Summary:

- Amazon will announce its first-quarter results next Tuesday, April 30.

- The number one focus point will remain profitability, as investors want to see the margin train continue to gain speed.

- Other key items to monitor will be AWS and its AI progress, continued market-share gains in digital advertising, and third-party sellers’ results following the recent price increases.

georgeclerk

Amazon (NASDAQ:AMZN) is set to report its Q1’24 results next Tuesday, April 30. Once again, the center of attention will be Amazon’s profitability, as investors want to see the Jassy-led company remain in a full-fledged harvest mode.

In addition to profitability, key focus points include growth acceleration in AWS, continued market share gains in digital advertising, and third-party sellers’ performance amid Amazon’s price increases.

Let’s dive in.

Introduction

I’ve been covering Amazon on Seeking Alpha since August of last year. I initiated coverage with a Buy rating, as I went over the company’s potential benefits from AI across many of its lines of business, and showed it has multiple paths to generate very high earnings growth for the rest of the decade.

In January, I upgraded Amazon to a Strong Buy, claiming it was the early innings in Amazon’s harvest stage, which, I believe, will last for a long time.

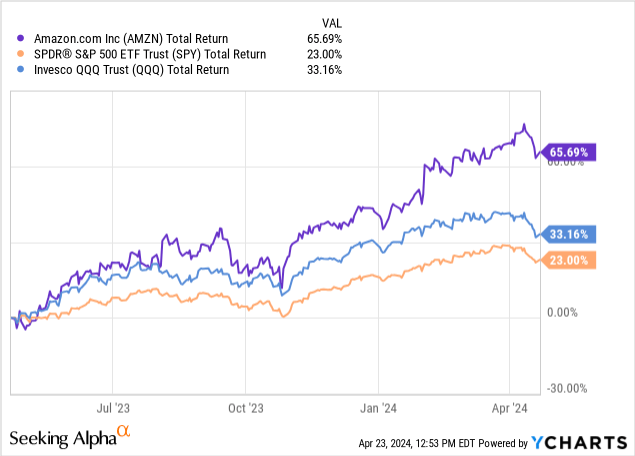

Amazon significantly outperformed the market during this period, a trend I expect to continue for the foreseeable future.

With that, let’s turn to our outlook and key points for the quarter.

Margin Is Still (Almost) Everything

Amazon is the second-largest company in North America in terms of sales, behind only Walmart (WMT). With Amazon’s much more diversified revenue streams and faster growth, the e-commerce giant is projected to surpass Walmart by 2025.

Even the staunchest of bears will struggle to think of a world where Amazon doesn’t grow its revenues at an above-market pace for the foreseeable future, as the company is riding multiple secular tailwinds across diversified categories, where it’s the clear industry leader.

This includes cloud computing and AI in AWS, and e-commerce in retail, as well as advertising, streaming, and more.

All of this foreword is to show that the primary driver for Amazon’s stock performance, by far, is the company’s ability to translate its unparalleled revenue opportunities into profits.

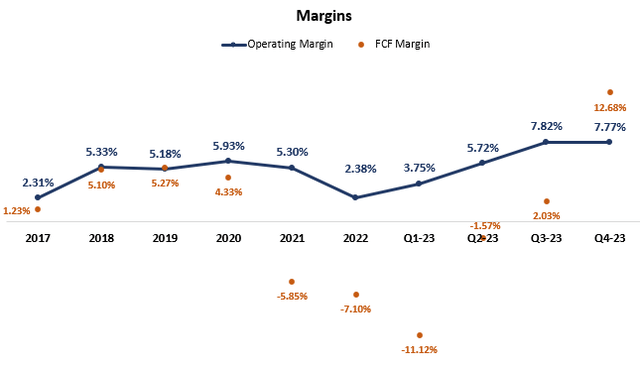

Created by the author using data from Amazon’s financial reports.

In 2023, Amazon achieved all-time high operating margins, primarily driven by improvements in the back half of the year. Despite Q4 being a seasonally lower-margin quarter, Amazon maintained record levels of profitability in both FCF and EBIT.

This gives me a very high degree of certainty we should see a significant margin expansion in 2024, with management guiding for Q1 operating margins of 8.4% at the high point.

