Summary:

- Rivian Automotive’s shares have plummeted due to slowing adoption rates in the electric vehicle market and fundamental issues.

- The company is facing challenges such as high production costs and undercapitalization.

- RIVN is the 7th largest player in the US electric vehicle market, with only 4.3% market share, but that won’t insulate it moving forward.

- Given how the industry is evolving, the company has little real chance of surviving in the long run.

jetcityimage/iStock Editorial via Getty Images

Ever since I learned about investing back in 2008, I have considered myself to be a value investor. However, I also have a big contrarian streak in my ideology. In many cases, these two investment philosophies go hand in hand. But every so often, they will disagree with one another on what constitutes an attractive opportunity. As and the example, we need only look at what’s going on in the electric vehicle market. Shares of companies in this space have been decimated for the most part. This is because adoption rates are slowing.

One company in this market that has historically been quite popular, but that is still a marginal player, is Rivian Automotive (NASDAQ:RIVN). Because of the concerns facing the industry, shares have taken quite a beating. Just recently, they hit a fresh 52-week low point. And at $10.10 apiece, as of this writing, they are currently down 64% from their 52-week-high mark. Naturally, the contrarian in me is highly interested in this opportunity. But the value investor in me is very concerned. Based on the data, the company is hemorrhaging cash. Yes, it is growing production capacity. But with production costs still so high, and weakness in the electric vehicle market, the picture is complicated at best. Add on top of these challenges that undercapitalized players in the industry will face moving forward, and I believe that this firm’s downside might not be over just yet. In fact, based on current market conditions, it very well could be facing an existential crisis.

A look at Rivian Automotive

Odds are, if you’re reading this article, you already know something about Rivian Automotive and what it does. But for those who are newcomers, it would be helpful to dig a bit into the company’s operations. Just like its much larger competitor Tesla (TSLA), Rivian Automotive is an American automotive manufacturer that’s focused on designing and selling electric vehicles and accessories. Historically speaking, Tesla’s emphasis has been on consumer vehicles. However, Rivian Automotive is a bit different. The business actually has an emphasis on both commercial and consumer vehicles.

On the consumer side of things, the company has the R1T and R1S models. The R1T is a two-row, five-passenger pickup truck, while the R1S is a three-row, seven-passenger sport utility vehicle, more commonly known as an SUV. Though not in production until 2026, the company does have another offering planned for production called the R2 platform. This will fall under the SUV market. The company also has a commercial vehicle known as the EDV, or Electric Delivery Van. This is being built in collaboration with Amazon (AMZN), the firm’s first commercial customer. For now, Amazon appears to be the only meaningful customer for this vehicle. But management does want to expand to other customers, as well as with different variants than their initial model. To date, the company has delivered over 10,000 EDVs, though Amazon has initially ordered 100,000. This gives Rivian Automotive significant additional backlog with which to grow.

Outside of the actual production and sale of consumer and commercial vehicles, the company is engaged in other activities. For instance, it provides various consumer services such as financing and leasing for its vehicles, insurance, software services, and more. The company is also building out its own network of fast chargers throughout parts of North America. This year, however, the company is going to make things easier on its customers because of a deal to gain integrated access to over 12,000 Tesla Superchargers. And lastly, the company also provides Commercial Services, including its own fleet operating system, with the objective of moving into financing, leasing, insurance, and a variety of other services as time goes on.

