Summary:

- Micron reported dismal F1Q 2023 earnings and bleak guidance for next quarter, both of which missed the Street consensus.

- The drop in memory revenues in 2022 is a repeat of the crash in 2019 because of excessive capex spending by memory companies.

- Memory executives seemingly have short memories because the memory market is currently plummeting for the same reason.

- Significant capex cuts by Micron and SK hynix will negatively impact memory equipment companies Applied Materials and Lam Research.

pictafolio

Micron Technology (NASDAQ:MU) recently announced results for its first quarter of fiscal 2023, which ended Dec. 1, 2022. Revenue of $4.09 billion vs. $6.64 billion for the prior quarter and $7.69 billion for the same period last year. Revenue missed by $50 million. Non-GAAP EPS of -$0.04 missed by $0.02.

Guidance for F2Q 2023 was 3.8 billion at the midpoint, down 7% QoQ and -51.2% YoY, below the Street’s $3.92 billion estimate.

Micron CEO Sanjay Mehrotra made some significant comments in the company’s earnings call. The most important, which is the underlying cause of problems, not only for Micron but the overall memory sector, addresses capex. Mehrotra noted:

“Due to the significant supply/demand mismatch entering calendar 2023, we expect that profitability will remain challenged throughout 2023.

Micron is taking a number of decisive actions in this environment to align supply with demand and to protect our balance sheet. First, we are reducing our capex investments to reduce bit supply growth in 2023 and 2024. Our fiscal 2023 capex is being lowered to a range between $7 billion to $7.5 billion from the earlier $8 billion target and the $12 billion level in fiscal year ’22.”

Capex Issues

I discussed this very issue just a week ago and prior to the earnings call in my Dec. 15, 2022, Seeking Alpha article entitled “Micron: Excessive Capex Spend Responsible For Plummeting Memory Market.“

A critical metric for investors that I noted in the article is that the overall IC market excluding memory is not demonstrating a significant drop in revenue as is the memory sector. According to our report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips,” memory revenues decreased 4.7% between May 2022 and October 2020 compared to a 2.0% decrease for total ICs excluding memory.

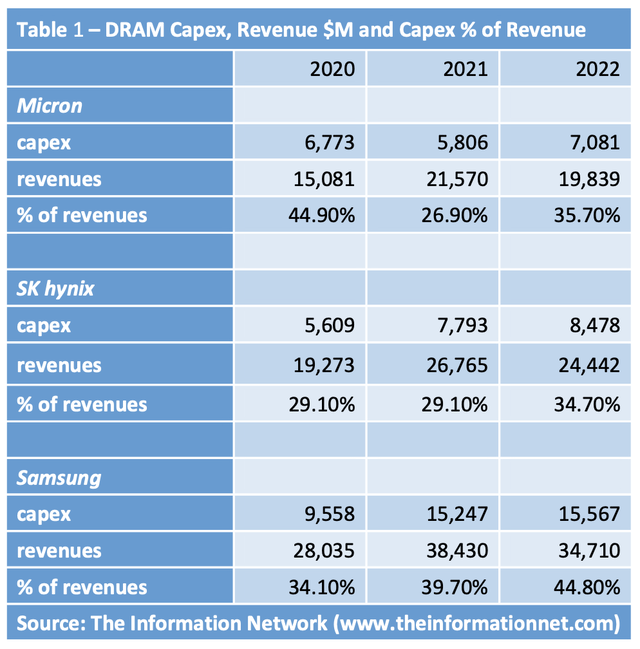

Table 1 repeats my analysis of DRAM capex in that article, not only for Micron but also for SH hynix (OTC:HXSCL) and Samsung Electronics (OTCPK:SSNLF).

