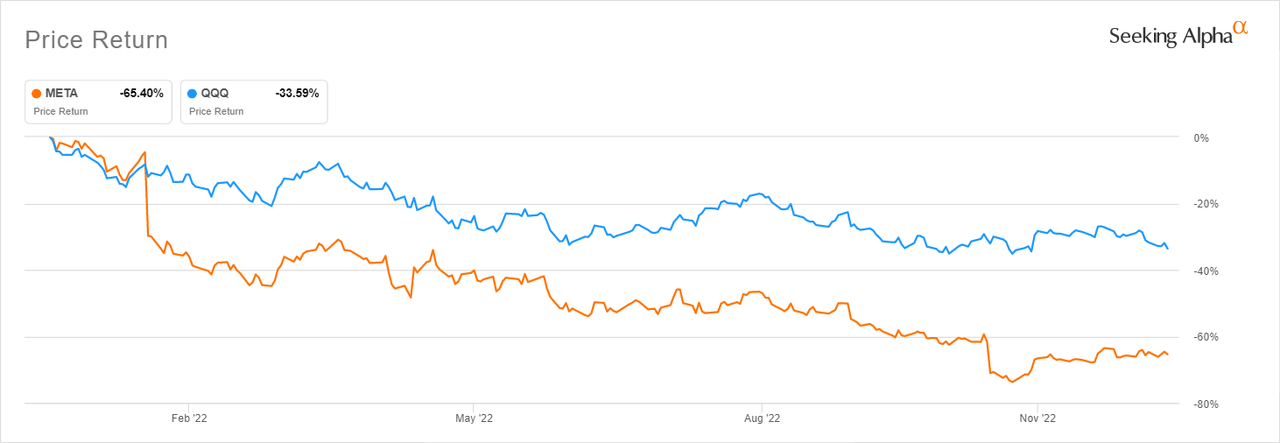

It has been a terrible year for the tech-heavy Nasdaq 100 (QQQ), which is down 33% YTD. Things are, however, markedly worse for Meta Platforms Inc (NASDAQ:META), which has declined 65% YTD – almost double the index’s loss.

META vs QQQ performance YTD (Seeking Alpha)

META’s significant underperformance vs the Nasdaq 100 is an indicator that there are underlying issues that have spooked investors. The main concern for investors in my opinion is the CEO Mark Zuckerberg’s stubborn insistence on investing billions in the metaverse, a futuristic idea whose commercial prospects are uncertain at the moment. The metaverse is supposed to make the internet more immersive through the use of virtual reality headsets and augmented reality glasses that give users a 3D experience.

While there are many bullish predictions about the metaverse’s long-term potential, including from the likes of JPMorgan (JPM), there are no internal or analyst projections of the amount of revenue META can generate from the idea, let alone when it can start meaningfully monetizing it. This makes it difficult to justify the billions of dollars that META has funneled into the flagship project in recent years.

Reality Labs is a money pit

The metaverse project is housed under META’s Reality Labs segment, which is distinct from the Family of Apps segment that houses Facebook, Instagram, Messenger and WhatsApp.

Reality Labs is currently incurring steep losses despite the billions of investments it has sucked up in recent years. META’s earnings reports indicate that, in 2019, the segment’s operating loss was $4.5 billion vs costs and expenses of $5 billion. In 2020, operating losses ballooned to $6.6 billion vs costs and expenses of $7.7 billion. The same trend continued in 2021 when operating losses reached $10.2 billion vs costs and expenses of $12.5 billion. For the first three quarters of 2022, operating losses for the segment reached $9.4 billion vs costs and expenses of $10.8 billion.

“We expect Reality Labs expenses will increase meaningfully again in 2023, with the biggest drivers of that being the launch of the next generation of our consumer Quest headset and hiring that has been done in 2022,” said Zuckerberg on the Q3 earnings call.

To make a bad situation worse, META is ramping up spending on the metaverse while Zuckerberg is still talking of the commercial opportunity being “years away.” This is worrisome for investors as technology is a rapidly evolving space where time is of the essence. It’s difficult to predict who survives and who gets disrupted over the next few months, let alone years. Putting an indefinite commercial timeline on a project sucking up billions of dollars today is not reassuring for investors.

There are a host of other unanswered questions as well considering the metaverse depends on expensive hardware to function. These include questions around supply chain and distribution, the pricing of the devices, margins, competition (many other tech companies have similarly bold ideas for the metaverse), and bandwidth and interoperability standards, among others.

Counting the opportunity cost

So far, META has lost around $36 billion and counting on Reality Labs. The opportunity cost is immense when you look at the impact this spending could have if it was allocated to other areas of META’s business or returned to shareholders.

I will look at the opportunity cost from three broad angles.

- How the company could have chased future growth opportunities in better ways

- How the company could have unlocked value for shareholders

- Why the company should have instead focused on making its core business more competitive.

When it comes to growth opportunities, META has historically made huge acquisitions to power its growth ambitions. The company spent $1 billion for Instagram in 2012, which was a good investment given how integral the app has become to the company’s overall performance today. Instagram reels, for example, had crossed the $1 billion annual revenue run-rate by Q2 this year, according to Zuckerberg’s statements on the latest earnings call.

META also spent $22 billion for WhatsApp in 2014, another acquisition that is paying off going by some of the engagement numbers touted by the company’s executives in recent earnings calls.