Dangerous growth

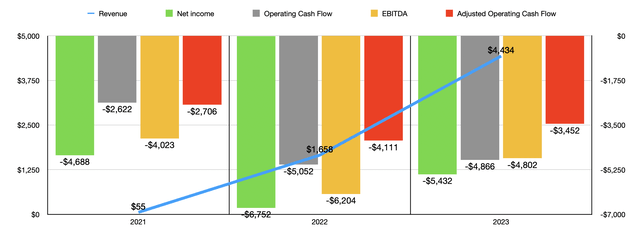

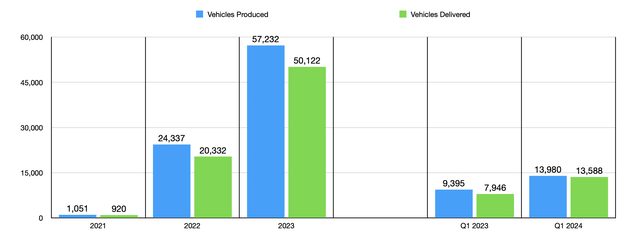

From a growth perspective, things have been really fantastic for shareholders. Revenue has gone from a paltry $55 million back in 2021 to $4.43 billion in 2023. This has been made possible by a surge in production. Back in 2021, the company produced 1,051 vehicles and delivered 920. By 2023, production had grown to 57,232 while deliveries had grown to 50,122. This kind of growth does not occur without significant investments. Fortunately, the company has a production facility in Illinois that is equipped to produce up to 150,000 vehicles per year if appropriately operated. This includes 85,000 vehicles per year for the consumer side of the equation, with the remaining 65,000 focused on the commercial side. However, the company is also planning to begin construction of an additional manufacturing facility in Georgia. If everything goes according to plan, this facility will be able to produce around 400,000 vehicles per year. But of course, management is taking this one step at a time. Construction will be broken up into two different phases, each one, making an annual production capacity of 200,000 vehicles possible.

While this growth has been fantastic, and it’s great to see investments made in further growth, there are some major problems that investors need to be aware of. For starters, while revenue has grown significantly, profits and cash flows have suffered. In each of the past three years, Rivian Automotive has seen net losses ranging between $4.69 billion and $6.75 billion. What’s really disconcerting here is the fact that the company’s cost of producing its goods from a cost of goods sold perspective is higher than the revenue it’s bringing in. The good news is that this picture is improving, as evidenced by the company’s gross profit margin improving from negative 845.5% in 2021 to negative 45.8% last year. But this still means that significant amounts of cash are still flowing from the company. You can see this in the chart above that shows operating cash flow, adjusted operating cash flow, and EBITDA.

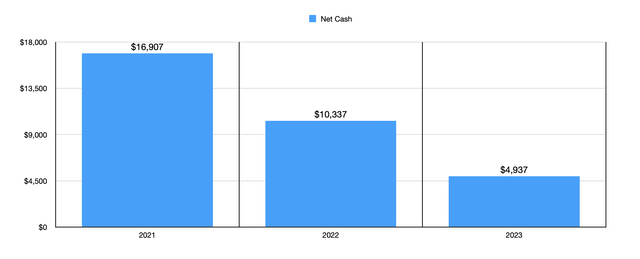

There are some other worrying signs besides just cash flows. If the company had plenty of cash on hand, I might feel differently. But over the past three years, the firm’s net debt picture has worsened materially. You see, back in 2021, the company ended the fiscal year with cash that exceeded debt, totaling $16.91 billion. By the end of last year, this had declined to $4.94 billion. The good news is that interest rates are expected to start coming down later this year. But they are still elevated, which makes it difficult for a company like this to raise additional capital. While $3.23 billion of the company’s $4.48 billion of gross debt has interest rates ranging between 3.8% and 4.9% because of their convertible nature, the business also has $1.25 billion in debt that bears an annual interest rate of 12%. For a company that’s hemorrhaging cash, raising additional debt will not be easy, and it will most certainly not be inexpensive. One could argue that the business could instead issue additional stock. This is certainly an option. But with how far shares have fallen, the end result would be rather painful dilution.

Unless shares rise from here or unless something else changes, it could be very difficult to raise additional capital. Of course, the company could always grow out of its problems. With growth comes scale, and with scale comes efficiencies. However, that doesn’t seem to be terribly likely to me. Management has not yet provided results for the first quarter of the 2024 fiscal year. But they did provide a count when it comes to both vehicles produced and vehicles delivered. For the first quarter of the year, the company produced 13,980 vehicles and delivered 13,588 of them. This was up from the 9,395 that were produced and the 7,946 that were delivered at the same time one year earlier. As impressive as this growth might seem, management took the opportunity to reaffirm guidance for only 57,000 vehicles being produced for all of this year. That will actually be slightly lower than the 57,232 produced in 2023. And as I mentioned already, production capacity is nearly triple this. So it’s not as though the company is constrained in its output.

While this is in line with prior forecasts, it does create some concern that the industry is seeing weakness. And this isn’t the only sign. Recently, Tesla revealed that, for the first quarter of the 2024 fiscal year, it produced around 433,000 cars and delivered 387,000. In addition to being down from the 495,000 and 484,000, respectively, seen in the final quarter of last year, the number delivered is down from the 422,000 that were delivered in the first quarter of 2023. Analysts were expecting deliveries to total 457,000. In other news, Ford Motor Company (F) came out with some interesting developments.