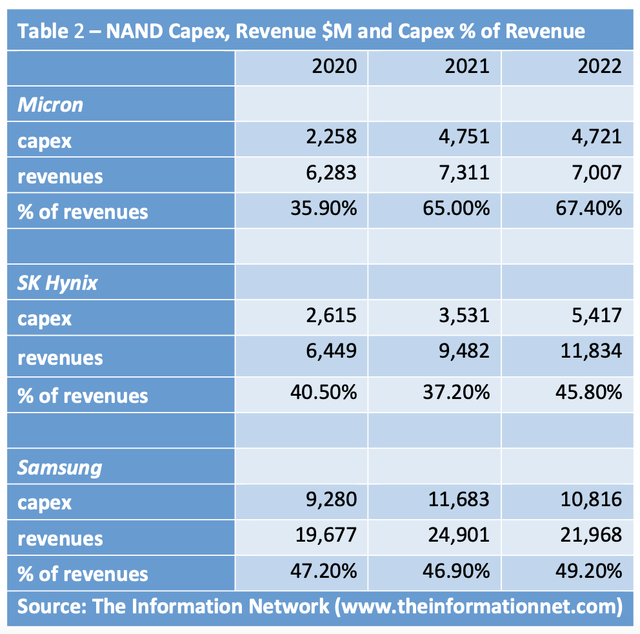

In Table 2, I show NAND capex. This table was exclusive to subscribers in my Semiconductor Deep Dive Marketplace, but I repeat it below.

Mehrotra stated that capex is being lowered to a range between $7 billion to $7.5 billion from the earlier $8 billion target and the $12 billion level in fiscal year ’22. This $12 billion is consistent with my analysis in the tables above, combing $7.1 billion for DRAM and $4.7 billion for NAND = $11.8 billion.

Micron hopes to bring the supply/demand dynamics back in sync, “believing that negative year-on-year calendar 2023 industry DRAM bit supply growth and flattish year-on-year calendar 2023, industry NAND bit supply growth would accelerate this recovery.”

But the damage was done, not only by Micron but also by its competitors. For DRAMs, SK hynix and Samsung increased capex in 2021 and Micron in 2022. Importantly, DRAM capex as a percentage of revenue increased for all three companies in 2021 and 2022.

Change in Product Cadence

Third, in response to the decline in expected long-term CAGR for DRAM and NAND bit growth, we are slowing the cadence of our process technology node transitions. This change will help us align our long-term bit supply CAGR investments. Given our decision to slow the 1-beta DRAM production ramp, we expect that our 1-gamma introduction will now be in 2025.

Mehrotra made another important comment where he said:

“In response to the decline in expected long-term CAGR for DRAM and NAND bit growth, we are slowing the cadence of our process technology node transitions. This change will help us align our long-term bit supply CAGR investments. Given our decision to slow the 1-beta DRAM production ramp, we expect that our 1-gamma introduction will now be in 2025.”

To the point, on Nov. 14, 2022, I wrote a Seeking Alpha article entitled “Micron: Even The Best Technology Won’t Help Until 2024.” I noted that:

“Technology advancement was a Moot Point at this time because of the state of the memory sector. Driven by a mix of skyrocketing consumer demand followed by pandemic supply constraints, the traditionally cyclical memory industry moved along a new cycle that started in Q1 2021 and ended in Q2 2022. The downturn was amplified by a 40-year high inflation rate and recessionary fears that dampened demand primarily for consumer electronic products.”

DRAM Analysis

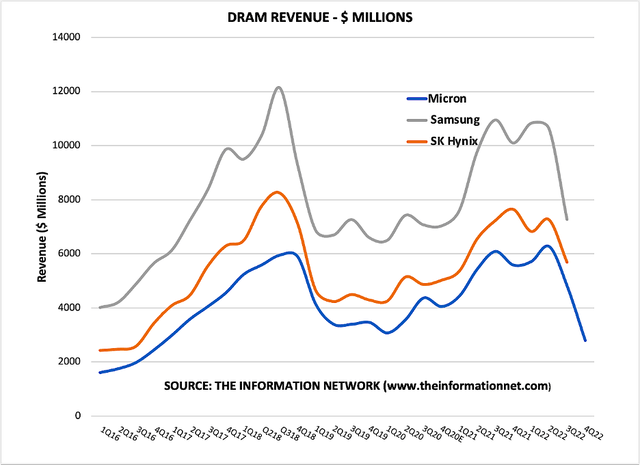

In this section I present several charts that compare the three companies in DRAMs. Micron’s data include the latest results for F1Q 2022 and those of SK hynix and Samsung just for C3Q 2022.