The question is: why couldn’t have META kept the $36 billion it spent on Reality Labs and waited for the opportune moment to venture into the metaverse space through an acquisition?

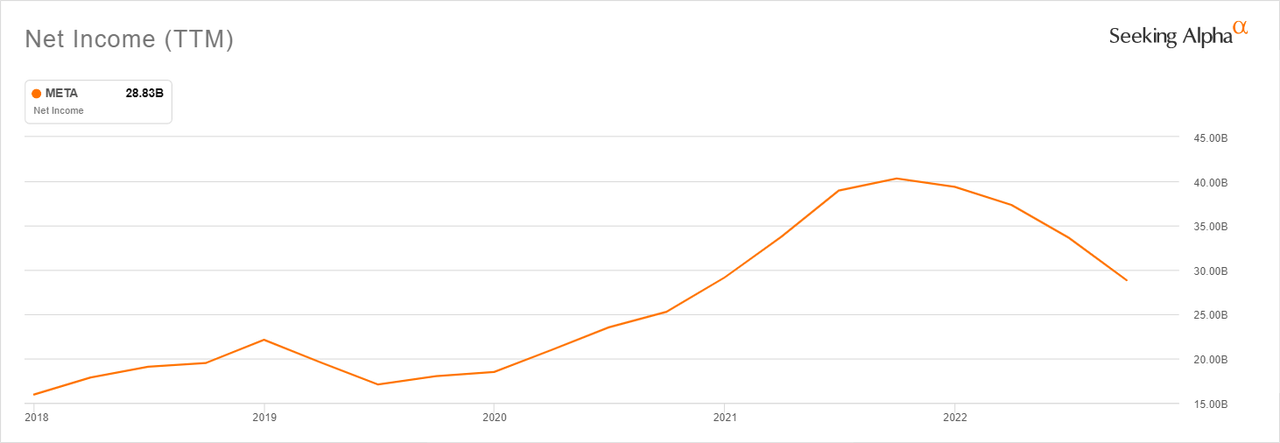

Keeping the $36 billion on its books would have also made a difference in terms of creating shareholder value. META’s fundamentals have deteriorated amid the huge spending on the metaverse. Its net income margin has been steadily declining. It currently has a net income margin of 24.41% vs a 5 year average of 33.23%. The impact? A 25% decline in net income from highs of $40 billion to $28.83 billion for the trailing twelve months.

META’s declining net income (Seeking Alpha)

META issued bonds for the first time in August 2022, raising $10 billion. While its balance sheet currently shows no signs of distress, it is telling that it is now resorting to debt when in the past it had no need of it. This is a signal to shareholders to stay on high alert as debt can sometimes be addictive. It would have been better if the company didn’t spend on the metaverse and instead initiated a dividend or accelerated buybacks. Instead, it is now issuing bonds while spending more on the metaverse, even as shareholders get no dividends despite the company being a mature profitable player.

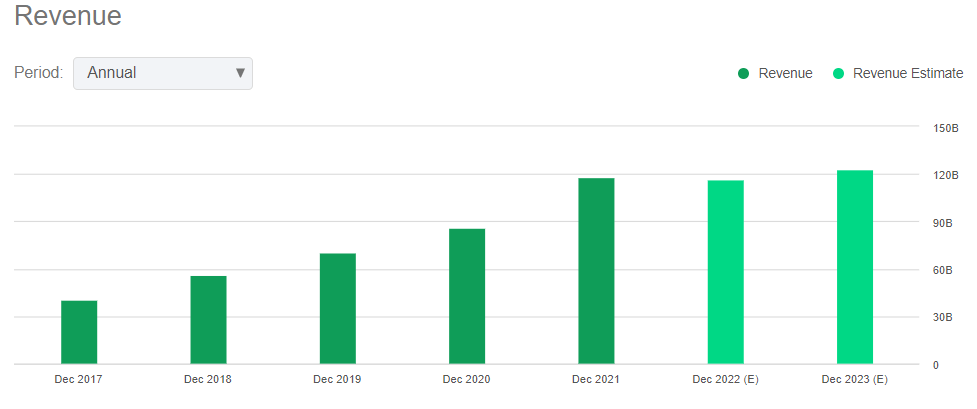

META could have also used the $36 billion it has spent on the metaverse in recent years to strengthen its competitive advantage in the digital ad business. The company, which derives approx. 98% of its revenue from advertising, has in recent years enjoyed strong topline growth thanks to the strength of its advertising proposition.

Revenues have grown in recent years (Seeking Alpha)

However, the rising popularity of platforms like TikTok means it has to toil harder to achieve growth in future, as users’ attention is an increasingly limited resource.

There’s basically an entire laundry list of issues that META needs to work through to maintain its edge in advertising, including working through anti-tracking changes in Apple’s (AAPL) iOS, a host of antitrust and privacy fines and probes in the US and EU, among others. With $36 billion and the CEO’s undivided attention, META would have better odds of managing these issues and ensuring competitiveness of its core business. META is now at a competitive disadvantage when you look at it from this angle.

It’s cheap for a reason

META is currently trading at a P/E (‘fwd’) of 13.18x vs. a 5-year average of 24.03x. This cheap valuation can be tempting for investors betting on a rebound in 2023. However, until the issue of the company’s spending on the metaverse is definitively addressed, I am of the opinion that META will struggle to reclaim its former glory. The cheap valuation in my opinion reflects this bearish view for 2023.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.