Aside from the incredible job they did in 2023, we’re seeing continued focus from the company, which is reportedly cutting low-potential projects, raising third-party seller fees, and adding an ad tier to Prime, among other things.

Additionally, the company’s capex spending is expected to remain below 2022 levels, as the front-loaded logistics buildout normalizes.

This gives me a very high degree of certainty we should see a significant margin expansion in 2024, with management guiding for Q1 operating margins of 8.4% at the high point.

I believe my 9% operating margin and 5.5% FCF margin estimates are on the extreme conservative side, but that would be enough to generate 60% EBIT growth and 4.4x FCF.

AWS

AWS sits comfortably at number two when it comes to its significance. Investors will look for growth acceleration, with consensus estimates in the 15% range, reflecting a two percentage point acceleration.

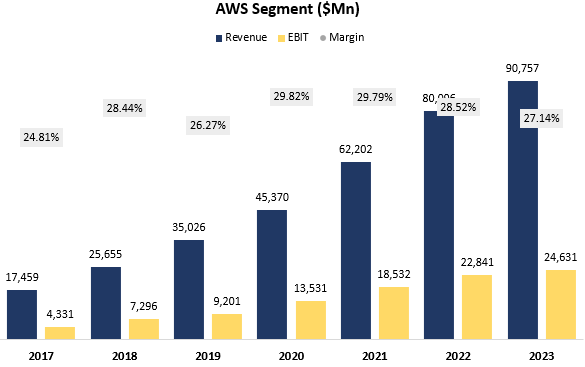

Created and calculated by the author using data from Amazon financial reports.

AWS is still the primary source of profit for Amazon, and it’s also the fastest-growing segment within the company.

An important aspect of AWS would be the success of its AI offerings, including Q, Bedrock, and SageMaker.

It’d be critical to see where Amazon places among the three hyper scalers, alongside GCP (GOOG) and Azure (MSFT), as AWS remains the largest cloud provider by far.

I expect Amazon will continue to narrow the growth gap, as the other providers grow in scale. Additionally, I expect Amazon to surprise investors to the upside, especially in AI. Despite being more “quiet”, I believe AWS is greatly positioned to benefit from the early growth stage of AI, with its much larger market share.

Advertising

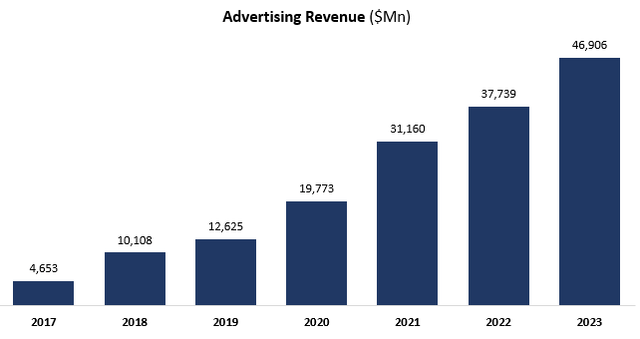

Amazon has been an outlier in the digital advertising sector over the last couple of years. While giants like Alphabet and Meta (META) saw their growth implode in 2022, Amazon continued to grow at a 20%+ pace.

Created by the author using data from Amazon’s financial reports.

This is a result of Amazon’s unique offering, as it primarily sells ads on its website, where the return on ad spend is exceptional. Customers who are already in a shopping mood are much more likely to convert based on a sponsored ad, rather than people who are watching videos on YouTube or scrolling through Instagram Reels.

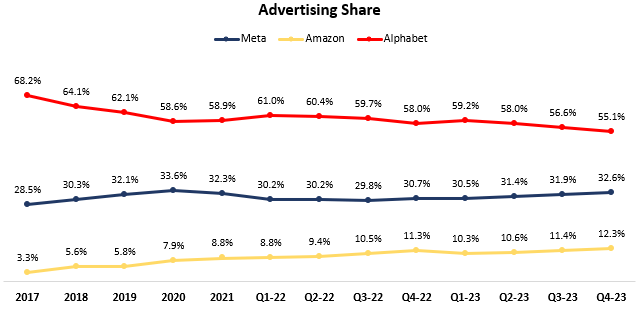

Created and calculated by the author using data from the companies’ financial reports. Share is calculated as the respective company’s share of the combined reported advertising revenue.