While announcing that it had seen electric vehicle sales jump 86% in the first quarter of 2024 compared to the same time last year, totaling 20,223 in all, the company also revealed that it is cutting its workforce at its Rouge EV plant by roughly one-third because of slower than expected demand growth. The company has also decided to delay approximately $12 billion in electric vehicle investments, even in the light of foreign companies growing their own market share in the U.S. market. It seems as though General Motors is also suffering. Unlike Ford, it actually saw a 20% year-over-year decline in the number of units sold. That brings its count for the most recent quarter down to 16,425. There are some other players in the space that are seeing growth. In the month of March, for instance, Hyundai saw its electric vehicle sales double, with the number of units sold for the first quarter as a whole climbing by 62% year over year.

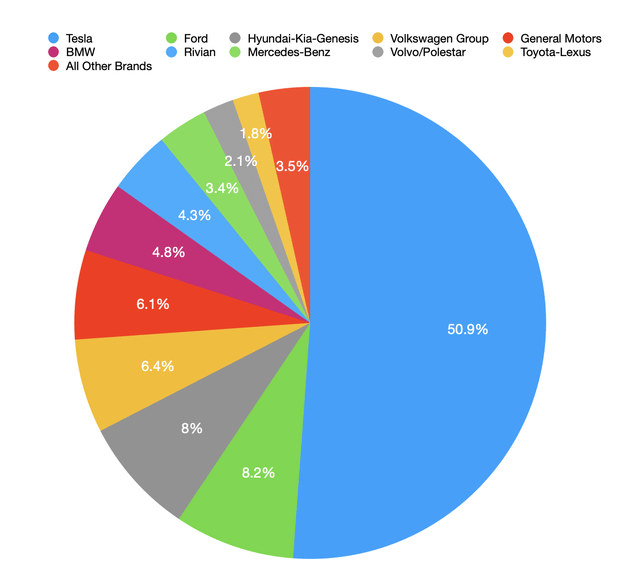

The way I see it, there would be two reasons to be optimistic when it comes to Rivian Automotive. The first would be if the company had a large slice of the market. And the second would be if it had robust resources with which to continue growing. Let’s take Tesla as an example of the former. Over the past couple of years now, Tesla has seen its market share decline. It peaked at about 72% in the final quarter of 2021. But as traditional automotive manufacturers stepped into the picture, Tesla has seen its market share shrink. By the final quarter of 2023, it had fallen to 50.9%. To be honest, I have been and remain bearish on Tesla because of its valuation. I also see life getting harder for the company because of increased competition. But between the investments it has made in infrastructure, and just how large its market share is, I imagine it will be around and thriving operationally a decade from now. It’s very difficult to imagine such a large player just disappearing.

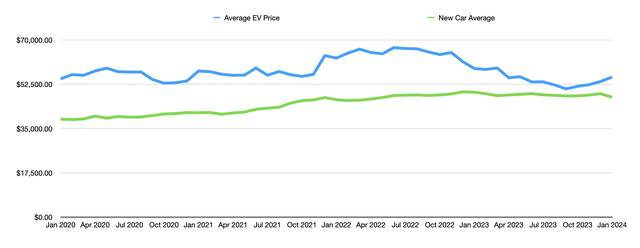

Clearly, Rivian Automotive doesn’t have that kind of exposure. Although it’s a large pureplay electric vehicle company, it’s actually the 7th largest in overall market share in the US when it comes to electric vehicles. That works out to roughly 4.3% of the overall market. Unlike rival firms, it also does not have the cash flow or other resources needed to deal in a market that, as the chart below illustrates, is seeing prices approach parity with those of traditional vehicles. And in recent months, it hasn’t been that traditional vehicles have become more expensive. Rather, it has been that electric vehicles have come down in price. Since peaking at $66,997 in June 2022, the average price of an electric vehicle has fallen by 17.4% down to $55,353 as of January of this year. This is likely because of increased competition, combined with a rather significant decline in lithium prices that I have written about previously.

When I talk about resources, I need only point to Ford and General Motors (GM) as examples. In 2023, General Motors generated $20.93 billion in operating cash flow. Ford was just a bit lower at $14.92 billion. Both companies are highly profitable and, in the case of Ford, significant strides have been made in recent years to gain market share. In the final quarter of 2021, for instance, the company had a 5.6% stake in the U.S. market for electric vehicles. That number had risen to 8.2% by the final quarter of last year. General Motors has had a more difficult time, with significant volatility from one quarter to the next. But with operating cash flow last year that was more than twice the entire market capitalization of Rivian Automotive, I have little doubt in the company’s ability to adapt to changing market conditions. Our prospect, on the other hand, which requires more capital just to produce its vehicles than the revenue it brings in, not to mention other operating costs above that, and with a decline in cash occurring annually, is not in a particularly pleasant position.