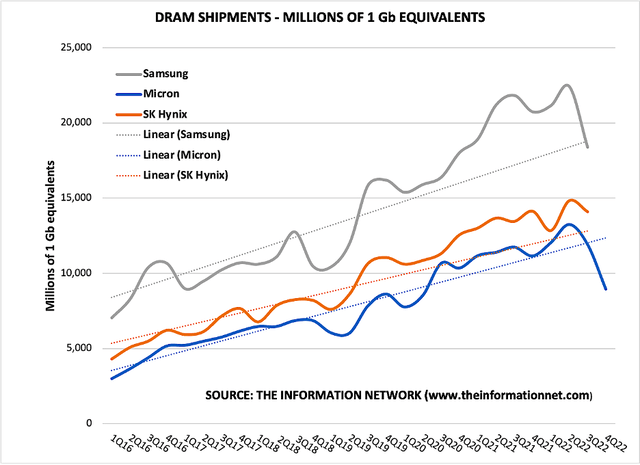

Chart 1 shows DRAM shipments, and we can see the downward trend of all three companies. Both SK hynix and Samsung will announce actual C4Q 2022 in one month.

Chart 1

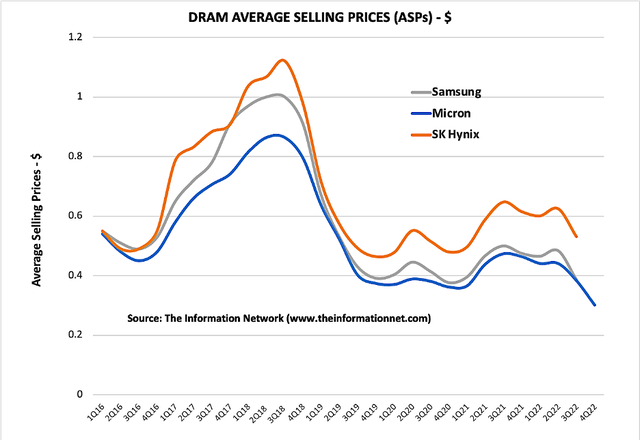

Chart 2 shows similar trends in ASPs (average selling prices).

Chart 2

Chart 3 shows DRAM revenues for the three companies with similar trends.

Chart 3

NAND Analysis

In my Semiconductor Deep Dive Marketplace newsletter, I present similar Charts for the NAND sector, and I encourage readers to understand my NAND analysis in the article of the same title.

Investor Takeaway

Memory company executive companies seemingly have short memories. The reason for the memory crash in 2019 was because of excessive capex spend in 2017 and 2018, and this clearly apparent in Charts 3 and 4. All through 2017 and 2018 I wrote numerous Seeking Alpha articles pointing to this problem but to no avail.

Now that they repeated their mistake, to counter oversupply and high inventory, Micron has explained in detail its plans to reduce capex spend. SK hynix has already announced it will reduce capex while Samsung has not. In their earnings call we will have a clearer picture as to whether these companies will work in concert to get supply/demand dynamics back in sync.

While capex cuts will provide a modicum of succor for eliminating excessive supply, the semiconductor equipment industry will suffer. Significant capex cuts on memory expansion by Micron and SK hynix will negatively impact Applied Materials (AMAT) and Lam Research (LRCX), according to our report entitled “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts.“

Because of the current cyclical downturn in the memory sector, I reaffirm Micron a hold. I maintain a sell on AMAT and a hold on LRCX.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free two-week trial now.