As we can see, Amazon’s share of advertising revenue has been on a sharp incline since 2017, with most of the gains coming at the expense of Google.

I expect this trend to continue in Q1, as the digital advertising category continues to improve amid a more favorable macro backdrop.

Third-Party Sellers

Since its latest fee increase announcements, we are seeing a lot of complaints online, from sellers who are saying they will have to take their business elsewhere, as Amazon became too greedy.

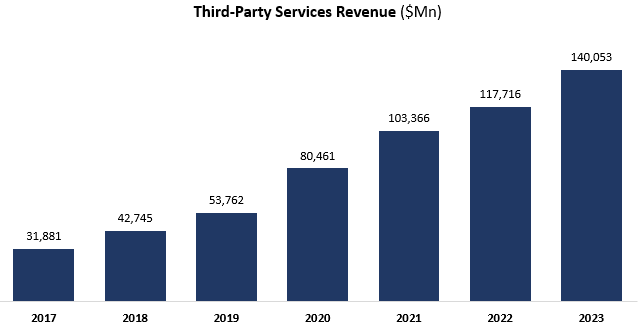

Created by the author using data from Amazon’s financial reports.

In reality, Amazon remains the cheapest option, by far, for fulfillment, logistics, and customer acquisition. Amazon is able to amortize and utilize its infrastructure across millions of sellers, and therefore provides its service for an unbeatable cost.

A seller needs to reach a very large scale for building their own fulfillment chain to become beneficial, and I don’t see a material threat of sellers leaving anytime soon.

Valuation

Amazon is one of the few big tech names that is yet to reach a new all-time high this year, as the stock is still slightly below its 2021 high, which was $183.80.

It’s a nice exercise to look back and see where Amazon was when the stock reached this level previously.

Amazon had three consecutive quarters of negative free cash flow (adjusted for SBC), and its operating margin for the year was 5.3%. Additionally, it was on track to generate $470 billion in revenues, which is 30% less than what it is expected to generate this year.

All this shows, really, is that valuations were crazy back then. Furthermore, it shows we can’t rely on Amazon’s historical valuation to assess whether or not the stock is cheap or not today.

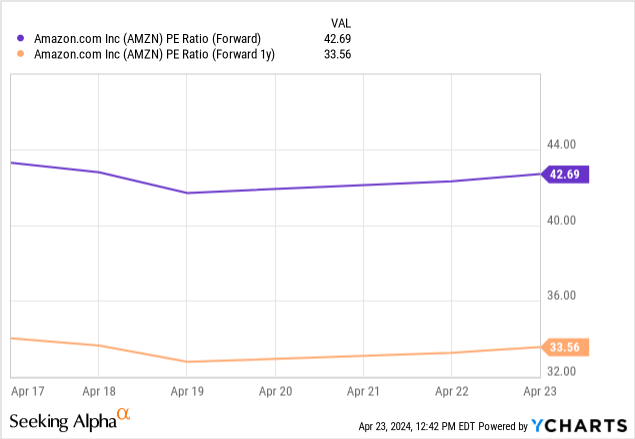

Amazon is trading at a 43x P/E over 2024 expectations, and a 33.6x P/E over 2025. While this might seem high, it’s important to put this in the right context.

Amazon is expected to grow EPS at a 25% CAGR for the rest of this decade, while continuing to grow revenues at a double-digit pace, despite the company’s huge size.

So looking at Amazon’s PEG, it’s somewhere in the 1.6x-1.8x range, depending on which growth number you’d want to use.

To me, this is a fair valuation considering Amazon’s wide moat and almost undisruptable leadership in several secular growing sectors.

Therefore, as long as Amazon continues to improve on profitability and deliver on its growth prospects, I expect the stock will follow EPS growth, and significantly outperform the market.

Conclusion

Amazon is set to report its first-quarter earnings next week, on April 30.

I believe the most important aspects of the report will include continued execution on profitability, as well as growth numbers in AWS, ads, and third-party services.

Trading at a 43x P/E, the stock isn’t necessarily cheap, but I find it attractive, nonetheless, as I estimate the stock will continue to follow the company’s very fast earnings growth, which is estimated at ~25% annually, for the rest of this decade.

Therefore, I reiterate Amazon as a Buy ahead of earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.