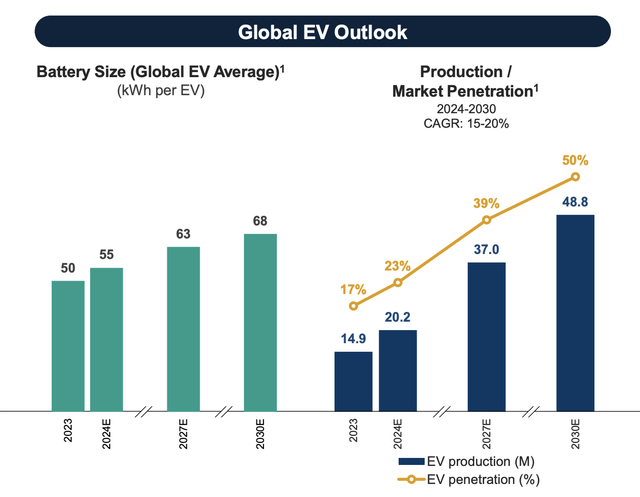

None of this is to say that I am bearish about electric vehicles in general. I do think that the industry is in for a rude awakening. I say this because increased competition is bound to bring profits of companies that are leading in the space, namely Tesla, down. But given its size and own robust cash flows, I suspect Tesla can survive this storm. A much smaller player with significant issues like Rivian Automotive might not be so lucky. Ultimately, though, whether you love it or hate it, the electric vehicle transition will take place. According to Albemarle (ALB), a major player in the lithium market, global electric vehicle penetration should grow from about 17% of all vehicles, totaling 14.9 million units per year, in 2023, to 50%, or 48.8 million units, by 20-30. Most of that leap should occur between this year and the end of 2027. It helps that, for now, lithium prices are lower. But what should also aid in the equation is the expectation that the average battery size per electric vehicle will grow by approximately 36%. That will help to extend range for the vehicles in question.

This doesn’t mean that there won’t be a slowdown in the US market. I do expect such a slowdown to occur, at least in the near term. There are two primary reasons behind this. First, the easy-to-get consumers, the ones who are most worried about climate change and the environment in general, have already been captured. The second is that there is a major concern in this country regarding electric vehicle infrastructure. For starters, the amount of infrastructure out there is severely lacking. Or, at the very least, public perception of it is. Despite billions of dollars in federal funding, not to mention untold amounts of state funding, all dedicated to building out a massive vehicle charging network, 79% of people who said that they were intending to eventually buy an electric vehicle stated, in a survey conducted in May of last year, that they believed charging infrastructure was either insufficient or they were unsure about it. 46% of all respondents, including owners of electric vehicles, expressed concern about the time required for charging as well. It’s also worth noting that, according to that same survey, the 67% of participants who said they were open to the idea of purchasing an electric vehicle actually represented a decline of 19% from the number that expressed the same sentiment back in 2021.

While companies have done some of their own work in getting charging stations out there, and federal and local governments have provided billions of dollars of funding, the government side of the equation needs to be far more significant. Our country has a long history of the government stepping in to make investments prior to or alongside private industry at times when it didn’t always make sense economically. But in the long run, it often works out. Sometimes, you end up with bad investments, such as the canal system that was built across some states. But other investments such as railroads, early space travel, telecommunications related investments, the Internet, and more, have proven that the government sometimes needs to step in a big way in order to get things done. And unfortunately, as of earlier this year, only four states in this nation have federal electric vehicle charging stations. Those states are my home state of Ohio, as well as New York, Pennsylvania, and Hawaii. If there is any bright spot, it’s that the number of charging stations is growing. In the second half of the 2023 calendar year, for instance, the country added nearly 1,100 new public, fast charging stations nationwide. And with $623 million in grants to states, local governments, and tribes that were awarded in January, 47 charging stations and related projects that will include around 7,500 charging ports will be built across 22 States and in Puerto Rico.

Takeaway

At this point in time, the electric vehicle market is growing, but that growth has slowed for multiple reasons. Obviously, this is negative for a company like Rivian Automotive. If the business were in a better position from a fundamental perspective, or if it had a massive market share and was showing signs that cash flow neutrality might be on the horizon, my mindset might be different. But between the industry issues and the fundamental issues, I wouldn’t be surprised to see shareholders experience a great deal more pain before we bottom out. Depending on how fierce competition gets in the space in the next couple of years, this could even turn into a situation where the company’s very existence is in serious doubt. Due to these concerns, I am rating the company a ‘strong sell’ for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!